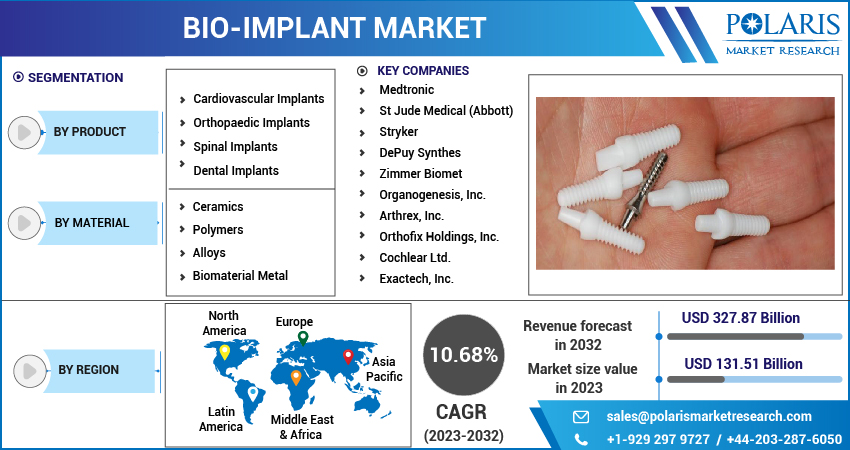

Bio-implant Market Size, Share & Trends Analysis Report

by Product (Cardiovascular, Orthopedic, Dental, Spinal), By Material (Ceramics, Polymers, Biomaterial Metal, Alloys) Segment Forecasts, 2023 - 2032

- Published Date:May-2023

- Pages: 116

- Format: PDF

- Report ID: PM3254

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

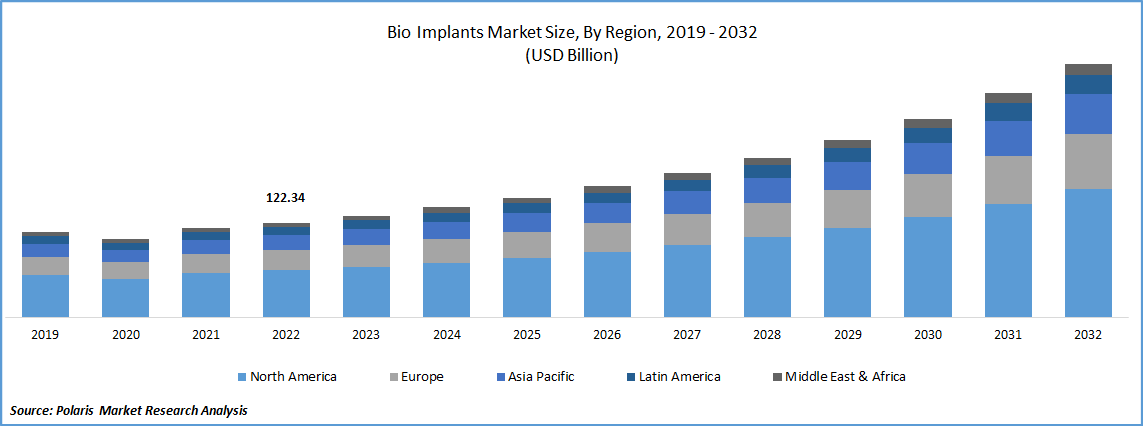

The market for bio-implants was valued at USD 122.34 billion in 2022 and is projected to grow at a CAGR of 10.68% over the next five years. One of the main factors propelling the market is the growing preference for bio-implant procedures over arthroscopy and other therapy therapies like physiotherapy. Due to related advantages like a higher success rate and biocompatibility, this preference has developed. Additionally, driving the market are rising rates of orthopedic and cardiovascular diseases (CVD), a sizable geriatric population, changing lifestyles, and growing popularity of cosmetic procedures.

Know more about this report: Request for sample pages

Growing public knowledge of cosmetic implants and improvements in bioengineering technologies are other factors driving the market. In many medical specialties, demand for non-surgical or slightly invasive bio-implants is rising. As an easier and more effective alternative to a root canal treatment, more and more dental patients are choosing to use bio-implants. An alarming rise in oral health issues will boost demand for bio-implants. For instance, according to WHO's 2021 Global Burden of Disease Study (GBDS), oral diseases were expected to impact roughly half of the world's population. Dental caries and other tooth issues were found to affect almost 3.58 billion people. In the immediate future, this will offer a larger market that can be served.

Numerous chronic diseases, including gout, congenital and neuropathic disorders, and CVD, have sedentary lifestyles as their primary contributing factor. The market for bio-implants has increased as a result all over the world. For instance, the National Spinal Cord Injury Statistical Center estimates that in 2021, spinal cord injury affected nearly 54.0% of the population in the United States. By 2021, it is anticipated that these occurrences will have an impact on nearly 60% of the US populace, creating market expansion opportunities.

The biocompatibility of these goods has been greatly improved by technological developments in bio-implant manufacturing, such as 3D printing, laser technology, and nanotechnology. The increase in healthcare financing by governments around the world is a major factor supporting these efforts. To bring new and more effective devices to market, a number of governmental organizations are collaborating with businesses that conduct healthcare study and manufacture medical equipment. For instance, the Government of Kazakhstan showed interest in partnering with the Indian company MIDHANI to commercially produce titanium bio-implants in June 2019.

