U.S. Acute External Ventricular Drain Market Size, Share, Trends, & Industry Analysis Report

By Patient Type (Pediatric and Adult), By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6005

- Base Year: 2024

- Historical Data: 2020-2023

Overview

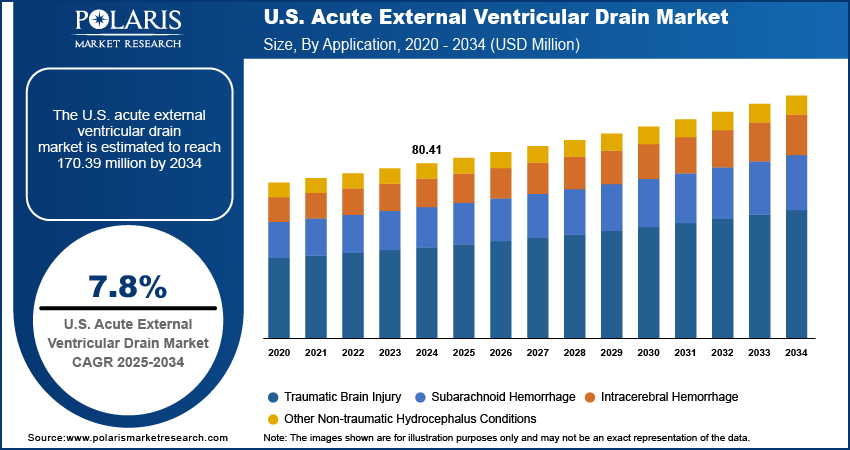

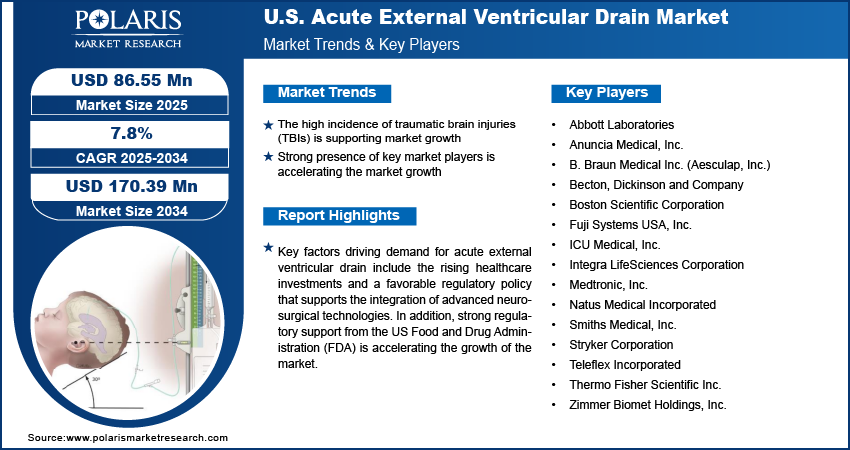

The US acute external ventricular drain market size was valued at USD 80.41 million in 2024, growing at a CAGR of 7.8% from 2025–2034. Key factors driving demand for acute external ventricular drains include a high incidence of traumatic brain injuries (TBIs) coupled with a strong presence of key market players in the country.

Key Insights

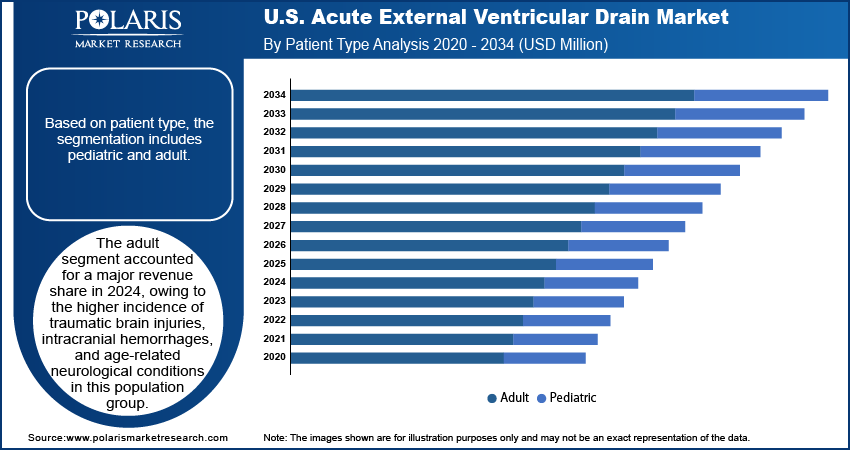

- The adult patient segment accounted for largest market share in 2024.

- The pediatric segment is projected to grow at the fastest rate over the forecast period, driven by the rising incidence of congenital hydrocephalus and traumatic brain injuries.

The US acute external ventricular drain market plays a key role in neurocritical care by supporting short-term cerebrospinal fluid diversion and intracranial pressure monitoring. These systems enable controlled cerebrospinal fluid diversion in patients with elevated intracranial pressure due to neurological trauma or conditions. They are widely used across intensive care settings to assist in pressure regulation and facilitate recovery following acute neurological events. The market encompasses a broad range of external drainage systems designed for short-term placement, including advanced models featuring closed-loop collection, pressure monitoring capabilities, and infection-control features.

