Point of Care Lipid Test Market Size, Share, Trends, Industry Analysis Report

By Product (Instruments, Consumables), By Application, By Disease Indication, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6107

- Base Year: 2024

- Historical Data: 2020-2023

Overview

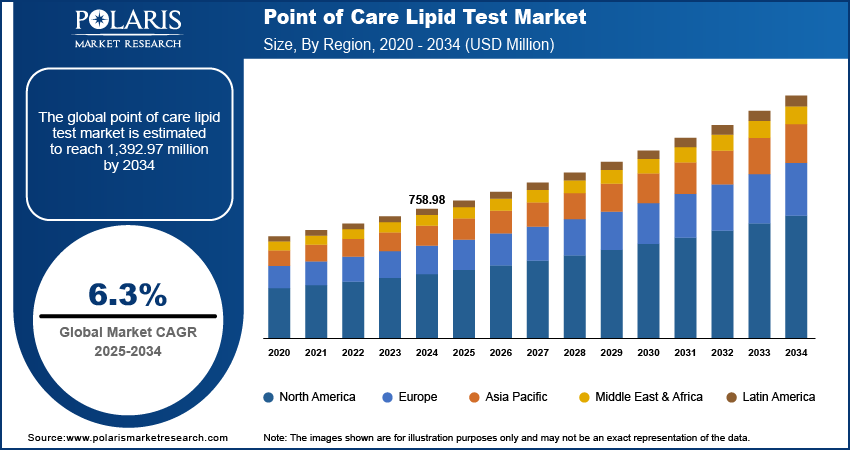

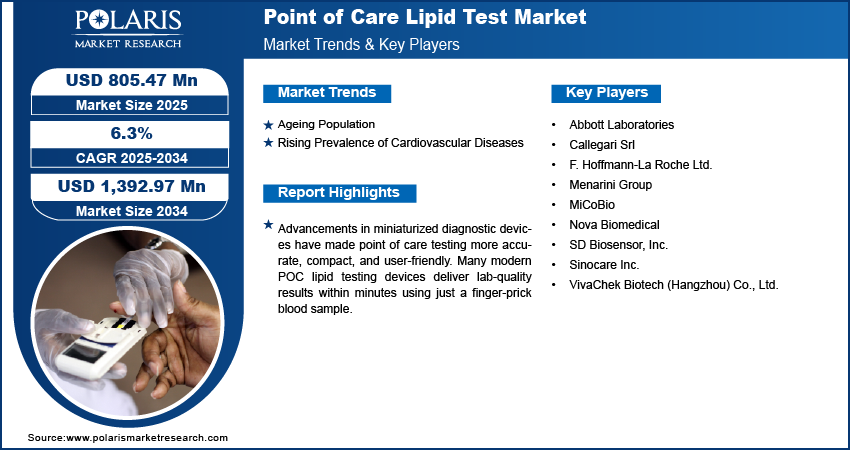

The global point of care lipid test market size was valued at USD 758.98 million in 2024, growing at a CAGR of 6.3% from 2025 to 2034. The market growth is driven by increasing ageing population across the world and rising prevalence of cardiovascular diseases.

