Patient Temperature Management Market Size, Share, Trends, Industry Analysis Report

By Product (Patient Warning Systems and Patient Cooling Systems), By Application, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6266

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

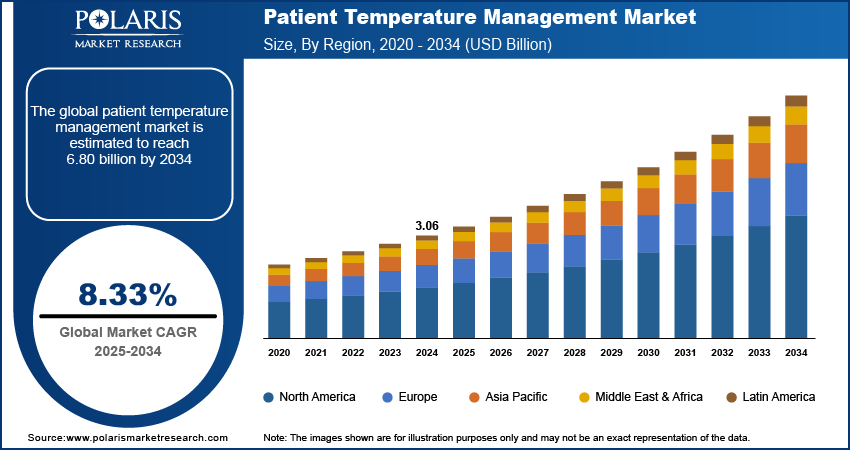

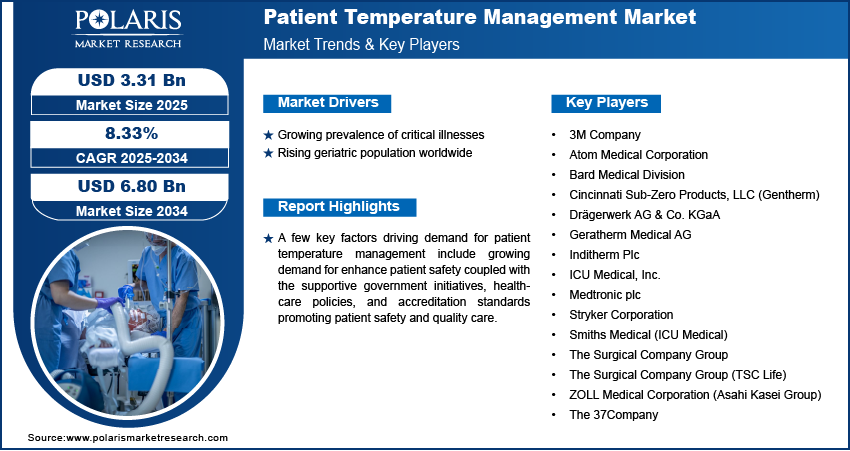

The global patient temperature management market size was valued at USD 3.06 billion in 2024, growing at a CAGR of 8.33% from 2025 to 2034. Key factors driving demand for patient temperature management include rising prevalence of critical illnesses and surgical procedures requiring precise temperature regulation coupled with increasing geriatric population driving market growth.

Key Insights

- The patient warming systems segment held the largest market share in 2024, driven by extensive use in perioperative care, critical care units, and emergency settings.

- The cardiology segment is projected to grow at the highest CAGR, driven by rising cardiac procedures and the need for precise temperature management to improve outcomes.

- The North America patient temperature management market dominated the market in 2024. This dominance is driven by the high prevalence of critical illnesses and surgical interventions that require precise temperature regulation.

- The U.S. held the largest revenue share in the North America patient temperature management landscape in 2024, attributed to the rising perioperative procedures, high rates of cardiovascular diseases, coupled with complex surgical interventions.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, fueled by the rising investments by governments and private healthcare providers in modern medical technologies, patient safety programs, and critical care infrastructure.

- China is emerging as a key growth hub, due to the increasing geriatric population, which is more susceptible to temperature-related complications.

