U.S. Jewelry Market Size, Share, Trend, Industry Analysis Report

By Product (Necklace, Ring, Earrings, Bracelet, Others), By Type, By Category, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6008

- Base Year: 2024

- Historical Data: 2020-2023

Overview

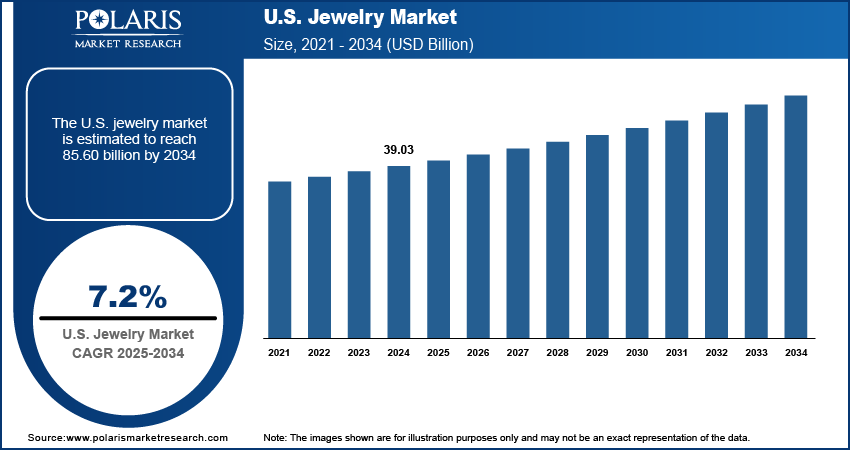

The U.S. jewelry market size was valued at USD 39.03 billion in 2024, growing at a CAGR of 7.2% from 2025 to 2034. Consumers are increasingly seeking custom-made jewelry that reflects personal style, milestones, or sentiments. Demand for engraved, birthstone, and made-to-order pieces has grown, especially among millennials and Gen Z, encouraging brands to expand customization options through online platforms and in-store digital tools.

Key Insights

- The ring segment held ~39% of the revenue share in 2024.

- The necklace segment is projected to witness the highest CAGR of 8.0% from 2025 to 2034.

- The gold segment accounted for ~48% of the revenue share in 2024.

- The platinum segment is projected to register a CAGR of 7.5% from 2025 to 2034.

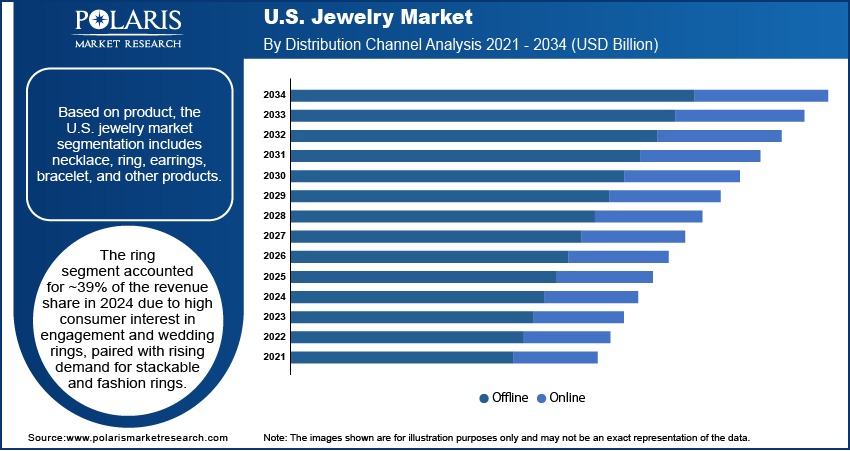

- The offline segment accounted for ~72% of the revenue share in 2024.

- The online segment is projected to witness a significant CAGR of 7.8% during the forecast period.

The U.S. jewelry market encompasses the design, production, and sale of ornaments made from precious metals, gemstones, and other materials. It includes categories such as fine jewelry, costume jewelry, and custom pieces, serving personal, cultural, and investment purposes. Lab-grown diamonds are gaining popularity due to their ethical sourcing, lower environmental impact, and affordability. Consumers are embracing them for engagement rings and fashion jewelry, prompting jewelers to add lab-grown options to their collections and educate buyers about their quality and authenticity.

In the U.S. jewelry market, digital platforms are expanding access to brands and personalized jewelry. High-impact campaigns by influencers and celebrities are shaping consumer choices. Instagram, Pinterest, and TikTok are particularly effective in promoting new collections and seasonal trends. Moreover, jewelry is no longer seen only as a gift; more women are purchasing pieces for themselves as symbols of success or self-expression. This shift in buying behavior supports the sale of fashion-forward and contemporary designs, particularly in urban markets with higher disposable incomes.

Industry Dynamics

- Jewelry brands in the U.S. jewelry market are increasingly exploring non-traditional materials to create collections that appeal to modern consumers.

