Battery Simulation Software Market Size, Share, Trends, Industry Report

By Battery Type (Lithium-Ion Batteries, Lead-Acid Batteries, Solid-State Batteries, Others), By Simulation Type, By End-Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5877

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

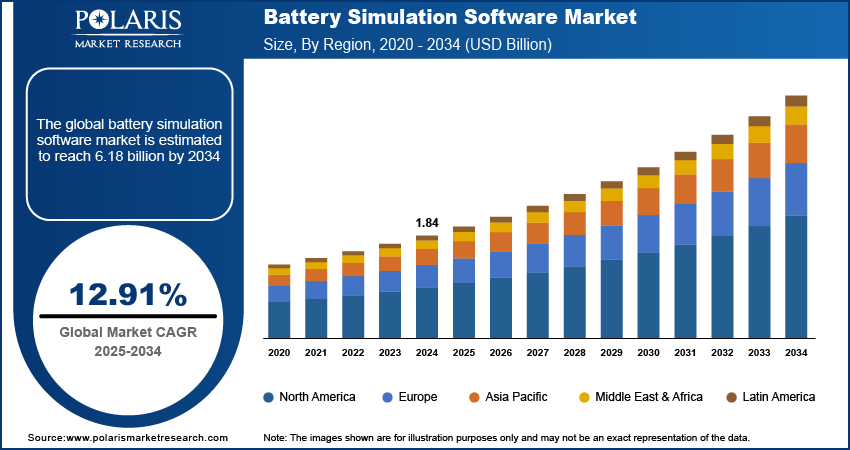

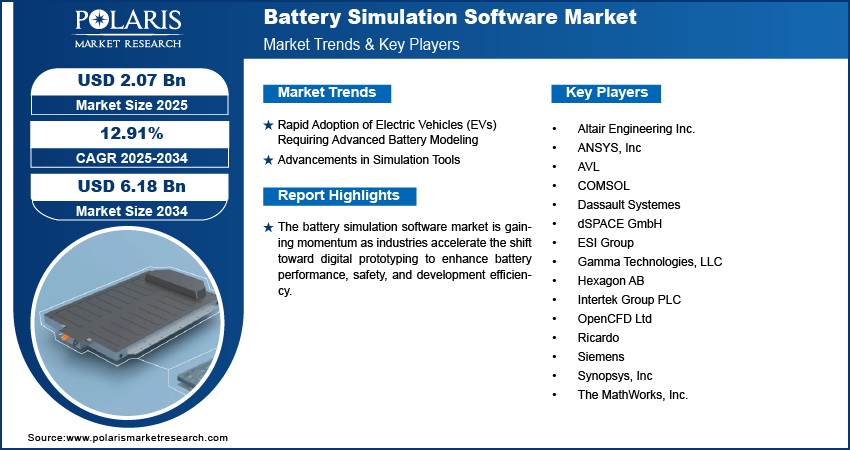

The global battery simulation software market size was valued at USD 1.84 billion in 2024, growing at a CAGR of 12.91% from 2025 to 2034. The growth is driven by the growing demand for high-performance, long-life batteries across automotive, consumer electronics, and battery energy storage systems .

Battery simulation software refers to advanced digital platforms that model, analyze, and predict the performance, thermal behavior, and lifespan of battery systems across various use cases. These tools play an increasingly critical role in accelerating innovation in energy storage and electric mobility. The expansion of government support and incentives for clean energy and electric mobility is propelling the adoption of this software. Governments are offering financial incentives, regulatory support, and infrastructure investments that boost demand for electric vehicles (EVs) and renewable energy storage solutions as global economies transition toward sustainable energy systems. According to a February 2025 report from the Ministry of Health and Family Welfare, India's FAME II scheme allocated ~USD 120 million for EV charging infrastructure. OMCs received ~USD 96 million to install 7,432 public stations, with 4,523 operational by January 2025. An additional ~USD 8.8 million upgraded 980 fast chargers, reflecting the expansion of government support and incentives. This shift drives manufacturers and developers to deploy simulation tools that reduce design time, optimize battery efficiency, and ensure regulatory compliance. The software’s ability to enable virtual prototyping and lifecycle prediction makes it essential for meeting strict energy goals within tight development timelines.