Industry Dynamics

- Rising prevalence of critical illnesses and the growing number of surgical procedures requiring precise thermal regulation are boosting the demand for advanced patient temperature management solutions.

- Increasing geriatric population, coupled with higher susceptibility to temperature-related complications, is further driving adoption across hospitals and specialty clinics.

- AI-driven patient monitoring and automated temperature regulation systems offer significant opportunities to enhance treatment accuracy, streamline workflows, and improve patient safety in critical care environments.

- High equipment and maintenance costs remain a major challenge for healthcare facilities in resource-constrained settings, limiting widespread adoption.

Market Statistics

- 2024 Market Size: USD 3.06 Billion

- 2034 Projected Market Size: USD 6.80 Billion

- CAGR (2025–2034): 8.33%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Patient Temperature Management Market

- AI enhances performance optimization in temperature management systems by analyzing patient-specific data to deliver precise, personalized thermal regulation during surgery and critical care.

- Integration of AI enables adaptive temperature control, automatically adjusting heating or cooling parameters in real time based on patient vitals and clinical conditions.

- AI-powered diagnostics assist in detecting anomalies such as thermal imbalances or equipment inefficiencies early, supporting predictive maintenance and uninterrupted patient care.

- AI improves clinician interaction by enabling smart interfaces, automated alerts, and real-time monitoring dashboards, enhancing treatment accuracy, patient safety, and workflow efficiency.

The patient temperature management systems include advanced warming and cooling devices, blankets, and fluid management technologies designed to maintain normothermia in patients across surgical, critical care, and emergency settings. Technological advancements in precision temperature control, non-invasive monitoring, and automated feedback mechanisms enhanced the safety, efficacy, and usability of these devices. Reducing the risk of perioperative hypothermia, hyperthermia, and associated complications helps enhance clinical outcomes, shorten hospital stays, and optimize healthcare resource utilization.

The adoption of patient temperature management systems is accelerating due to the growing demand for enhance patient safety and reduce post-surgical complications across hospitals, surgical centers, and critical care facilities. These systems include advanced warming and cooling devices, thermal blankets, and fluid management systems designed to maintain optimal patient body temperature during surgical, perioperative, and critical care procedures. The integration of precise temperature control, real-time monitoring, and automated feedback mechanisms enables manufacturers to deliver high-performance solutions that enhance clinical outcomes and ensure regulatory compliance. Hospitals and healthcare providers are investing in innovative devices and integrated patient management platforms to enhance efficacy, usability, and operational efficiency.

The growth of the patient temperature management market is driven by the supportive government initiatives, healthcare policies, and accreditation standards promoting patient safety and quality care. For instance, in July 2025, the Australian Commission on Safety and Quality in Health Care launched its Strategic Plan 2025–30 and unveiled a refreshed brand identity to strengthen its role in advancing healthcare safety and quality nationwide. The plan focuses on high-quality care, outcome-driven clinical governance, patient empowerment, and fostering a culture of continuous improvement within the healthcare workforce. These initiatives reflect the commitment of governments to delivering safer, more effective, and patient-centered care.

Drivers & Opportunities

Rising Prevalence of Critical Illnesses and Surgical Procedures Requiring Precise Temperature Regulation: The growing number of surgical procedures and critically ill patients is driving demand for advanced patient temperature management systems. Globally, an estimated 313 million surgical procedures are performed annually, yet an additional 143 million procedures are required each year in low- and middle-income countries to address unmet healthcare needs, save lives, and prevent long-term disability. This gap highlights the pressing need for expanded surgical capacity and improved access to essential healthcare services in resource-limited regions. Maintaining optimal body temperature during surgeries and intensive care is essential to reduce complications such as hypothermia, infections, and prolonged recovery times. Hospitals and surgical centers are increasingly adopting innovative warming and cooling device, thermal blankets, and fluid management solutions to ensure precise perioperative and critical care temperature control, thereby improving patient outcomes and safety.