- Online shopping has transformed the jewelry buying experience in the U.S., making it more convenient and accessible.

- Growing demand for lab-grown diamonds and sustainable jewelry opens new revenue streams for U.S. brands targeting eco-conscious consumers.

- Rising raw material costs and supply chain disruptions impact pricing stability and profit margins for jewelry retailers across the U.S.

Innovation in Materials and Design: Jewelry brands in the U.S. are increasingly exploring non-traditional materials to create collections that appeal to modern consumers. Materials such as ceramic, enamel, titanium, and mixed metals are being used to design pieces that are lightweight, durable, and visually distinct. These materials offer creative freedom to introduce new textures, finishes, and colors that stand out from conventional gold or silver jewelry. Brands are also focusing on modular and convertible designs, allowing a single piece to be worn in multiple ways. This versatility aligns well with consumer preferences for practical fashion that fits both casual and formal wear. Such design innovation increases value for money and also encourages more frequent purchases among style-conscious buyers looking for fresh, everyday options.

E-commerce and Omnichannel Expansion: Online shopping has transformed the jewelry buying experience in the U.S., making it more convenient and accessible. Virtual try-on tools, detailed 360-degree product views, and interactive interfaces help buyers make informed decisions from the comfort of home. In 2024, Blue Nile, an online jewelry retailer in the U.S., reported a 23% increase in online sales compared to the previous year, attributing the growth to enhanced digital tools such as AI-powered virtual try-ons, real-time video consultations, and customizable engagement ring builder features. Moreover, e-commerce platforms are offering tailored suggestions, easy customization, and flexible payment options to attract a broader customer base. Retailers are also blending digital and in-store experiences through click-and-collect, video consultations, and in-store returns for online purchases. This omnichannel model ensures consistent service, wider product access, and a seamless transition between online and physical retail. The approach enhances consumer confidence, particularly for higher-value items, and supports sustained growth in a competitive and evolving retail environment.

Segmental Insights

Product Analysis

Based on product, the U.S. jewelry market segmentation includes necklace, ring, earrings, bracelet, and other products. The ring segment accounted for ~39% of the revenue share in 2024, as high consumer interest in engagement and wedding rings, paired with rising demand for stackable and fashion rings, has fueled strong sales. Rings are often the first choice for commemorating life events, which keeps them in constant demand. Jewelers are offering extensive customization options, such as engravings and bespoke stone settings, which further elevate the appeal of this segment. Marketing campaigns focused on love, commitment, and individuality have helped maintain strong consumer engagement and supported repeat purchases across various age groups.

The necklace segment is projected to witness the highest CAGR of 8.0% from 2025 to 2034 due to its increasing popularity across casual and formal wear. Consumers are gravitating toward minimalist, layered, and pendant-style necklaces that blend fashion and function. Younger buyers are especially drawn to versatile pieces that complements a range of outfits. Retailers are also tapping into seasonal collections and gifting occasions such as birthdays and graduations to promote necklace sales. High visibility in digital fashion content and celebrity endorsements have helped accelerate trends in this category. Frequent design innovation and broader pricing options are keeping this segment dynamic.

Type Analysis

In terms of type, the U.S. jewelry market segmentation includes silver, gold, platinum, diamond, and others. The gold segment accounted for ~48% of the revenue share in 2024. The segment continues to benefit from cultural associations with status, wealth, and timeless beauty. Gold’s inherent value also makes it a preferred option for investment-oriented buyers. Jewelers are introducing lightweight designs to appeal to everyday users while retaining the luxury factor. Consumer trust in gold purity and hallmarking practices has improved with better awareness and retail transparency. Demand is further supported by a wide product variety ranging from classic bridal jewelry to modern, fashion-forward creations.

The platinum segment is projected to register a CAGR of 7.5% from 2025 to 2034 due to its reputation for purity, strength, and understated elegance. The metal’s naturally white sheen and hypoallergenic properties make it an attractive choice, especially for bridal and luxury pieces. Consumer interest in exclusive and durable jewelry is driving more purchases of platinum rings and bands. Retailers are expanding their platinum collections to cater to high-income groups and professionals seeking long-lasting pieces with refined aesthetics. Marketing campaigns highlighting rarity and craftsmanship are also supporting its appeal. The segment’s growth is closely linked to lifestyle upgrades and premiumization trends.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes offline and online. The offline segment accounted for ~72% of the revenue share in 2024. Many consumers prefer offline stores for high-value purchases where they can see, feel, and try on the jewelry before buying. Brick-and-mortar stores offer personalized service, certification assurance, and custom fitting, which remain important in the buying decision. Showrooms are increasingly using digital displays and real-time customization tools to enhance the in-store experience. The tactile and emotional value of in-person shopping, especially for significant purchases such as engagement or anniversary jewelry, remains a major advantage for traditional retailers.

