Animal Wound Care Market Size, Share, Trends, Industry Analysis Report

By Animal Type (Companion Animal, Livestock Animal), By Product, By End Use, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6011

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

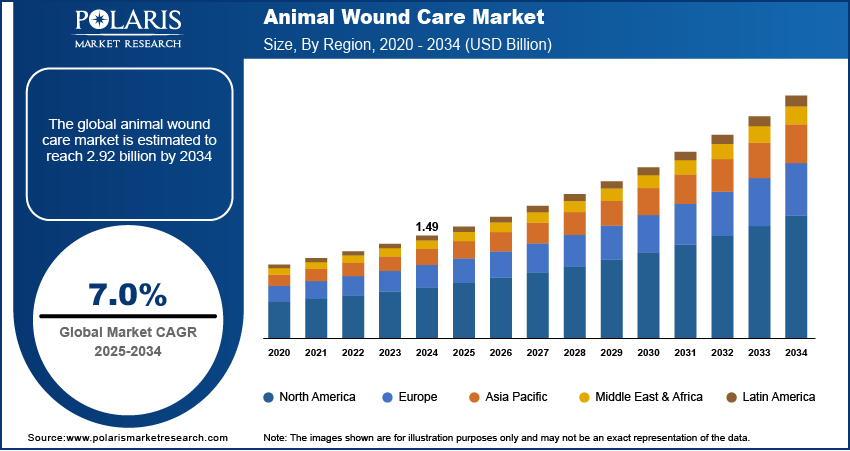

The global animal wound care market size was valued at USD 1.49 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The industry is mainly driven by an increase in pet ownership and growing awareness of animal health. Also, advancements in veterinary medicine and a rise in animal healthcare spending contribute to its expansion.

Key Insights

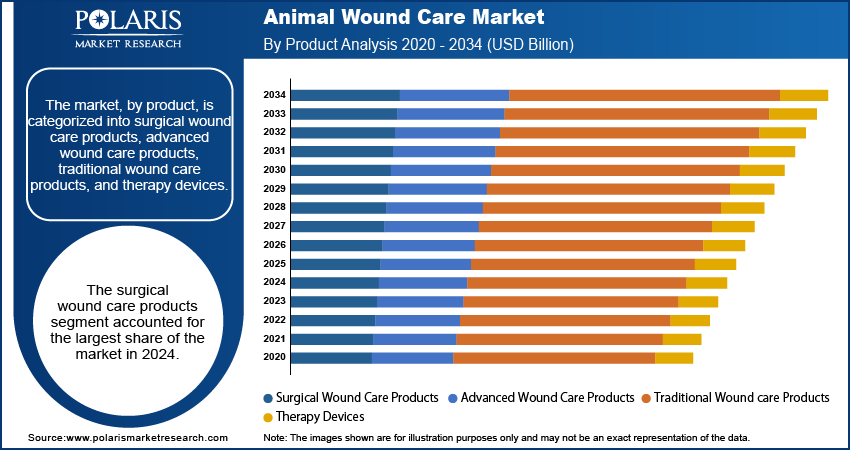

- By product, the surgical wound care products segment held the largest share in 2024 due to its essential role in almost all veterinary surgical procedures, including sutures, staples, and tissue adhesives vital for incision closure and promoting proper healing.

- By animal type, the companion animal segment held the largest share in 2024 as pets are increasingly viewed as integral family members, leading owners to prioritize their health and invest more in specialized veterinary care for injuries and ailments.

- By end use, the veterinary hospitals/clinics segment held the largest share in 2024 due to their critical function in providing comprehensive and professional animal healthcare.

- By distribution channel, the veterinary hospitals/clinics segment held the largest share in 2024, as veterinarians within these settings have direct influence over product selection, often preferring to stock and utilize trusted products for immediate application during treatments and procedures.

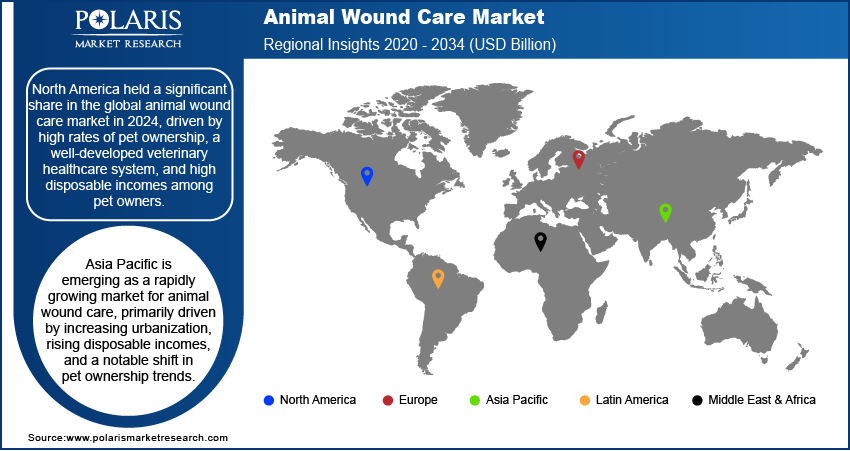

- By region, North America held the largest share in 2024, driven by the high rates of pet ownership, a well-developed veterinary healthcare system, and high disposable incomes among pet owners.

