Plastics in Electrical and Electronics Market Share, Size, Trends, & Industry Analysis Report

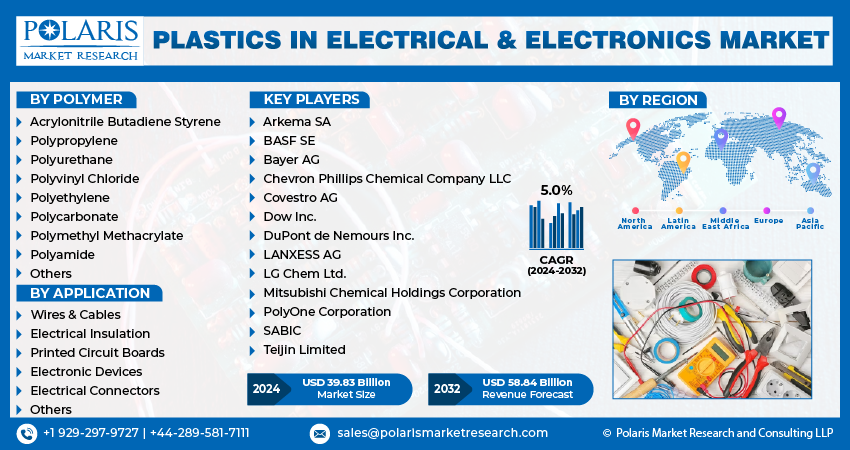

By Polymer (Acrylonitrile Butadiene Styrene, Polypropylene, Polyurethane, Polyvinyl Chloride, Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4329

- Base Year: 2024

- Historical Data: 2020 - 2023

The Plastics in Electrical and Electronics Market is valued at USD 80.9 billion in 2024 and will grow at a CAGR of 7.45% through 2034. Demand is fueled by miniaturization of components, the shift to lightweight alternatives, and rising applications in 5G infrastructure and consumer electronics.

Market Overview

The continuous expansion of the electronics industry as a result of the rising emergence of 5G, IoT, and AI technologies is driving the market’s growth. Also, the growing importance of plastics in the electronics & electrical sector is due to their ability to provide a variety of functions in the design, production, and functionality of different gadgets. Plastics have good thermal stability, which is crucial in plastics in electrical and electronic applications where plastics for electrical and electronic components generate heat. Growing awareness about numerous other advantageous of plastics in the industry like corrosion resistance, design flexibility, and better insulation properties, the demand for plastics in the electronics industry is growing substantially.

- For instance, according to a report by 5G Americas, the number of 5G wireless connections across the globe rose by 76% from 2021 to 2022 and reached a total of1.05 billion connections. Also, the number of connections is projected to touch 5.9 billion connections by 2027.

Furthermore, the increasing emphasis on sustainability and energy efficiency has significantly driven the use of plastics in the electrical and electronics industry. Sustainable and lightweight plastics are beneficial in many ways, such as energy savings, reduction in transportation costs, alignment with international environmental norms, and can be recycled. Thereby, there are companies heavily focusing on the development of sustainable plastic materials for electrical & electronic goods, which bodes well for the market’s growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, in May 2023, SABIC announced the expansion of its line of sustainable iQ resins with the launch of “LNP ELRIN WF0051iQ”. It is highly suited for electrical applications or goods and offers the electrical industry a novel solution that can improve sustainability while providing tailored performance properties.

Growth Factors

-

Rising demand for consumer electronic devices to drive market growth

The demand for consumer electronic devices such as smartphones, laptops, PCs, and wearables has been growing significantly over the years, which creates a substantial demand for plastics in the manufacturing of connectors, casings, and other Plastics for Electrical and Electronic Components used in these devices. Also, with consumers demanding lightweight, sleek, and portable devices, companies are increasingly using plastics because they are lightweight materials and are good alternatives for providing the required portability to gadgets.

-

Advancements in plastic technologies and the development of bio-based plastics are likely to spur market growth.

Rising advancements in several plastic technologies, including the development of flame-retardant and high-performance plastics, are gaining huge traction worldwide. Also, companies are focusing on the development of bio-based plastics and boosting their production, as they are used in the manufacturing of several plastics for electrical and electronic components due to their ability to provide the same protective and structural properties while reducing the environmental impact.