Increasing Geriatric Population Driving Market Growth: The expanding elderly population is more vulnerable to temperature-related complications during surgery and critical care. Aging patients present with comorbidities that increases the risk of hypothermia or hyperthermia, increasing the need for effective temperature management solutions. According to the United Nations, by the late 2070s, the global population aged 65 and above is projected to rise to 2.2 billion, reflecting a significant demographic shift toward an aging world population. Healthcare providers are investing in advanced patient temperature management technologies that offer automated monitoring, real-time feedback, and integrated clinical workflows to minimize risks, enhance patient safety, and optimize perioperative and intensive care procedures.

Segmental Insights

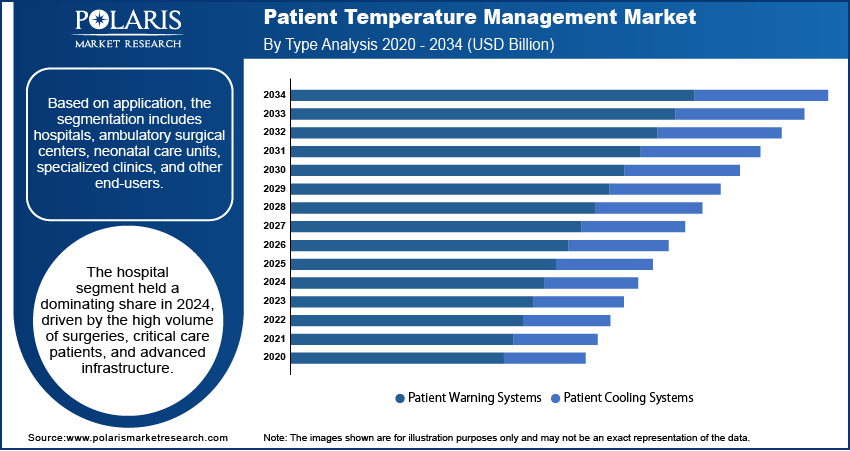

By Product

Based on product, the patient temperature management market is segmented into patient warming systems and patient cooling systems. The patient warming systems segment accounted for the largest share in 2024, driven by extensive use in perioperative care, critical care units, and emergency settings. These systems help maintain normothermia during surgical procedures, reducing the risk of hypothermia-related complications, improving patient outcomes, and shortening recovery times. Hospitals and surgical centers are increasingly adopting advanced warming blankets, fluid warmers, and forced-air warming devices to ensure precise and reliable temperature control.

The patient cooling systems segment is expected to register the fastest growth during the forecast period. Rising prevalence of hyperthermia, fever management requirements in critical care, and neuroprotective therapeutic applications are driving demand for automated cooling devices, cooling blankets, and ice-cold fluid systems. Technological advancements enabling precise, controlled, and non-invasive cooling are accelerating adoption in surgery, cardiology, neurology, and intensive care units.

By Application

Based on application, the market is categorized into general surgery, cardiology, pediatrics, neurology, orthopedic surgery, thoracic surgery, and others. The general surgery segment held the largest share in 2024, supported by the high volume of surgical procedures requiring perioperative temperature management to minimize post-surgical complications and optimize patient safety. Advanced warming and cooling solutions are increasingly integrated into operating rooms to maintain optimal patient temperature throughout procedures.

The cardiology segment is projected to grow at the highest CAGR during the forecast period. Increasing incidence of cardiac procedures, including catheters, bypass surgeries, and interventional treatments, is driving the adoption of precise temperature management systems. According to the Annals of Thoracic Surgery Short Report, over 1 million cardiac surgical procedures are performed annually worldwide, with high-income countries recording an average cardiac surgery rate of 123.2 procedures per 100,000 populations each year. These solutions help prevent hypothermia or hyperthermia during procedures, improving patient outcomes and enabling more efficient cardiac care.

