U.S. Ethylene Market Size, Share, Trends, Industry Analysis Report

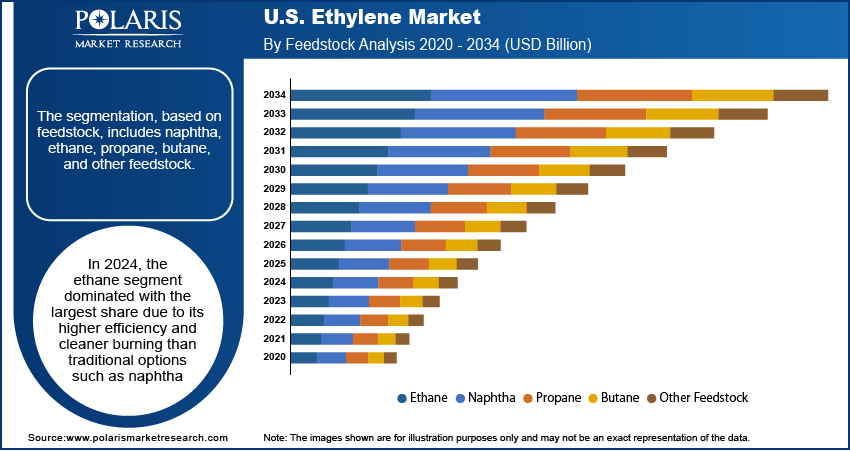

By Feedstock (Naphtha, Ethane, Propane, Butane, Other Feedstock), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6272

- Base Year: 2024

- Historical Data: 2020-2023

Overview

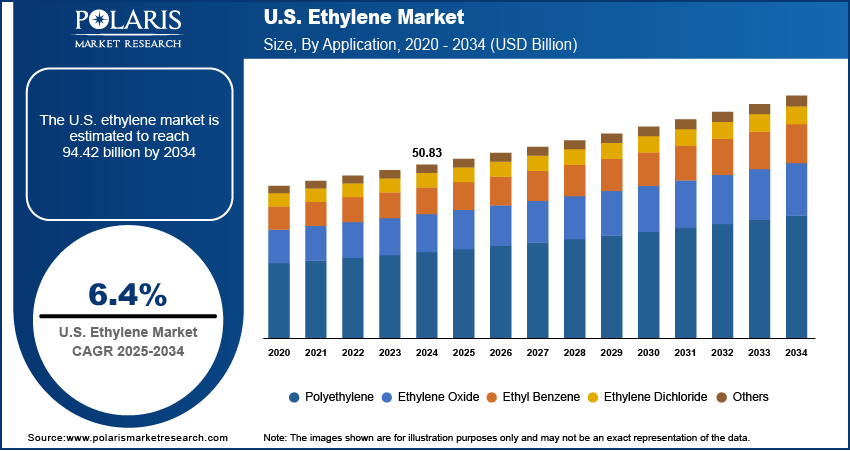

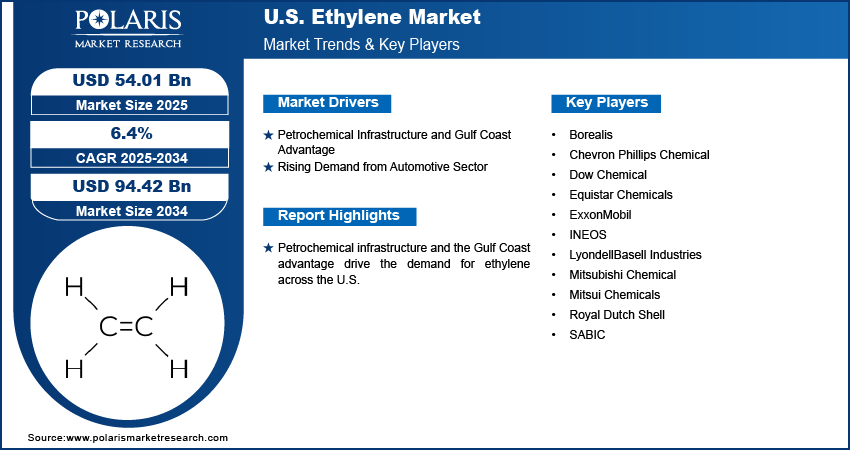

The U.S. ethylene market size was valued at USD 50.83 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. The market growth is driven by petrochemical infrastructure and gulf coast advantage, and rising demand from automotive sector.

