Peripheral Artery Disease Market Size, Share, Trend, Industry Analysis Report

By Treatment Type (Device, Drugs), By Distribution Channel, By End User, By Region – Market Forecast, 2025–2034, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6022

- Base Year: 2024

- Historical Data: 2020-2023

Overview

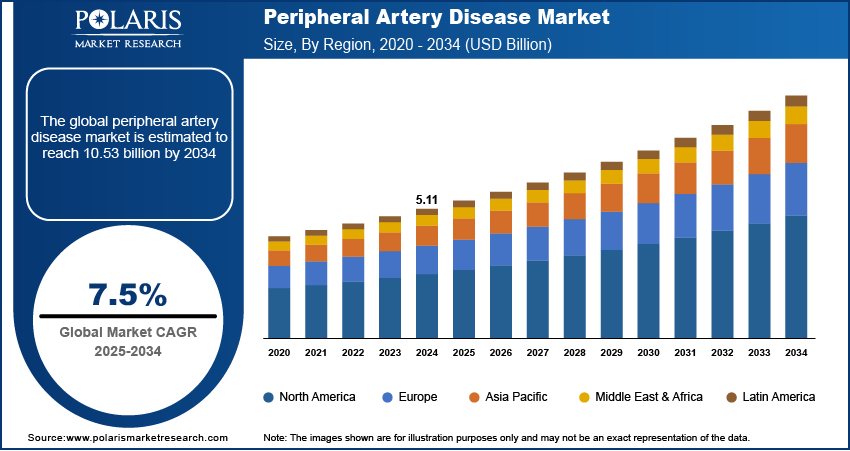

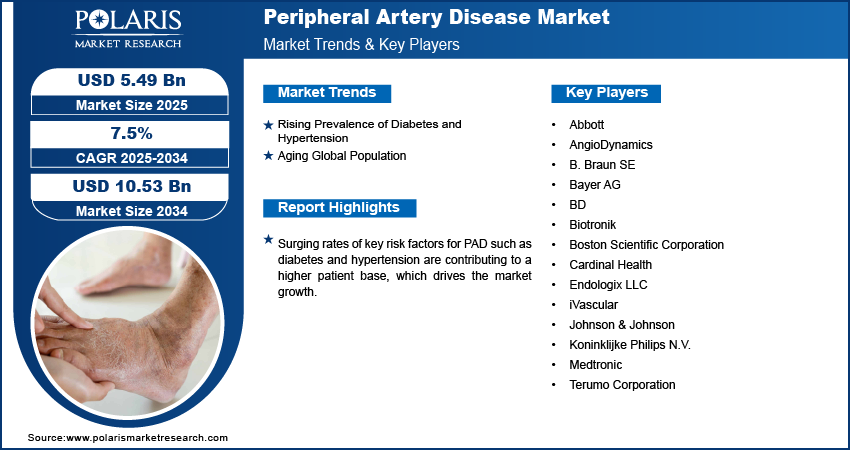

The global peripheral artery disease market size was valued at USD 5.11 billion in 2024, growing at a CAGR of 7.5% from 2025 to 2034. Surging prevalence of diabetes and hypertension, which are key risk factors for PAD, are contributing to a higher patient base. Chronic metabolic disorders accelerate atherosclerosis, making timely diagnosis and treatment of PAD increasingly critical in affected populations.

Key Insights

- The device segment accounted for ~62% of the revenue share in 2024.

- The hospital pharmacy segment accounted for the largest revenue share in 2024.

- North America held the largest share of the global peripheral artery disease market revenue in 2024.

- In 2024, the market in U.S. accounted for the largest revenue share in North America.

- The market in Asia Pacific is expected to grow significantly from 2025 to 2034.

- The peripheral artery disease industry in Europe registered significant growth in 2024.

