Phosphorus Trichloride Market Size, Share, Trends, Industry Analysis Report

By Grade (Industrial, Pharmaceutical, Pure, Analytical, Others), By Sales Channel, By Production Method, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6019

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

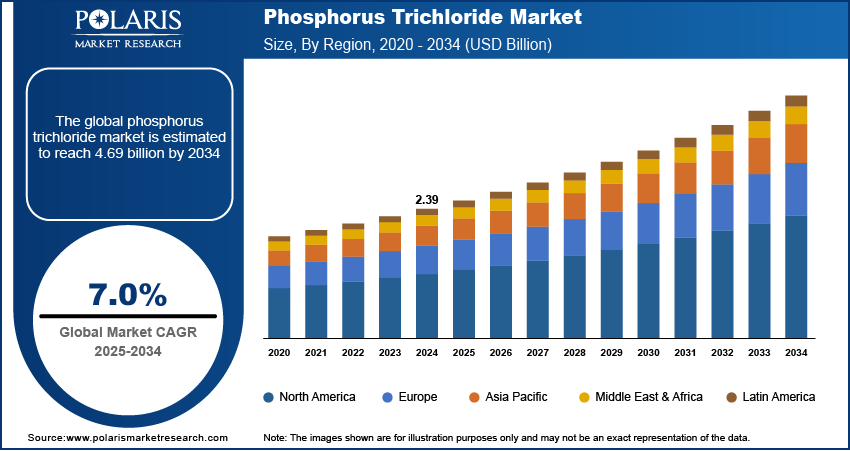

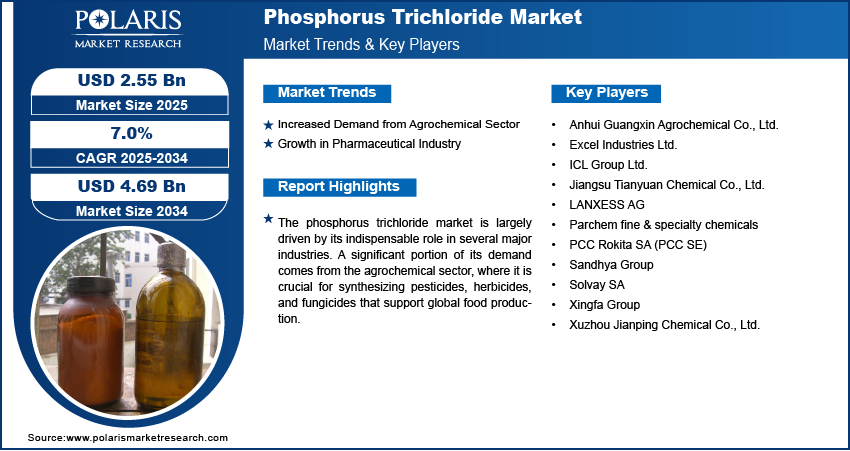

The global phosphorus trichloride market size was valued at USD 2.39 billion in 2024 and is anticipated to grow at a CAGR of 7.0% from 2025 to 2034. The growing demand for agrochemicals, particularly pesticides and herbicides, is a key driver for the market.

Key Insights

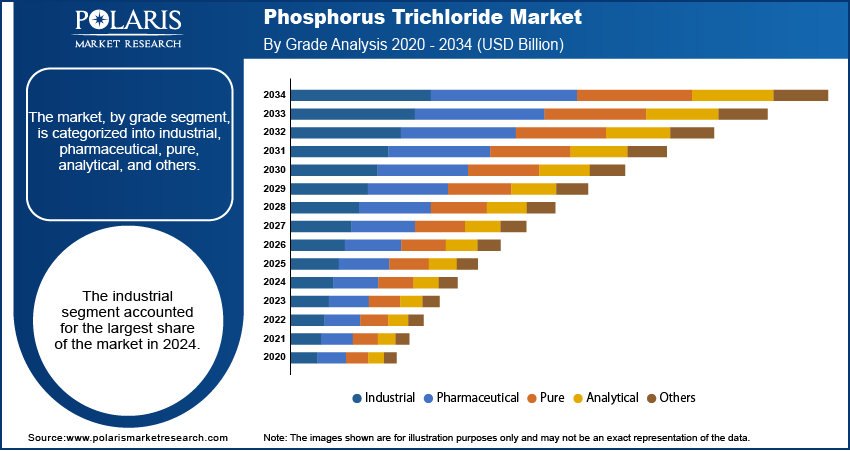

- By grade, the industrial grade segment held the largest share in 2024 due to its broad and high-volume applications across several key industries.

