Pipeline Integrity Management Market Size, Share, Trends, & Industry Analysis Report

By Location (Onshore and Offshore), By Service, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5770

- Base Year: 2024

- Historical Data: 2020-2023

Overview

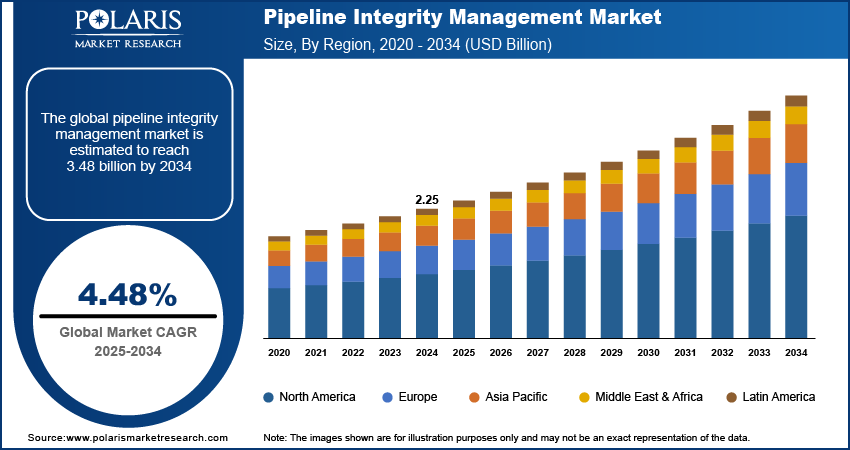

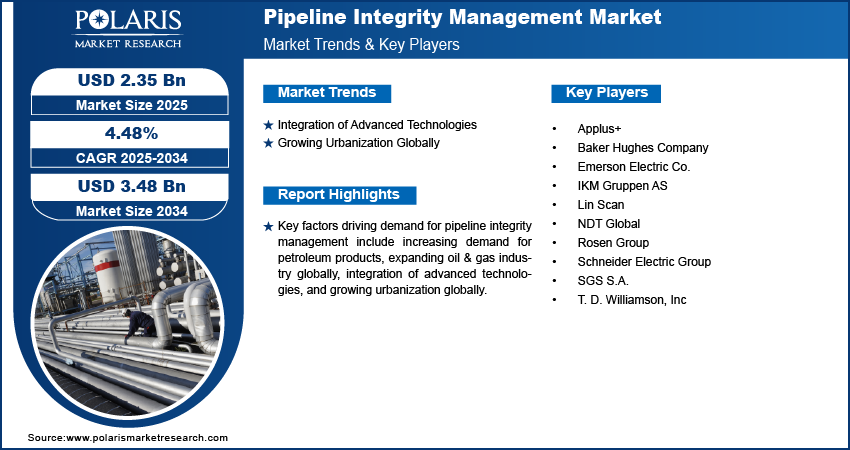

The global pipeline integrity management market size was valued at USD 2.25 billion in 2024, growing at a CAGR of 4.48% during 2025–2034. Key factors driving demand for pipeline integrity management include increasing demand for petroleum products, expanding oil & gas industry globally, integration of advanced technologies, and growing urbanization globally.

Pipeline integrity management is a systematic and comprehensive approach used by pipeline operators to ensure the safe, reliable, and efficient operation of pipelines throughout their entire lifecycle, from design and construction to operation, maintenance, and decommissioning. The core objective of the management is to prevent failures, leaks, and other incidents that may result in environmental harm, public safety hazards, or major disruptions to the supply of critical resources such as oil and gas.

The increasing demand for petroleum products such as LNG, LPG, and others is driving the market growth. According to the US Energy Information Administration, in the US, propane (a specific type of LPG) consumption reached 1.48 million barrels per day (b/d) in January 2025, the highest January consumption on record since January 2005. This increase in consumption is driving companies to expand their pipeline networks and ensure existing infrastructure operates at higher capacities, which increases the risk of leaks, corrosion, or failures. Pipeline integrity management solutions help operators to tackle these risks or challenges by monitoring, assessing, and maintaining pipelines. Therefore, as demand for petroleum products such as LNG and LPG increases, the adoption of pipeline integrity management solutions also spurs.

