Pig Protein Concentrate Market Share, Size, Trends, Industry Analysis Report

By Form (Pallets, and Powder); By Nature; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM3374

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

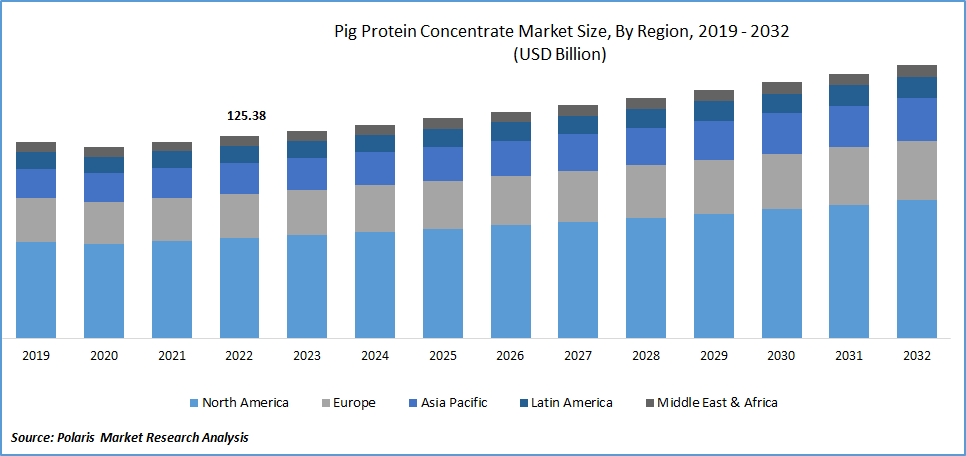

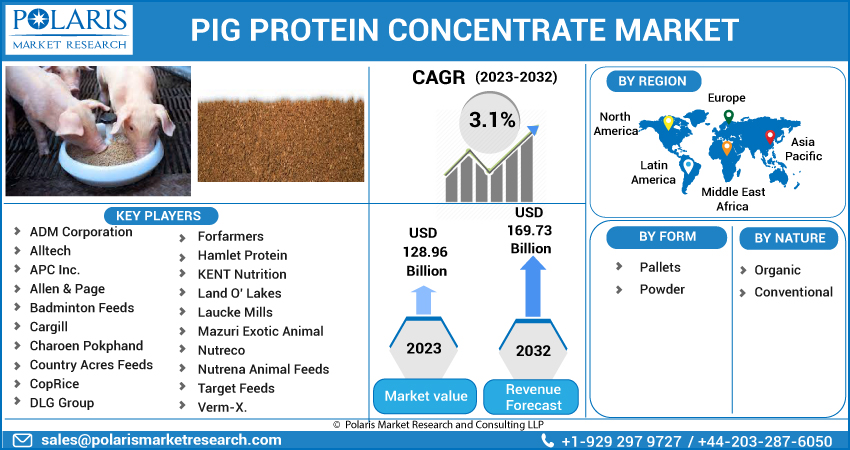

The global pig protein concentrate market was valued at USD 125.38 billion in 2022 and is expected to grow at a CAGR of 3.1% during the forecast period. Concentrates of pig protein are preferred over traditional cattle feeds because they maintain the consistent quality of nutrients needed to support pig reproduction. Pork is added to the pig's diet with grains in appropriate quantity. Depending on their needs for developing, lactating, and breeding, pigs receive various amounts of pig protein concentrate added to their diet. Pigs and other poultry are also being destroyed to increase farmers' profits.

To Understand More About this Research: Request a Free Sample Report

According to the Pork Checkoff and The National Pork Board, 11% of the world's pork is produced in the US. U.S. pork exports reached a value of over $7.7 billion in 2022. The pork was shipped in more than 2.5 million metric tonnes to other markets. In 2022, exports comprised 27.5% of all pork and hog-variety meat produced in the United States. The cultivation and distribution of pork have increased over time due to expanding food processing sectors worldwide, which is projected to impact the development of the market for pig protein positively concentrates.

Worldwide, all farmers need pig protein concentrate market. Pigs are raised for use in a variety of industrial processes in addition to being raised for meat. In February 2023, We Are Fresh, a private label brand of MM Mega Market, started a campaign to work with pig producers and sell fresh, premium meat products at regular pricing. MM Mega Market runs five direct purchasing platforms in significant agricultural regions, including Can Tho for fish, Tien Giang for fruit, Da Lat for vegetables, Dong Nai, and Hanoi for pork.

In collaboration with more than 200 farmers and cooperatives from the two major pork-producing regions of the nation, We Are Fresh, clean pork sends 30 tonnes of fresh pork to the domestic market every day. Consumers have consistently preferred it at home and canteens, restaurants, hotels, cafes, and cafeterias. To efficiently process pig products, farmers rely on pig protein concentrate. Because pig collagen contains significant protein, it is used to make gelatin and face masks. Due to their ability to impart color, fatty acids derived from pigs are frequently utilized as fabric softeners. The dough is softened in bakeries using proteins extracted from pig hair follicles.

During a pandemic, consumers are becoming more aware of the merits of plant-based protein, such as their high digestibility, high protein content, and minimal environmental impact. Increased pet food sales will add to the high demand for this alternative protein because animal feed-grade soybean proteins have a protein content of over 65% to meet the nutritional need of various animals. Comparable to fishmeal, this plant-based protein provides advantages in terms of utilization, including a high protein and amino acid content. Skimmed milk powder, utilized as a beginning soy protein concentrates for animal feed, will become more widely employed.