- By sales channel, the direct sales channel segment held the largest share in 2024 because of the nature of the chemical industry, which often involves large-volume transactions and long-term contracts between major manufacturers and significant end-use industries.

- By production method, the direct chlorination method segment held the largest share in 2024, as it is the most widely adopted and efficient process for producing phosphorus trichloride on an industrial scale.

- By application, the agrochemicals & pharmaceutical application segment held the largest share in 2024 due to the critical role phosphorus trichloride plays as an essential intermediate in the manufacturing of pesticides, herbicides, fungicides, and active pharmaceutical ingredients.

- By region, Asia Pacific held the largest share in 2024 in the global market for phosphorus trichloride, primarily driven by rapid industrialization, expanding manufacturing capabilities, and significant investments across diverse end-use industries.

The phosphorus trichloride (PCl3) market involves the production and sale of PCl3, a colorless to slightly yellow fuming liquid with a pungent odor. This chemical compound is primarily used as a key intermediate in the manufacturing of various downstream chemicals for different industries.

The polymer sector is a significant driver due to its use in producing various additives that enhance polymer properties. Phosphorus trichloride is an essential intermediate in the synthesis of plasticizers, which are compounds added to plastics to increase their flexibility, durability, and workability. With the continuous growth of the plastics sector across various sectors such as packaging, automotive, and construction, the demand for these additives, and consequently for phosphorus trichloride, also rises.

The growing concern over water scarcity and the increasing need for effective water treatment solutions are driving the PCl3 market demand. Phosphorus trichloride is used in the synthesis of various organophosphorus compounds, which serve as sequestrants, corrosion inhibitors, and anti-scaling agents in water treatment processes. These chemicals are vital for both industrial and municipal water treatment plants to ensure the quality and safety of water. As urbanization and industrial activities expand worldwide, the strain on water resources intensifies, leading to greater investment in advanced water treatment chemicals and technologies.

Industry Dynamics

- The increasing demand from the agrochemical sector is a primary driver, as phosphorus trichloride is a crucial ingredient in making pesticides and herbicides essential for crop protection and improving agricultural yields.

- Growth in the pharmaceutical sector is also driving this market as phosphorus trichloride is widely used in the synthesis of active pharmaceutical ingredients and other key intermediates for drug manufacturing.

- The rising use of flame retardants contributes significantly to demand, as phosphorus trichloride is a vital component in producing chemicals that enhance fire resistance in various materials such as plastics and textiles.

Increased Demand from Agrochemical Sector: The agrochemical sector is a primary consumer of phosphorus trichloride, utilizing it as a vital intermediate in the synthesis of various crop protection chemicals. With the continuously growing population across the world, there is an increasing need to boost agricultural output and ensure food security. This pressure directly translates into higher demand for effective pesticides, herbicides, and fungicides, which rely on phosphorus trichloride for their production.

Phosphorus trichloride is crucial in making organophosphorus pesticides. The Food and Agriculture Organization of the United Nations (FAO) provides data on the agricultural use of pesticides, indicating a consistent need for these chemicals to protect crops from pests and diseases, as highlighted in the "Pesticide use" dataset from Our World in Data, last updated in March 2025. This continuous demand for crop protection chemicals directly fuels the growth.

Growth in Pharmaceutical Industry: The pharmaceutical industry significantly contributes to the demand for phosphorus trichloride. It is widely used in the synthesis of active pharmaceutical ingredients (APIs) and other chemical intermediates necessary for drug manufacturing. The expansion of the global healthcare sector, driven by factors such as an aging population and increasing prevalence of chronic diseases, leads to a higher demand for diverse pharmaceutical products.