Technological advancements in bio-implant manufacturing, such as 3D printing, laser technology, and nanotechnology, have vastly improved the biocompatibility of these products. One of the main factors assisting these efforts is the rise in healthcare funding by governments worldwide. A number of governmental organizations are working with companies that perform healthcare research and produce medical equipment to bring new and more effective devices to market. For instance, in June 2019, the Government of Kazakhstan expressed interest in collaborating with the Indian business MIDHANI to make titanium bio-implants for sale.

For bio implants used in cardiac repair to properly integrate with the neighboring myocardium, they need to have effective vascularization and innervation. After an acute myocardial heart attack, cardiac performance is improved by bio implants containing extracellular vesicles from stem cells. The global increase in the prevalence of cardiovascular diseases is the main reason promoting the market segment's expansion. Additionally, there is a clear increase in the geriatric population worldwide, which is anticipated to open up more market opportunities over the course of the forecast term. For instance, 40,000 children in the United States have congenital heart surgery each year, according to an essay written by the American Heart Association in 2021.

The rise in interventional cardiology procedures is anticipated to be fueled by the rising prevalence of cardiovascular diseases and the resulting demand for early detection and therapy. The market for cardiovascular implants will expand as a result. Most patients choose heart surgery; though different cardiovascular diseases can also be treated with bio implants.

Additionally, it is anticipated that the rising number of product launches will fuel the studied segment's expansion over the forecast term. For instance, Impulse Dynamics introduced a clever mini optimizer in May 2022. It is a portable battery that monitors heart failure and gives healthcare professionals crucial clinical information to help them manage their heart failure patients.

For Specific Research Requirements, Request For Customized Report

Industry Dynamics

Growth Drivers

The number of elderly geriatric individuals over the age of 80 is rising as a result of rising living standards and medical breakthroughs. Older people don't want to undergo drawn-out medical procedures, which is likely to increase demand for bio-implants in this age group in the years to come. Because of their concern over medical complications in older patients, physicians tend to steer clear of major surgical procedures, which helps the bio-implant market expand. Most elderly individuals experience problems with their eyesight and joints. Retinal bioimplants and joint prostheses for the knees or the hip can be used to treat these conditions.

Report Segmentation

The market is primarily segmented based on product type, material, and region.

|

By Product |

By Material |

By Region |

|

|

|

Know more about this report: Request for sample pages

In 2022, the orthopedic implants segment has dominated the market share accounting for the largest market share.

Based on type, Orthopedic implants held the largest market share in 2022. This can be ascribed to elements like the increasing use of implants in orthopedic surgeries, the prevalence of orthopedic diseases, and supportive government reimbursement programs. The Centers for Disease Control and Prevention (CDC) estimate that in the United States alone, 54.4 million people had arthritis in 2021.

But due to variables like an ageing population with more tooth deformities and a rising need for dentistry and cosmetic procedures, dental implants are anticipated to expand at a faster rate during the forecast period. More than 69.0%, according to a projection made in 2021 by the American Academy of Implant Dentistry.

The biomaterial metal segment will account for a higher share of the market during projected timeframe

The biomaterial metal segment held the largest market share for bio-implants in 2022 and is predicted to keep it throughout the forecast term. Major development drivers for this market are associated benefits like greater tensile strength and corrosion resistance compared to other materials like ceramics and alloys. Dental implants, joint replacement implants, and pacemaker devices are just a few examples of the applications for biomaterial metals.

The demand in North America is expected to witness significant growth during forecast period

Due to factors like the rising demand for advanced technologies across all medical specialties and the rising number of surgical procedures requiring implants, North America is expected to lead the global market. More than 1.4 million orthopedic operations, including hip and knee replacement surgeries, were performed in 2017, according to the Organization for Economic Co-operation and Development's (OECD) Health Statistics. This number is expected to rise in the coming years. This will probably help the area economy.

Competitive Insight

Some of the major players operating in the global bio-implant market include Medtronic; St Jude Medical (Abbott); Stryker; DePuy Synthes; Zimmer Biomet; Organogenesis, Inc.; Arthrex, Inc.; Orthofix Holdings, Inc.; Cochlear Ltd.; Exactech, Inc.

Recent Developments

- For instance, in March 2020, Spinal Kinetics Inc., a privately owned manufacturer and developer of artificial cervical and lumbar discs, was purchased by Orthofix International N.V. The goal of the change was to expand Orthofix's line of orthobiologics bio-implants.

- The 3D printing techniques used by MaterialsCare for bio-implants are presently only intended for use by veterinarians, but the company has announced that the technology will be accessible to humans by the end of 2021. Similar to this, technological developments have given those involved in the development of biomaterials new possibilities.

Bio-implant Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 131.51 billion |

|

Revenue forecast in 2032 |

USD 327.87 billion |

|

CAGR |

10.68% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Material, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Medtronic; St Jude Medical (Abbott); Stryker; DePuy Synthes; Zimmer Biomet; Organogenesis, Inc.; Arthrex, Inc.; Orthofix Holdings, Inc.; Cochlear Ltd.; Exactech, Inc. |

FAQ's

key companies in bio-implant market are Medtronic; St Jude Medical (Abbott); Stryker; DePuy Synthes; Zimmer Biomet; Organogenesis, Inc.; Arthrex, Inc.; Orthofix Holdings, Inc.; Cochlear Ltd.; Exactech, Inc.

The bio-implants market projected to grow at a CAGR of 10.68% over the next five years.

The bio-implant market report covering key segments are product, material, and region.

key driving factors in bio-implant market are growing incidences of chronic conditions.

The global bio-implant market size is expected to reach USD 327.87 billion by 2032.