By End-Use

Based on end-use, the market is segmented into hospitals, ambulatory surgical centers, neonatal care units, specialized clinics, and other end-users. Hospitals accounted for the largest share in 2024, driven by the high volume of surgeries, critical care patients, and advanced infrastructure supporting the deployment of patient temperature management systems. Integration of automated warming and cooling devices across surgical and intensive care units enhances clinical efficiency and patient safety.

Neonatal care units are expected to register the fastest growth over the forecast period. This is due to premature and critically ill newborns are highly susceptible to temperature fluctuations, necessitating specialized warming and cooling solutions. Advanced incubators, radiant warmers, and integrated monitoring systems are increasingly adopted to maintain optimal thermal environments, improve survival rates, and support neonatal care protocols.

Regional Analysis

The North America patient temperature management market held the dominant revenue share in 2024, driven by the high prevalence of critical illnesses and surgical interventions that require precise temperature regulation. The region benefits from the presence of leading medical device manufacturers offering innovative warming and cooling solutions, which in turn is driving the market growth. Advanced healthcare infrastructure and well-equipped intensive care units (ICUs) further support the integration of patient temperature management systems across hospitals and surgical centers.

The U.S. Patient Temperature Management Market Insights

The U.S. accounted for the largest share of the North America market in 2024, fueled by well-established healthcare infrastructure, advanced ICU facilities, and a strong focus on patient safety. Rising perioperative procedures, high rates of cardiovascular diseases, coupled with complex surgical interventions are driving demand for precise temperature management solutions. The American Heart Association projects that by 2050, cardiovascular disease (CVD) could affect at least 60% of adults in the United States. Hospitals and ambulatory surgical centers are increasingly implementing warming and cooling devices to reduce post-surgical complications and improve patient outcomes.

Asia Pacific Patient Temperature Management Market Trends

The Asia Pacific market is projected to growth at the fastest CAGR by 2034, driven by the rising investments by governments and private healthcare providers in modern medical technologies, patient safety programs, and critical care infrastructure. In addition, the growing focus on perioperative care and postoperative recovery solutions is expanding the market for advanced temperature management systems.

China Patient Temperature Management Market Overview

China is emerging as a key growth hub in the patient temperature management market due to its increasing geriatric population, which is more susceptible to temperature-related complications. The World Health Organization reports that China’s ageing population is expanding rapidly, with individuals aged over 60 expected to comprise 28% of the population by 2040. The rising burden of age-related illnesses and surgical interventions is pushing hospitals and specialty clinics to adopt advanced warming and cooling devices. Additionally, government support for healthcare modernization and technological upgrades in patient care is further accelerating the market growth.

Middle East Patient Temperature Management Market Assessment

The Middle East market holds the substantial share, fueled by the development of modern healthcare infrastructure and specialty hospitals in GCC countries. Rising medical tourism and increasing demand for advanced surgical and critical care solutions are driving adoption of patient temperature management systems. For instance, under the Vision 2030 initiative, the Saudi Arabian Government aims to invest over USD 65 billion in enhancing healthcare infrastructure, restructuring and privatizing health services and insurance, and establishing 21 health clusters nationwide. Investments in state-of-the-art ICU facilities and perioperative care technologies are enhancing patient safety and clinical outcomes across the region.

-.webp)

Key Players & Competitive Analysis

The global patient temperature management market is highly competitive, with key players such as 3M Company, Atom Medical Corporation, Bard Medical Division (Becton, Dickinson and Company), Cincinnati Sub-Zero Products, LLC (Gentherm), and Drägerwerk AG & Co. KGaA shaping the industry through innovative product portfolios, advanced technology solutions, and global distribution networks. 3M Company leverages its expertise in medical devices and patient care solutions to provide reliable warming and cooling systems for perioperative and critical care applications. Cincinnati Sub-Zero Products, LLC (Gentherm) focuses on precision temperature management devices that enhance patient safety and clinical outcomes. Drägerwerk AG & Co. KGaA integrates advanced monitoring and control technologies in its patient temperature management platforms to support hospitals and surgical centers. Bard Medical Division and Atom Medical Corporation emphasize research-driven innovations, offering comprehensive solutions tailored to specific clinical needs.

