U.S. Dupixent Market Size, Share, Trends, Industry Analysis Report

By Indication [Atopic Dermatitis (AD), Asthma, Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)], By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6007

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

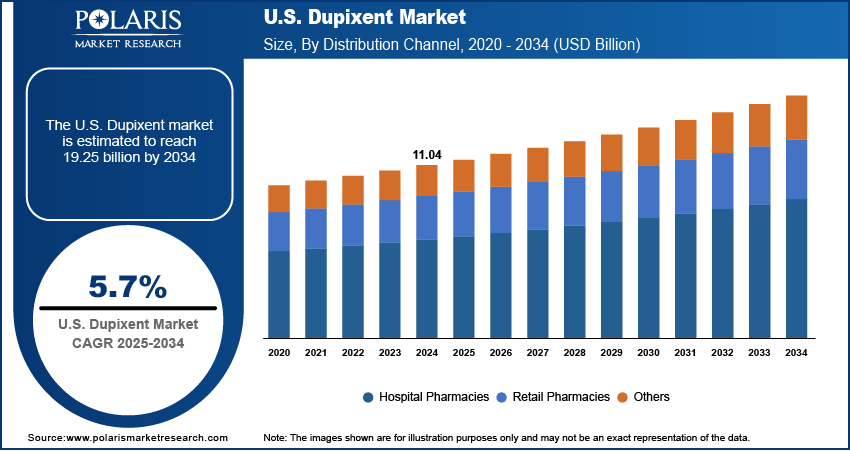

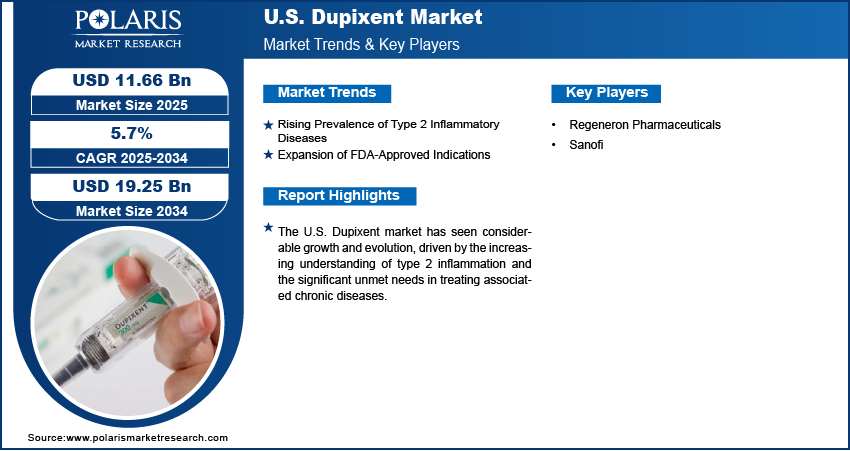

The U.S. Dupixent market size was valued at USD 11.04 billion in 2024 and is anticipated to register a CAGR of 5.7% from 2025 to 2034. The demand for Dupixent is primarily driven by the rising prevalence of type 2 inflammatory diseases and the expansion of FDA-approved indications.

Key Insights

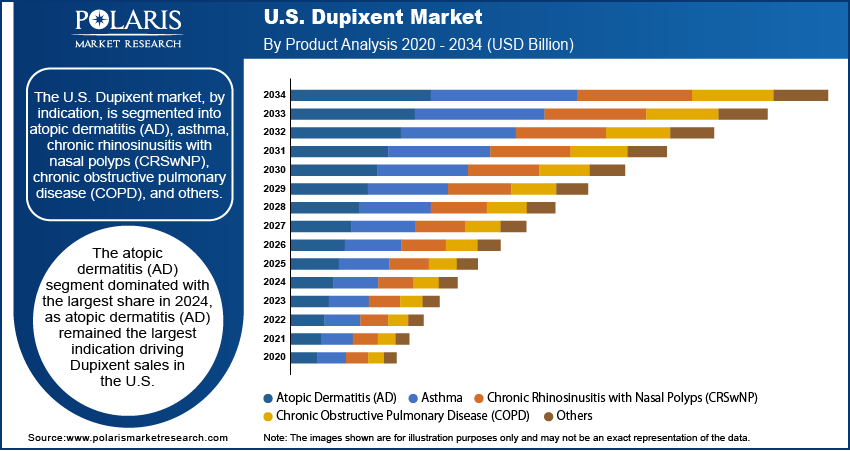

- The atopic dermatitis (AD) segment dominated with the largest share in 2024, as atopic dermatitis (AD) remained the largest indication driving Dupixent sales in the U.S.