The increasing collaboration between industry and academic institutions, which fulfills research-led development and specialized workforce training in battery simulation, further supports the sector's growth. For instance, in November 2024, Hexagon partnered with Fraunhofer ITWM to launch a simulation tool combining electrochemical modelling with multi-physics analysis. The solution reduces physical testing needs by digitally analyzing cell morphology impacts and manufacturing effects on performance, accelerating R&D cycles. These partnerships improve the pace of innovation by combining academic research capabilities with specific application needs, resulting in more accurate simulation models and advanced algorithms. Moreover, such collaborations help bridge the talent gap by equipping students and professionals with hands-on experience in using complex battery modelling platforms, eventually strengthening the overall ecosystem. The integration of advanced academic research into commercial simulation platforms ensures continuous improvements in accuracy, adaptability, and performance validation, which are essential for next-generation battery technologies across automotive, aerospace, and energy storage sectors.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Rapid Adoption of Electric Vehicles (EVs) Requiring Advanced Battery Modeling

The rapid adoption of electric vehicles (EVs) is driving the demand for advanced modeling solutions. According to the IEA 2025 report, EV sales across the world exceeded 17 million units in 2024, reflecting year-on-year growth of over 25%. Accurate simulation becomes essential for optimizing performance and assuring safety as EV manufacturers aim to deliver higher energy densities, improved thermal management, and extended battery life. These simulation software allow developers to test battery behavior under various operating conditions virtually, reducing physical prototyping costs and development timelines. Automakers and suppliers are relying on advanced modeling tools to streamline design, validate systems, and accelerate market readiness with increasing pressure to meet evolving regulatory and performance standards.

Advancements in Simulation Tools

Advancements in simulation tools, such as the integration of AI and quantum computing for faster, more accurate battery design and testing are transforming the battery development landscape by offering greater precision, scalability, and integration capabilities. The integration of AI-driven optimization and cloud-based simulation has expanded the usability and reach of these tools, making them essential in both R&D and commercial product design processes across automotive, aerospace, and renewable energy sectors. In December 2024, Monolith partnered with HORIBA MIRA to integrate AI tools with battery testing systems. The collaboration combines Monolith's anomaly detection algorithms with HORIBA's test data and digital twin technology to optimize EV powertrain development. Additionally, modern simulation platforms now support multiphysics modeling, such as electrochemical, thermal, and mechanical aspects of battery systems in a single environment. These advancements allow engineers to capture complex interactions more effectively, improving prediction accuracy and product reliability.

Segmental Insights

Simulation Type Analysis

The segmentation, based on simulation type, includes electrochemical simulation, thermal simulation, structural & mechanical simulation, electrical & circuit simulation, and others. The electrochemical simulation segment is expected to witness substantial growth during the forecast period owing to its critical role in predicting battery performance, degradation, and efficiency at the cell and pack levels. Manufacturers increasingly rely on electrochemical models to optimize electrode materials, electrolyte formulations, and cell configurations as the demand for high-performance batteries boosts across sectors such as EVs and energy storage. These simulations offer detailed insights into charge transport, reaction kinetics, and state-of-health analysis, which are crucial for enhancing safety, prolonging battery life, and reducing development costs. The growing complexity of next-generation batteries further boosts the need for robust electrochemical modeling capabilities.

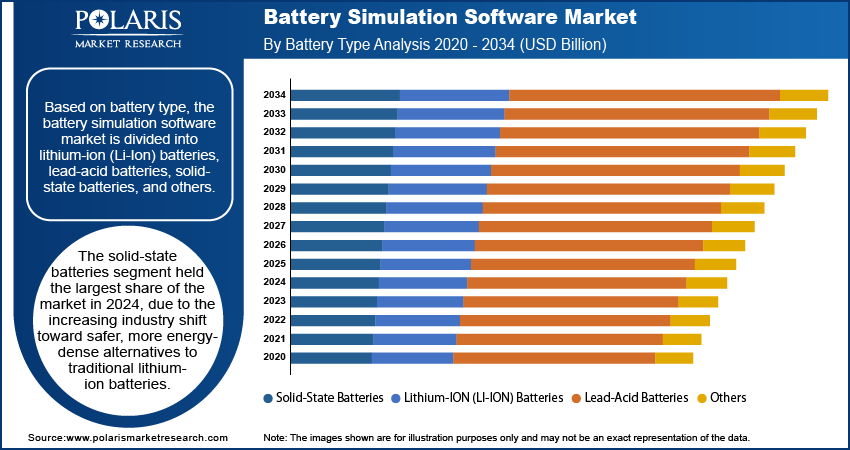

Battery Type Analysis

The segmentation, based on battery type, includes lithium-Ion (LI-ION) batteries, lead-acid batteries, solid-state batteries, and others. The solid-state batteries held the largest share in 2024, due to the increasing shift toward safer, more energy-dense alternatives to traditional lithium-ion batteries. Solid-state batteries eliminate flammable liquid electrolytes, allowing higher thermal stability and compact form factors, which are highly desired in electric vehicles and portable electronics. The complexities of solid-state battery design, such as solid electrolyte interfaces and material selection, require advanced simulation to validate performance under various mechanical and thermal conditions. These simulation software plays a pivotal role in optimizing these complex systems, supporting their commercialization and contributing to their dominant presence.