The peripheral artery disease (PAD) market refers to the healthcare segment focused on the diagnosis, treatment, and management of PAD, a circulatory condition where narrowed arteries reduce blood flow to the limbs, commonly caused by atherosclerosis. The market includes diagnostic imaging systems, angioplasty devices, stents, atherectomy tools, and pharmacological therapies aimed at improving blood circulation, relieving symptoms, and preventing serious complications such as ulcers or limb amputation. The surging demand for peripheral artery disease management is driven by rising global incidence, aging populations, and advances in endovascular techniques that enable minimally invasive treatment. Innovations in drug-coated balloons, bioresorbable stents, and atherectomy systems are improving outcomes for PAD patients. These technologies reduce restenosis risk and promote faster recovery, encouraging their adoption in both hospital and outpatient settings. In November 2024, the FDA granted approval for Abbott's innovative dissolvable stent technology aimed at treating peripheral artery disease (PAD). This novel therapeutic approach utilizes a biodegradable stent that supports arterial patency during the critical healing phase and subsequently dissolves, mitigating long-term complications associated with permanent implants.

Poor diet, lack of physical activity, and growing obesity prevalence are elevating the incidence of atherosclerotic conditions, thereby expanding the demand for PAD screening and interventional care. Moreover, public health programs aimed at early detection of cardiovascular conditions are helping identify PAD cases earlier, enabling prompt medical or surgical intervention and reducing downstream complications.

Industry Dynamics

- An increase in diabetes and hypertension cases is playing a critical role in the growing burden of peripheral artery disease

- Older adults face a naturally higher risk of peripheral artery disease due to cumulative vascular wear and the progression of atherosclerosis over time.

- Surge in patient and clinician preference for minimally invasive treatment approaches is raising rapid adoption of catheter-based therapies and image-guided interventions for PAD management.

- High treatment costs, limited reimbursement, and lack of awareness hinder market growth in emerging economies.

Rising Prevalence of Diabetes and Hypertension: The steady increase in diabetes and hypertension cases leads to the growing burden of peripheral artery disease (PAD). According to the International Diabetes Federation, 589 million adults aged 20–79 are affected by diabetes, equivalent to 1 in 9 people. This number is projected to rise to 853 million by 2050. Both conditions are closely linked to vascular damage and contribute to the narrowing of peripheral arteries.

Diabetic patients, in particular, face intensified risks of poor blood circulation, neuropathy, and delayed wound healing, all of which increase the likelihood of developing PAD. Hypertension further accelerates atherosclerosis by exerting pressure on arterial walls, reducing elasticity, and promoting plaque formation. This convergence of metabolic and vascular disorders is driving a larger population toward PAD diagnosis and treatment. As the prevalence of diabetes and hypertension continues to grow, the demand for early detection tools, interventional devices, and long-term disease management strategies focused on PAD also increases.

Aging Global Population: Older adults face a naturally higher risk of peripheral artery disease due to cumulative vascular wear and the progression of atherosclerosis over time. According to the US National Health and Nutrition Examination Survey, 70% of the elderly population aged 65 and above is affected by hypertension. Aging leads to structural and functional changes in the blood vessels, including arterial stiffening and reduced endothelial function, which can significantly impair peripheral circulation. In addition, seniors often present multiple comorbidities such as high cholesterol, reduced mobility, and cardiovascular disease, all of which compound PAD risk. This demographic shift is creating a sustained demand for treatment solutions that are both effective and tailored to the specific needs of geriatric patients. The growing elderly population is also prompting a focus on minimally invasive procedures and home-based care options that support faster recovery and maintain quality of life.