The animal wound care industry focuses on products and services used to treat and manage wounds in pets and other animals. This involves items such as wound cleanser products, bandages, dressings, antiseptics, and other medical supplies specifically designed for veterinary use to help injured animals heal and recover.

The rising incidence of chronic health conditions and various types of injuries in both companion and livestock animals is a significant driver. Similar to humans, animals are living longer due to improved nutrition and veterinary care, which unfortunately also increases their susceptibility to age-related diseases, diabetes, and other chronic ailments that can lead to non-healing wounds or require ongoing wound management. Additionally, a wide range of injuries, from accidental trauma in pets to lameness and other production-related injuries in livestock, consistently create a need for effective wound care solutions.

There is a steadily growing global awareness among pet owners, farmers, and the general public regarding animal health and welfare, which acts as a powerful driver. This rising awareness extends beyond basic care to include a deeper understanding of proper wound management, infection prevention, and the overall well-being of animals. Pet owners, viewing their animals as family, are more proactive in seeking veterinary attention for even minor injuries and are well-informed about the benefits of advanced wound care products.

Industry Dynamics

- As more people adopt pets and consider them family, there is a greater willingness to spend on their health, boosting demand for effective wound care.

- Animals are experiencing more long-term health issues and various injuries, leading to a consistent need for specialized wound management products and services.

- Ongoing innovations in surgical techniques and the development of new, more effective wound care products are improving treatment outcomes and increasing demand.

Rising Pet Ownership and Human-Animal Bond: The increasing number of people owning pets and the deeper bond shared between humans and their animal companions are significant factors boosting the demand. Pets are increasingly seen as integral family members, leading owners to prioritize their health and invest more in their care, including specialized treatments for injuries. This shift in perception means that pet owners are more likely to seek advanced medical attention and incur higher costs for their pets' well-being, directly influencing the demand for effective wound management solutions and companion animal vaccines.

The American Pet Products Association's (APPA) 2023–2024 National Pet Owners Survey found that nearly 66% of households (i.e., ~86.9 million families) in the U.S. owned a pet, a notable increase from previous years. This growing pet population naturally leads to a higher incidence of various injuries and conditions requiring wound care, thus driving the demand for animal wound care.

Advancements in Veterinary Surgical Procedures and Wound Care Products: Continuous innovation in veterinary surgical techniques and the development of more advanced wound care products are playing a crucial role in the expansion. Modern veterinary medicine offers sophisticated surgical options that were not available before, leading to better outcomes for animals undergoing procedures. Alongside this, new types of dressings, antiseptics, and healing aids contribute to faster and more effective recovery from wounds, both surgical and accidental.

A special issue of the journal Animals, published in June 2025, titled "Advancements in Veterinary Laparoscopic Surgery: Techniques, Applications, and Outcomes," highlights the ongoing progress in minimally invasive surgical techniques for animals. These advancements often result in smaller incisions, reduced pain, and quicker healing times, which boosts the demand for specialized and high-quality wound care products to support these improved surgical outcomes. This constant development in treatment options helps propel the growth.

Segmental Insights

Product Analysis

Based on product, the segmentation includes surgical wound care products, advanced wound care products, traditional wound care products, and therapy devices. The surgical wound care products segment held the largest share in 2024, due to the fundamental role of these products in almost all veterinary surgical procedures. When animals undergo surgeries, whether for spaying, neutering, orthopedic repairs, or tumor removals, surgical wound care items are essential for ensuring a successful outcome. This category primarily includes sutures, staples, and tissue adhesives, which are vital for closing incisions and promoting proper healing. The increasing number of veterinary surgeries performed globally, driven by rising pet ownership and advancements in complex surgical techniques, directly fuels the demand for these products.

The therapy devices segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is a result of continuous technological advancements and the introduction of innovative treatment modalities that enhance wound healing. Therapy devices include a range of tools such as negative pressure wound therapy (NPWT) systems, laser therapy devices, and ultrasound therapy equipment. These technologies offer noninvasive or minimally invasive approaches to manage complex and chronic wounds, often leading to faster healing times and better outcomes for animals. The growing awareness among veterinarians and pet owners about the benefits of these advanced therapies, coupled with their increasing adoption in veterinary clinics and hospitals, is a key factor behind this segment's strong growth trajectory.

