Phosgene Market Share, Size, Trends, Industry Analysis Report

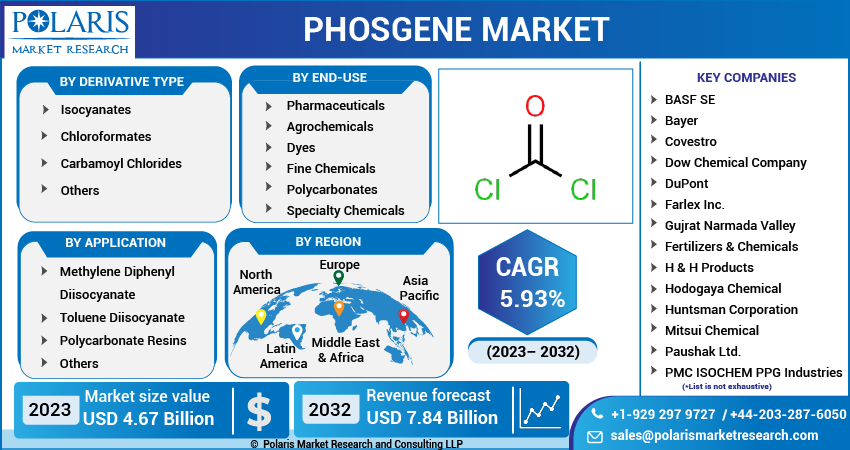

By Derivative Type (Isocyanates, Chloroformates, Carbamoyl Chlorides, and Others); By Application; By End-Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Aug-2023

- Pages: 116

- Format: PDF

- Report ID: PM3693

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

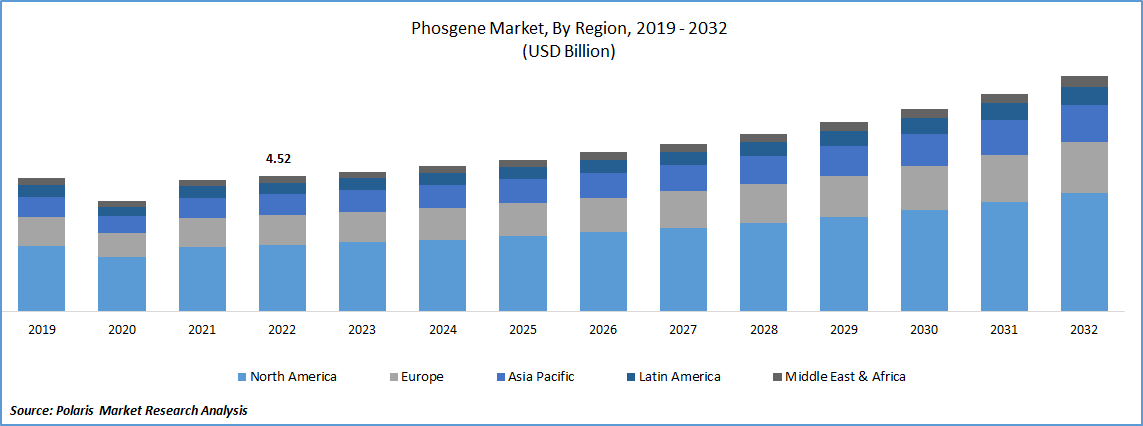

The global phosgene market was valued at USD 4.52 billion in 2022 and is expected to grow at a CAGR of 5.93% during the forecast period.

The rising prevalence for the use of thee chemicals on pharmaceutical, agrochemical, and polycarbonates industries and surging utilization for platinum, uranium, niobium, and plutonium metal extraction and their widespread use in numerous chemicals including aluminum chloride and beryllium chloride, are key factors influencing the global market growth.

To Understand More About this Research: Request a Free Sample Report

In addition, exponential growth in the global pharmaceutical sector, growing technological advancements, and extensive R&D activities supported by various government organizations and research institutes to expand the growth and revenue opportunities in the market, are likely to paved the way for higher product demand and adoption.

- For instance, in September 2021, ALTIVIA Specialty Chemicals, a global leading manufacturer of phosgene derivative intermediates across the North America region, announced that the company had sold its water treatment chemical business to the USALCO LLC. The traded business consist the ferrous and ferric sulfate production facilities situated in Houston, Texas.

Moreover, with the growing focus on sustainability and green initiatives across the globe, there is increasing emphasis on sustainable production methods, the use of renewable feedstocks, and reducing environmental impacts. Thereby, innovations such as the use of carbon dioxide as a feedstock, improved process efficiencies, and the development of greener alternatives are being explored by researchers to align with sustainability goals and pushing the market forward at significant rate.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the phosgene market. The rapid spread of the deadly coronavirus across the globe led to huge disruptions in global supply chains including the transportation and logistics networks and countries have imposed several restrictions on movement and lockdown measures that affected the production, distribution, and availability of phosgene and its raw materials, negatively influenced the market.

For Specific Research Requirements, Speak With Research Analyst

Industry Dynamics

Growth Drivers

Rising technological advancements are fueling the market growth

Rapid rate of urbanization, infrastructure development, and growing construction activities worldwide and surging proliferation about the use of phosgene in the production of materials such as polyurethane foam insulation, which is widely utilized in construction projects coupled with the growth of urban centers and infrastructure development projects across both developed and developing nations, are among the primary factors driving the market growth.

Furthermore, technological advancements which have led to the development of more efficient and environmentally friendly processes for the production of phosgene and introduction to new catalysts, reactor designs, and process optimization techniques to enhance the overall efficiency, productivity, and sustainability of phosgene production and that further helps to reduce energy consumption, waste generation, and environmental impact, are among the factors creating lucrative growth opportunities in the coming years.