Segmental Insights

Treatment Type Analysis

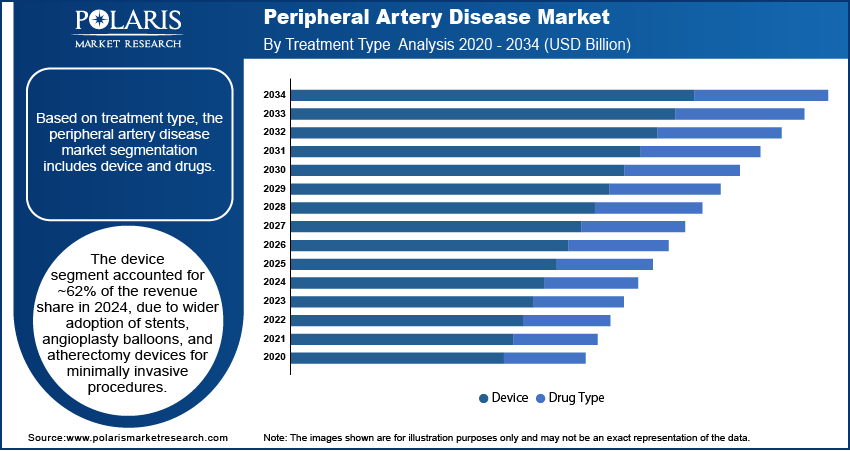

Based on treatment type, the segmentation includes device and drugs. The device segment accounted for approximately 62% of the revenue share in 2024 due to wider adoption of stents, angioplasty balloons, and atherectomy devices for minimally invasive surgery is contributing to strong demand in the device segment. The growing shift toward interventional therapies over pharmacological management has accelerated procedural volumes in both acute and chronic PAD settings. Surgeons and interventional radiologists increasingly prefer device-based approaches due to faster patient recovery, reduced hospitalization, and improved long-term outcomes. Expanding reimbursement frameworks and increasing investments in peripheral vascular technologies are further strengthening segment’s growth

The drugs segment is growing due to heightened awareness regarding early-stage PAD and the importance of long-term medical management has led to increased prescriptions for antiplatelet agents, statins, and antihypertensive drugs. Pharmaceutical approaches are often adopted for patients unfit for surgery or as part of post-procedural maintenance therapy. Advancements in drug formulations, availability of combination therapies, and a shift toward personalized medication regimens are bolstering market growth in this segment. Strong physician endorsement and patient adherence programs are expected to sustain momentum over the forecast period.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment accounted for the largest revenue share in 2024 due to the high patient inflow for complex PAD interventions, such as angioplasty or bypass surgeries, contributes to the dominance of hospital pharmacies. These facilities handle prescription medications used during procedures and post-operative care. Tight integration with hospital networks ensures timely drug availability, higher procurement volumes, and consistent medical guidance, ensuring steady revenue.

The retail pharmacy segment is projected to witness significant growth over the forecast period due to growing diagnosis of early-stage PAD and an aging population managing chronic vascular diseases at home are fueling demand through retail outlets. Increased access to over-the-counter medications and prescription drugs, coupled with greater emphasis on outpatient care and follow-up treatment, is enhancing the segment’s growth prospects.

End user Analysis

In terms of end user, the segmentation includes hospital, specialty clinics, and ambulatory surgical centers. The hospital segment accounted for the largest revenue share in 2024 due to rising rates of inpatient PAD treatments such as revascularization, limb salvage procedures, and critical limb ischemia management are increasing hospital admissions. The availability of advanced diagnostics, skilled vascular surgeons, and multidisciplinary care teams strengthens the hospital setting’s role in managing severe PAD cases, maintaining a dominant market presence.

The ambulatory surgical centers segment is projected to witness fastest CAGR over the forecast period due to growing demand for minimally invasive PAD interventions and the push for cost-effective, same-day procedures are driving patient volumes toward ambulatory services. These facilities offer shorter wait times, efficient scheduling, and lower healthcare costs. Favorable reimbursement models and advancements in endovascular technologies support rapid expansion across urban and semi-urban areas.