Key Insights

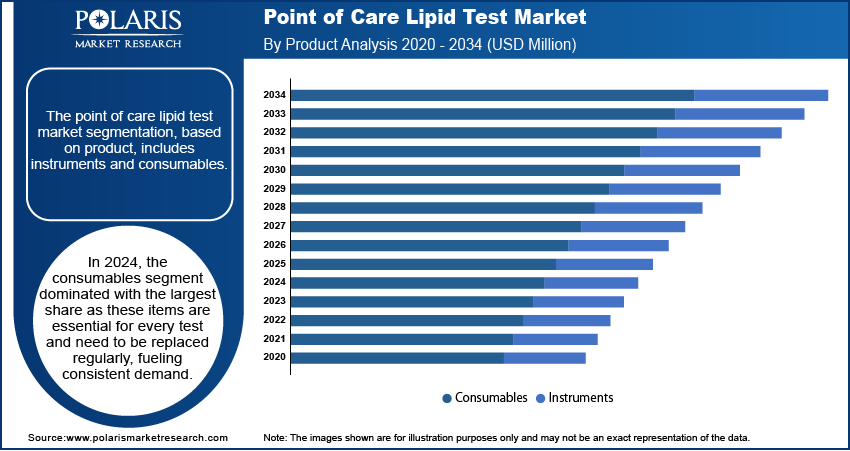

- In 2024, the consumables segment dominated with a larger share, as these items are essential for every test and need to be replaced regularly.

- The hypertriglyceridemia segment is expected to experience significant growth during the forecast period, as hypertriglyceridemia is becoming increasingly common due to rising obesity rates.

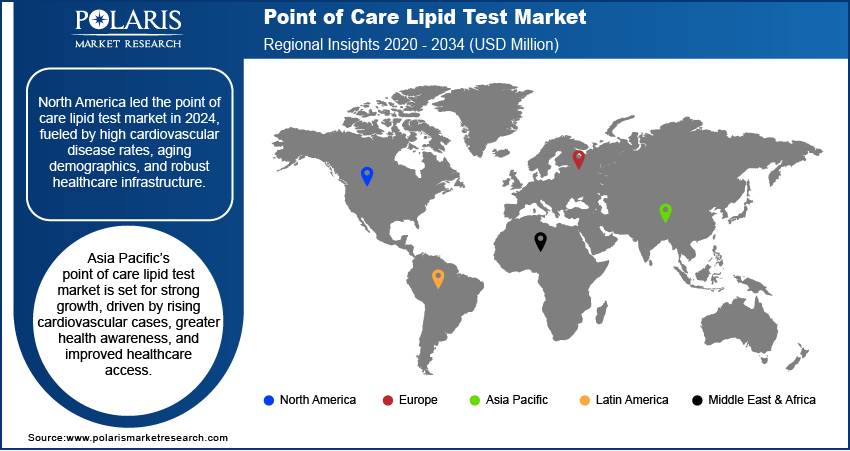

- North America dominated with the largest share in 2024, driven by rising cardiovascular disease prevalence, an aging population, and well-established healthcare infrastructure.

- The industry in the U.S. is expected to witness significant growth during the forecast period, due to its strong emphasis on preventive healthcare and early disease detection.

- The Asia Pacific industry is projected to witness substantial growth during the forecast period, driven by increasing cardiovascular disease cases, growing health awareness, and expanding access to healthcare services.

Industry Dynamics

- Rising ageing population drives the demand for point of care testing devices.

- Increasing prevalence of cardiovascular disease is fueling the POC lipid test market growth.

- Advancements in miniaturized diagnostic devices have made point of care testing more accurate, compact, and user-friendly.

- Limited accuracy and variability in test results compared to laboratory-based lipid testing restrain the widespread adoption of point of care lipid tests.

Market Statistics

- 2024 Market Size: USD 758.98 million

- 2034 Projected Market Size: USD 1,392.97 million

- CAGR (2025–2034): 6.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A point of care (POC) lipid test is a diagnostic tool used to measure lipid levels such as total cholesterol, HDL, LDL, and triglycerides, directly at the site of patient care. It provides rapid results from a small blood sample, often within minutes, without needing a central laboratory. This enables immediate clinical decision-making, especially in managing cardiovascular risk and monitoring lipid-related conditions.

Healthcare systems around the world are increasingly adopting decentralized models, where services are provided closer to the patient rather than centralized in hospitals. This is especially important in remote or underserved areas where access to full lab testing is limited. Point of care lipid tests fill this gap by offering fast, reliable results without the need for specialized lab equipment. They are used in community clinics, mobile health units, and at-home care settings. The demand for accessible diagnostic tools such as POC lipid tests rises as healthcare delivery becomes more patient-centric, thereby driving the growth.