Report Segmentation

The market is primarily segmented based on derivative type, application, end-use, and region.

|

By Derivative Type |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Derivative Type Analysis

Isocyanates segment accounted for the largest market share in 2022

The isocyanates segment accounted for global market share in 2022, which is largely attributable to exponential growth in the automotive sector and rapid rate of industrialization among major emerging economies like India and China along with the growing use of these derivatives in wide range of applications including manufacturing rigid & flexible foams, paints & varnishes, and elastomers among others, that are witness significant demand in the construction and automotive sector.

Moreover, wide arena of industries such as automotive, construction, and furniture are experiencing growth globally in the last few years and isocyanates are gaining huge traction and being widely adopted as crucial raw materials for these industries as they provide desirable properties like durability, insulation, and flexibility. Thus, the expansion of these end-use industries particularly in the emerging economies, is fueling the demand for isocyanates and subsequently driving the isocyanates segment at rapid pace.

By Application Analysis

Methyl diphenyl diisocyanate segment held the significant market share in 2022

The methyl diphenyl diisocyanate segment held the maximum market share in terms of revenue in 2022, which is mainly driven by its use in numerous applications including cast elastomers, thermoplastic polyurethanes, and other foam products coupled with the growing focus and efforts of major companies to enhance energy efficiency of polyurethane foams, develop sustainable and environmentally friendly formulations, and explore new applications for MDI in different sectors.

The polycarbonate resins segment is likely to exhibit considerable growth rate over the next coming years, on account of exponential rise in the need and demand for lightweight and durable materials in automobiles and surging prevalence for polycarbonate resins due to its ability to offer advantages like high impact strength and heat resistance, which makes them suitable for various automotive applications such as interior trim components, lighting, and exterior parts.

By End-Use Analysis

Specialty chemicals segment is projected to witness highest growth in 2022

The specialty chemicals segment is anticipated to grow during the forecast period, that is highly attributed to emergence of phosgene as a major raw material used in the production of specialty polycarbonates and higher demand for these carbonates across industries including construction, automotive, medical, and electronics. Additionally, continuously rising implementation on R&D activities to improve the efficiency, sustainability, and safety of phosgene-based processes, are further likely to expand the market scope and driving the demand for specialty chemicals.

The agrochemicals segment led the industry market with substantial share in 2022 and likely to expand further at significant growth rate over the next coming years, which is largely accelerated to growing need for higher crop productivity and increasing number of government authorities supporting the use of agrochemicals to ensure the food safety and promote the sustainable agricultural practices.

Regional Insights

Asia Pacific region dominated the global market share in 2022

The Asia Pacific region dominated the market. The growth of the regional market is highly attributable to significant demand for agricultural products and rising commercialization of agriculture to meet the growing requirements and need of region’s population. Beside this, with the increased focus towards the environmental sustainability among both consumers and producers and investments to promote the sustainable agricultural practices in countries like China, India, and Indonesia, the demand for agrochemicals has increased drastically.

The North America region is expected to be the fastest growing region in the course of study period, owing to presence of well-established infrastructure for chemical production and significant advancements in production technologies and process improvements resulting in more efficient and cost-effective manufacturing of phosgene. In addition, growing penetration regarding the use of phosgene in the synthesis of numerous pharmaceutical products including active pharmaceutical ingredients and intermediates especially in developed economies, thereby fueling the growth of the regional market.

Key Market Players & Competitive Insights

The phosgene market is fragmented and is anticipated to witness competition due to several players' presence. Players in the market are constantly upgrading the products to stay ahead of the competition. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- BASF SE

- Bayer

- Covestro

- Dow Chemical Company

- DuPont

- Farlex Inc.

- Gujrat Narmada Valley Fertilizers & Chemicals

- H & H Products

- Hodogaya Chemical

- Huntsman Corporation

- Mitsui Chemical

- Paushak Ltd.

- PMC ISOCHEM PPG Industries

- Shandong Tianan Chemicals

- Synthesia

- Tosoh Corporation

- Yantai Wanhua

- Vertellus Holdings

- VanDeMark Chemical

Recent Developments

- In October 2022, The Department of Chemical Technology Industry and Bioengineering Technologies, announced the launch of production of polyurethanes, as a part of the Ural Interregional Research and Education Centre operations. The newly developed product called HNIPU is generally known as the green polyurethane due to its production without any kind of harmful substances.

- In April 2021, Merck, announced that the company is investing around USD 22.9 million for the expansion of its research & development and manufacturing capabilities at their site located in Shizuoka, Japan. Under this expansion project, the company will advance its infrastructure and accelerate innovations in the electronic materials space and will allow company to focus on new material discovery, application testing, and device integration.

Phosgene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.67 billion |

|

Revenue forecast in 2032 |

USD 7.84 billion |

|

CAGR |

5.93% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Derivative Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Dow Chemical Company, Covestro AG, Mitsui Chemical, Yantai Wanhua, Vertellus Holdings LLC, VanDeMark Chemical Inc., BASF SE, PPG Industries Inc., Paushak Ltd., PMC ISOCHEM, Bayer AG, Tosoh Corporation, DuPont, H & H Products Ltd., Farlex Inc., Huntsman Corporation, Synthesia A.S., Hodogaya Chemical Co. Ld., Gujrat Narmada Valley Fertilizers & Chemicals Ltd., and Shandong Tianan Chemicals Co. Ltd. |

Navigate through the intricacies of the 2023 Phosgene Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

The phosgene market report covering key segments are derivative type, application, end-use, and region.

Phosgene Market Size Worth $7.84 Billion by 2032.

The global phosgene market is expected to grow at a CAGR of 5.93% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in phosgene market are growing demand for bedding and furniture sectors.