Regional Analysis

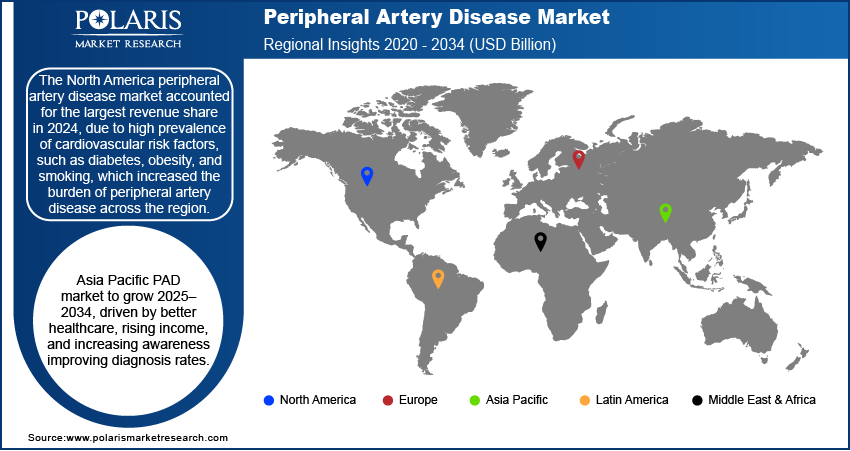

North America peripheral artery disease market accounted for the largest revenue share in 2024 due to high prevalence of cardiovascular risk factors, such as diabetes, obesity, and smoking, has increased the burden of peripheral artery disease across the region. For instance, according to the Centers for Disease Control and Prevention, in the U.S., approximately 58% of adults with obesity are diagnosed with hypertension, which is a significant risk factor for the development of cardiovascular disease. Additionally, around 23% of adults within this demographic also present with diabetes, which is often associated with obesity. Early access to screening programs, widespread awareness among patients, and robust reimbursement frameworks are supporting rapid diagnosis and timely treatment. Availability of technologically advanced devices like drug-eluting stents and atherectomy systems across hospitals and specialty clinics is improving clinical outcomes. Strong involvement of regional academic and research organizations in PAD-related studies is contributing to the refinement of treatment protocols and the approval of new therapies.

U.S. Peripheral Artery Disease Market Insight

In 2024, the market in the U.S. accounted for the largest revenue share. The rising geriatric population, high incidence of comorbidities, and the proactive adoption of interventional procedures have created sustained demand for PAD therapies across the U.S. Integration of minimally invasive devices and early clinical intervention are supported by well-developed vascular care infrastructure. Focus on population health management and preventive care is expanding access to PAD diagnosis and treatment.

Asia Pacific Peripheral Artery Disease Market Trends

Asia Pacific is expected to grow significantly from 2025 to 2034 due to rapidly expanding healthcare systems, rising disposable income, and growing health awareness are contributing to improved PAD screening and diagnosis rates. Urbanization and sedentary lifestyles are increasing the risk of atherosclerosis among middle-aged adults. Government health initiatives, private investments in vascular care facilities, and adoption of international clinical guidelines are creating favorable conditions for PAD treatment growth. Medical device manufacturers are entering emerging markets through strategic partnerships and localized product offerings, enabling better accessibility of advanced therapies. Increasing participation in clinical research and medical education is also raising physician confidence in adopting interventional PAD treatments across the region.

China Peripheral Artery Disease Market Overview

China accounted for the significant share in Asia Pacific in 2024 due to high incidence of diabetes, smoking, and hypertension has raised PAD prevalence, prompting hospitals to expand vascular care offerings. Investments in healthcare infrastructure and expanded reimbursement policies are driving patient access to minimally invasive treatment options. Domestic manufacturers are strengthening supply chains and technology collaborations to support growth.

