Nickel Mining Market Size, Share, Trends, & Industry Analysis Report

By Mining Technique (Underground Mining and Open Cast Mining), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6003

- Base Year: 2024

- Historical Data: 2020-2023

Overview

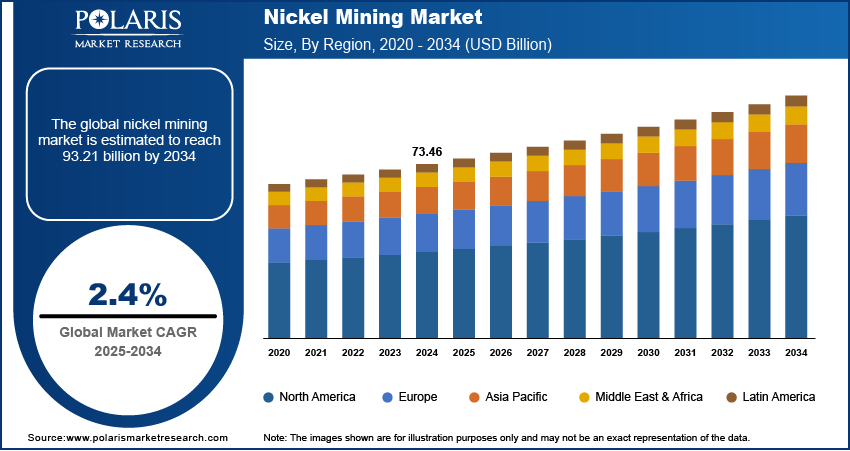

The global nickel mining market size was valued at USD 73.46 billion in 2024, growing at a CAGR of 2.4% from 2025–2034. Key factors driving demand for nickel mining include the growth in stainless steel production due to infrastructure expansion coupled with government investment in the mining sector.

Key Insights

- The open cast mining sealants segment accounted for largest market share in 2024.

- The batteries segment is projected to grow at a rapid pace in the coming years, driven by the rising global focus on electric vehicles, renewable energy storage, and portable electronics.

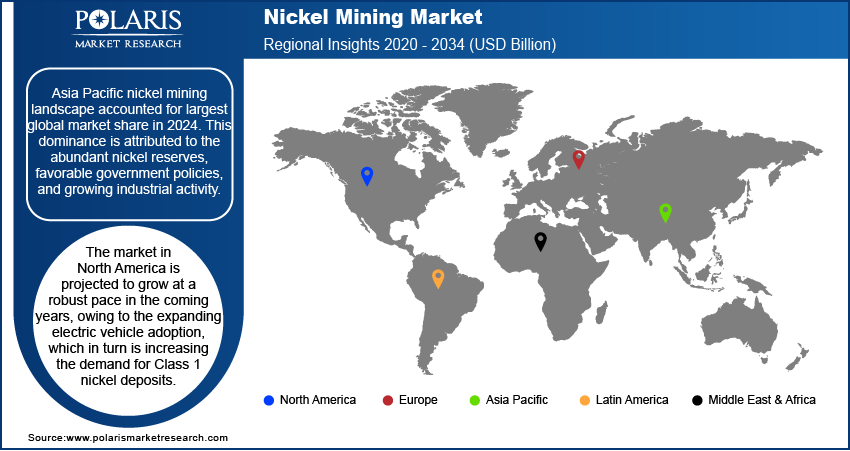

- The Asia Pacific nickel mining market accounted for largest share of the global market in 2024.

- The China nickel mining market held largest revenue share of the Asia Pacific market in 2024 due to its strong demand for stainless steel and growing investments in battery production.

- The market in North America is projected to grow with a fastest CAGR from 2025-2034, owing to the expanding electric vehicle adoption, which in turn is increasing the demand for Class 1 nickel deposits.

- The US market is experiencing growth driven by increasing government initiatives to promote domestically sourced nickel for use in electric vehicle batteries and defense-related manufacturing.

The nickel mining industry is expanding steadily due to the growing need for corrosion-resistant alloys in construction, energy, and marine industries. The surging construction of urban infrastructure, industrial equipment, and pipelines in developing economies is fueling demand for nickel-based alloys. Additionally, government initiatives across several countries are emphasizing the development of domestic critical mineral supply chains, including nickel, to reduce dependency on imports and ensure raw material security for green technology & sustainability.

