Performance Fabric Market Size, Share, Trends, Industry Analysis Report

By Material Type (Polyester, Nylon, Spandex, Aramid, Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6009

- Base Year: 2024

- Historical Data: 2020-2023

Overview

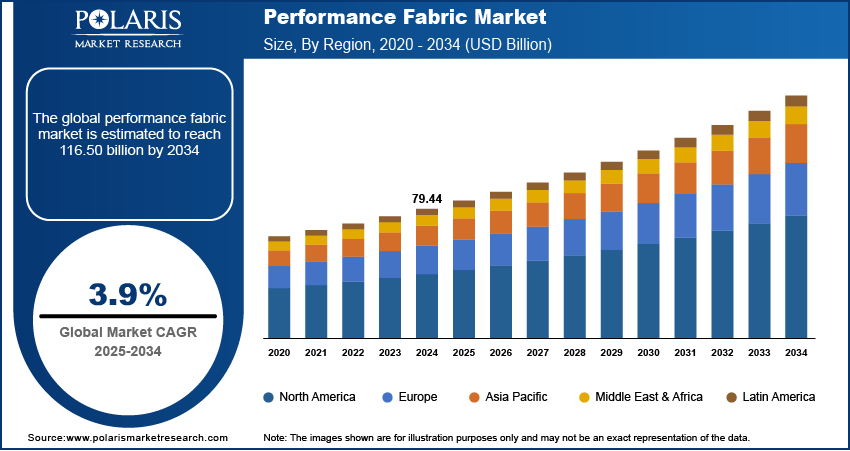

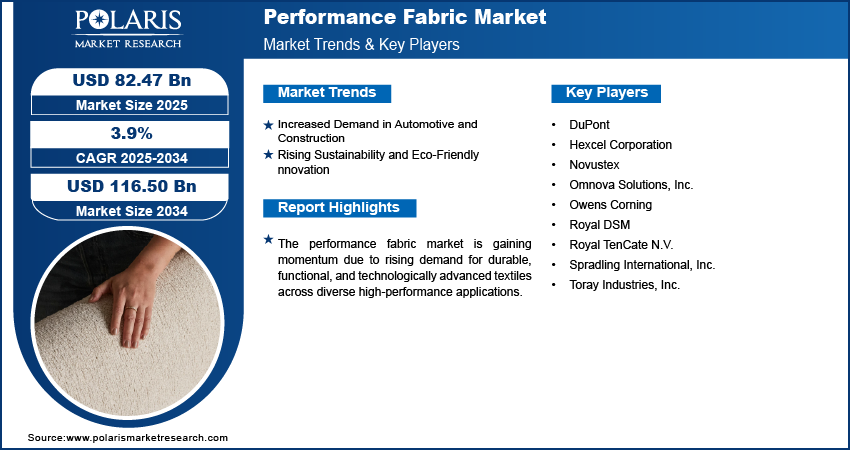

The global performance fabric market size was valued at USD 79.44 billion in 2024, growing at a CAGR of 3.9% from 2025 to 2034. Growing industrial and protective applications, driven by advances in smart textiles, and demand in automotive and construction sectors drive the market growth.

Key Insights

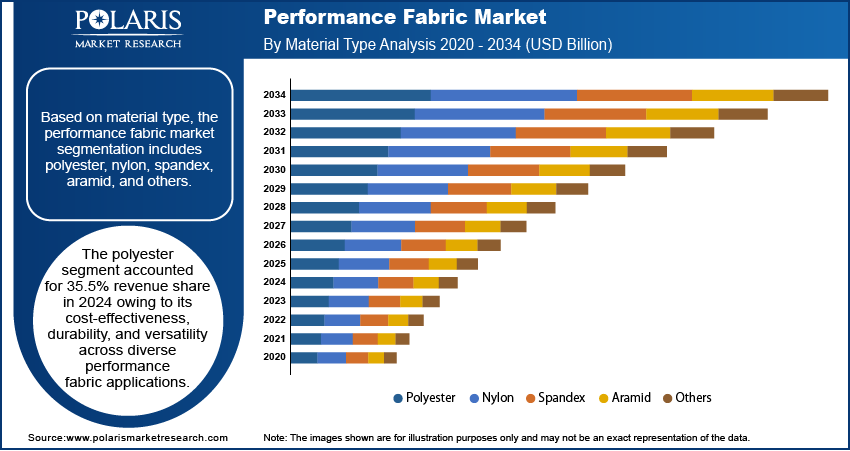

- The polyester segment accounted for 35.5% revenue share in 2024.

