Diamond Coatings Market Size, Share, Trends, & Industry Analysis Report

By Technology (Chemical Vapor Deposition and Physical Vapor Deposition), By Substrate, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6001

- Base Year: 2024

- Historical Data: 2020-2023

Overview

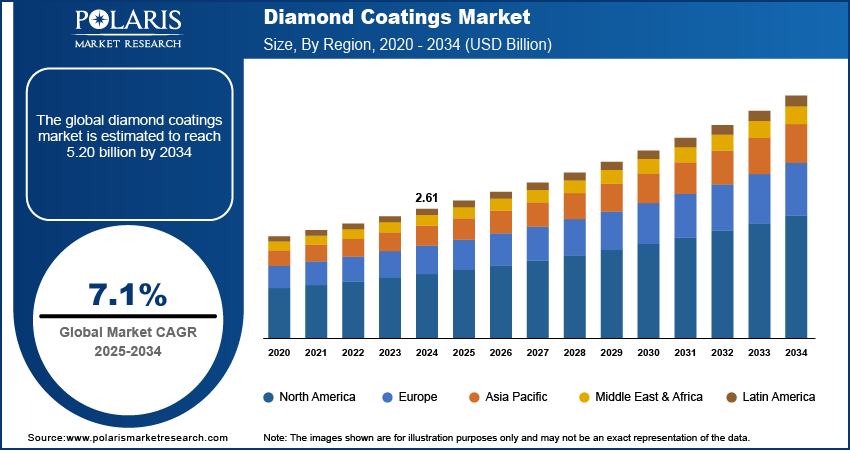

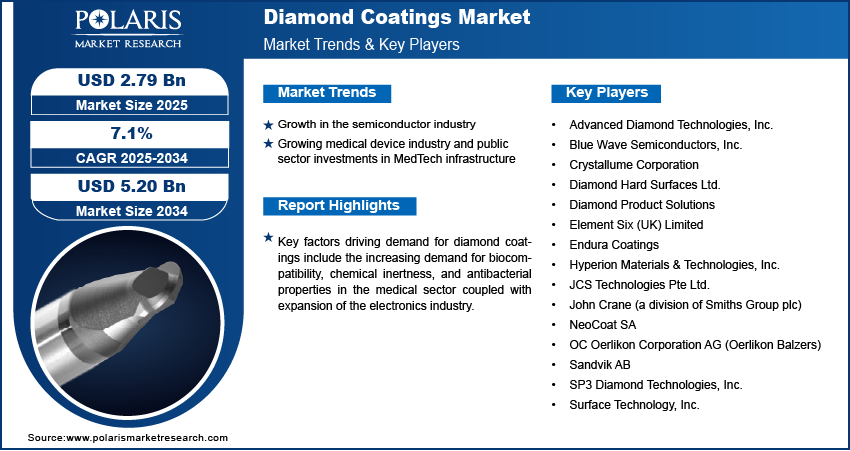

The global diamond coatings market size was valued at USD 2.61 billion in 2024, growing at a CAGR of 7.1% from 2025–2034. Key factors driving demand for diamond coatings include global surge in the semiconductor industry coupled with expansion of the medical device sector and increased public sector investment in MedTech infrastructure.

Key Insights

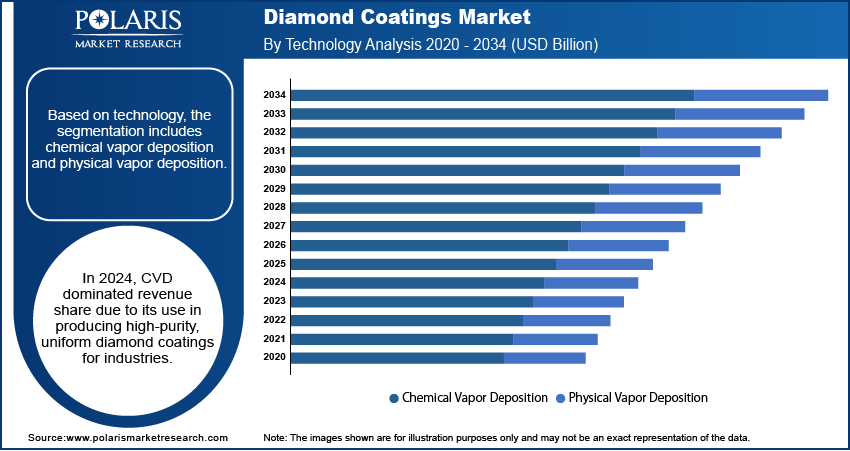

- The chemical vapor deposition (CVD) segment accounted for largest market share in 2024.