- The chronic obstructive pulmonary disease (COPD) segment is anticipated to register the highest growth rate during the forecast period, as the recent FDA approval for treating COPD with type 2 inflammation marks a significant milestone.

- The hospital pharmacies segment held the largest share in 2024, since these facilities typically handle complex or high-cost biologics such as Dupixent, especially for inpatient and specialty outpatient care.

- The retail pharmacies segment is anticipated to register the highest growth rate during the forecast period as more patients transition to long-term, self-administered treatment.

The U.S. Dupixent market includes the development, production, and sale of dupilumab, a biologic medication. It is primarily used to treat inflammatory conditions such as atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyps, eosinophilic esophagitis, and prurigo nodularis. The market also covers the entire ecosystem from pharmaceutical companies to healthcare providers and the patients who receive this therapy.

Coverage approval for Dupixent use by most major U.S. commercial insurers and public programs such as Medicare and Medicaid makes it more accessible to patients. Insurance companies often approve it due to its strong clinical results and ability to reduce hospital visits or complications. Pharmaceutical support programs assist patients with out-of-pocket costs. Easy access through insurance and affordability programs encourages ongoing treatment, helping to maintain consistent demand in the country. High coverage rates also reflect confidence in Dupixent’s value, making it a reliable option in healthcare plans across the country, thereby driving the U.S. Dupixent market growth.

There is a growing shift toward biologic drugs in the U.S., especially in chronic inflammatory disease management. Traditional treatments such as topical steroids or oral immunosuppressants may not be effective long-term or may have side effects. Dupixent, as a targeted biologic therapy, offers a safer and more effective alternative for many patients. It fits well into modern treatment guidelines with a preference for personalized medicine and a push to reduce long-term steroid use. More doctors and healthcare systems are prioritizing advanced therapies such as Dupixent, thereby contributing to the U.S. Dupixent market growth.

Pipeline Analysis

The research and development strategy for Dupixent continues to focus on expanding its label across a range of inflammatory and immune-mediated conditions. Ongoing clinical trials target indications such as chronic prurigo nodularis, chronic obstructive pulmonary disease (COPD) with type 2 inflammation, and chronic sinusitis without nasal polyps. These studies represent an effort to move beyond Dupixent’s established indications in atopic dermatitis, asthma, and eosinophilic esophagitis, thereby widening its therapeutic footprint.

A major development includes late-stage trials in COPD, a significant area of unmet need. Phase 3 trials showed promising results in reducing exacerbations in a subset of COPD patients with high type 2 inflammation, potentially unlocking a large and previously untapped market. Simultaneously, pediatric studies in atopic dermatitis and asthma aim to extend Dupixent's use to younger populations, which could further strengthen its presence in chronic disease management.

Sanofi and Regeneron are investing in exploring Dupixent’s role in the management of rare diseases such as eosinophilic gastritis and food allergies. These efforts diversify the product’s indication base and position Dupixent in the country with limited treatment options and high pricing flexibility. If approved, these new indications could drive long-term revenue growth and delay biosimilar erosion. Real-world data collection and health economic studies continue to reinforce Dupixent’s value proposition, supporting reimbursement and formulary access through 2033.