The pipeline integrity management demand is driven by the expanding oil & gas industry globally. The oil & gas industry in India is expected to attract US$ 25 billion in investment in exploration and production activities in the coming years. This expansion is leading to the construction of additional pipelines to transport crude oil, natural gas, LNG, and LPG to refineries, processing plants, and export terminals. These new pipelines are usually located in challenging terrains such as deepwater offshore locations, Arctic environments, or seismically active zones, necessitating the use of pipeline integrity management solutions to prevent structural failures. Regulatory agencies worldwide are also tightening compliance requirements with the expanding oil & gas industry, mandating more frequent inspections, risk assessments, and preventive maintenance, leading to market growth.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Integration of Advanced Technologies

Integration of pipeline integrity management solutions with IoT sensors and AI-driven predictive analytics allows operators to detect micro-leaks, corrosion, and structural weaknesses in real time, reducing the risk of catastrophic failures, thereby leading to their high adoption. Additionally, integration with machine learning and deep learning technology is expanding the capabilities of pipeline integrity management solutions as machine learning algorithms process historical and real-time data to predict failure risks. These expanded capabilities are encouraging pipeline operators to adopt machine learning powered pipeline integrity management solutions. Therefore, the integration of pipeline integrity management solutions with advanced technologies is driving the market expansion.

Growing Urbanization Globally

Urban regions heavily depend on pipelines to deliver synthetic natural gas, LPG, and other petroleum products for heating, electricity generation, and industrial use, making pipeline integrity management solutions an essential tool to prevent failures far more disruptive and dangerous. Municipalities and utility companies in the urban areas are adopting PIM solutions to prevent leaks, explosions, and service interruptions. Urban expansion also forces pipelines to navigate complex underground environments crowded with water lines, electrical cables, and transit systems, increasing the risk of damage and requiring advanced integrity management technologies such as GIS mapping, acoustic sensors, and real-time threat detection systems. Stricter safety regulations in urban areas are further pushing energy providers to adopt pipeline integrity management tools to ensure compliance and maintain public trust. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Therefore, as urbanization expands, the need for safe, efficient, and resilient pipeline networks makes pipeline integrity management a crucial investment for sustainable urban development.

Segmental Insights

By Location Analysis

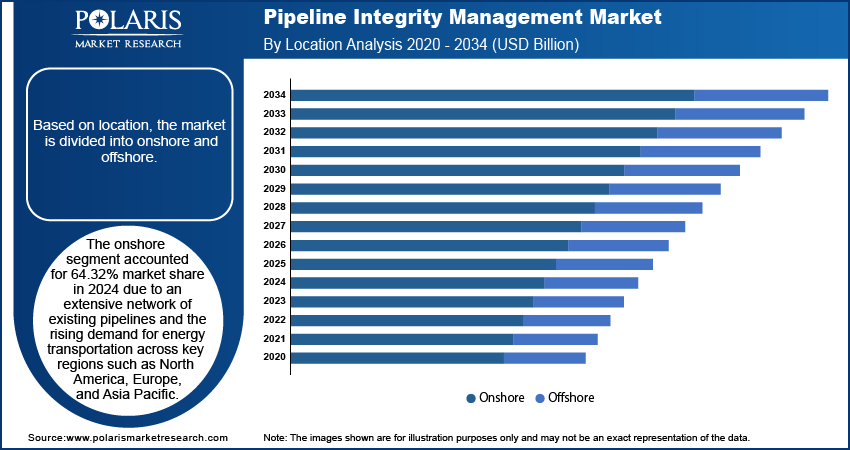

The onshore segment accounted for 64.32% market share in 2024 due to an extensive network of existing pipelines and the rising demand for energy transportation across key regions such as North America, Europe, and Asia Pacific. The expansion of shale gas production, particularly in the US, and the need to maintain aging infrastructure, drove investments in inspection, maintenance, and monitoring solutions at onshore locations. Governments and operators further prioritized onshore locations as they are more accessible and cost-effective to manage compared to offshore alternatives.

