Chemical Vapor Deposition Market Share, Size, Trends, Industry Analysis Report

By Category (CVD Services, CVD Equipment, CVD Materials); By End-use; By Technology; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 115

- Format: PDF

- Report ID: PM1490

- Base Year: 2024

- Historical Data: 2020-2023

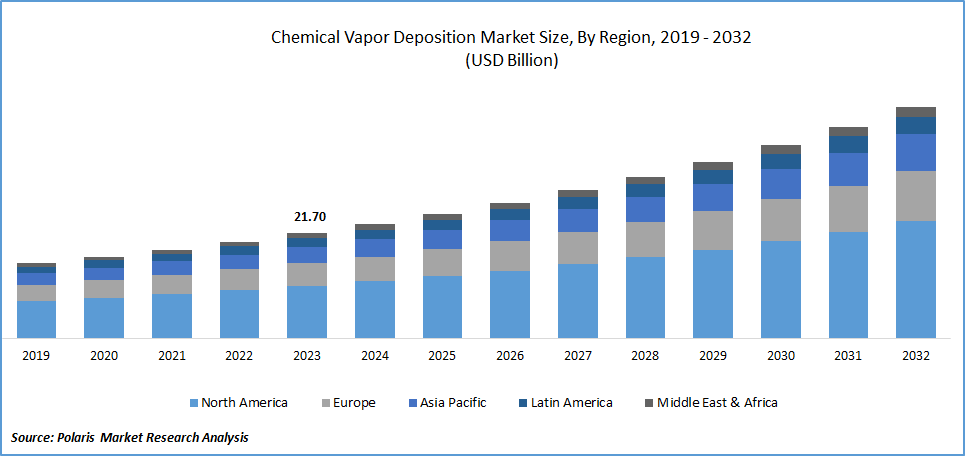

The global chemical vapor deposition market was valued at USD 32.1 billion in 2024 and is projected to grow at a CAGR of 8.40% from 2025 to 2034. The market is growing due to its rising use in semiconductors, solar panels, and medical devices.

Market Overview

The growing net income among the global population is significantly boosting the consumption of electronic tools for entertainment. The increasing development of new devices to promote the convenience of human beings in household chores supports the need for raw materials and chemicals required in production activities. As per the International Energy Agency, by 2030, the average television is expected to be owned by 1.38 units per household. This trend is optimally driving the demand for chemical vapor deposition, driven by its assistance in deploying thin films in semiconductor fabrication procedures .

To Understand More About this Research:Request a Free Sample Report

Furthermore, the growing technological developments in semiconductor production are showcasing significant support for the chemical vapor deposition market.

- For instance, in April 2023, a study published in Nature Nanotechnology developed the new cost-effective monolayer molybdenum disulfide to design 2D materials for the silicon circuit by utilizing metal-organic chemical vapor deposition.

Moreover, the growing companies’ initiatives to promote their brand coverage area likely to facilitate new demand potential for chemical vapor deposition. For instance, in September 2023, GlobiTech opted for Aixtron SE’s G10-SiC CVD system to expand its footprints in the silicon carbide epitaxy market.

Growth Drivers

Growing Investments in CVD Technological Developments

The chemical vapor deposition (CVD) market is witnessing substantial growth, driven by significant investments in research and technological advancements. Major companies worldwide are increasingly focusing on innovations in CVD, recognizing its potential to enhance various industrial applications. For instance, Nextwafe, a Germany-based company that recently secured USD 32 million to accelerate the production of green solar wafers. Nextwafe employs epitaxial silicon deposition in atmospheric CVD processes to create the initial layer, highlighting the efficiency and environmental benefits of advanced CVD technologies.

Such investments underscore the broader trend of growing interest in CVD technologies, which are pivotal in sectors like semiconductors, solar energy, and nanotechnology. The infusion of capital into CVD research is expected to drive further technological developments, improve production efficiencies, and foster sustainable practices, thereby propelling the global CVD market's expansion and innovation trajectory.

Increasing Demand for Semiconductors

The increasing production and consumption of electronic goods is significantly supporting the need for semiconductors. This is boosting investments in the production of semiconductors, consequently facilitating the need for raw materials along with the new technological advancements. For instance, in April 2023, Merck Group announced an investment of EUR 300 million to expand its semiconductor manufacturing facility in the United States.

Restraining Factors

Higher Electricity Consumption for Chemical Vapor Deposition

The increasing adoption and expansion of chemical vapor deposition (CVD) processes across various industries are contributing to higher electricity consumption. CVD techniques, vital in manufacturing processes like semiconductor fabrication and thin-film coatings, often require precise temperature control and energy-intensive reactions, driving up electricity usage.

As demand for CVD applications continues to grow, so does the requirement for electricity to power the equipment and sustain the necessary operating conditions. Moreover, the scale-up of CVD production facilities to meet rising market demands further amplifies electricity consumption.

Efforts to mitigate this heightened energy consumption include the development of more energy-efficient CVD equipment and process optimization techniques. Additionally, advancements in renewable energy sources offer opportunities to reduce the environmental impact associated with increased electricity usage in CVD processes.