Market Concentration and Characteristics

Sanofi and Regeneron consistently expand clinical footprint of Dupixent. The successful LIBERTY-CSU CUPID trial and subsequent FDA approval for chronic spontaneous urticaria in 2025 mark a key milestone. Additional studies targeting pediatric populations and rare immunological disorders, such as bullous pemphigoid and eosinophilic gastritis, continue to broaden the eligible patient base. Dupixent’s dual inhibition of IL-4 and IL-13 distinguishes it mechanistically from other biologics in the Type 2 inflammation space. Real-world evidence strengthens its clinical credibility and position. The product's consistent expansion into high-burden, underserved indications supports its therapeutic value and long-term relevance.

High entry barriers define the biologics in which Dupixent competes. Research and development expenditures for monoclonal antibodies often exceed $1–2 billion, discouraging smaller firms from entering. Dupixent production process is complex, as it requires cGMP-compliant facilities, stringent cold-chain logistics, and significant scale. Regulatory requirements add further hurdles, and extensive clinical trials and post-approval surveillance extend time-to-market and increase risk. With patent protection secured until 2033, the threat from biosimilars remains low. In addition, established distribution channels and provider confidence in Dupixent’s efficacy and safety profile reinforce the dominant position of Sanofi and Regeneron.

Regulatory factors play a crucial role in shaping Dupixent’s trajectory. Approvals by the FDA and EMA rely on robust clinical datasets, ensuring safety while delaying time-to-market. The 2024 approval in bullous pemphigoid followed multiple successful trials and post-trial evaluations. Orphan drug designations in rare diseases offer exclusivity extensions and tax credits, making such expansions commercially attractive. Alignment in regulatory pathways and increased reliance on real-world evidence may accelerate approvals and broaden access, especially in emerging areas.

Substitution risk for Dupixent remains low due to its unique mechanism of action and broad indication coverage. Common alternatives such as corticosteroids or topical therapies do not provide systemic control, especially in severe Type 2 inflammatory conditions. Other biologics such as tralokinumab and lebrikizumab target only IL-13 and demonstrate narrower efficacy. In asthma, conventional inhaled therapies are insufficient for patients having persistent eosinophilic inflammation. While bispecific antibodies are under investigation, most remain in early-phase development. Dupixent's robust clinical performance across indications and age groups minimizes the current threat from substitutes.

Industry Dynamics

- The rising prevalence of various type 2 inflammatory diseases is significantly increasing the requirement for effective treatment options such as Dupixent.

- Expansion of FDA-approved indications expands its potential patient base and reach.

- There is a high unmet medical need in severe forms of target diseases, and Dupixent provides a crucial therapeutic option where existing treatments are often insufficient.

- Growing awareness among patients and healthcare professionals, combined with improved diagnostic methods for allergic conditions, leads to earlier and more accurate identification of individuals who could benefit from Dupixent.

Rising Prevalence of Type 2 Inflammatory Diseases: More people, especially children and adults in urban areas, in the U.S. are being diagnosed with chronic conditions such as atopic dermatitis (eczema) and asthma. According to the National Eczema Association, ~16.5 million people suffer from atopic dermatitis in the country. This rise creates a greater need for effective treatments such as Dupixent, which is approved for both conditions. These diseases significantly impact quality of life due to which patients and doctors are seeking long-term therapies that offer symptom control. Dupixent’s ability to reduce inflammation and provide lasting relief makes it a preferred option in treating dermatological and respiratory conditions, thereby driving the U.S. Dupixent market expansion across the U.S.

Expansion of FDA-Approved Indications: Dupixent continues to receive new FDA approvals for additional uses, such as treating eosinophilic esophagitis, prurigo nodularis, and chronic rhinosinusitis with nasal polyps. In June 2025, the FDA approved Dupixent for the treatment of adult patients with bullous pemphigoid (BP). Each new indication opens access to new patient groups and specialist areas, increasing its industry size. The U.S. regulatory environment supports fast-tracking drugs for high unmet medical needs, giving Dupixent a competitive advantage. Physicians become more confident in prescribing it for various conditions as more real-world evidence supports its effectiveness and safety, contributing to wider use and increasing overall sales and presence in the U.S. healthcare sector, thereby driving the growth.