- The defense & public safety segment is projected to witness the highest CAGR of 4.5% during the forecast period.

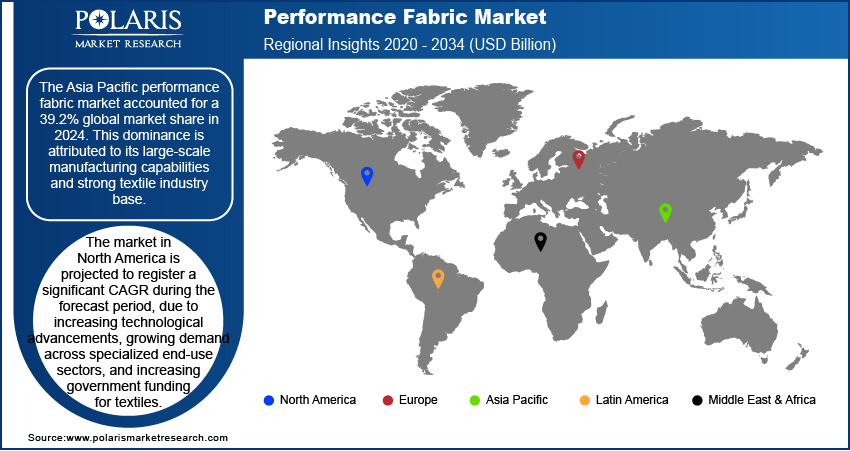

- Asia Pacific accounted for a 39.2% share of the global performance fabric market in 2024.

- China held the major regional market share in Asia Pacific in 2024.

- The market in North America is projected to register a significant CAGR during the forecast period.

- The market in the U.S. is expanding due to growing consumer awareness and rising demand across multiple sectors such as defense, healthcare, and athletic wear.

Performance fabric, also known as high-functionality textile, refers to materials engineered to deliver superior durability, breathability, moisture-wicking, and resistance to elements such as water, fire, or chemicals. The market for performance fabrics is witnessing notable growth, driven by its increasing adoption in industrial and protective applications. These fabrics are being widely utilized in various sectors such as construction, defense, and oil & gas, where worker safety and environmental resistance are critical. Their properties, such as flame retardancy, high tensile strength, and resistance to harsh working conditions, make them essential in manufacturing protective gear, uniforms, and other industrial equipment, thereby boosting market demand.

Rapid advancements in textile engineering are contributing to the enhancement of these fabrics' appeal and performance. Innovations such as nanomaterials, smart fibers, and advanced finishing processes enable manufacturers to design textiles with multifunctional properties such as temperature regulation, antibacterial action, and self-cleaning capabilities. In March 2024, Directa Plus partnered with Heathcoat Fabrics to integrate graphene-based G+ thermal technology into advanced textiles, resulting in enhanced heat dissipation with over 60% improvement, improved anti-static performance, and improved antibacterial properties for aerospace, defense, and healthcare applications. These developments are enhancing the functional value of the fabric and expanding its application to high-performance sportswear, military wearable, and medical textiles. Moreover, this ongoing integration of advanced technologies is strengthening the fabric’s competitive edge and broadening its presence across diverse sectors.

Industry Dynamics

- The automotive and construction sectors are increasingly adopting performance fabrics due to their durability, UV resistance, and thermal stability.

- Sustainability trends are reshaping the industry, with manufacturers prioritizing eco-friendly innovations to comply with regulatory requirements and meet shifting consumer preferences toward greener materials.

- Evolving sustainability regulations are pressuring manufacturers to develop eco-friendly performance fabrics without compromising durability or functionality, creating R&D and cost hurdles.

- The rise of smart textiles and wearable technology presents new avenues for innovation, particularly in integrated temperature regulation and biometric monitoring for athletic and medical applications.