- The ceramics segment is projected to grow at a rapid pace in the coming years, owing to the increasing deployment of advanced ceramics in electronic components, medical devices, and wear-resistant coatings.

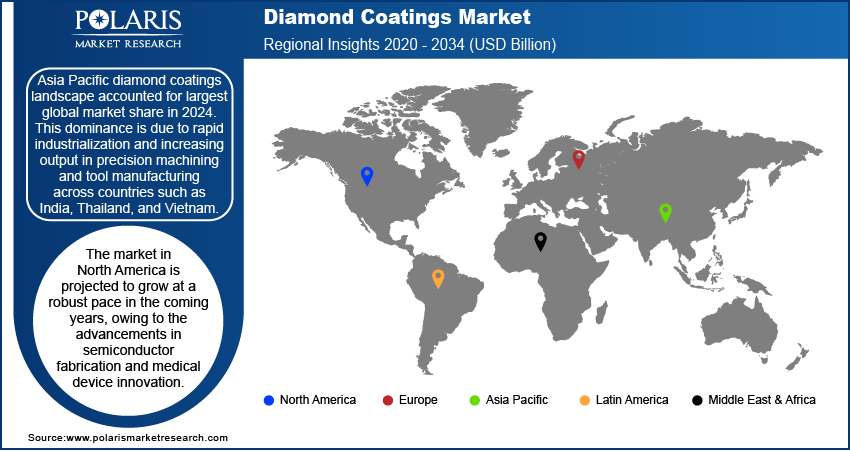

- The Asia Pacific diamond coatings market accounted for largest share of the global market in 2024.

- The China diamond coatings market held largest regional share of the Asia Pacific market in 2024, due to the expanding electronics and semiconductor manufacturing ecosystem is contributing to the growth of diamond coatings.

- The market in North America is projected to grow with a fastest CAGR from 2025-2034, owing to the advancements in semiconductor fabrication and medical device innovation.

- The US market is experiencing growth due to the expanding aerospace and defense sector, thus accelerating the use of diamond coatings in essential components.

Diamond coatings are created using chemical vapor deposition (CVD) techniques that enable a thin layer of synthetic diamond to be applied to surfaces including metals, ceramics, and semiconductors. These coatings offer a combination of ultra-hardness, low friction, high transparency, and biocompatibility, making it suitable for cutting tools, heat spreaders, bio-implants and optical components. Rising miniaturization of electronics and the growing emphasis on precision manufacturing are driving demand for uniform, defect-free diamond-coated surfaces across advanced technology sectors.

The increasing demand for biocompatibility, chemical inertness, and antibacterial properties in the medical sector is driving the growth of the diamond coatings market. These coatings are applied to surgical instruments, orthopedic implants, and dental tools to ensure enhanced hygiene and minimize the risk of infection. It also helps reduce tissue damage during procedures and extend the functional lifespan of medical devices. Additionally, ongoing advancements in coating deposition techniques coupled with improved scalability and cost-efficiency are making diamond coatings more accessible across hospitals, specialized clinics and medical device manufacturing facilities.

Expansion of the electronics sector is fueling the increasing utilization of diamond coatings for thermal management applications. According to the India Brand Equity Foundation, India’s appliances and consumer electronics (ACE) market was valued at USD 9.84 billion in 2021 and is anticipated to exceed USD 21.18 billion by the end of 2025, more than doubling in size over the forecast period. Growing miniaturization and rising performance requirements in consumer electronics and semiconductors made thermal conductivity a crucial component for device reliability. Diamond coatings are used to dissipate heat in components such as heat spreaders, wafers and substrates, ensuring stable operation under high thermal loads. The adoption of these coatings is increasing in advanced chip packaging and high-frequency devices to improve efficiency and prevent overheating.

