Pin Mills Market Share, Size, Trends, Industry Analysis Report

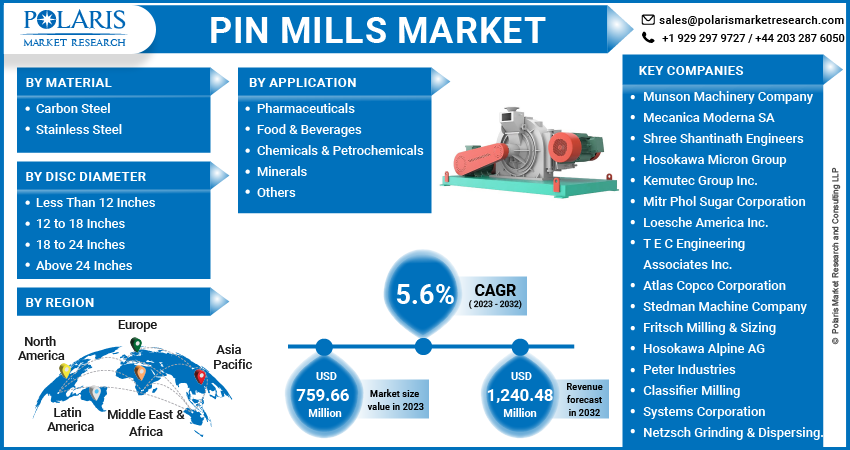

By Material (Carbon Steel and Stainless Steel); By Disc Diameter; By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3606

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

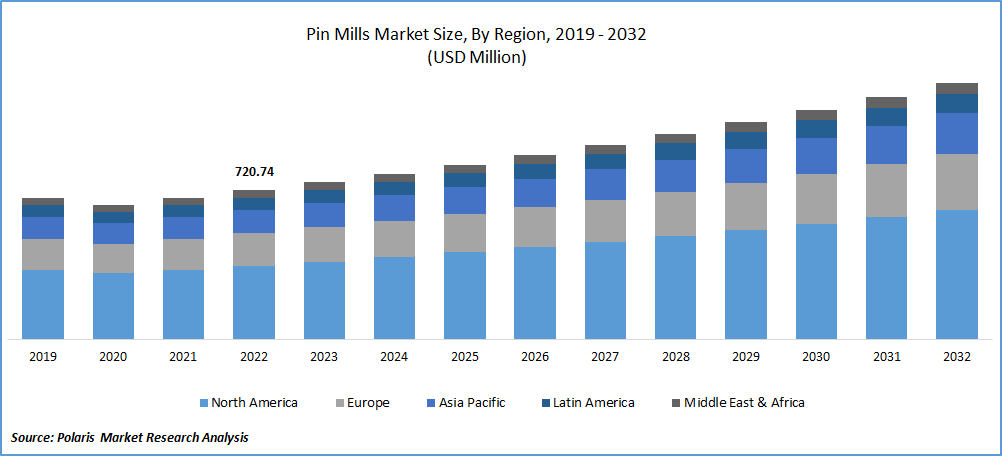

The global pin mills market was valued at USD 720.74 million in 2022 and is expected to grow at a CAGR of 5.6% during the forecast period. The growing popularity of pin mills due to their ability to produce fine and uniform particle sizes for various industries such as food processing, pharmaceuticals, and chemicals requiring finer grinding for numerous applications and rising mills applications in the production of specialty chemicals like dyes, coatings, and pigments are the primary factors boosting the global market demand and growth. Incorporating technological advancements, including enhanced material selection and innovative control systems that led to the development of advanced and more efficient pin mill designs, are also likely to impact the global market over the coming years positively.

To Understand More About this Research: Request a Free Sample Report

For instance, in November 2022, Hosokawa Micron Powder Systems announced the launch of its new system specially designed for the size reduction of several heat-sensitive polymeric materials. The newly developed system incorporates state-of-the-art milling and classification equipment for the grinding of numerous types of materials across both fine and coarse applications.

Moreover, the rising digitalization trend across the globe, which has enabled several innovative features such as remote monitoring, predictive maintenance, and data analytics, and the growing prevalence of pin mills equipped with IoT sensors and connectivity capabilities providing real-time insights into machine performance, enabling proactive maintenance and optimizing grinding processes, is creating lucrative growth opportunities for the global market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the pin mills market. Due to the rapid spread of the deadly coronavirus, many industries faced temporary closures, reduced operations, or supply chain disruptions due to lockdowns and restrictions imposed by government authorities, which directly impacted the demand for pin mills, affecting the market adversely. The pandemic also caused economic uncertainty and financial constraints for businesses, as companies needed to reduce budgets, investment delays, and project cancellations.

For Specific Research Requirements, Request for a customized e Report

Industry Dynamics

Growth Drivers

The rapidly increasing focus of key market players towards participating in several research & development-based activities mainly to improve the design, performance, and efficiency of these mills along with the growing incorporation of incorporation innovated features like automated controls, advanced safety features, and energy-efficient motors making them more user-friendly and cost-effective are among the major factors driving the market growth. Furthermore, the significant emergence of the pharmaceutical industry with advancements in drug development and manufacturing processes and widespread use of pin mills in pharmaceutical applications, including size reduction of APIs and micronization of drug particles, has been propelling the market at a significant pace. As pharmaceutical companies explore novel drug delivery systems and develop specialized formulations, the demand for pin mills with advanced features and capabilities will increase in the projected years.