Europe Peripheral Artery Disease Market Outlook

The peripheral artery disease landscape in Europe registered significant growth in 2024. The strong emphasis on preventive healthcare, structured disease management programs, and timely referral systems are enabling early diagnosis and treatment of PAD across the region. Availability of trained vascular specialists, combined with high adoption of drug-coated balloons and stenting procedures, is improving clinical outcomes. Research funding in vascular diseases and cross-border clinical trials is helping accelerate the regulatory approval of advanced technologies. Aging population and higher life expectancy are contributing to increased procedural volumes. Hospitals and ambulatory centers are integrating digital technologies for PAD monitoring and follow-up, further enhancing patient compliance and long-term care quality.

Key Players and Competitive Analysis

The competitive landscape of the peripheral artery disease (PAD) market is characterized by intense innovation, strategic expansion, and strong emphasis on product differentiation. Industry analysis reflects a surge in mergers and acquisitions, as market players aim to broaden their vascular device portfolios and reinforce regional market positions. Joint ventures and strategic alliances are becoming increasingly prevalent, especially between medical device developers and healthcare providers, to streamline the adoption of endovascular interventions and improve patient outcomes.

Post-merger integration strategies are focusing on synergizing R&D capabilities and commercial networks to accelerate time-to-market for next-generation PAD therapies. Technology advancements, particularly in drug-coated balloons, atherectomy systems, and revascularization devices, are redefining treatment algorithms and supporting minimally invasive care pathways. Key participants are also leveraging digital health tools and artificial intelligence for improved patient monitoring and real-time decision-making. Continuous investments in clinical trials and regulatory approvals reflects the sector’s focus on innovation and evidence-based expansion.

Key Players

- Abbott

- AngioDynamics

- B. Braun SE

- Bayer AG

- BD

- Biotronik

- Boston Scientific Corporation

- Cardinal Health

- Endologix LLC

- iVascular

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medtronic

- Terumo Corporation

Industry Developments

January 2025: B. Braun Medical Inc. launched the Clik-FIX Epidural/Peripheral Nerve Block Catheter Securement Device.

September 2024: Shockwave Medical, Inc., a subsidiary of Johnson & Johnson MedTech, launched the Shockwave E8 Peripheral Intravascular Lithotripsy (IVL) Catheter in the U.S. after receiving FDA clearance. This catheter is designed to treat calcified lesions in femoro-popliteal and below-the-knee peripheral artery disease (PAD) by using sonic pressure waves to disrupt calcified plaque, thereby improving vessel dilation and patient outcomes.

Peripheral Artery Disease Market Segmentation

By Treatment Type Outlook (Revenue, USD Billion, 2020–2034)

- Device

- Balloon Catheters

- Plaque Modification Devices

- Stents

- Atherectomy Devices

- Guidewires and Sheaths

- Other Devices

- Drug Type

- Lipid-lowering Drugs

- Antiplatelet Drugs

- Thrombolytic Agents

- Triple-H Therapy

- Other Drugs

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospital

- Specialty Clinics

- Ambulatory Surgical Centers

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Peripheral Artery Disease Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.11 billion |

|

Market Size in 2025 |

USD 5.49 billion |

|

Revenue Forecast by 2034 |

USD 10.53 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.11 billion in 2024 and is projected to grow to USD 10.53 billion by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

The North America peripheral artery disease market accounted for the largest revenue share in 2024 due to the high prevalence of cardiovascular risk factors, such as diabetes, obesity, and smoking, which increased the burden of peripheral artery disease across the region.

A few of the key players in the market are Abbott, AngioDynamics, B. Braun SE, Bayer AG, BD, Biotronik, Boston Scientific Corporation, Cardinal Health, Endologix LLC, iVascular, Johnson & Johnson, Koninklijke Philips N.V., Medtronic, and Terumo Corporation.

The device segment accounted for ~62% of the revenue share in 2024, due to the wider adoption of stents, angioplasty balloons, and atherectomy devices for minimally invasive procedures.

The hospital pharmacy segment accounted for the largest revenue share in 2024, due to the high patient inflow for complex PAD interventions, such as angioplasty or bypass surgeries.