Animal Type Analysis

Based on animal type, the segmentation includes companion animal and livestock animal. The companion animal segment held a larger share in 2024, primarily due to the deeply ingrained human-animal bond, where pets are increasingly viewed as family members. This emotional connection motivates owners to spend more on their pets' health and well-being, including seeking specialized veterinary care for injuries and ailments. The sheer global population of companion animals, coupled with the rising incidence of various injuries, chronic conditions, and the growing number of elective and emergency surgeries performed on them, creates a consistent and high demand for wound care products and services.

The livestock animal segment is anticipated to register the highest growth rate during the forecast period. This increasing momentum is driven by several factors, including the rising global demand for meat, dairy, and other animal products, which leads to larger livestock populations. As the number of animals raised for production grows, so does the potential for injuries resulting from farm accidents, animal interactions, or necessary medical procedures. There is also a growing emphasis on animal welfare and productivity in the livestock industry. Healthy animals are more productive, and effective wound care helps prevent economic losses due to illness, reduced growth, or mortality.

End Use Analysis

Based on end use, the segmentation includes veterinary hospitals/clinics, homecare, and research institutes. The veterinary hospitals/clinics segment held the largest share in 2024. These facilities are equipped with specialized infrastructure, diagnostic tools, and skilled veterinary professionals necessary for advanced wound management. They serve as primary points of contact for pet owners seeking treatment for various animal injuries, post-surgical care, and chronic conditions. The high volume of surgical procedures performed in these settings, ranging from routine to complex, necessitates a consistent demand for a wide array of wound care products. Additionally, the ability of veterinary hospitals and clinics to offer immediate and intensive care for emergency cases solidifies their leading position.

The homecare segment is anticipated to register the highest growth rate during the forecast period, driven by a growing preference among pet owners for convenient and often more affordable at-home treatment options. This trend is fueled by the increasing availability of user-friendly wound care products designed for home use, allowing pet parents to manage minor injuries, change dressings, and provide ongoing care for their animals outside of a clinical setting. The rising cost of frequent veterinary visits also plays a role, making homecare an attractive alternative for routine wound maintenance. Furthermore, advancements in telemedicine and remote veterinary consultations are empowering pet owners to receive professional guidance and support for wound management from the comfort of their homes.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes retail, e-commerce, and veterinary hospitals/clinics. The veterinary hospitals/clinics segment held the largest share in 2024, owing to their central role as primary care providers for animals suffering from injuries, requiring surgery, or managing chronic wounds. Veterinarians within these settings have direct influence over product selection, often preferring to stock and utilize products that they trust and are readily available for immediate application during examinations, treatments, and surgical procedures. The need for precise product application, coupled with the critical nature of many animal wounds, means that professional oversight and in-clinic availability are paramount.

The e-commerce segment is anticipated to register the highest growth rate during the forecast period. This surge is driven by increasing internet penetration, the convenience of online shopping, and a wider availability of diverse wound care products through digital platforms. Pet owners are increasingly turning to online retailers to purchase both prescription and over-the-counter wound care items for their animals, often benefiting from competitive pricing and direct-to-door delivery. The ability to compare products, read reviews, and access a broader selection than typically found in physical stores contributes to this segment’s rapid expansion.

Regional Analysis

The North America animal wound care market accounted for the largest share in 2024, largely driven by high rates of pet ownership and a well-developed veterinary healthcare system. The strong human-animal bond in countries across the region means that pet owners are increasingly willing to invest in advanced medical treatments for their companion animals, including sophisticated wound care solutions. This region also benefits from a high disposable income among pet owners, enabling them to afford more specialized and sometimes costly veterinary procedures and follow-up care. The presence of numerous veterinary hospitals, clinics, and research institutes, coupled with continuous advancements in veterinary medicine and product development, further contributes to the robust demand for animal wound care products.

U.S. Animal Wound Care Market Insights

In North America, the U.S. is a dominant force as the country has a vast pet population, with a significant portion of households owning at least one pet, which naturally increases the likelihood of injuries and the need for medical intervention. There is a strong culture of pet humanization, where pets are considered integral family members, leading to substantial spending on their health and wellness. This includes a high willingness to pay for veterinary services, often supported by growing pet insurance penetration. The U.S. also boasts a leading-edge veterinary infrastructure, with access to advanced technologies and skilled professionals, ensuring that a wide range of wound care products, from basic dressings to complex therapy devices, are readily adopted and utilized.