Key Insights

- In 2024, the ethane segment led in the U.S. ethylene market, primarily due to the country’s abundant shale gas reserves that offer a cost-effective and efficient production source.

- The ethyl benzene segment recorded notable growth, supported by rising demand for styrene used in plastics, insulation, and consumer goods across various U.S. industries.

- The packaging segment held the largest market share in 2024, driven by consistent demand from sectors such as food, retail, and healthcare and the rapidly expanding e-commerce industry.

- The automotive segment is projected to witness strong growth during the forecast period, fueled by increasing use of lightweight plastics, synthetic rubber, and ethylene glycol in vehicle manufacturing to meet fuel efficiency and emission standards.

Industry Dynamics

- Petrochemical infrastructure and the Gulf Coast advantage drive the demand for ethylene across the U.S.

- Rising demand from the automotive sector is fueling the industry growth.

- Increasing adoption of technological advancements in production helps companies produce ethylene more efficiently and with lower environmental impact.

- High environmental concerns and imposition of stringent regulations on plastic production and waste management restrain the growth of the U.S. ethylene market.

Market Statistics

- 2024 Market Size: USD 50.83 billion

- 2034 Projected Market Size: USD 94.42 billion

- CAGR (2025–2034): 6.4%

Ethylene is a colorless, flammable gas with a slightly sweet odor, widely used as a key raw material in the petrochemical industry. It is primarily used to produce polyethylene and other industrial chemicals.

The U.S. has rapidly expanded its ethylene export capacity in recent years, allowing producers to serve growing markets in Asia, Latin America, and Europe. The U.S.-based producers are well-positioned to meet global demand with competitive pricing and abundant supply. Investments in export terminals, especially along the Gulf Coast, have made it easier to ship ethylene and polyethylene in bulk. The growing trade agreements and partnerships with foreign buyers further support U.S. export strength. This export-driven strategy boosts production and fuels the market during domestic demand fluctuations, thereby driving the growth.

In the U.S., ethylene producers are investing heavily in advanced technologies to improve production efficiency, reduce emissions, and meet sustainability goals. Innovations include digital plant monitoring, energy-efficient steam crackers, and efforts to integrate recycled or bio-based feedstocks. Companies are further exploring carbon capture and storage (CCS) and hydrogen-based production to reduce their environmental footprint. These investments are supported by both federal incentives and private-sector demand for greener products. The U.S. companies are using technology to future-proof their operations, attract investment, and maintain leadership as sustainability becomes a competitive advantage, thereby driving the growth.

Drivers & Opportunities

Petrochemical Infrastructure and Gulf Coast Advantage: The U.S. Gulf Coast is home to one of the most advanced petrochemical hubs in the world, with a dense network of refineries, pipelines, and port facilities. This region enables highly efficient ethylene production and export operations. Major players such as ExxonMobil, Dow, and Chevron Phillips Chemical have invested in ethylene crackers and integrated complexes in Texas and Louisiana. Proximity to both feedstock and export terminals lowers logistics costs and supports global trade. The infrastructure advantage allows U.S. ethylene producers to scale operations quickly and remain competitive globally, thereby fueling the growth.

Rising Demand from Automotive Sector: The U.S. automotive industry drives ethylene demand through the use of plastics, rubber, and antifreeze made from ethylene derivatives. Lightweight materials such as polyethylene and ethylene-propylene rubber are in higher demand as vehicle manufacturers focus on improving fuel efficiency and meeting emission standards. Ethylene glycol, another major derivative, is widely used in vehicle cooling systems. Additionally, the shift toward electric vehicles (EVs) is increasing the need for advanced polymers and insulating materials. This demand from automakers supports ethylene consumption across various applications, with the U.S. being one of the world’s largest vehicle industries, fueling the ethylene industry growth in the country.

Segmental Insights

Feedstock Analysis

The segmentation, based on feedstock, includes naphtha, ethane, propane, butane, and other feedstock. In 2024, the ethane segment dominated with the largest share due to the country’s vast shale gas reserves. Ethane is cheaper and yields more ethylene than alternatives such as naphtha, making it the preferred choice for producers. The development of ethane crackers along the Gulf Coast has allowed companies to lower production costs and scale operations efficiently. Ethane offers a strong competitive advantage with ongoing investments in shale gas extraction and pipeline infrastructure, thereby driving the growth.

