Pharmaceutical Packaging Market Share, Size, Trends, Industry Analysis Report

By Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil, Others); By Product (Primary, Secondary, Tertiary); By End Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 112

- Format: PDF

- Report ID: PM2358

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

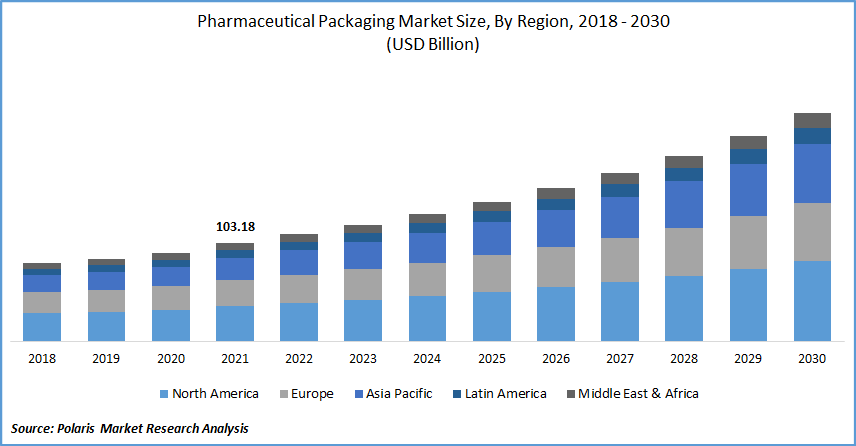

The global pharmaceutical packaging market was valued at USD 103.18 billion in 2021 and is expected to grow at a CAGR of 9.9% during the forecast period. The rising technological advancements, growing medical and healthcare expenditure, increasing advanced manufacturing processes to develop sustainable and eco-friendly packing are the factors contributing to the growth of the industry.

Know more about this report: request for sample pages

The pharma sector requires reliable and speedy packing solutions that provide a combination of product protection, tamper evidence, quality, patient comfort, and security needs. Continuous and persistent innovation over the years in the pharma industry such as Plasma Impulse Chemical Vapor Deposition (PICVD) coating technology, anti-counterfeit measures, snap off ampoules, unit dose vials, Blow Fill Seal (BFS) vials, two-in-one prefilled vial design, prefilled syringes, and child-resistant packs is anticipated to witness a surge in demand for the industry.

The Covid-19 pandemic had a positive impact on the industry. The increased production and consumption of medicines, along with investments in drug discovery, paved the way for increased demand for packing. Furthermore, the outbreak of disease raised concern over the ability of the virus to sustain on packing surfaces, leading to the increased development of high performance and sustainable packing.

The world has also witnessed a paradigm shift amongst pharma companies, particularly in the European nations and other regulated markets for generics to choose for sustainable primary packing materials, which further resulted in the increased demand for Polylactic Acid (PLA) packaging as a sustainable blister packaging material as it consumes 65% less energy during production.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The healthcare & pharmaceutical industry across the globe has witnessed an immense rate of growth over the years. The growing population, higher life expectancy rate, prevalence of embracing a healthy lifestyle, and the rising consumer awareness regarding a good healthcare system are expected to accelerate the growth of the market in the near future.

The rising government initiatives, along with the increased investment in drug discovery and technological innovation, is likely to propel the growth of the market during the forecast period. For instance, Honeywell India Technology Center (HITC), a global packaging laboratory in Gurgaon, Haryana (India) develops novel technologies for pharma packaging that provide assistance to its regional partners with required technical support.

Report Segmentation

The market is primarily segmented based on material, product, end-use, and region.

|

By Material |

By Product |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Speak to Analyst

Insight by Material

On the basis of material, the market is categorized into plastics & polymers, paper & paperboard, glass, aluminum foil, and others. The plastic & polymers market segment is expected to account for the largest share over the forecast period. The demand for plastics is high across the pharma industry as it offers a cost-effective and reliable form of packing for pharma products. Thermoplastics and thermosets are the two types of polymers widely used in pharmaceutical product packing that offers protection to sealed pharma products.

Insight by Product

Based on product type, the market is bifurcated into primary, secondary, and tertiary packaging. The primary segment dominated the global pharmaceutical packaging market in 2021 and is anticipated to hold the largest share over the forecast period. Primary packing poses a great significance in the pharmaceutical industry as it ensures the safety of drugs and medicines during storage, sale, and use.

Secondary packaging is projected to witness a lucrative share during the forecast period. Secondary packing is basically a second layer of covering that protects the pharmaceutical products from external barriers and provides informative information such as the presence of active and inactive ingredients, type of medicines, warning precautions, and many others.

Geographic Overview

North America dominated the pharmaceutical packaging market in 2021 and is expected to retain its position over the forecast period. A large pharma manufacturing base, along with the increased investment in technological advancements for sustainable packing, is expected to drive the growth of the market. The pharmaceutical industry of the U.S. is one of the world’s largest single pharmaceutical markets that generated more than USD 490 billion of revenue and spent USD 83 billion on research and development in fiscal 2019.

Asia Pacific is expected to account for a significant share during the forecast period. The evolving pharmaceutical industry in the region's developing nations, owing to the increasing health awareness, rising governing norms, and growing emphasis on population health management, is projected to stimulate the demand for the pharmaceutical packaging market.

The packaging manufacturing companies such as West Pharmaceutical Packaging India Pvt. Ltd, Huhtamaki PPL Ltd?., SGD Pharma India Ltd, Uflex Limited, Amcor Flexibles India Pvt Ltd., Essel Propack Ltd, Parekhplast India Limited, Regent Plast Pvt Ltd., and many others present across the region are investing in novel technologies in order to create and develop sustainable packaging for their clientele base.

Competitive Insight

Some of the major players operating in the global market include Amcor Plc, Aptargroup, Inc., Becton, Dickinson and Company, Berry Global Inc., Catalent, Inc., CCL Industries, Inc., Comar, LLC, Drug Plastics Group, Gerresheimer AG, International Paper, Nipro Corporation, Owens Illinois Inc., Schott AG, Silgan Holdings Inc., Stevanato Group, Vetter Pharma International, West Pharmaceutical Services, Inc., and Westrock Company.

Pharmaceutical Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 103.18 billion |

|

Revenue forecast in 2030 |

USD 238.89 billion |

|

CAGR |

9.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Material, By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amcor Plc, Aptargroup, Inc., Becton, Dickinson and Company, Berry Global Inc., Catalent, Inc., CCL Industries, Inc., Comar, LLC, Drug Plastics Group, Gerresheimer AG, International Paper, Nipro Corporation, Owens Illinois Inc., Schott AG, Silgan Holdings Inc., Stevanato Group, Vetter Pharma International, West Pharmaceutical Services, Inc., and Westrock Company. |