Non-Hodgkin Lymphoma Therapeutics Market Size, Share, Trends, & Industry Analysis Report

By Cell Type (B-cell lymphomas, T-cell lymphoma),By Therapy Type, By Route of Administration, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6004

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

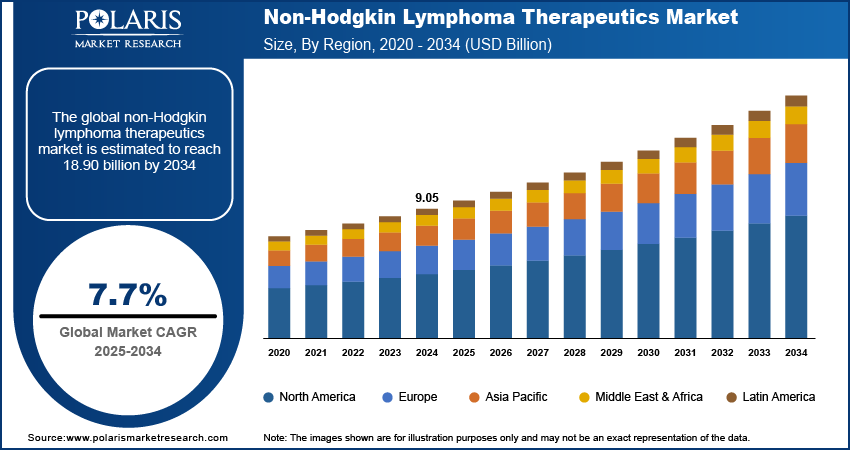

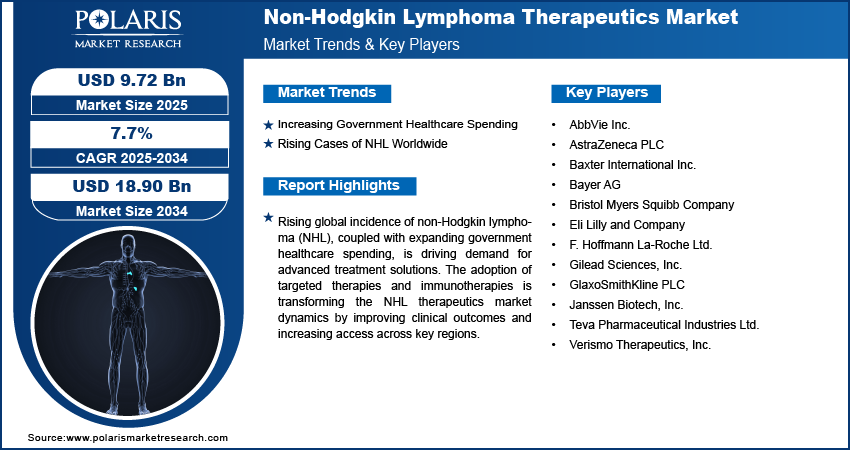

The global non-hodgkin lymphoma therapeutics market size was valued at USD 9.05 billion in 2024, growing at a CAGR of 7.7% during 2025–2034. Growing demand for non-Hodgkin lymphoma therapeutics is fueled by rising government healthcare expenditure and the increasing global incidence of NHL.

Key Insights

- The B-cell lymphoma segment accounted for largest market share in 2024.

- The targeted therapy segment is projected to grow at a rapid pace in the coming years, driven by advancements in biomarker-based treatment approaches.

