Wound Cleanser Products Market Share, Size, Trends, Industry Analysis Report

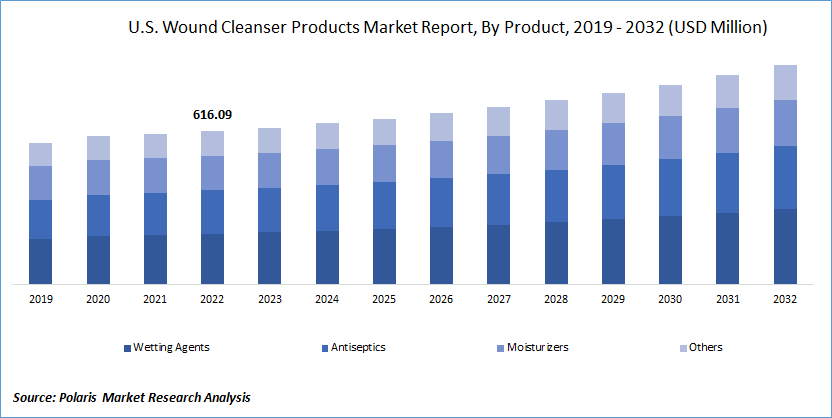

By Product Type (Wetting Agents, Antiseptics, Moisturizers, Others); By Foam Type; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 117

- Format: PDF

- Report ID: PM2739

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global wound cleanser products market was valued at USD 2,049.85 million in 2022 and is expected to grow at a CAGR of 3.9% during the forecast period. The wound cleanser product market stands at the forefront of healthcare, catering to a wide spectrum of needs in wound care management. This market, propelled by advancements in medical technology and a growing emphasis on efficient wound healing, has witnessed significant expansion in recent years. Its remarkable growth can be attributed to several driving factors, making it a vital segment within the healthcare industry.

To Understand More About this Research: Request a Free Sample Report

At its core, the wound cleanser product market addresses the critical need for effective wound cleansing, an essential step in the wound care continuum. Wound cleansers serve a diverse range of end-users, from hospitals and clinics to home healthcare settings, ensuring that wounds are thoroughly cleaned to prevent infections and promote healing. The market’s growth is growing by the rising incidence of chronic diseases, such as diabetes and obesity, leading to an increase in wounds that require specialized care. For instance, according to CDC, 37.3 million US individuals have diabetes; 28.7 million diagnosed, 8.5 million undiagnosed, and 96 million have prediabetes.

Additionally, an aging global population has contributed to a surge in the prevalence of wounds, further fueling the demand for advanced wound cleansing solutions. Moreover, the market has been driven by an increased awareness among both healthcare professionals and patients regarding the importance of proper wound care, leading to the adoption of specialized wound cleanser products.

Technological advancements have played a pivotal role in shaping the market landscape. Innovations in wound cleanser formulations, such as incorporating antimicrobial agents and enzymes for efficient debridement, have enhanced the efficacy of these products. Moreover, the development of eco-friendly wound cleansers aligning with sustainable practices has resonated well with environmentally conscious consumers, fostering a positive market outlook.

The COVID-19 pandemic has significantly impacted the wound cleanser product market, ushering in both challenges and opportunities for this niche within the broader healthcare industry. Wound cleansers, which are essential in wound care management, experienced several notable shifts in demand, supply, and innovation during the pandemic.

One of the most prominent impacts of COVID-19 on the wound cleanser product market was the increased demand for these products. With hospitals and healthcare facilities stretched thin by the surge in COVID-19 cases, the importance of effective wound care became more apparent than ever. Patients with wounds, whether due to infection, surgery, or other reasons, required meticulous attention to prevent complications and infections.

Consequently, the demand for wound cleansers surged as healthcare providers sought to maintain high standards of hygiene and wound care.

Industry Dynamics

Growth Drivers

Rise in ambulatory surgical centers (ASCs)

The rise in ambulatory surgical centers (ASCs) has significantly impacted the wound cleanser products market, leading to an upsurge in demand and subsequently shaping the industry landscape. Ambulatory surgical centers have gained prominence in recent years due to their cost-effectiveness, convenience, and efficiency. For instance, data from Advancing Surgical Care as of March 2021 indicates that there are approximately 6,023 ASCs in the United States. This increasing prevalence of ASCs is anticipated to drive market growth significantly throughout the forecast period.