The online segment is projected to witness a significant CAGR of 7.8% over the forecast period due to rising digital literacy and convenience-driven consumer behavior. Virtual try-on features, high-resolution product visuals, and customer reviews are making online platforms more reliable. Consumers are embracing e-commerce for its wider selections, customization options, and competitive pricing. Brands are also enhancing user experience through AI-based recommendations, chat support, and easy returns. In August 2023, Tanishq collaborated with Oracle Cloud Infrastructure to enhance its jewelry business, optimizing inventory management and reducing technology support costs by 30%. Younger demographics, in particular, are drawn to mobile-first shopping, limited-edition online drops, and influencer-driven trends. Hybrid models where online platforms connect with in-store services are becoming a key strategy to drive sales and loyalty.

Category Analysis

In terms of category, the segmentation includes branded and unbranded. The unbranded segment accounted for ~66% of the revenue share in 2024. Many consumers favor local or independent jewelers offering customizable, affordable designs without the added cost of brand premiums. The unbranded segment often provides unique, handmade items that cater to regional tastes and personal preferences. Buyers in this segment are also driven by trust built through long-standing relationships with local stores. Unbranded products continue to thrive in family and cultural purchases where design flexibility and price sensitivity matter more than brand name. The availability of bespoke craftsmanship further strengthens demand in this segment.

The branded centers segment is projected to witness a higher CAGR of 7.6% during the forecast period due to shifting consumer preferences toward quality assurance, traceability, and lifestyle alignment. Branded pieces often come with certifications, warranties, and consistent design language that appeal to value-conscious, modern buyers. Major retailers are investing in retail innovation, influencer partnerships, and omnichannel selling to reach a broader audience. Brand storytelling, loyalty programs, and digital customization features are also helping drive repeat purchases. Increasing demand for aspirational luxury among younger consumers is encouraging brands to offer accessible product lines without compromising on quality or design integrity.

Key Players and Competitive Analysis

The competitive landscape of the U.S. jewelry market is shaped by evolving consumer behavior, rapid digitization, and a strong focus on product differentiation. Industry analysis reveals a growing emphasis on market expansion strategies, including geographic diversification and portfolio enhancement. Leading players are engaging in joint ventures and strategic alliances to access advanced design capabilities, expand retail footprints, and strengthen sourcing networks. Mergers and acquisitions are being pursued to consolidate market share and enter high-growth niches such as lab-grown diamonds and sustainable fine jewelry, followed by streamlined post-merger integration processes.

Technology advancements in virtual try-ons, AI-driven personalization, and blockchain-based traceability are redefining consumer engagement. The market is also seeing a shift toward experiential retail, omnichannel models, and branded offerings. Rising demand for ethically sourced materials, personalization, and lifestyle-oriented collections continues to influence strategic direction. Competitive dynamics are further driven by real-time inventory management, data analytics, and adaptive pricing tools that support customer-centric retail operations.

Key Players

- Buccellati

- Blue Nile

- Cartier

- Chow Tai Fook Jewellery Group Limited

- LVMH Group

- Malabar Gold & Diamonds

- PANDORA JEWELRY LLC

- SHR Jewelry Group LLC

- Swarovski

- Swatch Group AG

- Titan Company Limited

Industry Developments

In May 2025, Pavé The Way Jewelry launched Joan Hornig's capsule collection, featuring pieces from the Empowerment Tools, Tool Bits, and My BFFs Collections. The collection is available for purchase on Anthropologie.com.

In August 2023, Pandora launched three new lab-grown diamond collections and a campaign declaring “Diamonds for All.”

In May 2023, Bulova partnered with SHR Jewelry Group to launch its men's fine jewelry collection, embodying the brand's bold spirit and Joseph Bulova's iconic style.

In August 2023, Chow Tai Fook introduced a series of new creations to its HUÁ Collection through collaborating with Shaanxi History Museum and Northwestern Polytechnical University.

U.S. Jewelry Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Necklace

- Ring

- Earrings

- Bracelet

- Other Products

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Silver

- Gold

- Platinum

- Diamond

- Others

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Branded

- Unbranded

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

U.S. Jewelry Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 39.03 billion |

|

Market Size in 2025 |

USD 40.93 billion |

|

Revenue Forecast by 2034 |

USD 85.60 billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 39.03 billion in 2024 and is projected to grow to USD 85.60 billion by 2034.

The U.S. market is projected to register a CAGR of 7.2% during the forecast period.

A few of the key players in the market are Buccellati, Blue Nile, Cartier, Chow Tai Fook Jewellery Group Limited, LVMH Group, Malabar Gold & Diamonds, PANDORA JEWELRY LLC, SHR Jewelry Group LLC, Swarovski, Swatch Group AG, and Titan Company Limited.

The ring segment accounted for ~39% of the revenue share in 2024 due to high consumer interest in engagement and wedding rings, paired with rising demand for stackable and fashion rings.

The gold segment accounted for ~48% of the revenue share in 2024. The segment continues to benefit from cultural associations with status, wealth, and timeless beauty.