India's pharmaceutical sector is witnessing strong growth, recording a 7.8% year-on-year increase in April 2025, according to a report by the Press Information Bureau (PIB), published by the Times of India in May 2025. This rise reflects a global trend of expanding pharmaceutical production to meet increasing healthcare demands, which in turn is driving the demand for phosphorus trichloride—a key raw material used in drug manufacturing.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes industrial, pharmaceutical, pure, analytical, and others. The industrial segment held the largest share in 2024. This dominance is largely attributed to its widespread and high-volume application across several key industries. Industrial-grade PCl3, while not as highly purified as other grades, is cost-effective for large-scale manufacturing processes where minor impurities do not significantly impact the final product quality. It is primary used as a crucial intermediate in the production of agrochemicals, such as herbicides and insecticides, which are consumed globally in massive quantities to enhance agricultural productivity. Additionally, this grade is vital for making flame retardants used in various materials such as plastics and textiles, as well as for manufacturing plasticizers that impart flexibility to polymers.

The pure grade segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing demand for high-purity chemicals in specialized applications, particularly within the pharmaceutical and electronics industries. In pharmaceutical manufacturing, pure PCl3 is essential for synthesizing active pharmaceutical ingredients (APIs), where stringent quality control and absence of impurities are paramount to ensure drug efficacy and patient safety. Similarly, in the electronics sector, its use in producing semiconductor materials and other sensitive components requires exceptionally high purity to prevent defects and ensure optimal performance. The rising complexity of drug formulations and the continuous innovation in electronic devices are pushing the need for chemical inputs with minimal contaminants.

Sales Channel Analysis

Based on sales channel, the segmentation includes direct sales, distributors & traders, and others. The direct sales segment held the largest share in 2024, This is primarily attributed to the nature of the chemical sector, where large-volume transactions and long-term contracts are common, particularly between major manufacturers and significant end-use industries such as agrochemicals and pharmaceuticals. Companies that require large, consistent supplies of phosphorus trichloride often prefer to deal directly with manufacturers to ensure supply security, stable pricing, and specialized technical support. Direct sales allow for better customization of product specifications, more efficient logistics for bulk orders, and stronger relationships built on trust and reliability. This channel is crucial for maintaining quality control and ensuring timely delivery, which are critical factors for industries with high production demands and strict regulatory requirements.

The distributors and traders segment is anticipated to record the highest growth rate during the forecast period. This growth is driven by the increasing number of smaller and medium-sized enterprises (SMEs) entering the downstream industries that use phosphorus trichloride. These smaller players often lack the capacity or desire for direct bulk purchases from manufacturers, finding more flexibility and convenience through distributors. Distributors offer a wider range of products, smaller order quantities, and often provide additional services such as warehousing, repackaging, and localized delivery, making them attractive to diverse customer bases. Furthermore, the expansion of the chemical sector into new geographic regions, particularly in developing economies, creates a greater need for robust distribution networks.

Production Method Analysis

Based on production method, the segmentation includes direct chlorination substitution reaction. The direct chlorination segment held the largest share in 2024. This method involves the reaction of white phosphorus with chlorine gas, a process widely adopted due to its efficiency and the direct formation of PCl3. Manufacturers prefer this method for large-scale industrial production as it allows for continuous operation, which is essential for meeting the high volume demand from various end-use industries. The process is well-established, with existing infrastructure and expertise, making it a cost-effective and reliable way to produce phosphorus trichloride. The ability to control reaction parameters to minimize unwanted byproducts such as phosphorus pentachloride (PCl5) further solidifies its position as the leading production method.

The substitution reactions segment is anticipated to register the highest growth rate during the forecast period. These methods, which often involve reacting phosphorus compounds with other chlorinated agents such as thionyl chloride, can offer advantages in terms of product purity or specific reaction conditions. The demand for purer grades of phosphorus trichloride in specialized applications, such as high-end pharmaceuticals and electronics, drives the exploration and adoption of these alternative production routes. These methods might be more suitable for producing smaller, highly controlled batches where precise control over the final product's impurity profile is critical.