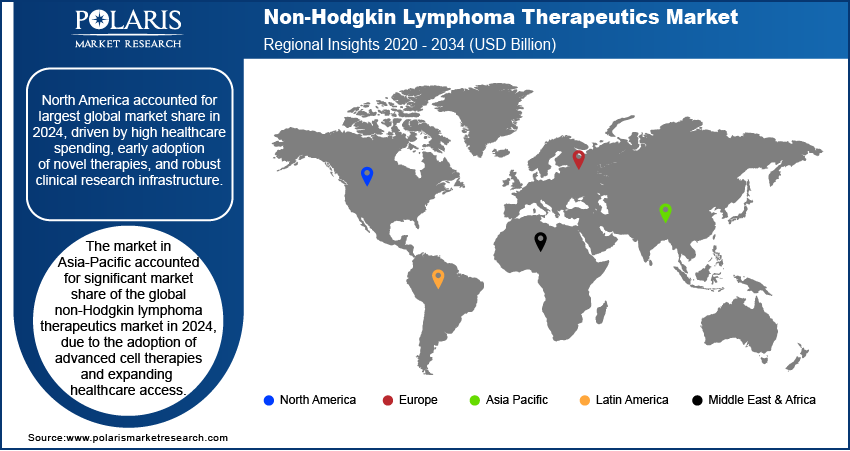

- The North America non-Hodgkin lymphoma therapeutics market accounted for largest share of the global market in 2024.

- The US non-Hodgkin lymphoma therapeutics market held largest regional share of the North America market in 2024, due to high healthcare spending and early diagnostic access.

- The market in Asia Pacific is projected to grow with a fastest CAGR from 2025-2034, fueled by rising cancer incidence, growing awareness, and improving healthcare infrastructure.

- Countries such as China and Japan are playing a key role in regional growth, due to expanding healthcare access, supportive government initiatives, and increasing adoption of innovative treatments.

Non-Hodgkin Lymphoma (NHL) therapeutics refer to a range of treatments used to manage cancers of the lymphatic system to target abnormal lymphocyte growth. These therapies target NHL subtypes, including diffuse large B-cell, follicular, and mantle cell lymphoma, to improve precision, boost response rates, and lower relapse risk. Some of the treatment options include chemotherapy, monoclonal antibodies, cancer immunotherapy, targeted drugs, and stem cell transplantation based on the specific NHL subtype. This therapy is administered in hospitals, oncology clinics, and specialized cancer centers, based on disease stage, subtype, and patient condition. Rising advancements in biologics and precision medicines are helping improve clinical outcomes while reducing treatment-related toxicity.

The surge in global cancer cases is driving the non-Hodgkin lymphoma (NHL) therapeutics market due to growing demand for early diagnosis and targeted therapies for minimizing pressure on healthcare systems to expand oncology treatment infrastructure. According to the latest report by the World Health Organization (WHO), cancer was responsible for nearly 10 million deaths worldwide, with lymphomas accounting for a major share of hematologic malignancies. The growing global cancer burden is expanding patient pools as well as driving governments and private healthcare providers to adopt effective NHL treatment options. This trend is expected to support continued innovation and steady growth in the NHL therapeutics market.

The rising global geriatric population is fueling demand in the non-Hodgkin lymphoma (NHL) therapeutics market, as older adults face a higher risk of lymphoproliferative disorders due to age-related immune decline. According to the World Population Prospects 2024, the global population is projected to rise from 8.2 billion in 2024 to a peak of approximately 10.3 billion by mid-2080. This demographic shift is increasing the incidence of NHL, stimulating the need for age-appropriate treatments with improved safety and efficacy profiles. Thus, healthcare systems prepare for higher cancer caseloads among aging individuals, and the geriatric trend continues to play a central role in driving demand for NHL therapeutics globally.

Industry Dynamics

- Increasing government healthcare spending globally is boosting access to advanced NHL therapies and accelerating the development of innovative treatment options.

- The emergence of targeted and immunotherapies is driving the market growth by reshaping NHL treatment approaches, offering higher efficacy and personalized care.

- The growing focus on personalized medicine and biomarker-driven therapies is creating opportunities for targeted drug development, improving treatment outcomes, and expanding therapeutic options for diverse patient subtypes.

- The high treatment cost is restricting the adoption of advanced therapies in countries with an underdeveloped healthcare infrastructure and minimal insurance coverage.

Increasing Government Healthcare Spending: Rising government healthcare spending is driving the growth of the non-Hodgkin lymphoma (NHL) therapeutics market by improving access to cancer diagnosis, treatment, and long-term care. According to the World Health Organization (WHO), global health expenditure reached approximately USD 9 trillion in 2021, with many countries allocating larger budgets toward oncology services. Moreover, government health spending in 2023 represented 10.1% of GDP in Germany, 9.5% in Japan, and 7.9% in Canada, marking an increase from 9.8%, 9.2% and 7.7% respectively in 2019. The funding enables public hospitals to adopt advanced biologics, immunotherapies, and supportive care infrastructure for hematologic malignancies, including NHL. Thus, investment in national health programs is expanding access to cancer care, increasing treatment uptake, and driving consistent demand for NHL therapeutics across key markets.