End-Use Industry Analysis

The segmentation, based on end-use industry, includes EV manufacturers, automotive OEMS, battery manufacturers, energy storage systems (ESS), consumer electronics, aerospace, and others. The EV manufacturers segment is expected to register the highest CAGR during the forecast period due to the escalating demand for high-efficiency, long-range electric vehicles. Manufacturers are under pressure to reduce development time while ensuring battery reliability, safety, and performance as competition increases in the EV sector. The software enables virtual testing of cell chemistry, thermal behavior, and degradation patterns, accelerating innovation while minimizing costs. This capability empowers EV manufacturers to make data-driven design decisions early in the development cycle, driving widespread adoption of simulation tools within this rapidly growing segment.

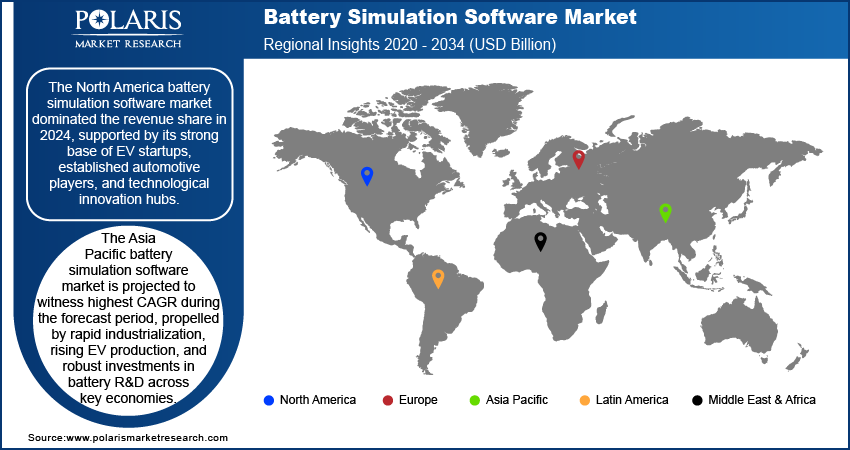

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America battery simulation software market dominated the revenue share in 2024, supported by its strong base of EV startups, established automotive players, and technological innovation hubs. For instance, in October 2023, the US EDA designated 31 Tech Hubs across the country as part of a new program aimed at boosting regional innovation, manufacturing capacity, and technology deployment to enhance national competitiveness. The region benefits from a developed ecosystem of simulation software providers, mixed with high R&D investments and a skilled engineering workforce. Moreover, North American organizations have actively integrated digital tools into their product development workflows, driving early adoption of advanced modeling platforms. These factors, combined with a strategic focus on electrification and energy transition, have positioned the region as a global leader in simulation software deployment.

U.S. Battery Simulation Software Market Trends

The U.S. held the largest share in North America in 2024 due to the country’s advanced technological infrastructure and strong presence of leading software providers. Increasing R&D investments by both private and public sectors have accelerated the integration of simulation tools into battery design and validation workflows. Additionally, the widespread adoption of digital engineering practices and early focus on electric mobility has boosted the demand for robust simulation platforms.

Asia Pacific Battery Simulation Software Market Overview

The Asia Pacific market is projected to witness the highest CAGR during the forecast period, propelled by rapid industrialization, rising EV production, and robust investments in battery R&D across key economies. In February 2025, Epsilon Group committed USD 1.84 billion to establish EV battery facilities in Karnataka. The region's expanding manufacturing base for batteries and electric vehicles creates a strong demand for simulation solutions that enhance efficiency, reduce prototyping costs, and accelerate time-to-market. In addition, government-backed initiatives aimed at boosting domestic innovation and reducing carbon emissions are encouraging the adoption of digital design tools. Simulation software becomes an essential enabler of competitive advantage as regional players scale their operations.

China Battery Simulation Software Market Assessment

The market in China is experiencing growth, driven by the country’s rapid expansion in electric vehicle production and battery manufacturing capacity. The need for precise and scalable simulation tools has become increasingly critical as China positions itself as a global leader in clean energy and electric mobility. Domestic companies are also investing in advanced digital solutions to reduce development timelines and meet strict quality and safety standards, which is fueling the adoption of battery simulation technologies.