The growing adoption of electric vehicle globally is driving the growth of the nickel mining market. According to the International Energy Agency, electric car sales surpassed 17 million worldwide in 2024, accounting for over 20% of total vehicle sales. This steady demand for EVs is fueling the demand for nickel mining due to its high energy density properties used in battery manufacturing. The transition toward longer-range vehicle models is increasing the demand for high-purity nickel. This is pushing mining companies to explore new deposits, expand capacity and integrate downstream into refining operations to secure supply.

Technological improvements in ore processing and hydrometallurgical techniques are accelerating the market growth. Mining firms are adopting cost-efficient and environmentally responsible methods to extract nickel from laterite and sulfide ores in regions such as Southeast Asia and Latin America. Environmental concerns are shaping investment decisions, fueling the development of low-carbon nickel extraction methods and improved tailings management systems.

Industry Dynamics

- Growth in stainless steel production due to infrastructure expansion is driving nickel mining activity, as nickel remains a critical alloying element in stainless steel used across construction, transportation, and industrial sectors.

- Government investment in the mining sector is accelerating the development of advanced extraction capabilities and infrastructure, boosting nickel production globally.

- Volatile nickel prices and geopolitical uncertainties are limiting market stability by affecting investment decisions and increasing risks across the supply chain for producers and end users.

- Rising demand from the electric vehicle and battery manufacturing sectors is creating significant growth opportunities, as high-purity nickel becomes essential for producing energy-dense, long-range EV batteries.

Growth in Stainless Steel Production Due to Infrastructure Expansion: The growing production of stainless steel across global markets is propelling the nickel mining market. According to American Iron and Steel Institute data, in June 2025, US domestic raw steel production reached 1,776,000 net tons with a capability utilization rate of 79.1%. In comparison, production for the same week ending June 2024, stood at 1,703,000 net tons, with a utilization rate of 76.7%. This alloy is widely utilized in a range of sectors including construction, food processing, automotive manufacturing, and heavy industrial machinery, due to its corrosion resistance, strength, and durability. The steady increase in infrastructure projects, coupled with expanding industrial activity, is further increasing the stainless-steel consumption, thereby boosting the market growth. Stainless steel’s strong reliance on nickel accelerated the demand for the metal, putting increased pressure on global nickel mining operations and supply chains.

Government Investment in the Mining Sector: Growing public sector investment in critical mineral extraction is boosting the nickel mining market across major economies. Governments are actively funding exploration, processing, and sustainable production to secure future supply chains for energy transition technologies. For example, in January 2025, India approved a USD 1.88 billion investment to support the development of its critical minerals sector, which includes nickel among 30 prioritized minerals. The investment spans exploration, processing, and mining, aligning with the country’s broader ambitions in electric mobility and strategic materials independence. In addition, in December 2024, the Australian Government committed USD 75 million through the Clean Energy Finance Corporation to advance decarbonization efforts in the mining sector. This funding focuses on enhancing the sustainable extraction of key minerals such as lithium, nickel, and copper. These government-backed initiatives are accelerating the development of next-generation mining technologies, increasing production capacity, and creating a more resilient and environmentally responsible nickel supply chain.

Segmental Insights

Mining Technique Analysis

Based on mining technique, the segmentation includes underground mining and open cast mining. The open cast mining segment accounted for largest revenue share in 2024 due to its cost-effectiveness, operational simplicity, and suitability for large-scale ore extraction. This technique allows miners to access near-surface deposits using heavy machinery, leading to higher production volumes and reduced labor intensity. Open cast operations are widely used in countries such as Indonesia and the Philippines, where nickel laterite deposits are abundant and shallow. The use of advanced drilling and blasting technologies further enhanced the efficiency of open cast mining, making it the preferred method for major producers aiming to meet the rising demand for nickel in stainless steel and battery applications.

The underground mining segment is projected to grow at the fastest CAGR during the forecast period, driven by increasing investments in deeper sulfide ore deposits found in geologically complex terrains. Countries such as Canada and Australia are witnessing a rise in underground mining activity due to the depletion of surface-level reserves and the need for high-grade Class 1 nickel suitable for EV batteries. In 2023, Australia witnessed a surge in nickel sector activity as companies moved to capitalize on rising prices. Wyloo Metals acquired Mincor Resources for USD 499 million, while BHP expanded its presence by taking over key nickel operations in Western Australia. Enhanced safety systems, remote-controlled equipment, and ore body mapping technologies are enabling deeper extraction while maintaining safety and productivity, contributing to the growth of underground mining operations.