Rising Cases of NHL Worldwide: The growing cases of non-Hodgkin lymphoma (NHL) worldwide are driving the demand for more effective and personalized treatment options. The increasing disease burden among aging populations and immunocompromised individuals, is pushing healthcare systems to expand access to novel therapies beyond conventional chemotherapy. According to the Global Cancer Observatory (GLOBOCAN), the global incidence of non-Hodgkin lymphoma is expected to rise by 43%, reaching approximately 779,000 cases by 2040, up from 544,000 in 2020. This trend is accelerating investment in targeted biologics, immunotherapies and advanced cell-based treatments to improve long-term outcomes. Additionally, the growing patient volumes and clinical complexity are expected to support steady expansion of the global NHL therapeutics market.

Segmental Insights

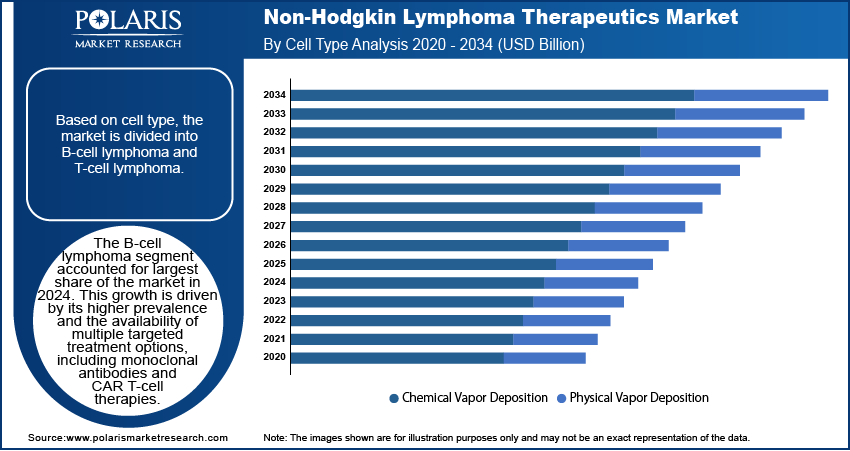

Cell Type Analysis

Based on cell type, the segmentation includes B-cell lymphoma and T-cell lymphoma. The B-cell lymphoma segment accounted for the largest market share in 2024. This is due to its high prevalence and increasing clinical focus on targeted monoclonal antibody therapies. Treatments such as CD20 monoclonal antibodies and emerging bispecifics are improving clinical outcomes in common subtypes such as diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma. For instance, in June 2023, the US Food and Drug Administration (FDA) approved Roche’s Columvi for treating adult patients with relapsed or refractory diffuse large B-cell lymphoma. The segment continues to benefit from deeper clinical pipelines, high patient screening rates, and integration of diagnostic biomarkers that support subtype-specific treatment strategies.

The T-cell lymphoma segment is projected to expand at a notable pace through 2034, driven by increasing awareness and evolving therapeutic options for aggressive subtypes. Novel agents including HDAC inhibitors, immune modulators, and cellular therapies are addressing gaps in treatment efficacy for relapsed or refractory T-cell variants. Clinical research targeting epigenetic pathways and immune dysregulation continues to broaden the treatment landscape for this segment.

Therapy Type Analysis

In terms of therapy type, the segmentation includes chemotherapy, targeted therapy, radiation therapy, and other therapy types. The chemotherapy segment held the dominant market share in 2024, due to its well-known role in first-line treatment across a wide spectrum of NHL subtypes. Treatment regimens such as CHOP (cyclophosphamide, doxorubicin, vincristine, and prednisone) combined with targeted therapies are widely used in the induction and consolidation phases for treating non-Hodgkin lymphoma. Chemotherapy continues to offer broad cytotoxic action against malignant lymphocytes, and its cost-effectiveness makes it accessible across public and private healthcare settings. The segment maintains its relevance in early-stage or low-grade lymphomas where long-term remission is achieved with fewer cycles.