Patients prefer ASCs for minor surgical procedures and treatments as they offer same-day discharge, reducing the need for overnight hospital stays. This shift in healthcare delivery has created a substantial market for wound cleanser products, as these centers often require efficient and high-quality wound care products to maintain patient safety and prevent infections.

One of the driving factors behind the increased demand for wound cleanser products in ASCs is the growing emphasis on infection control and prevention. Healthcare providers and regulatory bodies have placed a significant focus on reducing hospital-acquired infections (HAIs), making it imperative for ASCs to adhere to stringent infection prevention protocols. Wound cleanser products play a crucial role in this context, ensuring that wounds are thoroughly cleaned and disinfected, minimizing the risk of infections.

Moreover, advancements in wound care technology have led to the development of innovative and efficient wound cleanser products. Manufacturers are investing in research and development to create products that promote faster healing, reduce pain, and are easy to use. For instance, In April 2021, Nanomedic Technologies Ltd., a biomedical therapeutics company, introduced an innovative method for wound care and treatment. This approach has a substantial effect on factors such as cutting force, material flow, tool performance, and the distribution of cutting temperatures. These innovations have not only enhanced the efficacy of wound cleansers but have also widened the product offerings available to ASCs, allowing them to choose products tailored to specific patient needs and wound types.

Report Segmentation

The market is primarily segmented based on product type, foam type, end-use and region.

|

By Product Type |

By Foam Type |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type

The wetting agents segment dominate the market during forecast period

The wetting agents accounted for 33.28% of market share in the wound cleanser products market for 2022. Wetting agents play a crucial role in wound cleanser products due to the increasing number of traumatic accidents like assaults and crush injuries. Wetting agents, also known as surfactants, help reduce the surface tension of liquids, allowing them to spread more evenly across a wound surface. This property facilitates better cleansing by ensuring that the wound's entire surface is exposed to the cleanser. It is essential for removing debris, bacteria, and other contaminants from the wound.

It is used in the removal of dead tissue, slough, and foreign materials from wounds. They assist in loosening and detaching these substances from the wound bed, making it easier for healthcare providers to perform wound debridement when necessary. Effective wound cleaning without causing additional trauma to the wound is vital for the healing process. By providing a clean and moist wound environment, wound cleansers with wetting agents can support the natural wound-healing process. They help create an optimal environment for cellular proliferation and tissue repair.

Wetting agents like saline wound treatments and sterile, drinkable water reduce infection risks and promote rapid healing. In May 2023, NovaBay Pharmaceuticals, Inc. announced that China Pharma Holdings, Limited had begun a $1 million purchase of NovaBay's NeutroPhase Wound and Skin Cleanser. NeutroPhase, developed by NovaBay, is an FDA-cleared, 510(k) proprietary skin and wound cleanser containing pure hypochlorous acid in saline solution.

Ongoing research and development in wound care led to the creation of advanced wound cleanser products with novel wetting agents, further expanding their scope and capabilities in the market.

By Foam Type

The wipes segment witness fastest growth during the forecast period

The wipes segment witness fastest growth during the forecast period with a CAGR of 4.3%. The wipes in the wound cleanser market, including their effectiveness in wound care, convenience, and specific applications, drive the demand. Wipes are a preferred choice for wound cleansing due to their effectiveness in removing debris, exudate, and contaminants from wounds. They offer a gentle yet thorough cleansing action that promotes a clean wound bed, which is essential for optimal wound healing.

Wound care professionals often opt for wipes because they are easy to use and dispose of. The single-use nature of wipes reduces the risk of cross-contamination and ensures that each application is sterile and hygienic. Wipes provide a controlled and targeted approach to wound cleansing. Healthcare providers can precisely clean the wound area without excessive moisture or wastage, making them suitable for various wound types.

The high demand for effective wipes in wound cleansing products boosts manufacturers to innovate and launch different types of wipes tailored to specific wound care needs.

For instance, in November 2021, Sanara MedTech Inc. revealed the launch of FORTIFY TRG, FORTIFY FLOWABLE extracellular matrix, and a tissue repair graft designed for the treatment of chronic wounds. These chronic wounds include venous ulcers, chronic vascular ulcers, pressure ulcers, diabetic ulcers, and various other types of ulcers. FORTIFY TRG Tissue Repair Graft and FORTIFY FLOWABLE extracellular matrix are used in conjunction with wipes. Such innovation fuels the market growth.