The offshore segment is projected to grow at a robust pace in the coming years, owing to the increasing deepwater exploration activities and the development of new oil and gas fields in regions such as the North Sea, Gulf of Mexico, and West Africa. Harsh environmental conditions at offshore locations and stricter regulatory standards are pushing operators to adopt pipeline integrity assessment tools. Additionally, the growing focus on renewable energy integration, such as offshore wind farms connected via subsea pipelines, is projected to fuel demand for robust integrity management solutions for offshore locations.

By Service Analysis

The inspection service segment held the largest share in 2024 due to the increasing need for proactive maintenance and regulatory compliance across aging pipeline networks. Advanced technologies such as smart pigging, drones, and satellite-based monitoring gained traction, enabling operators to detect corrosion, cracks, and other defects with higher accuracy. Governments in North America and Europe imposed stricter safety standards, mandating frequent inspections to prevent leaks and spills, particularly in high-risk areas. Additionally, the rise of digitalization and predictive analytics allowed companies to optimize inspection schedules, reducing downtime while enhancing safety, which further contributed to the dominance of the segment.

The repairs & refurbishment segment is projected to hold 22.13% market share in 2034 due to the shifting focus from detection to corrective actions. Many pipelines worldwide are reaching the end of their operational lifespan, requiring extensive repairs & refurbishment to extend usability. Innovations in composite repair systems and robotic welding technologies are reducing costs and downtime, making refurbishment more efficient. Furthermore, the increasing adoption of renewable energy sources, such as hydrogen and biofuels, is necessitating pipeline modifications to handle new types of transportation systems, contributing to segment growth.

Regional Analysis

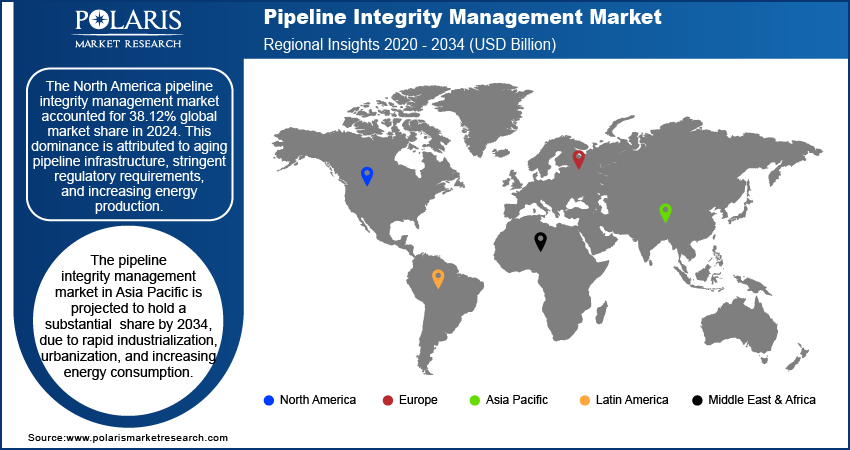

The North America pipeline integrity management market accounted for 38.12% global market share in 2024. This dominance is attributed to aging pipeline infrastructure, stringent regulatory requirements, and increasing energy production. The US and Canada have vast pipeline networks, many of which are decades old, necessitating regular inspections and maintenance to prevent leaks and ruptures. Regulations such as the Pipeline and Hazardous Materials Safety Administration (PHMSA) mandated strict compliance, pushing operators to adopt advanced pipeline integrity management solutions. Additionally, the growth in shale gas and oil production in the region increased the need for reliable pipelines and their management solutions.

US Pipeline Integrity Management Market Insight

The pipeline integrity management market in the US is heavily influenced by federal and state regulations, particularly those enforced by PHMSA under the Pipeline Safety Act. The increasing frequency of pipeline incidents has led to public and governmental pressure for stricter oversight, leading to market growth. The expansion of natural gas pipelines, driven by the shale boom, further propelled demand for pipeline management solutions. Tools such as inline inspection tools and predictive analytics are being widely adopted in the country to enhance monitoring and reduce risks, supporting market dominance.