Industry Dynamics

- Growth in the semiconductor industry is driving demand for diamond coatings, as advanced electronic components increasingly require materials with superior thermal conductivity, electrical insulation, and wear resistance.

- Expansion of the medical device industry, along with increased public sector investment in MedTech infrastructure, is fueling the market growth.

- High capital and operational costs associated with diamond coating technologies are restraining broader adoption, among small and medium-sized manufacturers.

- Rising deployment of GaN and SiC semiconductors in electric vehicles, 5G infrastructure, and data centers is creating opportunities for the market.

Growth in the Semiconductor Industry: Growing global semiconductor industry is driving the demand for diamond coatings in thermal management and equipment protection. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached USD 627.6 billion in 2024, marking a 19.1% increase from the 2023 total of USD 526.8 billion. Increasing complexity in semiconductor manufacturing and the shift toward higher power densities are elevating the need for coatings that deliver exceptional heat dissipation and mechanical wear resistance. Diamond coatings are applied to wafers, tooling surfaces and heat spreaders to improve process stability and extend equipment life during high-speed fabrication. The thermal conductivity and abrasion resistance contribute to improved production efficiency in semiconductor fabrication facilities.

Growing Medical Device Industry and Public Sector Investments in MedTech Infrastructure: The expansion of the global medical device industry coupled with increasing public sector investments in healthcare infrastructure, is propelling to the growth of the diamond coatings market. Diamond coatings are increasingly used in surgical tools, orthopedic implants, and dental instruments due to its biocompatibility, corrosion resistance, and durability. According to the MedTech Association Report, the US remains the world’s largest medical device market, accounting for over 40% of the global share. Also, the Indian government announced a USD 59.24 million initiative in its 2025-26 Union Budget to strengthen the domestic medical devices sector. The scheme focuses on enhancing manufacturing capabilities, skill development, clinical research, and shared infrastructure. These public and private sector efforts are boosting the demand for advanced coatings that extend product life, improve hygiene, and enhance performance in critical care settings, fueling the market growth globally.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes chemical vapor deposition and physical vapor deposition. The chemical vapor deposition (CVD) segment accounted for largest revenue share in 2024, due to its widespread adoption for producing high-purity, uniform diamond coatings across a variety of industrial applications. CVD technology allows precise control over coating thickness and crystallinity, making it suitable for use in cutting tools, heat sinks and medical instruments. Its compatibility with complex geometries and ability to deliver strong adhesion to various substrates further boosting its demand in precision engineering and electronics manufacturing.

The physical vapor deposition (PVD) segment is expected to grow at the fastest CAGR during the forecast period. Increasing interest in compact coating equipment and growing efforts to reduce process temperatures are fueling the development of PVD-based solutions. This technique is used in cost-sensitive applications where thin, wear-resistant coatings are required for metal surfaces, particularly in tool refurbishment and microelectronic components.

Substrate Analysis

In terms of substrate, the segmentation includes metals, ceramics, composites, and others. The metals substrate segment dominated the revenue share in 2024, attributed to the extensive use in aerospace, automotive, and industrial tooling applications. Metal substrates such as stainless steel, titanium, and tungsten carbide are coated with diamond films to enhance surface hardness, reduce friction, and improve service life under high-load conditions. The reliability and durability offered by diamond-coated metals is accelerating adoption in applications exposed to intense heat, friction, and mechanical load.

The ceramics segment is projected to witness the fastest growth through 2034, owing to the increasing deployment of advanced ceramics in electronic components, medical devices, and wear-resistant coatings. Ceramics coated with diamond films are used for the insulating properties, chemical stability, and enhanced biocompatibility, in dental and orthopedic implants. Advances in deposition techniques improved the adhesion of diamond coatings on ceramic substrates, further boosting adoption across high-precision and biomedical sectors.