The market is witnessing increased adoption of patient warming and cooling systems across hospitals, surgical centers, and neonatal care units to improve perioperative outcomes, reduce complications, and maintain patient safety. Companies are investing in next-generation warming blankets, cooling devices, fluid warmers, and integrated monitoring platforms that deliver precise, non-invasive temperature regulation. Strategic partnerships with healthcare providers and medical technology firms are expanding the reach and capabilities of these solutions across multiple therapeutic areas. The competitive focus is shifting toward user-friendly, automated, and energy-efficient temperature management systems that meet stringent clinical standards and enhance patient care.

Prominent companies in the patient temperature management market include 3M Company, Atom Medical Corporation, Bard Medical Division (Becton, Dickinson and Company), Cincinnati Sub-Zero Products, LLC (Gentherm), Drägerwerk AG & Co. KGaA, Geratherm Medical AG, Inditherm Plc, ICU Medical, Inc., Medtronic plc, Stryker Corporation, Smiths Medical (ICU Medical), The 37Company, The Surgical Company Group (TSC Life), and ZOLL Medical Corporation (Asahi Kasei Group).

Key Players

- 3M Company

- Atom Medical Corporation

- Bard Medical Division (Becton, Dickinson and Company)

- Cincinnati Sub-Zero Products, LLC (Gentherm)

- Drägerwerk AG & Co. KGaA

- Geratherm Medical AG

- Inditherm Plc

- ICU Medical, Inc.

- Medtronic plc

- Stryker Corporation

- Smith’s Medical

- The Surgical Company Group

- The Surgical Company Group (TSC Life)

- ZOLL Medical Corporation (Asahi Kasei Group)

- The 37Company

Patient Temperature Management Industry Developments

In July 2025: Medline launched the ComfortTemp Patient Warming System, a comprehensive solution designed to enhance patient comfort and maintain normothermia during surgical procedures. This system includes disposable blankets and gowns, featuring an innovative lock-in hose mechanism and rotating elbow connector for secure and flexible setup.

In January 2024: ZOLL, part of Asahi Kasei, obtained U.S. FDA clearance and the CE mark for a major enhancement of the Thermogard Temperature Management System. The upgrade enables the system to deliver core and surface-based temperature management, making it the first solution to provide precise, personalized patient care with intelligent analytics and comprehensive temperature control.

Patient Temperature Management Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Patient Warning Systems

- Conventional Warning Systems

- Surface Warning Systems

- Intravascular Warning Systems

- Patient Cooling Systems

- Conventional cooling Systems

- Surface Cooling Systems

- Intravascular Cooling Systems

By Application Outlook (Revenue, USD Billion, 2020–2034)

- General Surgery

- Cardiology

- Pediatrics

- Neurology

- Orthopedic Surgery

- Thoracic Surgery

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory surgical centers

- Neonatal care units

- Specialized clinics

- Other end-users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Temperature Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.06 Billion |

|

Market Size in 2025 |

USD 3.31 Billion |

|

Revenue Forecast by 2034 |

USD 6.80 Billion |

|

CAGR |

8.33% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.06 billion in 2024 and is projected to grow to USD 6.80 billion by 2034.

The global market is projected to register a CAGR of 8.33% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are 3M Company, Atom Medical Corporation, Bard Medical Division (Becton, Dickinson and Company), Cincinnati Sub-Zero Products, LLC (Gentherm), Drägerwerk AG & Co. KGaA, Geratherm Medical AG, Inditherm Plc, ICU Medical, Inc., Medtronic plc, Stryker Corporation, Smiths Medical (ICU Medical), The 37Company, The Surgical Company Group (TSC Life), and ZOLL Medical Corporation (Asahi Kasei Group).

The patient warming systems segment dominated the market revenue share in 2024.

The cardiology segment is projected to witness the fastest growth during the forecast period.