By Regional Analysis

The demand in North America is expected to witness significant growth during forecast period

The rising prevalence of surgical wounds, as well as chronic wounds and fatal injuries in North America, dominate the wound cleanser products market with the total market share of 41.20% in 2022. Combined with these factors, the growing number of surgeries, rising healthcare expenditure, and growth in disposable income have led to growth in the global wound cleanser products market in this particular region.

North America, distinctly the United States and Canada, is a contributor to the global supply of wound cleanser products, owing to improved medical infrastructure and the general surge in population. The demand for wound care products not only delivers domestic but also plays a crucial role in meeting global scale. The concern for acute and chronic wounds is surging rapidly in North America as the aging population and the occurrence of obesity and diabetes rise. For instance, 37.3 million people in the U.S. population have been diagnosed with diabetes, and 8.5 million individuals who have diabetes haven't been analyzed yet. About 1.4 million people are diagnosed with diabetes every year.

The rising number of accidents and the attainability of skilled doctors are the factors presumed to drive the demand for wound cleanser products in the region. For instance, as per the report of the Insurance Institute for Highway Safety, 39508 accidents occurred in 2021, in which 42939 people have lost their lives. It caused 12.9 deaths by 100,000 people and 1.37 deaths by 100 million miles traveled.

Moreover, healthcare professionals and patients are becoming further aware of the demand for good wound care to remove bacteria, debris, and necrotic tissues from the wound and speedy recovery. It embraces the use of special wound cleaners. In cases of complex, infected, or non-healing wounds, healthcare providers in the region may consult with wound care specialists, such as wound care nurses or dermatologists, to ensure optimal wound management.

There were numerous companies present in North America that offer wound cleanser products. 3M Healthcare (The company offers an extensive range of inventive products that were specifically designed to meet the needs of patient's healthcare professionals, counting tapes, bandages, dressings, and wound therapy devices). Smith & Nephew (The company provides progressive wound management products and sells their products in over 100 countries. Ethicon, Inc. (The company has a sturdy presence in the wound care market with a reach of products and solutions specifically designed to assist healthcare professionals in delivering effective wound care.

Competitive Insight

The Wound Cleanser Products market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- 3M

- Anacapa Ltd. Technologies, Inc.

- Angelini Pharma

- B. Braun Melsungen AG

- Bionix, LLC

- Centruy Pharmaceuticals

- Coloplast Ltd

- Cramer Sports Medicine

- DermaRite Industries, LLC

- Hollister Incorporated

- Johnson & Johnson Services, Inc

- Medline Industries

- Mölnlycke Health Care AB

- NovaBay Pharmaceuticals, Inc.

- Sanara MedTech Inc.

Recent Developments

- In April 2023, Sanara MedTech Inc. announced that Biasurge advanced surgical solution, a proprietary composition leveraging its Biakos technology, has received 510(k) clearance. Biasurge was created to clean and remove material from wounds, including bacteria, mechanically.

- In November 2022, Infusystem Holdings, Inc. and Sanara MedTech, Inc. have partnered in November 2022 with the goal of providing a comprehensive wound care solution aimed at improving patient outcomes, lowering healthcare costs, and increasing patient and provider satisfaction. The collaboration is expected to enable Infusystem to provide innovative products, such as the unfavorable pressure wound therapy devices and supplies from Cork Medical LLC and the progressive wound care product line from Sanara, to recent clients through the collectively controlled company.

Wound Cleanser Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,099.04 million |

|

Revenue Forecast in 2032 |

USD 2,949.79 million |

|

CAGR |

3.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product Type, By Foam Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Wound Cleanser Products market size is expected to reach USD 2,949.79 million by 2032

Key players in the market are NovaBay Pharmaceuticals, Inc., Bionix, LLC, Centruy Pharmaceuticals, Anacapa Ltd.

North America contribute notably towards the global wound cleanser products market.

The global wound cleanser products market is expected to grow at a CAGR of 3.9% during the forecast period.

The wound cleanser products market report covering key segments are product type, foam type, end-use and region.