Pet Grooming Services Market Share, Size, Trends, Industry Analysis Report

By Pet Type (Dogs, Cats, Others); By Delivery Channel (Commercial Facilities, Others); By Service Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2601

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

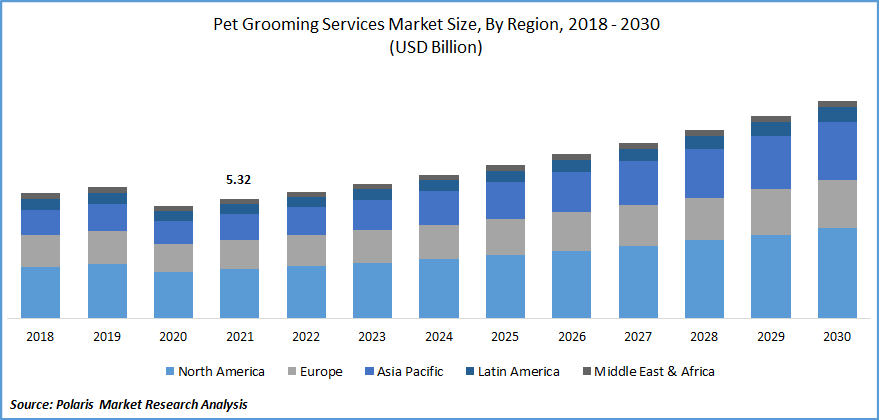

The global pet grooming services market was valued at USD 5.32 billion in 2021 and is expected to grow at a CAGR of 7.0% during the forecast period. The market for pet grooming is expanding as a result of growing pet humanization concepts, pet adoption from shelters, and rising demand for mobile pet grooming services market.

Know more about this report: Request for sample pages

Pet grooming involves giving animals sanitary cleaning and care. The physical attractiveness of a pet is improved by pet grooming services. Pet owners shower attention, organic pet food, and other upscale services on their animals as though they were part of the family. Pet grooming services can help pets avoid a range of health issues and also reveal a range of sickness or injury symptoms.

The COVID-19 pandemic had a detrimental effect on business in the global market because non-essential activities, like pet grooming services, were shut down as a result of the rising Covid-19 cases and government-imposed movement restrictions across the globe.

The economic crisis caused by the pandemic enabled pet owners to reduce their spending on pet care, which could have a negative impact on the market. The disruption in the supply chain and necessary equipment for pet grooming, including nail clippers, pet toys, clothing, shampoos, and others, has hampered the industry's overall growth.

Furthermore, animal care and service employment are expected to increase in the coming years in both developed and developing nations, offering lucrative opportunities for market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The pet grooming services market has been primarily driven by the rising trend of pet ownership and the ability of pet owners, particularly those in the high-income category, to spend more on the look of their pets.

The increased benefits of routine grooming also help to drive up demand for the services. Services like bathing, brushing, and nail trimming enable pet owners to preserve their pets' physical well-being and aesthetic appeal.

The demand for these services is expanding as a result of both the growing importance of pet health and well-being and the growing popularity of styling. Pet grooming keeps them clean and healthy and prevents illnesses, skin infections, and allergies. Additionally, new dog grooming trends, including dreadlocks, stencil designs, and putting pet fur on animals with round or square faces, are propelling the expansion of the sector.

Report Segmentation

The market is primarily segmented based on pet type, service type, delivery channel and region.

|

By Pet Type |

By Service Type |

By Delivery Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Dogs Pet segment accounted for the largest share

The pet type segment for dogs dominated the global market. On the other hand, in the upcoming years, the category of cats as pets is anticipated to develop over the forecast period. The huge population and humanization of pet dogs and cats compared to other pet varieties are important factors in the growth.

Dog segment is anticipated to grow owing to the rising adoption of dogs as more dogs are adopted through rescue foundations and animal shelters. Additionally, pet grooming promotes a clean home and helps to lower allergies caused by pets through early detection of changes to the skin or body of the pet.