Application Analysis

Based on application, the segmentation includes agrochemicals & pharmaceutical, EV battery chemicals, flame retardants, surfactants, water treatment, plastic additives, oil & gas, and others. The agrochemicals & pharmaceutical segment held the largest share in 2024. This dominance is driven by the critical role of phosphorus trichloride as a vital intermediate in producing a vast array of compounds for these industries. In agrochemicals, it is extensively used to synthesize herbicides, insecticides, and fungicides that are essential for protecting crops and boosting agricultural yields worldwide. The continuous need for increased food production to feed a growing global population ensures sustained demand from this sector. Similarly, within the pharmaceutical sector, phosphorus trichloride is a key building block for various active pharmaceutical ingredients (APIs) and other chemical intermediates, crucial for the development and manufacturing of numerous drugs.

The electric vehicle (EV) battery chemicals segment is anticipated to exhibit the highest growth rate during 2025–2034. This rapid growth is directly linked to the surging global demand for EVs and energy storage systems. Phosphorus trichloride is a crucial raw material in the production of certain phosphorus-based compounds, such as lithium hexafluorophosphate (LiPF6), which are vital components of electrolytes in lithium-ion batteries. As the automotive sector rapidly shifts toward electrification and governments worldwide promote EV adoption through incentives and regulations, the demand for battery materials is skyrocketing.

Regional Analysis

The Asia Pacific phosphorus trichloride market accounted for the largest share in 2024. Asia Pacific is a dominant region in the global market and reports a rapidly growing demand for phosphorus trichloride. This growth is fueled by rapid industrialization, expanding manufacturing capabilities, and significant investments in various end-use industries. The vast agricultural landscapes and increasing population in countries across the region necessitate a huge demand for agrochemicals, making them a primary driver for phosphorus trichloride. Furthermore, the burgeoning pharmaceutical sectors and the rapid expansion of the electronics sector, particularly in battery chemical production for electric vehicles, contribute substantially to the region's leading position.

China Phosphorus Trichloride Market Insights

China is a dominant country in the Asia Pacific as well as global market. The country's massive chemical manufacturing base makes it a leading producer and consumer of PCl3. China's enormous agricultural sector drives immense demand for phosphorus trichloride in agrochemical production. Moreover, the country's rapid advancements in the pharmaceutical area and its aggressive push into EV battery manufacturing significantly boost the consumption of phosphorus trichloride. The scale of industrial growth and ongoing infrastructure development across various sectors in China firmly establishes its critical role in the global phosphorus trichloride landscape.

North America Phosphorus Trichloride Market Trends

North America represents a significant region in the global phosphorus trichloride market, driven by its well-established chemical manufacturing sector and strong agricultural activities. The demand for agrochemicals, including herbicides and insecticides that use phosphorus trichloride as a key intermediate, is consistently high across the region due to large-scale farming practices and the need for efficient crop protection. Additionally, the region's robust pharmaceutical sector contributes to the demand, as phosphorus trichloride is crucial in synthesizing various pharmaceutical compounds. Innovation in specialty chemicals and advancements in manufacturing processes also play a role in sustaining the region.

U.S. Phosphorus Trichloride Market Overview

In North America, the U.S. is a major contributor to the phosphorus trichloride market. The country has a large and technologically advanced chemical sector, which facilitates the production and consumption of PCl3. The extensive agricultural sector in the U.S., particularly in the Midwest, drives substantial demand for phosphorus trichloride in agrochemical applications. Furthermore, the strong presence of pharmaceutical companies and ongoing research and development in drug discovery and manufacturing contribute significantly to the stability and growth. Regulatory frameworks, while stringent, also ensure high-quality production standards.

Europe Phosphorus Trichloride Market Analysis

Europe holds a considerable share in the global market, characterized by its mature chemical sector and strong focus on specialty chemicals and pharmaceuticals. The region's stringent environmental regulations often lead to advanced manufacturing processes and a push toward higher purity grades of chemicals. While agricultural land might be less expensive than in some other regions, the demand for high-value agrochemicals remains consistent. The emphasis on innovation and the presence of numerous research and development facilities further drive the need for phosphorus trichloride in various sophisticated applications.