The US acute external ventricular drains (EVD) market is significantly growing due to rising healthcare investments and a favorable regulatory policy that supports the integration of advanced neurosurgical technologies. According to the Centers for Medicare & Medicaid Services, US healthcare spending increased by 7.5% in 2023, totaling USD 4.9 trillion or approximately USD 14,570 per person. This reflects sustained investment in neurocritical infrastructure and essential equipment, such as external ventricular drains. Hospitals and trauma centers are expanding EVD use to support efficient cerebrospinal fluid control and neurological care delivery.

In addition, market growth is supported by FDA policies that expedite the approval and adoption of external ventricular drainage devices in the US Programs such as the FDA’s breakthrough devices program and the streamlined 510(k) premarket clearance process are enabling faster commercialization of innovations in external drainage systems. These include smart EVD platforms with integrated pressure monitoring and antimicrobial features designed to reduce infection risk and enhance CSF drainage accuracy. The presence of structured regulatory pathways supports safer technology adoption, fostering continuous innovation among domestic manufacturers. Therefore, hospitals across the US are upgrading to more efficient and intelligent EVD systems to meet the modern neurosurgical protocols, improve patient outcomes, and reduce complication rates in critical neurological care.

Industry Dynamics

- Rising cases of traumatic brain injuries (TBIs) in the US are driving the adoption of external ventricular drain systems in neurocritical care units.

- Surge in R&D investments by leading US-based manufacturers to develop next-generation EVD technologies is propelling the market growth.

- Advancements such as real-time intracranial pressure (ICP) monitoring and wireless-enabled systems are creating market opportunities to enhance critical care outcomes and clinical decision-making.

- High device and procedural costs, along with infection risks and catheter-related complications, are restraining the market growth.

High Incidence of Traumatic Brain Injuries (TBIs) is Supporting Market Growth

The growing prevalence of traumatic brain injuries (TBIs) in the US is increasing the demand for external ventricular drain systems across neurocritical care settings. According to the Centre for Neuro Skills, approximately 2.5 million traumatic brain injuries (TBIs) occur each year in the US TBIs are the leading cause of death and disability among children and adolescents, with the highest incidence seen in the 0–4 and 15–19 age groups. EVD systems are frequently used to divert cerebrospinal fluid (CSF) and allow precise intracranial pressure monitoring. These procedures are widely adopted in trauma centers and emergency units due to their effectiveness in preventing secondary brain injury and supporting neurological recovery. The rising incidence of road accidents, falls, and sports-related head injuries is pushing healthcare providers to include EVD placement as a standard component of critical care protocols. The growing clinical need for real-time pressure relief and cerebrospinal fluid management is accelerating the adoption of external ventricular drain systems across US hospitals.

Strong Presence of Key Market Players is Accelerating the Market Growth

The presence of key market players in the country that are actively investing in research and development to deliver next-generation EVD systems is further boosting the growth of the market. For instance, in March 2025, Anuncia Medical received FDA Breakthrough Device Designation for its ReFlow External Ventricular Drain (EVD) system. This system features a noninvasive manual flush mechanism that restores and maintains cerebrospinal fluid flow. This helps to prevent catheter occlusions and reduces the need for device replacement or surgical revision. The design allows trained nursing staff to perform maintenance at the bedside, minimizing reliance on neurosurgeons and improving workflow efficiency in intensive care units. These developments are strengthening the US market by expanding access to advanced drainage technologies and supporting improved care delivery.

Segmental Insights

Patient Type Analysis

Based on patient type, the segmentation includes pediatric and adult. The adult segment accounted for largest revenue share in 2024, owing to the higher incidence of traumatic brain injuries, intracranial hemorrhages, and age-related neurological conditions in this population group. Adults are more likely to be affected by hypertension-related hemorrhages, aneurysms, and traumatic incidents such as road accidents or falls, which require external ventricular drainage for intracranial pressure relief. According to the World Health Organization, approximately 1.28 billion adults aged 30 to 79 worldwide are affected by hypertension. Hospitals and trauma centers across developed and emerging countries are equipping neurosurgical ICUs to address these adult neurological emergencies through rapid EVD placement and monitoring. Additionally, the prevalence of postoperative hydrocephalus in adult brain tumor surgeries further boosts the use of temporary ventricular access systems.

The pediatric segment is projected to grow at the fastest CAGR from 2025 to 2034, fueled by improved neonatal and pediatric neurosurgery services across specialized hospitals. Congenital hydrocephalus, infections such as meningitis, and intraventricular hemorrhage in premature infants are leading contributors to EVD usage in pediatric care. Increasing focus on pediatric neurocritical care in tertiary and academic hospitals, is driving demand for child-specific EVD systems tailored to smaller ventricles and lower pressure requirements. Additionally, the introduction of safer, low-profile pediatric catheters is improving clinical adoption and procedural outcomes in younger patients.