Europe Animal Wound Care Market Trends

Europe represents a substantial share in the global market, characterized by a high awareness of animal welfare and a well-established veterinary sector. The region has a large population of companion animals, and owners are increasingly prioritizing their pets' health, leading to a steady demand for various wound care solutions. Furthermore, the European Union's strict regulations concerning animal health and safety standards contribute to the adoption of high-quality and effective wound care products. The dynamics are also influenced by the prevalence of certain animal diseases and a focus on maintaining the health and productivity of livestock, which necessitates robust wound management strategies across the region.

The Germany animal wound care market is a major country in Europe. The country benefits from a strong economy, allowing for considerable expenditure on animal healthcare. German pet owners are generally well-informed and dedicated to their pets' well-being, driving demand for innovative wound care products and advanced veterinary services. The presence of reputable veterinary research institutions and a proactive approach to adopting new medical technologies further boost the industry in Germany. Additionally, the country's emphasis on livestock health and food safety standards creates a consistent need for effective wound care solutions in the agricultural sector.

Asia Pacific Animal Wound Care Market Overview

Asia Pacific is emerging as a rapidly growing market for animal wound care, primarily driven by increasing urbanization, rising disposable incomes, and a notable shift in pet ownership trends. As economic conditions improve in many countries within this region, more households are adopting pets, and there is a growing recognition of the importance of animal health. This leads to increased spending on veterinary care, including treatments for various types of animal wounds. Furthermore, the expansion of veterinary infrastructure and the increasing availability of advanced wound care products contribute to the upward trajectory.

China Animal Wound Care Market Outlook

China stands out as a key contributor to the Asia Pacific market. The country has witnessed a remarkable surge in pet ownership in recent years, particularly in urban areas, driven by changing lifestyles and a growing desire for companionship. This increase in the pet population translates directly into a higher demand for veterinary services, including comprehensive wound care for common injuries, surgical procedures, and chronic conditions. Coupled with ongoing developments in local veterinary expertise and a rising awareness among pet owners about animal welfare, China is playing a pivotal role in shaping the demand trends for animal wound care in Asia Pacific.

Key Players and Competitive Insights

The field of animal wound care features a competitive landscape with several established players and emerging companies striving for innovation. These companies aim to offer a wide range of products, from traditional dressings to advanced therapy devices, catering to both companion and livestock animals. Key strategies include product development, strategic partnerships, and expanding distribution networks to reach a broader customer base of veterinarians and pet owners. The focus is on developing solutions that improve healing outcomes, reduce recovery times, and prevent infections in animals, reflecting the increasing demand for effective and convenient animal healthcare.

A few prominent companies in the industry include 3M Company, Medtronic PLC, B. Braun Melsungen AG, Virbac, Neogen Corporation, Jorgen Kruuse A/S, Sonoma Pharmaceuticals, Inc., and Advancis Veterinary Ltd.

Key Players

- 3M Company

- Advancis Veterinary Ltd.

- B. Braun Melsungen AG

- Elanco Animal Health

- Ethicon, Inc. (Johnson & Johnson)

- Jorgen Kruuse A/S (KRUUSE)

- KeriCure Inc.

- Medtronic PLC

- Neogen Corporation

- Sentrx Animal Care

- Sonoma Pharmaceuticals, Inc.

- Virbac

Industry Developments

April 2025: Virbac announced that it has licensed novel therapeutic antibodies from MabGenesis for canine diseases.

October 2024: Sonoma Pharmaceuticals announced an expanded partnership with a global healthcare distributor for the distribution of its wound care products in Canada.

Animal Wound Care Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Surgical Wound Care Products

- Advanced Wound Care Products

- Traditional Wound Care Products

- Therapy Devices

By Animal Type Outlook (Revenue – USD Billion, 2020–2034)

- Companion Animal

- Livestock Animal

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Veterinary Hospitals/Clinics

- Homecare

- Research Institutes

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Retail

- E-commerce

- Veterinary Hospitals/Clinics

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Animal Wound Care Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.49 billion |

|

Market Size in 2025 |

USD 1.59 billion |

|

Revenue Forecast by 2034 |

USD 2.92 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.49 billion in 2024 and is projected to grow to USD 2.92 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

North America dominated the share in 2024.

A few key players in the market include 3M Company, Medtronic PLC, B. Braun Melsungen AG, Virbac, Neogen Corporation, Jorgen Kruuse A/S, Sonoma Pharmaceuticals, Inc., and Advancis Veterinary Ltd.

The surgical wound care products segment accounted for the largest share of the market in 2024.

The companion animal segment is expected to witness the fastest growth during the forecast period.