Restraining Factors

-

Growing environmental concerns and the availability of alternative materials hampering the market’s growth

An increasing number of environmental regulations and concerns associated with the use and production of plastics and the surging availability of alternative materials to plastics, such as metals and ceramics, are the factors restraining global market growth.

Report Segmentation

The market is primarily segmented based on polymer, application, and region.

|

By Polymer |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Polymer Insights

The Polyvinyl chloride segment accounted for the highest market share in 2024

The polyvinyl chloride segment accounted for the highest market share. Segment’s dominance is attributed to its widespread adoption due to numerous beneficial properties, including heat-resistance, non-conductivity, and cost-effectiveness, and its surging use for various purposes, such as cable sheathing, insulation, and wire coatings. In addition, polyvinyl chloride is comparatively less expensive than other polymers and exhibits high durability & longevity that results in a longer lifespan of plastics for electrical and electronic components.

The polycarbonate segment is projected to grow at the highest growth rate. Segment’s growth is accelerated by its emergence as a highly versatile material used in the electrical & electronics sector due to its characteristics such as transparency, impact resistance, UV resistance, design flexibility, and lightweight nature.

By Application Insights

The electronic devices segment held a significant market revenue share in 2024

The electronic devices segment for plastics in electrical and electronic applications held the majority of market revenue share. This dominance is accelerated by rising demand for consumer electronics across the world and the emerging trend of compact or smaller electronic devices that led to increased use of lightweight materials like plastics. Additionally, the rising awareness of environmental concerns or issues leads to greater focus on the use of sustainable and eco-friendly materials in electronic devices; thereby, the demand for recycled or bio-based plastics is growing rapidly.

The wires & cables segment also held a substantial market revenue share. Segment’s dominance is due to ongoing infrastructure development projects that increase the use of wires & cables in a wide range of plastics in electrical and electronic applications to ensure smooth operations. The expansion of telecommunication infrastructure and power distribution networks would boost demand for wires & cables over the years.