End User Analysis

In terms of end-use, the segmentation includes manufacturing, aerospace, automotive, medical devices, oil and gas industry, food processing, and others. The manufacturing segment accounted for the largest revenue share in 2024, attributed to the widespread application of diamond coatings in cutting tools, dies, molds, and wear components. These coatings significantly improve tool hardness, reduce friction, and extend the operational life of equipment used in high-volume machining, metal forming, and fabrication processes. The manufacturing sector increasingly adopts diamond coatings to maintain precision and operational efficiency, in sectors dealing with high-speed and high-temperature processes.

The medical devices segment is expected to grow at the fastest CAGR through 2034, due to the increasing preference for biocompatible and corrosion-resistant materials in surgical instruments and implants. Diamond coatings offer antibacterial properties, high wear resistance, and chemical inertness, making them ideal for orthopedic implants, dental drills, and endoscopic tools. Growing investments in healthcare infrastructure, coupled with technological advancements in minimally invasive surgeries, are accelerating the adoption of precision-engineered medical tools, boosting the growth of the market.

Regional Analysis

Asia Pacific diamond coatings market accounted for largest share of global market in 2024. This dominance is due to rapid industrialization and increasing output in precision machining and tool manufacturing across countries such as China, India, Thailand, and Vietnam. The growing use of diamond-coated tools in high-precision operations is supported by rising demand from the automotive, aerospace, and general engineering sectors. Government-led programs such as Make in India and Made in China 2025 are further boosting domestic production of advanced components, leading to higher adoption of specialized coating technologies. In addition, the presence of low-cost manufacturing infrastructure and expanding R&D capabilities is boosting large-scale diamond coating production and innovation in the region.

China Diamond Coatings Market Insight

China held largest market share in Asia Pacific diamond coatings landscape in 2024, due to the expanding electronics and semiconductor manufacturing ecosystem is contributing to the growth of diamond coatings. The growing applications such as heat spreaders, wafer carriers and tooling components are coated with diamond films to withstand high thermal and mechanical stress. According to the Semiconductor Industry Association, China serves as the world’s largest electronics manufacturing hub, accounting for 36% of global production, including smartphones, computers, cloud servers, and telecommunications infrastructure. This strong manufacturing base is increasing the demand for durable, high-performance diamond coating solutions across China’s electronics sector. Moreover, government investments in semiconductor self-sufficiency and process innovation are further accelerating growth of the diamond coatings market.

North America Diamond Coatings Market Trend

The market in North America is projected to grow with a fastest CAGR from 2025-2034, owing to the advancements in semiconductor fabrication and medical device innovation. Also, rising production of surgical instruments, orthopedic implants, and precision diagnostic tools is increasing the demand for biocompatible coatings. Additionally, investments in nanotechnology research and the commercialization of next-generation CVD equipment are enabling the development of specialized coatings tailored to industry-specific performance needs. Also, industrial stakeholders are emphasizing energy efficiency and extended component lifecycles that further boost the demand for diamond-coated surfaces in this region.

US Diamond Coatings Market Overview

The market in the US is expanding due to the growing aerospace and defense industry, which is driving the adoption of diamond coatings in critical components for enhanced durability and performance. According to the International Trade Administration, foreign direct investment (FDI) in the US aerospace industry surpassed USD 20 billion by the end of 2022, with a significant portion held by majority foreign-owned affiliates operating within the sector. Moreover, manufacturers are integrating these coatings to reduce friction, enhance thermal resistance and extend wear life in turbine blades, optical sensors and structural elements exposed to extreme conditions. This in turn fuels the demand for the diamond coatings market across the country.

Europe Diamond Coatings Market Outlook

The diamond coatings landscape in Europe is projected to hold a substantial share in 2034, driven by well-established medical device manufacturing base, with major production hubs in the UK, France, and Germany. According to the MedTech Europe Report, the European medical technology market was valued at approximately USD 175 billion in 2023 and it is growing at an average of 5.4% per year over the past 10 years. This sustained growth is creating strong demand for diamond coatings across critical medical applications, including surgical instruments, dental drills, and implantable devices to enhance durability, precision and biocompatibility. In addition, high demand from the precision optics and photonics sectors in Germany and Switzerland is further propelling the growth of the market.

