U.S. Gypsum Market Size, Share, Trends, & Industry Analysis Report

By Form (Natural, Synthetic), By Product, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6006

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

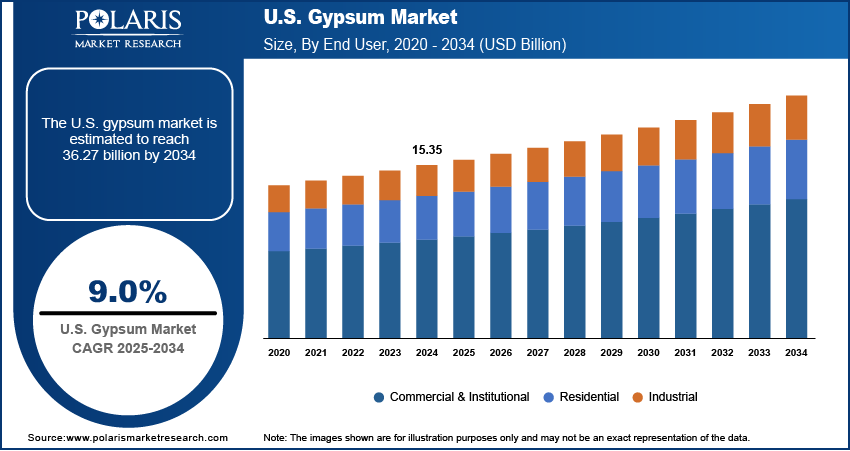

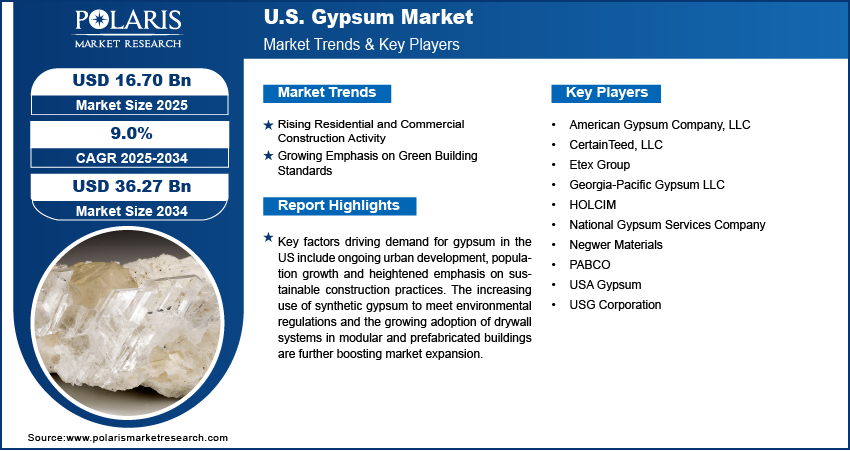

The US gypsum market size was valued at USD 15.35 billion in 2024, growing at a CAGR of 9.0% during 2025–2034. Rising residential and commercial construction activity, coupled with the growing regulatory support for sustainable building standards, is driving the demand for gypsum-based materials in the US

Key Insights

- The drywalls segment accounted for largest market share in 2024.

- The synthetic segment is projected to grow at the fastest rate over the forecast period, driven by rising emphasis on environmental compliance and circular economy practices.

- The US market is expanding steadily, fueled by increasing demand for energy-efficient construction materials, growth in modular building systems, and regulatory support for sustainable building solutions.

Gypsum consumption is rising steadily across the US due to its critical role in drywall manufacturing, cement production, and soil conditioning. Its widespread application in residential, commercial, and industrial construction supports high-volume demand across supply chains. The material offers fire resistance, sound insulation, and cost-efficiency, making it integral to modern building codes and standards.

The market is further driven by infrastructure rehabilitation programs, increased housing starts, and sustainability-driven shifts toward eco-friendly construction materials. In June 2023, National Gypsum Company expanded its production capacity in South Carolina to address growing regional demand for wallboard and related gypsum-based products. Such developments reflect the ongoing efforts by manufacturers to enhance supply resilience and meet evolving regulatory and performance standards across the US construction sector.

Key performance factors such as fire resistance, sound insulation, and structural integrity continue to drive the adoption of gypsum products across the US construction sector. There is a rising demand for lightweight, recyclable, and energy-efficient materials to support green building certifications and modular construction practices. Manufacturers are focusing on process automation, synthetic gypsum utilization, and enhanced product consistency to meet evolving sustainability and regulatory requirements. Additionally, national initiatives to reduce carbon emissions in building materials and promote environmentally compliant infrastructure are boosting market growth across residential, commercial, and institutional applications. For instance, in December 2024, the US government announced a climate target to reduce US greenhouse gas emissions by 61–66% below 2005 levels by 2035.

- Growing construction and infrastructure development across the US is increasing demand for gypsum products in residential, commercial, and public projects.