In Europe, the Germany phosphorus trichloride market stands out as a key country. Its highly developed chemical sector, known for its technological prowess and engineering excellence, is a major producer and consumer of PCl3. German chemical companies are at the forefront of developing advanced materials and specialty chemicals, where phosphorus trichloride serves as a fundamental building block. The country's strong pharmaceutical sector also contributes significantly to demand, emphasizing high-purity products. Germany's commitment to research and development further ensures a steady need for this chemical in innovative applications.

Key Players and Competitive Insights

The phosphorus trichloride market features a competitive landscape with several key players, including Solvay SA, LANXESS AG, ICL Group Ltd., Xingfa Group, and Sandhya Group. These companies are actively involved in the production and distribution of phosphorus trichloride, catering to a diverse range of end-use industries. The competitive environment is shaped by factors such as production capacity, technological advancements in manufacturing processes, and the ability to offer various grades of PCl3 to meet specific customer requirements. Players often compete on product purity, supply chain reliability, and technical support, especially for sensitive applications such as pharmaceuticals. Strategic partnerships and long-term contracts with major consumers also play a significant role in securing share.

A few prominent companies in the industry are Solvay SA; LANXESS AG; ICL Group Ltd.; Xingfa Group; Sandhya Group; PCC Rokita SA; Parchem Fine & Specialty Chemicals; Xuzhou Jianping Chemical Co., Ltd.; Anhui Guangxin Agrochemical Co., Ltd.; Excel Industries Ltd.; and Jiangsu Tianyuan Chemical Co., Ltd.

Key Players

- Anhui Guangxin Agrochemical Co., Ltd.

- Excel Industries Ltd.

- ICL Group Ltd.

- Jiangsu Tianyuan Chemical Co., Ltd.

- LANXESS AG

- Parchem fine & specialty chemicals

- PCC Rokita SA (PCC SE)

- Sandhya Group

- Solvay SA

- Xingfa Group (Hubei Xingfa Chemicals Group Co., Ltd.)

- Xuzhou Jianping Chemical Co., Ltd.

Phosphorus Trichloride Industry Development

September 2024: ICL’s Industrial Products division entered into a Memorandum of Understanding (MoU) with Orbia Fluor & Energy Materials (OF&EM) to supply phosphorus trichloride (PCl₃). This chemical will be used in the production of lithium hexafluorophosphate (LiPF₆), an essential electrolyte in lithium-ion batteries.

Phosphorus Trichloride Market Segmentation

By Grade Outlook (Revenue – USD Billion, 2020–2034)

- Industrial

- Pharmaceutical

- Pure

- Analytical

- Others

By Sales Channel Outlook (Revenue – USD Billion, 2020–2034)

- Direct Sales

- Distributors & Traders

- Others

By Production Method Outlook (Revenue – USD Billion, 2020–2034)

- Direct Chlorination

- Substitution Reaction

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Agrochemicals & Pharmaceutical

- EV Battery Chemicals

- Flame Retardants

- Surfactants

- Water Treatment

- Plastic Additives

- Oil & Gas

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Phosphorus Trichloride Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.39 billion |

|

Market Size in 2025 |

USD 2.55 billion |

|

Revenue Forecast by 2034 |

USD 4.69 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.39 billion in 2024 and is projected to grow to USD 4.69 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market are Solvay SA; LANXESS AG; ICL Group Ltd.; Xingfa Group; Sandhya Group; PCC Rokita SA; Parchem Fine & Specialty Chemicals; Xuzhou Jianping Chemical Co., Ltd.; Anhui Guangxin Agrochemical Co., Ltd.; Excel Industries Ltd.; and Jiangsu Tianyuan Chemical Co., Ltd.

The industrial segment accounted for the largest share of the market in 2024.

The distributors and traders segment is expected to witness the fastest growth during the forecast period.