Key Players & Competitive Analysis Report

The diamond coatings market is moderately competitive, with key players concentrating on precision engineering capabilities, coating uniformity, and material performance across critical applications. Manufacturers are investing in advanced deposition technologies in chemical vapor deposition (CVD) to enhance coating consistency, substrate compatibility, and operational efficiency. Strategic priorities include scaling production capacity and improving adhesion on diverse materials such as metals, ceramics, and composites. Companies are increasingly adopting eco-friendly production practices and emphasizing durability and energy efficiency to meet regulatory and end-user demands. To strengthen market position, players are targeting partnerships with OEMs, diversifying their global distribution networks, and expanding into high-growth regions through tailored product lines and localized support infrastructure.

Major companies operating in the diamond coatings industry include Advanced Diamond Technologies, Inc.; Blue Wave Semiconductors, Inc.; Crystallume Corporation; Diamond Hard Surfaces Ltd.; Diamond Product Solutions; Element Six (UK) Limited; Endura Coatings; Hyperion Materials & Technologies, Inc.; JCS Technologies Pte Ltd.; John Crane (a division of Smiths Group plc); NeoCoat SA; OC Oerlikon Corporation AG (Oerlikon Balzers); Sandvik AB; SP3 Diamond Technologies, Inc.; and Surface Technology, Inc.

Key Players

- Advanced Diamond Technologies, Inc.

- Blue Wave Semiconductors, Inc.

- Crystallume Corporation

- Diamond Hard Surfaces Ltd.

- Diamond Product Solutions

- Element Six (UK) Limited

- Endura Coatings

- Hyperion Materials & Technologies, Inc.

- JCS Technologies Pte Ltd.

- John Crane (a division of Smiths Group plc)

- NeoCoat SA

- OC Oerlikon Corporation AG (Oerlikon Balzers)

- Sandvik AB

- SP3 Diamond Technologies, Inc.

- Surface Technology, Inc.

Industry Developments

- June 2025: Oerlikon Balzers launched BALDIA VARIA, an advanced CVD diamond coating for machining special materials such as CFRPs, ceramics, and composites across a wide tool size range. The coating offered improved thermal stability and cutting-edge strength, enhancing productivity in precision applications.

- March 2023: KORLOY introduced ND3000 and ND2100 diamond coating grades optimized for non-ferrous metals and composite machining, featuring high-crystallinity and multi-layer nano-coating technologies. These grades increased tool lifespan while maintaining sharpness and performance in dry-cutting environments.

- June 2021: Oerlikon Balzers launched the Baldia diamond coating portfolio, offering specialized CVD coatings for high-wear applications such as drilling and machining of abrasive materials. The coatings also reduced tool replacement frequency, supporting cost-effective production cycles.

Diamond Coatings Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Chemical Vapor Deposition

- Physical Vapor Deposition

By Substrate Outlook (Revenue, USD Billion, 2020–2034)

- Metals

- Ceramics

- Composites

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Aerospace

- Automotive

- Medical Devices

- Oil and Gas Industry

- Food Processing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Diamond Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.61 Billion |

|

Market Size in 2025 |

USD 2.79 Billion |

|

Revenue Forecast by 2034 |

USD 5.20 Billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.61 billion in 2024 and is projected to grow to USD 5.20 billion by 2034.

The global market is projected to register a CAGR of 7.1% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Advanced Diamond Technologies, Inc.; Blue Wave Semiconductors, Inc.; Crystallume Corporation; Diamond Hard Surfaces Ltd.; Diamond Product Solutions; Element Six (UK) Limited; Endura Coatings; Hyperion Materials & Technologies, Inc.; JCS Technologies Pte Ltd.; John Crane (a division of Smiths Group plc); NeoCoat SA; OC Oerlikon Corporation AG (Oerlikon Balzers); Sandvik AB; SP3 Diamond Technologies, Inc.; and Surface Technology, Inc.

The chemical vapor deposition (CVD) segment dominated the market in 2024.

The ceramics segment is expected to witness the fastest growth during the forecast period.