Nevertheless, addressing the energy requirements of CVD remains crucial to ensuring sustainable growth in industries reliant on this technology, balancing the need for continued innovation with energy conservation initiatives.

Report Segmentation

The market is primarily segmented based on category, end-use, technology, and region.

|

By Category |

By End-use |

By Technology |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Category Analysis

CVD Equipment Segment is Expected to Witness the Highest Growth During the Forecast Period

The CVD equipment segment will grow rapidly, due to its potential to offer chemical vapor deposition services for multiple times, and enhanced convenience. The growing demand for chemical vapor deposition in the marketplace is positively influencing market growth. For instance, in April 2024, CVD Equipment Corporation announced that it had received a USD 10 million contract to deliver CVD-based silicon carbide coating reactors.

The CVD services segment led the market with a substantial revenue share in 2023, largely attributable to its ability to provide cost-effective alternatives to the higher cost of consuming equipment. The availability of players engaged in electronic goods manufacturing without any expertise in chemical vapor deposition activities is driving the demand for CVD services.

By End-use Analysis

Microelectronics Segment Accounted for the Largest Chemical Vapor Deposition Market Share in 2024

The microelectronics segment accounted for the largest market share in 2023. This is due to the increasing development of advanced electronics in the world, significantly facilitating the reasonable demand for semiconductors, and thereby chemical vapor deposition. As per India Cellular and Electronic Association, the manufacturing of electric goods is estimated to be worth USD 115 billion in FY 2023-24, with more than USD 50 billion coming from smartphones.

By Technology Analysis

Atomic Layer CVD Segment Held the Significant Chemical Vapor Deposition Market Revenue Share In 2024

The atomic layer CVD segment held a largest share in revenue in 2023, due to its potential to facilitate high-quality films with conformity, a lower temperature requirement, and stoichiometric control. The growing application of atomic layer chemical vapor deposition in solar panels, nanotechnology, and semiconductors manufacturing processes are playing a vital role in fueling its demand in the marketplace.

Regional Insights

Asia Pacific Region Registered the Largest Share of The Global Market in 2024

The Asia Pacific region held the dominant share in 2023. This is attributable to the presence of a larger number of customers interested in purchasing consumer electronics, particularly in China and India. The growing demand for premium jewelry, primarily diamonds, is expected to facilitate new growth opportunities, driven by the growing use of CVD in synthetic diamonds production in the region. For instance, in April 2024, Limelight Lab Grown Diamonds, a CVD diamond jewelry manufacturer, received funding of USD 1 million, aiming to expand its retail presence in India.

The North America region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing consumption of semiconductors, and the increasing number of companies engaged in producing electronic devices. As per the US Semiconductor Industry Association (SIA) in 2024, China registered a rise in the sale of semiconductors by 26.6%, followed by the US and Asia Pacific by 20.3% and 12.8%, respectively. There will be a significant demand for chemical vapor deposition equipment and services, with the growing demand for semiconductors in the region.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The chemical vapor deposition market is moderately fragmented. Major companies are working on developing new chemical vapor deposition technologies to meet the growing need for advanced semiconductors. For instance, in June 2023, General Graphene Corporation and Hememics Biotechnologies entered a partnership to boost the production of graphene-based biosensor chips.

Some of the major players operating in the global market include:

- Aixtron SE

- Applied Materials, Inc.

- ASM International N.V.

- CVD Equipment Corporation

- IHI Corporation

- LPE

- Nuflare Technology Inc.

- OC Oerlikon Management AG

- Plasma-Therm LLC

- RIBER

- TAIYO NIPPON SANSO CORPORATION

- Tokyo Electron Limited

- ULVAC Inc.

- Veeco Instruments Inc.

- Voestalpine AG

Recent Developments in the Industry

- In November 2024, CVD Equipment Corporation received a USD 3.5 million follow-on order for a Chemical Vapor Infiltration (CVI) system. The system, designed for producing advanced, energy-efficient materials, supports aerospace applications, particularly for gas turbine engines, and strengthens CVD's market position.

- In September 2023, a study published in Energy Nexus Journal focused on reviewing the recent developments in the production of vanadium dioxide materials by using chemical vapor deposition technology.

Report Coverage

The chemical vapor deposition market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, category, end-use, technology, and their futuristic growth opportunities.

Chemical Vapor Deposition Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 34.8 billion |

|

Revenue forecast in 2034 |

USD 72.2 billion |

|

CAGR |

8.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Chemical Vapor Deposition Market Size Worth $72.2 Billion By 2034

The top market players in Chemical Vapor Deposition Market are Aixtron SE, Applied Materials, Inc., ASM International N.V., CVD Equipment Corporation,

Asia Pacific is thr region contribute notably towards the Chemical Vapor Deposition Market

Chemical Vapor Deposition Market exhibiting the CAGR of 8.40% during the forecast period.

Chemical Vapor Deposition Market report covering key segments are category, end-use, technology, and region