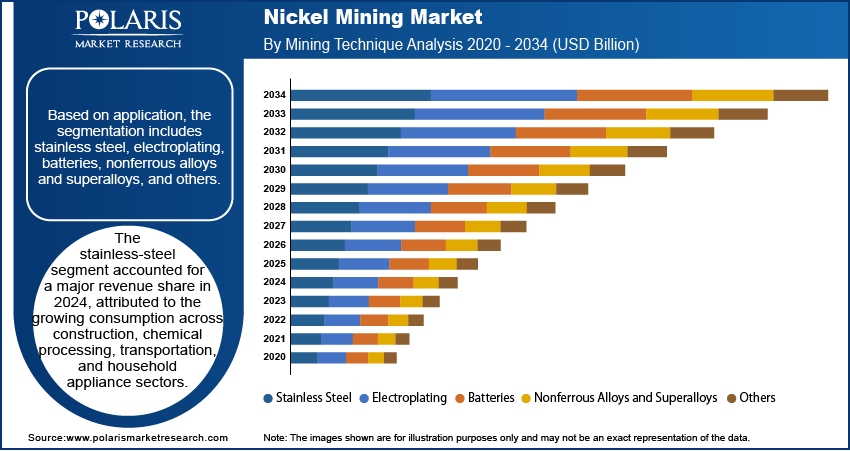

Application Analysis

In terms of application, the segmentation includes stainless steel, electroplating, batteries, nonferrous alloys and superalloys, and others. The stainless-steel segment dominated the revenue share in 2024, attributed to the growing consumption across construction, chemical processing, transportation, and household appliance sectors. Nickel enhances the corrosion resistance, ductility, and heat tolerance of stainless steel, making it essential for critical infrastructure and industrial equipment. Rapid urbanization and government-led infrastructure development projects, particularly in China and India, are increasing stainless steel demand and, in turn, boosting nickel mining market. According to the Green Finance & Development Center report, Chinese Belt and Road Initiative (BRI) engagement reached a record high in 2024, with approximately USD 70.7 billion in construction contracts and around USD 51 billion in investments.

The batteries segment is expected to expand at the fastest CAGR from 2025 to 2034. This growth is attributed to the rising global focus on electric vehicles, renewable energy storage, and portable electronics. Battery manufacturers are increasingly demanding high-purity nickel sulfate derived from Class 1 nickel for advanced energy storage solutions. The growing efforts by governments and automakers to build local EV battery supply chains and reduce carbon emissions are further accelerating the demand for battery-grade nickel.

Regional Analysis

Asia Pacific nickel mining market accounted for largest share of global market share in 2024. This dominance is attributed to the abundant reserves and favorable government policies. Countries such as Indonesia and the Philippines are leading contributors, supported by substantial resource bases and large-scale production. Growing demand from the stainless steel sector is further accelerating the mining activity across the region. Rapid infrastructure and industrial growth in India and Vietnam is driving higher demand for stainless steel across multiple sectors. Therefore, mining companies are increasing investments in refining infrastructure to meet downstream processing needs and propelling the market growth in the region.

China Nickel Mining Market Insight

China held largest market share in Asia Pacific Nickel Mining landscape in 2024, due to its strong demand for stainless steel and growing investments in battery production. The country is the largest consumer of nickel globally, driven by its expansive stainless steel and EV battery manufacturing ecosystem. The country continues to strengthen supply security through overseas mining investments and large-scale domestic smelting capacity expansion. According to the International Energy Agency (IEA), China accounted for over 75% of global battery production in 2024, with more than 70% of all EV batteries manufactured in the country. Battery prices in China were over 30% lower than in Europe and more than 20% lower than in North America, reflecting the country’s manufacturing scale and supply chain integration. Additionally, government support for clean energy technologies and emission reduction goals is increasing investment in Class 1 nickel production. Thus, driving the demand for the nickel mining across the country.

North America Nickel Mining Market Trend

The market in North America is projected to grow with fastest CAGR from 2025-2034, owing to the expanding electric vehicle adoption, which in turn is increasing the demand for Class 1 nickel deposits. Also, the governments in the region are prioritizing the development of secure and sustainable supply chains for critical minerals, including nickel to support clean energy transitions. Moreover, the presence of major mining companies coupled with advancements in ore extraction and environmental compliance is contributing to regional industry development. Furthermore, increasing R&D in nickel extraction from sulfide ores and investments in new exploration projects are accelerating the market growth in the region.