For Specific Research Requirements, Speak With the Research Analyst

Industry Dynamics

Growth Drivers

Increasing movement by farmers toward nutrient-rich animal feeds is attributed to the rise in demand for pig proteins. Farmers emphasize providing their cattle with an incredibly nutrient-dense diet to provide nutritional meat on the market. Pigs need plant-based and fish products in their diets because they are naturally omnivorous. Pig protein concentrate has seen a surge in demand over the past ten years due to the rising demand for swine meat in the food processing industries. The market is anticipated to offer more potential and guarantee higher returns for investors as more farmers and poultry managers have started pig farming in recent years.

Leading manufacturers are also concentrating on creating a variety of pig protein concentrates that match pigs' diverse nutritional and physiological needs. In May 2021, Hamlet Protein worked with the multinational pig breeding business Danbred to create a new manual for optimal pig feeding. An environment that is difficult for pig producers worldwide includes high and unstable feeding prices, pressure to reduce medicine use, restrictions on the use of antibiotics, and the threat of illnesses, among other obstacles. Because of these advantages, pig proteins will likely increase their market share over the forecast period.

Report Segmentation

The market is primarily segmented based on form, nature, and region.

|

By Form |

By Nature |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The pallet form segment is expected to witness the fastest growth over the projected period.

Pig protein in the pallet form is useful for treating conditions like diarrhea. The feed itself is the main cause of diarrhea in pigs. The reason for this is frequently that feed cannot be milked. Due to the low-grade, typical, immature suckling feed choice, pallets have proven useful in treating diarrhea. Pig pellet feed is used because it is more cost-effective than feed in powder form. Pallets are predicted to increase at the fastest CAGR during the projected period.

The organic segment industry accounted for the highest market share in 2022.

The rising benefits and adoption of organic ingredients drive market growth over the forecast period. Research on the impact of entirely organic feed on pigs is still needed. The main organic ingredients in pig diets are cereals and sources of protein. Some organic pig farms discover that growing their grain is more economical than buying it from a retailer. The organic ration can contain organic vitamins and minerals. The pigs' backfat had considerably greater iodine values and PUFA concentrations after being fed a 100% organic diet, leading to lower daily growth and carcass weights.

Furthermore, achieving enough levels of amino acids in the diet became more difficult by removing traditional potato protein. A lack of necessary limiting amino acids persisted despite substituting only soybean cake, increasing the diet's protein amount. The range of available feed components is limited since the standards for fast-growing organic pork are just as stringent as in conventional farming. The viability of feeding animals with organic ingredients would be enhanced by modifying the criteria for organic meat and accepting somewhat slower development rates.

The demand in Asia-Pacific is expected to witness significant growth over the forecast period.

Due to greater exports to food processors worldwide, pig protein concentrate is mostly produced and processed in Asia-Pacific, particularly in Japan and China. The region is growing due to the major player's investment in healthy pig farming. For instance, in July 2020, A Chinese technological start-up that enables smarter and healthier pig rearing received investment from Evonik's venture capital arm. The Internet of Things and artificial intelligence are used by the Chengdu and Shanghai-based company SmartAHC to provide monitoring tools and software that increase farm productivity and animal care. For instance, early illness diagnosis enables farmers to isolate sick animals and stop the spread of infection. Therefore, the region is growing with the highest share.

Furthermore, pig protein concentrate is widely used in North America since animal populations have grown recently. The rising government initiatives programs are driving regional growth. In June 2022, The Animal and Plant Health Inspection Service (APHIS) of the United States Department of Agriculture (USDA) unveiled new initiatives to halt the introduction and dissemination of African swine fever in the country. APHIS will assist commercial pork farmers, veterinarians, and pig welfare organizations through the "Protect Our Pigs" outreach and education program. Due to growing awareness of the dietary requirements of poultry, pig protein concentrate is consumed at moderate rates in the Middle East and Africa. There are few restrictions on the global market for pig protein concentrates.

Competitive Insight

Some of the major players operating in the global market include ADM Corporation, Alltech, APC Inc., Allen & Page, Badminton Feeds, Cargill, Charoen Pokphand, Country Acres Feeds, CopRice, DLG Group, Forfarmers, Hamlet Protein, KENT Nutrition, Land O' Lakes, Laucke Mills, Mazuri Exotic Animal, Nutreco, Nutrena Animal Feeds, Target Feeds, and Verm-X.

Recent Developments

In September 2021, Hamlet Protein launched HP FiberBoost, a pure fiber product for piglets, as an alternative to Zinc Oxide in pig diets. The product completes its fiber range and offers flexibility in formulating diets without zinc oxide while maintaining animal health and performance.

Pig Protein Concentrate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 128.96 billion |

|

Revenue forecast in 2032 |

USD 169.73 billion |

|

CAGR |

3.1% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Form, By Nature, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ADM Corporation, Alltech, APC Inc., Allen & Page, Badminton Feeds, Cargill, Charoen Pokphand, Country Acres Feeds, CopRice, DLG Group, Forfarmers, Hamlet Protein, KENT Nutrition, Land O' Lakes, Laucke Mills, Mazuri Exotic Animal, Nutreco, Nutrena Animal Feeds, Target Feeds, and Verm-X. |

FAQ's

The global Pig Protein Concentrate market size is expected to reach USD 169.73 billion by 2032.

Key Players in the Pig Protein Concentrate Market are ADM Corporation, Alltech, APC Inc., Allen & Page, Badminton Feeds, Cargill, Charoen Pokphand, Country Acres Feeds.

Asia-Pacific contribute notably towards the global Pig Protein Concentrate Market.

The global pig protein concentrate market expected to grow at a CAGR of 3.1% during the forecast period.

The Pig Protein Concentrate Market report covering key segments are form, nature, and region.