- Expansion in sustainable building practices is driving the adoption of synthetic gypsum and gypsum-based insulation materials to meet green construction standards.

- Technological advancements in gypsum board manufacturing, including process automation and quality control, are improving product consistency and supply reliability.

- Fluctuating raw material costs and regulatory compliance expenses present challenges for smaller gypsum producers, limiting their market penetration in certain regional segments.

Rising Residential and Commercial Construction Activity: The expanding residential and commercial construction sectors in the US are driving significant demand for gypsum products. Rising construction of multifamily and single-family housing is driving demand for drywall and plaster materials. As per the National Low Income Housing Coalition (NLIHC), the US federal budget for FY2025 includes USD 32.3 billion for housing vouchers, USD 6.2 billion for public housing operations, and USD 4.7 billion for homeless assistance programs. At the same time, expansion in commercial infrastructure such as office buildings, retail centers, and public facilities is further boosting gypsum consumption. These construction activities are underpinned by favorable economic conditions and government incentives targeting urban development. The rising construction projects are creating steady demand across the gypsum supply chain, driving market growth by boosting raw material extraction and finished product manufacturing.

Growing Emphasis on Green Building Standards: The rising focus on sustainability in the US construction industry is accelerating the use of gypsum materials to meet green building certifications. These regulations include Leadership in Energy and Environmental Design (LEED) and Energy Star incentivize the use of synthetic gypsum to reduce environmental impact and landfill waste. For example, the Department of Energy (DoE) found that 22 LEED-certified GSA buildings had 34% lower CO₂ emissions, used 25% less energy, 11% less water, and diverted over 80 million tons of waste from landfills. These standards promote energy-efficient, fire-resistant, and recyclable building materials to boost eco-friendly gypsum products. Manufacturers are improving production processes to reduce carbon footprint and energy consumption. This regulatory environment fosters innovation and adoption of sustainable gypsum solutions while supporting long-term market growth within the framework of environmental compliance.

Segmental Insights

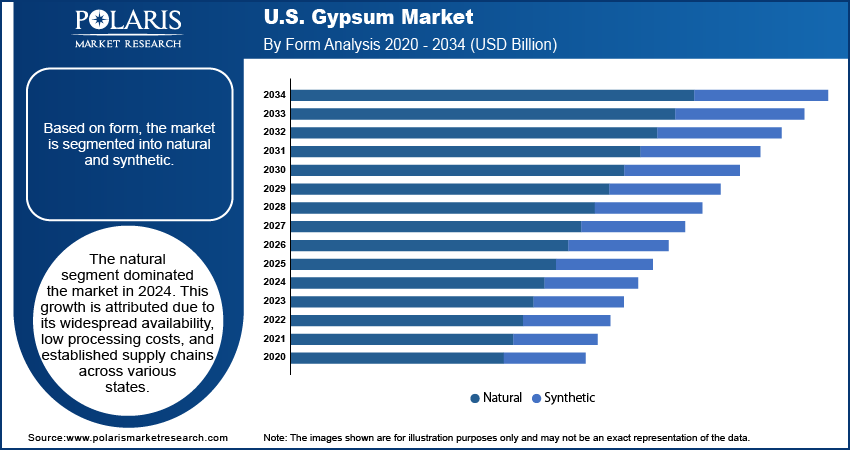

Form Analysis

Based on form, the segmentation includes natural and synthetic. The natural segment accounted for largest revenue share in 2024, driven by its abundant domestic reserves and minimal processing requirements. It remains the primary input for cement, drywall and plaster production across residential and commercial applications. Construction firms prefer natural gypsum due to its high purity and compatibility with conventional building methods. Reliable supply from large-scale mining operations supports steady demand for the natural gypsum products. The natural segments maintain its dominance in the US gypsum market due to its cost-effectiveness and traditional construction practices.

The synthetic segment is projected to grow at the fastest pace during the forecast period, owing to the sustainability mandates and environmental compliance. These products are derived primarily from flue gas desulfurization (FGD) at coal-fired power plants and helps to reduces landfill waste and promotes circular material use. The growing use of synthetic gypsum in wallboards and plasters reflects regulatory initiatives aimed at reducing dependence on natural resources. Advancements in processing technologies are improving the quality and scalability of synthetic gypsum production, driving its adoption across construction applications. Additionally, rising demand for eco-friendly materials and efforts by utilities and manufacturers to meet carbon reduction targets are further accelerating segment growth.