The targeted therapy segment is estimated to hold a significant market share in 2034, owing to the growing use of monoclonal antibodies, small-molecule inhibitors, and CAR-T cell therapies. These treatments are designed to target specific antigens, signaling pathways, or genetic mutations associated with NHL progression. Increasing patient preference for personalized and less toxic regimens along with active R&D in antibody-drug conjugates and dual-target platforms, continues to drive this segment’s growth across different regions.

Route of Administration Analysis

Based on route of administration, the segmentation includes oral, intravenous, and subcutaneous. The intravenous (IV) segment accounted for the largest market share in 2024, due to its standard use in administering chemotherapy, monoclonal antibodies, and CAR-T therapies in clinical and hospital-based settings. IV administration allows for controlled dosing, rapid drug delivery and monitoring of patient response in real time, making it essential in induction, consolidation and maintenance phases of NHL treatment. The evolution of treatment protocols is increasing the reliance on IV delivery in moderate-to-severe cases that require hospital infrastructure and infusion-based administration.

The oral segment is projected to grow at the fastest CAGR during the forecast period, driven by the increasing use of small-molecule targeted therapies and kinase inhibitors formulated for at-home treatment. Oral agents such as BTK and PI3K inhibitors are improving convenience and helping patients stay on treatment, particularly in elderly individuals or those on long-term maintenance therapy. The shift toward outpatient care and patient preference for non-invasive options along with approvals of targeted oral drugs with favorable safety profiles, is accelerating the adoption of oral-based therapeutics across the globe.

Regional Analysis

North America non-Hodgkin lymphoma therapeutics industry accounted for largest global market share in 2024. This growth is driven by high disease incidence and early adoption of advanced biologics across oncology centers. Additionally, the increasing availability of CAR T-cell therapies and next-generation monoclonal antibodies is boosting the demand for NHL treatment across the US and Canada.

US Non-Hodgkin Lymphoma Therapeutics Market Insight

The US dominated the regional market, in 2024. This is driven by rising healthcare spending that propels hospitals and clinics to invest in cancer diagnosis, treatment and specialty care services. According to the Centers for Medicare & Medicaid Services (CMS), US national health expenditure reached approximately USD 4.9 trillion in 2023 from USD 4.1 trillion in 2020. Moreover, higher budget allocations are enabling broader access to immunotherapies, targeted drugs, and precision diagnostics for NHL patients. Additionally, growing investment in oncology infrastructure and treatment innovation in the US market is expected to contribute to the NHL therapeutics.

Asia-Pacific Non-Hodgkin Lymphoma Therapeutics Market Trend

The Asia-Pacific non-Hodgkin lymphoma therapeutics industry is projected to reach at a significant share by 2034. This is driven by rising cancer burden, increasing elderly population, and growing adoption of advanced therapies. Many countries such as China, Japan, and South Korea are expanding hematologic care services and accelerating the clinical integration of CAR T-cell and antibody-based treatments. Moreover, the growing expansion of clinical trial activity combined with regulatory support for biosimilar entry is boosting therapeutic development across the region.

India Non-Hodgkin Lymphoma Therapeutics Market Insight

Rising adoption of advanced cell therapies is driving growth in India non-Hodgkin lymphoma (NHL) therapeutics market, due to increasing clinical use in relapsed and treatment-resistant cases. These therapies offer targeted mechanisms that enhance response rates and reduce the limitations of traditional chemotherapy. For instance, in January 2025, Immuneel Therapeutics launched Qartemi, a CAR T-cell therapy designed for adult patients with relapsed or refractory B-cell NHL. The introduction of Qartemi reflects growing investment in locally accessible advanced therapies, broader clinical adoption, and improved patient outcomes across India’s oncology care ecosystem.

Europe Non-Hodgkin Lymphoma Therapeutics Market Overview

The market in Europe accounted for significant market share of the global non-Hodgkin lymphoma therapeutics market in 2024, driven by the rising number of NHL patients and growing adoption of biosimilar-based therapies. According to the European Cancer Information System (ECIS), Germany reported 18,980 new cases of non-Hodgkin lymphoma in 2022, with projections indicating a rise to 21,705 cases by 2040. Similarly, France recorded 16,972 cases in 2022, and it is expected to increase to 21,178 by 2040, highlighting the growing need for accessible and cost-effective treatment solutions. Moreover, the increasing product approvals and clinical integration of rituximab biosimilars by the European Medicines Agency (EMA) is expanding therapeutic access across hospitals and hematology centers. This shift toward biosimilar integration is helping healthcare systems across the region enhance treatment affordability while maintaining consistency in clinical outcomes.