Increased Demand in Automotive and Construction: The increased demand from the automotive and construction sectors is being driven by the growing need for materials that combine durability, aesthetics, and functionality. According to an April 2025 Niti Aayog report, the global automotive components market reached a valuation of USD 2 trillion in 2022, reflecting the expansion opportunities for these fabrics. In the automotive industry, performance fabrics are being integrated into vehicle interiors for their resistance to wear, UV rays, and temperature fluctuations, enhancing both longevity and user comfort. Similarly, in the construction sector, these fabrics are utilized in architectural membranes, protective clothing, and insulation materials due to their strength, weather resistance, and flame-retardant properties. The increasing application of performance textiles in these high-demand environments highlights their crucial role in enhancing product reliability and operational safety.

Rising Sustainability and Eco-Friendly Innovation: Rising focus on sustainability and eco-friendly innovation is fueling the performance fabric market demand as consumers and industries increasingly prioritize environmentally responsible materials. Manufacturers are investing in bio-based fibers, recyclable textiles, and waterless dyeing technologies to reduce environmental impact while maintaining high-performance standards. In April 2025, Jiwarajka Textile Industries partnered with CiCLO technology to enhance the biodegradability of its polyester yarns, addressing synthetic microfiber waste. The collaboration aligns with the company’s sustainability goals while maintaining its 20,000-tonne annual production capacity producing high-quality Draw Texturized Yarn (DTY). Additionally, eco-conscious innovations are enhancing the appeal of performance fabrics across sectors such as fashion, sportswear, and home furnishings, enabling the market to evolve toward greener, more sustainable solutions without compromising on quality or functionality.

Segmental Insights

Material Type Analysis

Based on material type, the segmentation includes polyester, nylon, spandex, aramid, and others. The polyester segment accounted for 35.5% revenue share in 2024 owing to its cost-effectiveness, durability, and versatility across diverse performance fabric applications. Polyester is widely preferred due to its high resistance to stretching, shrinking, and environmental conditions, making it suitable for a variety of applications, including sportswear, industrial textiles, and outdoor gear. Its compatibility with functional finishes, such as moisture-wicking, UV protection, and antimicrobial coatings, further strengthens its market position. Additionally, advancements in recycled polyester and eco-friendly variants are enhancing its adoption in sustainability-driven textile innovations, thereby reinforcing its dominance across various end-use sectors.

End Use Analysis

In terms of end use, the segmentation includes textile & apparel, sports & outdoor, defense & public safety, and others. The defense & public safety segment is projected to witness the highest CAGR of 4.5% during the forecast period due to rising demand for high-performance protective gear and specialized textiles. The increasing focus on enhancing safety standards for personnel operating in hazardous environments is driving investments in flame-resistant, bulletproof, and chemical-resistant fabrics. Growing geopolitical tensions and increasing defense budgets are further accelerating the adoption of advanced protective solutions. Moreover, ongoing innovations in lightweight, breathable, and multifunctional materials are enhancing comfort and mobility for end users, thereby improving operational efficiency. These factors collectively contribute to the rapid expansion of this segment.

Regional Analysis

The Asia Pacific performance fabric market accounted for 39.2% of the global market share in 2024. This dominance is attributed to its large-scale manufacturing capabilities and strong textile industry base. According to a February 2025 report by India's Ministry of Commerce and Industry, the country's textile and apparel market is expected to register a CAGR of 10%, reaching USD 350 billion by 2030. The region benefits from the availability of raw materials, cost-efficient labor, and a well-established supply chain, making it a global hub for fabric production. Additionally, rising consumer demand for activewear, protective gear, and industrial textiles, along with increasing urbanization and infrastructure development, is boosting expansion opportunities. The presence of leading fabric manufacturers and growing investments in R&D also support the region’s dominance in the global landscape.

China Performance Fabric Market Insight

China accounted for a major regional market share in Asia Pacific in 2024 due to its dominant position as a major exporter and low-cost manufacturing hub. North American companies heavily rely on Chinese suppliers for the cost-efficient production of high-volume, functional fabrics that meet both industrial and consumer-grade specifications. Additionally, China’s well-established textile infrastructure and rapid scalability contribute to its strong presence in fulfilling North American market demand.

North America Performance Fabric Market Trends

The market in North America is projected to record a significant CAGR during the forecast period, due to increasing technological advancements, growing demand across specialized end-use sectors, and increasing government funding for textiles. In September 2024, the U.S. Department of Commerce allocated USD 800,000 to strengthen textile manufacturing infrastructure in Morganton, North Carolina. The region exhibits a strong inclination toward innovation, particularly in smart textiles, sustainable materials, and high-performance protective wear. Sectors such as defense, healthcare, and sports are actively adopting performance fabrics to meet rising performance and safety expectations. Moreover, increasing consumer awareness of advanced textile functionality and sustainability is further contributing to the growth trajectory in this region.