Application Analysis

In terms of application, the segmentation includes traumatic brain injury, subarachnoid hemorrhage, intracerebral hemorrhage, and other non-traumatic hydrocephalus conditions. The traumatic brain injury segment dominated the revenue share in 2024, due to the increasing volume of emergency cases requiring immediate intervention to prevent brain swelling and neurological deterioration. Traumatic incidents such as vehicle collisions, workplace injuries, and assaults are contributing to elevated intracranial pressure that requires rapid management through CSF drainage and pressure monitoring. According to the World Health Organization, road traffic crashes result in approximately 1.19 million deaths globally each year. EVD systems provide surgeons with a reliable and adjustable method to stabilize such patients in intensive care settings.

The subarachnoid hemorrhage segment is expected to witness the fastest growth rate during the forecast period. Aneurysmal ruptures and spontaneous bleeding into the subarachnoid space leading to acute hydrocephalus, necessitating the placement of EVD to maintain cerebral perfusion pressure. The increased availability of diagnostic imaging services and neurosurgical facilities across hospitals enabled faster diagnosis and intervention in subarachnoid hemorrhage cases. Additionally, the growing prevalence of risk factors such as hypertension and vascular malformations is fueling the need for early cerebrospinal fluid management through external ventricular drainage.

Key Players & Competitive Analysis Report

The US acute external ventricular drain (EVD) market is moderately consolidated, with leading manufacturers focusing on innovation, clinical reliability, and infection prevention to strengthen their presence in critical care environments. Companies are investing in the development of advanced drainage systems that combine accuracy in cerebrospinal fluid (CSF) diversion with improved ease of use for neurosurgical teams operating in intensive care and trauma settings. The market is witnessing increasing demand for specialized systems tailored to the needs of adult and pediatric patient populations, pushing companies to expand their product portfolios and clinical training programs. Abbott Laboratories is actively advancing neurocritical care solutions in the US through innovations in intracranial pressure monitoring and CSF management systems. Anuncia Medical, Inc. focuses on developing advanced CSF management devices, including smart shunt and EVD technologies tailored for hydrocephalus and acute brain injury patients. B. Braun Medical Inc. (Aesculap, Inc.) offers a portfolio of precision-engineered external ventricular drainage systems designed to support neurosurgical and intensive care applications across US hospitals. Collaborative efforts with neurosurgeons and healthcare providers are contributing to the development of devices that meet evolving clinical demands.

Prominent companies operating in the US acute external ventricular drain market include Abbott Laboratories, Anuncia Medical, Inc., B. Braun Medical Inc. (Aesculap, Inc.), Becton, Dickinson and Company, Boston Scientific Corporation, Fuji Systems USA, Inc., ICU Medical, Inc., Integra LifeSciences Corporation, Medtronic, Inc., Natus Medical Incorporated, Smiths Medical, Inc., Stryker Corporation, Teleflex Incorporated, Thermo Fisher Scientific Inc., and Zimmer Biomet Holdings, Inc.

Key Players

- Abbott Laboratories

- Anuncia Medical, Inc.

- B. Braun Medical Inc. (Aesculap, Inc.)

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Fuji Systems USA, Inc.

- ICU Medical, Inc.

- Integra LifeSciences Corporation

- Medtronic, Inc.

- Natus Medical Incorporated

- Smiths Medical, Inc.

- Stryker Corporation

- Teleflex Incorporated

- Thermo Fisher Scientific Inc.

- Zimmer Biomet Holdings, Inc.

Industry Developments

December 2024: SoundPass, a novel external ventricular drain (EVD) catheter was awarded the prestigious USD 100,000 SVINnovation grand prize at the Society for Vascular and Interventional Neurology (SVIN) annual meeting held in San Diego. This highlights the growing trend in the US EVD market toward safer, image-guided devices designed to enhance patient outcomes in neurocritical care settings.

U.S. Acute External Ventricular Drain Market Segmentation

By Patient Type Outlook (Revenue, USD Billion, 2020–2034)

- Pediatric

- Adult

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Traumatic Brain Injury

- Subarachnoid Hemorrhage

- Intracerebral Hemorrhage

- Other Non-traumatic Hydrocephalus Conditions

U.S. Acute External Ventricular Drain Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 80.41 million |

|

Market Size in 2025 |

USD 86.55 million |

|

Revenue Forecast by 2034 |

USD 170.39 million |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, countries, and segmentation. |

FAQ's

The US market size was valued at USD 80.41 billion in 2024 and is projected to grow to USD 170.39 billion by 2034.

The US market is projected to register a CAGR of 7.8% during the forecast period.

A few of the key players in the market are Abbott Laboratories, Anuncia Medical, Inc., B. Braun Medical Inc. (Aesculap, Inc.), Becton, Dickinson and Company, Boston Scientific Corporation, Fuji Systems USA, Inc., ICU Medical, Inc., Integra LifeSciences Corporation, Medtronic, Inc., Natus Medical Incorporated, Smiths Medical, Inc., Stryker Corporation, Teleflex Incorporated, Thermo Fisher Scientific Inc., and Zimmer Biomet Holdings, Inc.

The adult sealants segment dominated the market in 2024.

The traumatic brain injury segment is expected to witness the fastest growth during the forecast period.