Massage or spa & other segment dominated the market

In 2021, the massage/spa & other segments held the largest share. The segment offers a variety of services, including bathing, shampoo, brushing, blow-drying, massages, conditioning, cleaning your teeth, etc. For example, brushing spreads natural oils evenly for healthy skin and removes debris, dead hair, and loose hair knots. It also promotes blood flow. Additionally, it prevents shedding and preserves the hydration of fur.

The segment growth is expected to increase due to awareness of the significance of routine pet washing and grooming to prevent allergies and illnesses. In addition, the shear & trimming segment is also anticipated to expand significantly.

Since that pet's hair and nails grow more quickly than people's, cutting or trimming is essential to pet grooming services. Running can cause toenail tearing in pets, which could cause pain and put pressure on the toe joints. These factors are anticipated to accelerate segment growth in the upcoming years.

The commercial facilities delivery channel segment held the largest share

Commercial grooming facilities have a high adoption rate and are well-equipped to provide services on-site, which supports segment expansion. Other delivery services include at-home and mobile services, which are becoming increasingly popular as pet expenses increase.

During the pandemic, there has been a significant boom in the e-commerce sector. Pet grooming companies are expanding their distribution network on internet platforms to meet customer demand.

Mobile pet groomers may offer the greatest assistance and services to pet owners at their doorsteps. Over the projection period, it is anticipated that the market will grow due to the rising popularity of mobile pet services.

North America accounted for the biggest market share in 2021

North America dominated the industry and contributed the highest share. This is due to increased pet costs and worries about the health of pets. Due to the number of pet ownership, particularly dog ownership, in North American homes, as well as the high standards of living, the regional segment has been dominating the pet grooming services market.

Asia Pacific is anticipated to see the fastest growth rate over the forecast period. The emerging economies' rising consumer disposable income levels, rise in the number of pet groomers, and the humanization of pets are all contributing to the APAC region's rapid growth.

The rising adoption of a pet in emerging countries, such as India and China, is anticipated to drive the growth of the market. Consequently, there would be a possibility for a rise in the demand for pet grooming services in these areas. Additionally, the pet grooming services market will develop as a result of a number of new trends in pet grooming, including dreadlocks, stencilled designs, coloured highlights, and the setting up of fur in various shapes.

Competitive Insight

Some of the major players operating in the global market include Anvis Inc., Aussie Pet Mobile; Dogtopia Enterprises, Doggyman H.A.Co,Ltd; Hollywood Grooming Inc; Muddy Paws; The Pooch Mobile; Wag Labs, Inc;Pawz & Company,PetBacker, Paradise 4 Paws, Pets At Home, Inc., Petsfolio, PetSmart LLC, PetSmart LLC,Pet Palace,Prodiet Pet Foods,Inc; Petvalu and Chewy.

Recent Developments

In June 2020, In Trowbridge, We Love Pets opened a pet grooming business that provides salon treatments and a comprehensive range of services for dogs of all breeds, sizes, and coat types. The company's service portfolio was increased because of this service innovation, which also increased regional market share.

In December 2021, In order to launch a mobile pet grooming service in India, Pet Precious partnered with Papa Pawsome, a business that focuses on all-natural pet grooming products.

In June 2019, The ability to book professional in-home pet grooming services has officially been launched by Rover, the largest global network of 5-star pet sitters and dog walkers, making it easier for pet parents to locate accessible, considerate grooming services online.

Pet Grooming Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.32 billion |

|

Revenue forecast in 2030 |

USD 9.70 billion |

|

CAGR |

7.0 % from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Pet Type, By Service Type, By Delivery Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Anvis Inc.,Aussie Pet Mobile; Dogtopia Enterprises,Doggyman H.A.Co,Ltd; Hollywood Grooming Inc; Muddy Paws; The Pooch Mobile; Wag Labs, Inc;Pawz & Company,PetBacker, Paradise 4 Paws, Pets At Home, Inc., Petsfolio, PetSmart LLC, PetSmart LLC,Pet Palace,Prodiet Pet Foods,Inc; Petvalu and Chewy. |