U.S. Performance Fabric Market Outlook

The market in the U.S. is expanding due to growing consumer awareness and rising demand across multiple sectors such as defense, healthcare, and athletic wear. The region’s focus on domestic innovation and high-performance textile applications is driving the adoption of advanced materials. Furthermore, the presence of key market players and increasing investments in sustainable textile solutions are reinforcing the country’s position as a growing market for performance fabrics.

Europe Performance Fabric Market Insights

The performance fabric landscape in Europe is projected to hold a substantial share in 2034, owing to its well-established technical textile industry and strict regulatory standards emphasizing quality and sustainability. The region is witnessing robust demand for eco-friendly, certified performance fabrics in applications such as work wear, fashion, healthcare, and automotive. European manufacturers are at the forefront of innovation in functional materials, often integrating recyclability, biodegradability, and advanced performance characteristics. Strong support for research and collaboration across academia and industry also fosters continued development and adoption of high-value textile solutions across the region.

Germany Performance Fabric Market Analysis

The market for performance fabric in Germany is witnessing growth driven by its robust technical textile industry and strong focus on engineering innovation. The country’s advanced manufacturing capabilities support the production of highly functional fabrics used in automotive, industrial, and safety applications. In addition, Germany’s focus on environmental compliance and quality standards continues to drive demand for high-end, sustainable textile solutions, contributing to consistent market expansion.

Key Players and Competitive Analysis

The performance fabrics sector is witnessing dynamic competition driven by emerging markets, sustainable value chains, and disruptions and trends in material innovation. Major players, such as DuPont, Toray, and Milliken, are leveraging strategic investments in graphene-enhanced and biodegradable textiles to capture revenue opportunities across the healthcare, defense, and sportswear segments. Competitive intelligence and strategy reveal that small and medium-sized businesses are gaining traction through niche offerings, such as phase-change fabrics. At the same time, larger corporations focus on expansion opportunities through acquisitions. Technological advancements in smart textiles are reshaping industry trends, with economic and geopolitical shifts prompting localized production. Challenges include supply chain disruptions and strict sustainability mandates; however, future development strategies emphasize circular economy models to align with ESG goals.

A few major companies operating in the performance fabric industry include DuPont; Hexcel Corporation; Milliken & Company; Novustex; Omnova Solutions, Inc.; Owens Corning; Royal DSM; Royal TenCate N.V.; Spradling International, Inc.; and Toray Industries, Inc.

Key Players

- DuPont

- Hexcel Corporation

- Milliken & Company

- Novustex

- Omnova Solutions, Inc.

- Owens Corning

- Royal DSM

- Royal TenCate N.V.

- Spradling International, Inc.

- Toray Industries, Inc.

Industry Developments

- June 2025: Teijin Frontier developed a next-generation stretch fabric featuring a 3D structure with random crimps, offering enhanced elasticity, lightweight comfort, quick-drying properties, and moisture-wicking performance while maintaining a soft, airy texture.

- February 2025: Noble Biomaterials partnered with Coolcore to develop COOLPRO fabric, which combines ionic antimicrobial properties with thermoregulation technology, marking the first fabric to merge these dual-performance technologies.

Performance Fabric Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyester

- Nylon

- Spandex

- Aramid

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Textile & Apparel

- Sports & Outdoor

- Defense & Public Safety

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Performance Fabric Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 79.44 Billion |

|

Market Size in 2025 |

USD 82.47 Billion |

|

Revenue Forecast by 2034 |

USD 116.50 Billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 79.44 billion in 2024 and is projected to grow to USD 116.50 billion by 2034.

The global market is projected to register a CAGR of 3.9% during the forecast period.

Asia Pacific accounted for a 39.2% global market share in 2024.

A few of the key players in the market are DuPont; Hexcel Corporation; Milliken & Company; Novustex; Omnova Solutions, Inc.; Owens Corning; Royal DSM; Royal TenCate N.V.; Spradling International, Inc.; and Toray Industries, Inc.

The polyester segment accounted for 35.5% revenue share in 2024.

The defense & public safety segment is projected to witness the highest CAGR of 4.5% during the forecast period.