US Nickel Mining Market Overview

The market in US is expanding due to the rising government support for domestically sourced nickel required in EV battery and defense manufacturing applications. According to the Stockholm International Peace Research Institute, U.S. military expenditure increased by 5.7% in 2024, reaching USD 997 billion. This accounted for 66% of total NATO defense spending and 37% of global military expenditure for the year. This surge in investment is increasing the demand for nickel supply to meet national defense and clean energy objectives. Additionally, growing collaborations between automakers and mining companies to secure long-term nickel supplies for the rapidly growing domestic EV industry is fueling the market.

Europe Nickel Mining Market Outlook

In Europe, growing public sector support through the European Commission’s climate objectives under the European Green Deal is driving market expansion. The region’s long-term goal of achieving carbon neutrality by 2050 is increasing demand for sustainable materials such as nickel, which is essential for EV batteries and energy storage technologies. Also, The growing adoption of nickel in the energy sector to meet transition goals is supporting the expansion of nickel mining activities across the region. In response, governments are launching funding programs, simplifying permitting procedures, and encouraging joint-venture mining projects. In addition, many strategic frameworks such as the Critical Raw Materials Act are adopted by the countries to accelerate diversification and reducing reliance on external sources.

Key Players & Competitive Analysis Report

The nickel mining market is moderately consolidated, with competition centered on resource access, extraction efficiency, and downstream integration. Leading mining companies are investing in sustainable extraction technologies, automation of mining operations, and development of low-carbon refining methods to enhance productivity and meet ESG mandates. Strategic priorities include securing long-term supply agreements, expanding operations in resource-rich regions, and partnering with battery manufacturers to support the growing electric vehicle (EV) demand. Additionally, firms are diversifying production portfolios by increasing output of Class 1 battery-grade nickel to align with clean energy goals. Adoption of responsible mining certifications and entry into emerging markets are further shaping expansion strategies, in response to rising demand from stainless steel, battery, and alloy manufacturing industries.

Prominent companies operating in the nickel mining market include Anglo American plc, BHP Group Limited, Eramet S.A., FUJI ULTRASONIC ENGINEERING Co., Ltd., Glencore plc, IGO Limited, Lundin Mining Corporation, MMC Norilsk Nickel PJSC, Nickel Asia Corporation, Sherritt International Corporation, South32 Limited, Sumitomo Metal Mining Co., Ltd., Terrafame Ltd., Tsingshan Holding Group Co., Ltd., and Vale S.A.

Key Players

- Anglo American plc

- BHP Group Limited

- Eramet S.A.

- FUJI ULTRASONIC ENGINEERING Co., Ltd.

- Glencore plc

- IGO Limited

- Lundin Mining Corporation

- Nickel Asia Corporation

- MMC Norilsk Nickel PJSC

- Sherritt International Corporation

- Sumitomo Metal Mining Co., Ltd.

- Terrafame Ltd.

- Tsingshan Holding Group Co., Ltd.

- Vale S.A.

- South32 Limited

Industry Developments

- June 2025: Indonesian nickel miners association proposed and received government approval for a domestic metal exchange aimed at launching in H1 2026 to trade nickel pig iron futures contracts, with plans to expand into refined nickel products and other metals. This exchange aimed to reduce reliance on global benchmarks such as the LME and help stabilize domestic nickel prices amid growing production.

- December 2024: The Philippines proposed a new Mining Act amendment featuring a four-tier, margin-based royalty structure (1.5%–5%) and stricter environmental and stakeholder criteria, aimed at boosting investment in nickel operations and downstream processing.

Nickel Mining Market Segmentation

By Mining Technique Outlook (Revenue, USD Billion, 2020–2034)

- Underground Mining

- Open Cast Mining

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Stainless Steel

- Electroplating

- Batteries

- Nonferrous Alloys and Superalloys

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nickel Mining Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 73.46 Billion |

|

Market Size in 2025 |

USD 75.20 Billion |

|

Revenue Forecast by 2034 |

USD 93.21 Billion |

|

CAGR |

2.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 73.46 billion in 2024 and is projected to grow to USD 93.21 billion by 2034

The global market is projected to register a CAGR of 2.4% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Anglo American plc, BHP Group Limited, Eramet S.A., FUJI ULTRASONIC ENGINEERING Co., Ltd., Glencore plc, IGO Limited, Lundin Mining Corporation, MMC Norilsk Nickel PJSC, Nickel Asia Corporation, Sherritt International Corporation, South32 Limited, Sumitomo Metal Mining Co., Ltd., Terrafame Ltd., Tsingshan Holding Group Co., Ltd., and Vale S.A.

The open cast mining segment dominated the market in 2024, holding 2.4% share.

The batteries segment is expected to witness the fastest growth during the forecast period.