Report Segmentation

The market is primarily segmented based on material, disc diameter, application, and region.

|

By Material |

By Disc Diameter |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Stainless steel segment accounted for the largest market share in 2022

The stainless-steel segment accounted for the largest global market share in 2022 and will likely retain its market position throughout the anticipated period. The growth of the segment market can be largely attributed to its numerous beneficial characteristics and properties, including exceptional corrosion resistance properties, durability & longevity, and hygienic processing, which makes them suitable for use in the food and pharmaceuticals industries.

Regulatory requirements and industry standards are also driving the stainless-steel segment, as many industries, particularly in food and pharmaceutical production, have imposed strict regulations and guidelines for equipment materials and the proliferation of stainless steel to ensure compliance with these regulations.

The carbon steel segment is anticipated to gain a significant growth rate over the coming years, mainly attributable to its high compatibility with various other materials, cost-effectiveness, relative ease of maintenance and repair, and the growing adoption to provide withstanding capabilities in rigorous operating conditions.

12 to 18 inches segment held the significant market revenue share in 2022

The 12 to 18 inches segment held the majority of market revenue share in 2022, mainly driven by its efficient processing capabilities and ability to handle a significant volume of material and efficiently achieve fine particle size reduction. Most pin mills have disc diameters of 12 to 18, offering flexibility and customization options to meet specific processing requirements, and can be equipped with different types of pins, screens, and liners, allowing manufacturers to optimize the machine for their particular needs.

Moreover, continuous advancements in pin mill technology which have improved their efficiency, ease of use, and maintenance and have made the 12 to 18 inches segment more attractive to manufacturers looking for reliable and advanced grinding solutions, are fostering the segment market growth at a significant pace.

Chemicals & petrochemicals segment is expected to witness highest growth during forecast period

The chemicals segment is projected to grow fastest due to the increasing number of pin mills applications in chemical and petrochemical industries, including pulverizing and grinding materials like pigments, resins, and polymers. They are also gaining traction in applications for particle size reduction of materials which are quite difficult to process with the help of other grinding technologies, thereby propelling the market.

The pharmaceuticals segment led the industry market with a substantial market share in 2022, which is highly attributable to the growing need for precise control over the particle size distribution to ensure optimal drug performance and bioavailability. With the continuous growth in the global pharmaceutical sector and surge in the healthcare infrastructure promoting the development of new drug formulations, the demand for advanced pin mills has grown drastically in the forecast period.

North America region dominated the global market in 2022

North American region dominated the global market with a considerable share because of the constantly rising adoption of innovative and advanced grinding technologies, growing investments in the pharmaceutical sector, and a surge in demand for processed food products across the region. In addition, the widespread focus of government authorities on promoting domestic manufacturing and reducing the dependence on import activities for various crucial products is fostering the market at a rapid pace.

The Europe region is anticipated to be the fastest growing region with a healthy CAGR over the study period, owing to the continuous surging focus on food safety and quality and increasing penetration and emphasis towards maintaining product sustainability. Along with this, the presence of a diverse industrial landscape encompassing sectors like food processing, minerals, chemicals, and pharmaceuticals requiring mineral size reductions is pushing the market's growth forward.

Competitive Insight

Some of the major players operating in the global market include Munson Machinery Company, Mecanica Moderna, Shree Shantinath Engineers, Hosokawa Micron, Kemutec Group, Mitr Phol Sugar Corporation, Loesche America, T E C Engineering Associates, Atlas Copco Corporation, Stedman Machine Company, Fritsch Milling & Sizing, Hosokawa Alpine, Peter Industries, Classifier Milling Systems Corporation, Netzsch Grinding & Dispersing

Recent Developments

- In December 2021, BillerudKorsnas, one of the global providers of virgin fiber paper and packaging, announced that it has entered into a strategic merger agreement with the Verso Corporation, under which the company will acquire Verso against a purchase consideration of USD 825 million.

- In June 2021, Hosokawa Micron announced the launch of its new Alpine CW Contraplex pin mills, mainly designed to provide high performance, reliability, and better versatility in an energy-efficient and compact package. The new mills also offer the finest grinding results and help the company to be one step ahead of its competitors.

Pin Mills Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 759.66 million |

|

Revenue forecast in 2032 |

USD 1,240.48 million |

|

CAGR |

5.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Material, By Disc Diameter, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Munson Machinery Company, Mecanica Moderna SA, Shree Shantinath Engineers, Hosokawa Micron Group, Kemutec Group Inc., Mitr Phol Sugar Corporation, Loesche America Inc., T E C Engineering Associates Inc., Atlas Copco Corporation, Stedman Machine Company, Fritsch Milling & Sizing, Hosokawa Alpine AG, Peter Industries, Classifier Milling Systems Corporation, Netzsch Grinding & Dispersing. |

FAQ's

The global pin mills market size is expected to reach USD 1,240.48 million by 2032.

Top market players in the Pin Mills Market are Munson Machinery Company, Mecanica Moderna, Shree Shantinath Engineers, Hosokawa Micron.

North America contribute notably towards the global Pin Mills Market.

The global pin mills market expected to grow at a CAGR of 5.6% during the forecast period.

The Pin Mills Market report covering key are material, disc diameter, application, and region.