Europe Battery Simulation Software Market Insights

The market in Europe is projected to witness substantial growth during the forecast period, driven by the region’s strategic focus on green energy transition and sustainable mobility. There is a rising demand for digital tools that can streamline R&D processes and reduce time-to-market with increasing investments in EV production, renewable energy integration, and battery innovation. These software supports these goals by allowing accurate modeling of battery behavior under various conditions, thus minimizing costly physical prototyping and improving design validation.

UK Battery Simulation Software Market Analysis

The UK market growth is driven by growing initiatives in clean energy transition and the development of next-generation battery technologies. Collaborative efforts between government bodies, academia, and private firms are boosting innovation and driving the integration of modeling tools into early-stage battery research and product development. The country's focus on sustainability, combined with its emphasis on digital engineering, is driving the rise in demand for advanced simulation solutions.

Key Players and Competitive Analysis

The battery simulation software landscape is witnessing competition driven by technological advancements and emerging segments such as solid-state batteries. Major players are leveraging strategic investments in AI-driven electrochemical and thermal simulation tools to address latent demand from EV manufacturers and energy storage systems. Developed markets dominate the revenue share due to their strong R&D ecosystems, while emerging markets present high growth opportunities with the expansion of battery giga-factories. Competitive intelligence reveals vendors are prioritizing sustainable value chains and partnerships with automotive OEMs to improve simulation accuracy for next-gen batteries. Disruptions and trends, such as geopolitical shifts in raw material supply, are pushing firms to innovate in localized battery designs. Revenue growth is further fueled by expansion strategies into high-growth markets, where small and medium-sized businesses are adopting cloud-based simulation platforms. Industry trends highlight a focus on expert insights to optimize battery performance and safety, with future development strategies centered on integrating digital twins and machine learning.

A few key players are Altair Engineering Inc.; ANSYS, Inc; AVL; COMSOL; Dassault Systemes; dSPACE GmbH; ESI Group; Gamma Technologies, LLC; Hexagon AB; Intertek Group PLC; The MathWorks, Inc.; OpenCFD Ltd; Ricardo; Siemens; and Synopsys, Inc.

Key Players

- Altair Engineering Inc.

- ANSYS, Inc

- AVL

- COMSOL

- Dassault Systemes

- dSPACE GmbH

- ESI Group

- Gamma Technologies, LLC

- Hexagon AB

- Intertek Group PLC

- OpenCFD Ltd

- Ricardo

- Siemens

- Synopsys, Inc

- The MathWorks, Inc.

Industry Developments

May 2025: Breathe expanded its battery software portfolio, launching physics-based simulation (Breathe Model), performance mapping (Breathe Map), and upcoming cell design tools (Breathe Design). These tools aim to streamline battery development by reducing reliance on empirical testing and optimizing system-level performance.

December 2024: PNNL launched EZBattery Model, enabling sub-second performance predictions for redox flow batteries. This accelerates material optimization and lifespan analysis, reducing reliance on traditional trial-and-error testing methods. The tool supports faster development of energy storage systems.

October 2024: TWAICE (battery analytics) and Element Materials Technology (testing services) collaborated to improve U.S. battery testing and characterization capabilities, responding to increased local demand for integrated testing and data-driven battery performance analysis.

Battery Simulation Software Market Segmentation

By Simulation Type Outlook (Revenue, USD Billion, 2020–2034)

- Electrochemical Simulation

- Thermal Simulation

- Structural & Mechanical Simulation

- Electrical & Circuit Simulation

- Others

By Battery Type Outlook (Revenue, USD Billion, 2020–2034)

- Lithium-Ion (Li-Ion) Batteries

- Lead-Acid Batteries

- Solid-State Batteries

- Others

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- EV Manufacturers

- Automotive OEMs

- Battery Manufacturers

- Energy Storage Systems (ESS)

- Consumer Electronics

- Aerospace

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Battery Simulation Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.84 billion |

|

Market Size in 2025 |

USD 2.07 billion |

|

Revenue Forecast by 2034 |

USD 6.18 billion |

|

CAGR |

12.91% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.84 billion in 2024 and is projected to grow to USD 6.18 billion by 2034.

The global market is projected to register a CAGR of 12.91% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Altair Engineering Inc.; ANSYS, Inc; AVL; COMSOL; Dassault Systemes; dSPACE GmbH; ESI Group; Gamma Technologies, LLC; Hexagon AB; Intertek Group PLC; The MathWorks, Inc.; OpenCFD Ltd; Ricardo; Siemens; and Synopsys, Inc.

The solid-state batteries held the largest share of the market in 2024.

The EV manufacturers segment is expected to register the highest CAGR during the forecast period.