Product Analysis

By product, the market includes cement, drywalls, plaster, soil amendment, gypsum blocks, and others. The drywalls segment held the largest revenue share in 2024, due to extensive use in residential and commercial construction. These boards provide fire safety, acoustic insulation and quick installation benefits. For instance, in October 2023, Georgia-Pacific inaugurated a USD 325 million gypsum wallboard facility in Sweetwater, Texas, enhancing its production capacity to meet growing construction demand. The plant features advanced manufacturing technologies aimed at improving efficiency and product quality. Moreover, builders are adopting drywall systems to meet strict US building codes while reducing project timelines. Rising construction of multi-family housing, commercial interiors and modular buildings is driving the demand for drywall products in the US The growing innovations in moisture and mold-resistant variants are further boosting the adoption of drywalls in high-humidity building applications.

The plaster segment is anticipated to grow at the fastest rate, owing to growing preference for ready-mix gypsum formulations in new construction and remodeling. Builders and contractors choose gypsum plasters for their smooth finish, reduced curing time and labor efficiency. Rising demand from urban residential developments and institutional buildings, including schools and hospitals, is fueling market growth. The increasing emphasis on regulatory policies aimed at dust control and sustainable construction practices is driving growth in the plaster segment. Additionally, product innovations improving thermal insulation and surface durability are expanding application opportunities in high-performance building projects.

End User Analysis

By end user, the market includes residential, commercial & institutional, and industrial sectors. The residential segment held the largest revenue share in 2024, rising single-family home and multi-unit housing construction. According to the US Bureau of Economic Analysis, real private residential fixed investment grew by 4.4% early 2024. Federal incentives for affordable housing and green buildings are increasing gypsum use in interior walls, ceilings and partition systems. The segment growth is driven by the preference for gypsum boards and plasters due to their ease of installation, fire-resistant properties to meet energy-efficient housing standards. Furthermore, rapidly growing urban population in the developing countries boost the gypsum products for residential consumption.

The commercial & institutional segment is anticipated to grow at the fastest rate, owing to expansion in office spaces, healthcare facilities and educational infrastructure. The segment growth is driven by developers’ increasing adoption of gypsum-based materials due to their design flexibility, acoustic performance, and compliance with fire safety regulations. Rising incorporation of gypsum panels in green-certified buildings further supports sustainability objectives. Additionally, rapid investments in healthcare, hospitality and public infrastructure, with an emphasis on climate resilience and energy efficiency are driving growth within the market.

Key Players & Competitive Analysis Report

The US gypsum industry is moderately consolidated, with competition focused on product quality, manufacturing efficiency, sustainability and regulatory compliance. Leading manufacturers focus innovations in synthetic gypsum production, process automation, and energy-efficient manufacturing to reduce costs and environmental impact. Key strategies include expanding production capacity, improving fire-resistant and lightweight gypsum products to meet green building certifications such as LEED and Energy Star. The prominent players in the US gypsum industry are prioritizing supply chain integration to ensure timely delivery to construction and agricultural sectors, addressing evolving market demands and regulatory requirements.

Key companies in the US gypsum industry include National Gypsum Services Company, USG Corporation, CertainTeed, LLC, Georgia-Pacific Gypsum LLC, Negwer Materials, American Gypsum Company, LLC, USA Gypsum, HOLCIM, PABCO, and Etex Group.

Key Players

- American Gypsum Company, LLC

- CertainTeed, LLC

- Etex Group

- Georgia-Pacific Gypsum LLC

- HOLCIM

- National Gypsum Services Company

- Negwer Materials

- PABCO

- USA Gypsum

- USG Corporation

Industry Developments

May 2025: Eagle Materials announced to modernize and expand its gypsum wallboard plant in Oklahoma, US This aims to enhance production efficiency and meet rising demand. The upgrade will incorporate advanced manufacturing technologies to support long-term growth and strengthen supply capabilities.

December 2024: CertainTeed announced to expand its gypsum wallboard manufacturing facility in Palatka, Florida, to increase production capacity and meet growing demand. The expansion supports the company's commitment to serving the US construction market with high-performance, sustainable building materials.

US Gypsum Market Segmentation

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Natural

- Synthetic

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Cement

- Drywalls

- Plaster

- Soil Amendment

- Gypsum Blocks

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial & Institutional

- Industrial

US Gypsum Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.35 Billion |

|

Market Size in 2025 |

USD 16.70 Billion |

|

Revenue Forecast by 2034 |

USD 36.27 Billion |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US market size was valued at USD 15.35 billion in 2024 and is projected to grow to USD 36.27 billion by 2034.

The US market is projected to register a CAGR of 9.0% during the forecast period.

A few of the key players in the market are National Gypsum Services Company, USG Corporation, CertainTeed, LLC, Georgia-Pacific Gypsum LLC, Negwer Materials, American Gypsum Company, LLC, USA Gypsum, HOLCIM, PABCO, and Etex Group.

The drywalls segment dominated the market share in 2024, due to its extensive use across residential and commercial construction.

The commercial and institutional segment is expected to witness the fastest growth during the forecast period, driven by increasing investments in office buildings, healthcare facilities and hospitality infrastructure.