Application Analysis

The segmentation, based on application, includes polyethylene, ethylene oxide, ethyl benzene, ethylene dichloride, and others. The ethyl benzene segment accounted for significant growth as styrene is widely used in plastics, insulation, and consumer goods, all of which are in high demand across American industries. Growth in construction and home renovation, particularly post-pandemic, has boosted the need for styrene-based materials such as polystyrene and insulation foams. Additionally, domestic electronics and appliance manufacturing rely on styrene, supporting ethylbenzene production. Ethylene consumption for ethylbenzene grows with a well-developed petrochemical supply chain and strong demand across end-use sectors, thereby driving the segment growth.

End Use Analysis

The segmentation, based on end use, includes building & construction, automotive, packaging, textiles, agrochemicals & agriculture, and others. The packaging segment dominated with the largest share, driven by strong demand from food, retail, healthcare, and e-commerce. Ethylene is a major raw material for polyethylene, which is used in bags, films, containers, and other packaging products. The rise of online shopping and food delivery services has increased the need for flexible, lightweight, and durable packaging. Moreover, the U.S. is home to some of the world’s largest consumer brands, fueling continuous demand for advanced packaging solutions. This widespread usage fuels the segment growth.

The automotive segment is expected to experience significant growth during the forecast period, driven by the demand for lightweight plastics, synthetic rubber, and ethylene glycol. Automakers use ethylene-based materials to manufacture dashboards, bumpers, seals, and cooling system components. Manufacturers are shifting toward lighter vehicles, increasing reliance on ethylene-derived products as fuel efficiency and emission standards tighten, especially under government regulations. Additionally, the growing electric vehicle (EV) market is boosting demand for advanced polymers and wiring insulation, thereby driving the growth.

Key Players and Competitive Analysis

The competitive landscape of the U.S. ethylene market is dominated by major chemical manufacturers such as ExxonMobil, Dow Chemical, Chevron Phillips Chemical, LyondellBasell Industries, INEOS, Equistar Chemicals, and SABIC. These companies operate large-scale ethylene crackers, primarily located along the Gulf Coast, benefiting from abundant shale gas reserves that provide low-cost ethane feedstock. Dow, ExxonMobil, and Chevron Phillips have invested heavily in expanding their production capacities to meet both domestic and export demand. INEOS and LyondellBasell continue to strengthen their positions through technological innovation and operational efficiency. Companies such as Mitsui Chemicals, Mitsubishi Chemical, and Borealis maintain a presence through partnerships and joint ventures. The U.S. market is further shaped by efforts to decarbonize production, including the use of advanced cracking technologies and carbon capture initiatives. Overall, the market remains highly competitive, innovation-driven, and export-oriented, with firms leveraging infrastructure, feedstock advantages, and global demand to maintain market leadership.

Key Players

- Borealis

- Chevron Phillips Chemical

- Dow Chemical

- Equistar Chemicals

- ExxonMobil

- INEOS

- LyondellBasell Industries

- Mitsubishi Chemical

- Mitsui Chemicals

- Royal Dutch Shell

- SABIC

U.S. Ethylene Industry Developments

In December 2024, Technip Energies and LanzaTech received up to USD 200 million in the U.S. Department of Energy funding to begin Project SECURE. The project aims to convert captured CO₂ and hydrogen into sustainable ethylene at a U.S. Gulf Coast facility.

U.S. Ethylene Market Segmentation

By Feedstock Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Naphtha

- Ethane

- Propane

- Butane

- Other Feedstock

By Application Output Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

- Others

By End Use Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Building & Construction

- Automotive

- Packaging

- Textiles

- Agrochemicals & Agriculture

- Others

U.S. Ethylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 50.83 Billion |

|

Market Size in 2025 |

USD 54.01 Billion |

|

Revenue Forecast by 2034 |

USD 94.42 Billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to regions, countries, and segmentation. |

FAQ's

The market size was valued at USD 50.83 billion in 2024 and is projected to grow to USD 94.42 billion by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period.

A few of the key players in the market are Borealis, Chevron Phillips Chemical, Dow Chemical, Equistar Chemicals, ExxonMobil, INEOS, LyondellBasell Industries, Mitsubishi Chemical, Mitsui Chemicals, Royal Dutch Shell, and SABIC.

The ethane segment dominated the market share in 2024.

The automotive segment is expected to witness the significant growth during the forecast period.