Segmental Insights

Indication Analysis

Based on indication, the U.S. Dupixent market segmentation includes atopic dermatitis (AD), asthma, chronic rhinosinusitis with nasal polyps (CRSwNP), chronic obstructive pulmonary disease (COPD), and others. The atopic dermatitis (AD) segment dominated with the largest share in 2024, as AD remained the largest indication driving Dupixent sales in the U.S. The drug has been widely adopted as a first-line biologic treatment for moderate to severe AD, especially in patients who fail topical therapies. High awareness, proven effectiveness in reducing itching and flare-ups, and pediatric approval further support its demand. Dermatologists prefer Dupixent due to its long-term benefits and manageable safety profile. The increasing diagnoses and chronic nature of AD further drive the segment growth.

The chronic obstructive pulmonary disease (COPD) segment is anticipated to register the highest growth rate during the forecast period as the recent FDA approval for treating COPD with type 2 inflammation marks a significant milestone. This opens a new market with millions of patients in the U.S., especially older adults suffering from severe symptoms. Current treatment options often fail to address underlying inflammation, making Dupixent an attractive alternative. Demand is expected to rise rapidly as awareness among pulmonologists grows and real-world success stories emerge, thereby fueling the segment growth.

Distribution Channel Analysis

Based on distribution channel, the U.S. Dupixent market segmentation includes hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment held the largest share in 2024, as these facilities typically handle complex or high-cost biologics such as Dupixent, especially for inpatient and specialty ambulatory care services. Many patients begin treatment under specialist supervision in hospitals, ensuring proper evaluation and monitoring. Dupixent’s use for conditions such as severe eczema, asthma, and nasal polyps often involves multidisciplinary care, making hospitals a key access point. Hospitals further benefit from established reimbursement pathways and stock management for biologics, thereby propelling the growth.

The retail pharmacies segment is anticipated to register the highest growth rate during the forecast period as more patients transition to long-term, self-administered treatment. Patients increasingly prefer picking up prescriptions from local pharmacies with subcutaneous injections available for at-home use. This shift is supported by expanding insurance coverage, easier access to biologics in retail settings, and improved storage logistics. The patient familiarity with Dupixent is growing, and use across indications such as AD, asthma, and soon COPD is rising, thereby boosting the segment growth.

Key Players and Competitive Insights

Sanofi and Regeneron lead the U.S. Dupixent market through a strategic partnership that drives clinical development and expansion. Their collaborative efforts focus on expanding indications, with recent FDA approvals for bullous pemphigoid and chronic spontaneous urticaria in 2025, supported by trials such as LIBERTY-CSU CUPID. Investments in real-world evidence and pediatric formulations enhance Dupixent’s penetration across the country. Patient access programs and flexible pricing strategies address cost barriers in areas with low insurance coverage. The partnership’s robust distribution networks and regulatory expertise ensure rapid access, positioning Dupixent as a leader in interleukin inhibitors.

Key Players

Industry Developments

June 2025: The U.S. Food and Drug Administration (FDA) approved Dupixent for the treatment of adult patients suffering from bullous pemphigoid, making it the only targeted medicine for this condition.

February 2025: Sanofi and Regeneron announced that the FDA had accepted a supplemental Biologics License Application (sBLA) for Dupixent in the treatment of bullous pemphigoid under priority review, expediting the approval process. The submission was supported by Phase 3 trial data demonstrating notable improvements in disease management, further strengthening Dupixent’s regulatory trajectory.

U.S. Dupixent Market Segmentation

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Atopic Dermatitis (AD)

- Asthma

- Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)

- Chronic Obstructive Pulmonary Disease (COPD)

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Others

U.S. Dupixent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.04 billion |

|

Market Size in 2025 |

USD 11.66 billion |

|

Revenue Forecast by 2034 |

USD 19.25 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 11.04 billion in 2024 and is projected to grow to USD 19.25 billion by 2034.

The market is projected to register a CAGR of 5.7% during the forecast period.

Key players in the market include Sanofi and Regeneron Pharmaceuticals.

The atopic dermatitis (AD) segment accounted for the largest share of the market in 2024.

The retail pharmacies segment is expected to witness the fastest growth during the forecast period.