Key Players & Competitive Analysis Report

The non-Hodgkin lymphoma (NHL) therapeutics market is highly competitive, with major players such as AbbVie Inc., AstraZeneca PLC, Baxter International Inc., Bayer AG, Bristol Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., and GlaxoSmithKline PLC. These companies are driving innovation across immunotherapy and targeted treatment landscapes by competing on therapy efficacy, clinical trial success, and strategic partnerships to fuel their pipelines in B-cell and T-cell lymphomas. The competitive dynamics are influenced by partnerships with biotech firms, licensing of next-generation therapies, and global clinical trials aimed at accelerating market approvals. The shift toward personalized medicine and first-line treatment options is driving companies to prioritize biomarker-driven therapies and expand access across emerging oncology markets.

Key companies in the industry include AbbVie Inc., AstraZeneca PLC, Baxter International Inc., Bayer AG, Bristol Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., GlaxoSmithKline PLC, Janssen Biotech, Inc., Teva Pharmaceutical Industries Ltd., and Verismo Therapeutics, Inc.

Key Players

- AbbVie Inc.

- AstraZeneca PLC

- Baxter International Inc.

- Bayer AG

- Bristol Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann La-Roche Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Janssen Biotech, Inc.

- Teva Pharmaceutical Industries Ltd.

- Verismo Therapeutics, Inc.

Industry Developments

January 2025: Verismo Therapeutics partnered with the Institute for Follicular Lymphoma Innovation (IFLI) to advance the development of SynKIR-310 for follicular lymphoma. This partnership aims to enhance Verismo’s pipeline of next-generation cell therapies for follicular lymphoma and other non-Hodgkin lymphoma subtypes, supporting the development of innovative treatment options for patients with high medical needs.

June 2024: F. Hoffmann-La Roche Ltd. launched the VENTANA Kappa and Lambda Dual ISH mRNA Probe Cocktail assay to assess the full spectrum of B-cell lymphoma subtypes. This innovative test enables pathologists to distinguish B-cell malignancies from normal immune responses, helping in faster and more accurate diagnoses.

May 2024: Bristol Myers Squibb received US FDA approval for Breyanzi, a CD19-directed CAR T cell therapy, for adults with relapsed or refractory mantle cell lymphoma. This approval marks the fourth distinct subtype of non-Hodgkin lymphoma for which Breyanzi is approved, making it the CAR T cell therapy with the broadest range of indications for B-cell malignancies.

Non-Hodgkin Lymphoma Therapeutics Market Segmentation

By Cell Type Outlook (Revenue, USD Billion, 2020–2034)

- B-cell lymphomas

- T-cell lymphoma

By Therapy Type Outlook (Revenue, USD Billion, 2020–2034)

- Chemotherapy

- Targeted therapy

- Radiation therapy

- Other therapy types

By Route of Administration (Revenue, USD Billion, 2020–2034)

- Oral

- Intravenous

- Subcutaneous

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Non-Hodgkin Lymphoma Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.05 Billion |

|

Market Size in 2025 |

USD 9.72 Billion |

|

Revenue Forecast by 2034 |

USD 18.90 Billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Non-Hodgkin Lymphoma Therapeutics Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.05 billion in 2024 and is projected to grow to USD 18.90 billion by 2034.

The global market is projected to register a CAGR of 7.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AbbVie Inc., AstraZeneca PLC, Baxter International Inc., Bayer AG, Bristol Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., GlaxoSmithKline PLC, Janssen Biotech, Inc., Teva Pharmaceutical Industries Ltd., and Verismo Therapeutics, Inc.

The B-cell lymphoma segment dominated the market share in 2024 due to its higher prevalence and availability of targeted therapies.

The T-cell lymphoma segment is expected to witness the fastest growth during the forecast period due to rising awareness, improved diagnostic capabilities, and increasing clinical trials exploring novel treatment approaches.