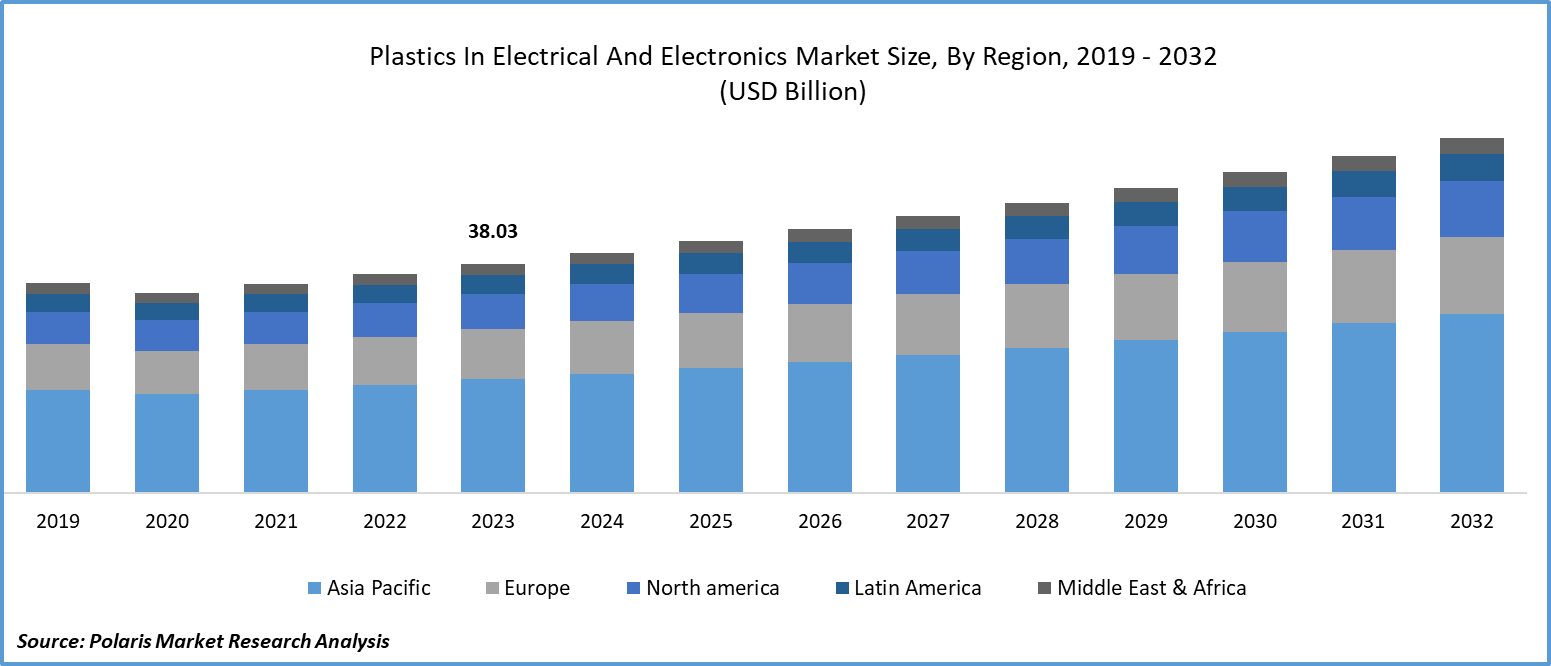

Regional Insights

Asia Pacific region dominated the global market in 2024

The Asia Pacific region dominated the global market. Region’s dominance is accelerated by greater demand for high-quality medical devices in emerging economies and a rise in the number of consumer electronics users. Some APAC countries are increasingly implementing supportive policies or initiatives that promote the electronic and manufacturing sectors, which, in turn, creates a positive environment for market growth.

The North American region will grow at the highest growth rate. The region’s growth is attributable to the region’s growing adoption of smart home devices and increasing consumer preference for sleek and aesthetically appealing consumer electronics that require plastics. Also, the increasing adoption of electric vehicles in the region fosters market growth, as demand for plastic in the manufacturing of various important components of these vehicles, such as insulators and connectors, is growing significantly.

- For instance, as per a report by the International Energy Agency, the total electric car sales in the United States rose by 55% in 2022, and the country accounted for 10% of global growth in the sales of EV cars.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The plastics in the electrical and electronics market are moderately competitive and are anticipated to witness competition due to several players' presence. Key companies are competing on factors such as improving the durability and reliability of their products or materials, enhancing consistency in processing techniques, new product development, and technological integration, which all help them gain a competitive edge in the market and consolidate their position.

Some of the major players operating in the global market include:

- Arkema SA

- BASF SE

- Bayer AG

- Chevron Phillips Chemical Company LLC

- Covestro AG

- Dow Inc.

- DuPont de Nemours Inc.

- LANXESS AG

- LG Chem Ltd.

- Mitsubishi Chemical Holdings Corporation

- PolyOne Corporation

- SABIC

- Teijin Limited

Recent Developments in the Industry

- In April 2024 – Trinseo debuts halogen-free PC & PC/ABS resins with recycled content

- In September 2023, Mitsubishi Chemical Group announced that they have partnered with two Europe-based firms in order to develop lightweight polymer composite battery enclosures for EVs. The company used several composite materials in the enclosure and also included an extra layer of MAFTEC-brand polycrystalline insulative material.

- In October 2023, Covestro introduced a new mechanical recycling polycarbonate compounding facility in China and is committed to supplying 60,000 tons of recycled polycarbonates annually in the APAC by 2026. The line is set to produce 25,000 tons of high-quality polycarbonates & blends annually.

Report Coverage

The plastics in electrical and electronics market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and market trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, polymer, application, and their futuristic growth opportunities.

Plastics in Electrical and Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 85.6 billion |

|

Revenue Forecast in 2034 |

USD 157.5 billion |

|

CAGR |

7.45% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global plastics in electrical and electronics market size is expected to reach USD 157.5 billion by 2034

Key players in the market are LANXESS AG, Covestro AG, BASF SE, Arkema SA, LG Chem Ltd

Asia Pacific contribute notably towards the global plastics in electrical and electronics market

Plastics in electrical and electronics market exhibiting a CAGR of 7.45% during the forecast period.

The plastics in electrical and electronics market report covering key segments are polymer, application, and region.