Europe Pipeline Integrity Management

The pipeline integrity management market in Europe is projected to grow at a robust pace in the coming years, owing to the extensive pipeline network, along with stringent EU regulations aimed at ensuring safety and environmental protection. The European Union’s Third Energy Package and the Gas and Oil Pipeline Safety Directives are imposing rigorous inspection and maintenance requirements, fueling market revenue. Additionally, Europe’s shift toward renewable energy and hydrogen transportation is necessitating modifications in existing pipelines, driving the need for advanced integrity management solutions.

UK Pipeline Integrity Management Market Overview

The demand for pipeline integrity management in the UK is driven by a combination of aging infrastructure, stringent regulatory frameworks, and evolving energy transition initiatives. The UK’s extensive pipeline network, including critical oil and gas transmission systems, requires continuous monitoring and maintenance to prevent leaks, corrosion, and catastrophic failures. Additionally, the UK’s shift toward low-carbon energy, including hydrogen blending and carbon capture and storage (CCS) projects, is necessitating modifications to existing pipelines, further propelling the need for robust pipeline integrity management solutions. The growing emphasis on energy security and reducing methane emissions is further boosting pipeline integrity management tools adoption in maintaining the reliability of pipeline infrastructure.

Asia Pacific Pipeline Integrity Management Market

The pipeline integrity management market in Asia Pacific is projected to hold a substantial share by 2034, due to rapid industrialization, urbanization, and increasing energy consumption. United Nations Human Settlements Programme in its report stated that by 2050, the urban population in Asia is expected to grow by 50%. Countries such as China, India, and Australia are expanding their oil and gas pipeline networks to meet growing energy needs, necessitating the need for integrity management solutions. Government regulations in the region are further mandating regular inspections and risk assessments, thereby driving the market. Additionally, the rise of liquefied natural gas (LNG) infrastructure and cross-border pipelines, such as those between China and Russia, is further emphasizing the need for advanced pipeline integrity management solutions in the region to ensure operational safety and efficiency.

Key Players & Competitive Analysis Report

The pipeline integrity management (PIM) market is highly competitive, with key players leveraging product portfolio expansion, strategic partnerships, and mergers and acquisitions (M&A) to strengthen their positions. Major companies such as Baker Hughes, Schlumberger, and Emerson are continuously broadening their service offerings through technological innovation and product diversification. These expansions are allowing firms to offer end-to-end solutions, from inspection to maintenance, enhancing customer retention and attracting new clients. Strategic partnerships are another critical growth strategy, enabling companies to combine expertise and access new regions. These partnerships further help companies fill technological gaps and reduce R&D costs.

Applus+; Baker Hughes Company; Emerson Electric Co.; IKM Gruppen AS; Lin Scan; NDT Global; Rosen Group; Schneider Electric Group; SGS S.A.; and T. D. Williamson, Inc. are among the major companies operating in the pipeline integrity management market.

Key Players

- Applus+

- Baker Hughes Company

- Emerson Electric Co.

- IKM Gruppen AS

- Lin Scan

- NDT Global

- Rosen Group

- Schneider Electric Group

- SGS S.A.

- T. D. Williamson, Inc.

Industry Developments

April 2025: Applus+ launched a project in El Salvador to conduct a comprehensive pipeline inspection using advanced ultrasonic techniques.

December 2024: NDT Global launched a 56" ultrasonic in-line inspection tool, developed in collaboration with Aramco, to meet the inspection requirements.

Pipeline Integrity Management Market Segmentation

By Location Outlook (Revenue, USD Billion, 2020–2034)

- Onshore

- Offshore

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Inspection Service

- Cleaning Service

- Repairs & Refurbishment

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Pipeline Integrity Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.25 Billion |

|

Market Size in 2025 |

USD 2.35 Billion |

|

Revenue Forecast by 2034 |

USD 3.48 Billion |

|

CAGR |

4.48% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.25 billion in 2024 and is projected to grow to USD 3.48 billion by 2034.

The global market is projected to register a CAGR of 4.48% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Applus+; Baker Hughes Company; Emerson Electric Co.; IKM Gruppen AS; Lin Scan; NDT Global; Rosen Group; Schneider Electric Group; SGS S.A.; and T. D. Williamson, Inc.

The onshore segment dominated the market share in 2024.

The repairs & refurbishment segment is expected to witness the fastest growth during the forecast period.