Advancements in miniaturized diagnostic devices have made point of care testing more accurate, compact, and user-friendly. Many modern POC lipid testing devices deliver lab-quality results within minutes using just a finger-prick blood sample. These innovations are especially helpful in non-traditional settings such as pharmacies, rural clinics, and even at home. Additionally, the integration of Bluetooth, cloud connectivity, and mobile apps allows easy tracking and sharing of results. Such technological improvements have boosted the appeal of POC lipid tests, making them a popular choice for healthcare providers and patients alike.

Drivers and Opportunities

Ageing Population: The population of older adults is growing as global life expectancy increases. According to Eurostat, as of 2024, ~449.3 million people in Europe alone are aged 65 years and above. This age group is more prone to chronic diseases such as heart disease, diabetes, and high cholesterol. Managing these conditions requires regular monitoring of lipid levels. Point of care lipid tests offer a simple and fast way to do this, making them highly suitable for geriatric care. Moreover, these tests support ongoing disease management and help reduce complications through timely interventions. POC lipid testing is becoming a major part of long-term healthcare strategies with chronic disease burden rising worldwide, especially among the elderly, thereby boosting the industry expansion.

Rising Prevalence of Cardiovascular Diseases: Cardiovascular diseases (CVDs) are among the leading causes of death worldwide. Various factors such as poor diet, sedentary lifestyles, and increasing age can cause CVD. According to the Government of Canada, 1 in 12 Canadian with age 20 years and above are diagnosed with heart disease. Regular monitoring of lipid levels, especially cholesterol and triglycerides, is essential for early detection and prevention. Point of care lipid tests allow healthcare providers to quickly assess cardiovascular risk without sending samples to a lab, making them especially valuable in emergency and primary care settings. The demand for rapid and accessible testing solutions continues to grow as heart disease rates rise globally, thereby fueling the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes instruments and consumables. In 2024, the consumables segment dominated with a larger share as these items are essential for every test and need to be replaced regularly, fueling consistent demand. Healthcare facilities, clinics, and pharmacies rely on consumables for day-to-day testing, especially in high-volume settings. Additionally, the convenience and low cost of disposable components make them the preferred choice for quick lipid screenings. Moreover, the increase in testing frequency with rising cardiovascular awareness fuels the segment growth.

Application Analysis

The segmentation, based on application, includes hyperlipidemia, hypertriglyceridemia, tangier disease, hyperlipoproteinemia, familial hypercholesterolemia, and others. The hypertriglyceridemia segment is expected to experience significant growth during the forecast period as hypertriglyceridemia is becoming increasingly common due to rising obesity rates, poor dietary habits, and sedentary lifestyles. It is often a symptom of broader metabolic issues such as diabetes and cardiovascular disease, making early diagnosis crucial. Point-of-care lipid tests offer a rapid and efficient way to detect elevated triglyceride levels, enabling healthcare providers to start treatment or lifestyle interventions immediately. Additionally, these tests are particularly valuable in outpatient clinics, rural health centers, and during community screenings. The demand for POC lipid tests targeting hypertriglyceridemia is expected to grow significantly in the coming years as awareness increases and screening guidelines expand, thereby fueling the segment growth.

Disease Indication Analysis

The segmentation, based on disease indication, includes lipid and lipoprotein disorders, atherosclerosis, liver and renal diseases, diabetes mellitus, and others. The atherosclerosis segment is expected to experience significant growth during the forecast period as lipid testing plays a vital role in diagnosing and monitoring this condition. Point-of-care lipid tests allow for quick assessment of lipid profiles, making it easier for clinicians to evaluate cardiovascular risk and initiate timely intervention. The demand for rapid and accessible lipid testing is rising with an increasing emphasis on preventive cardiology and regular health screenings, especially in aging populations, thereby boosting the segment growth.

End Use Analysis

The segmentation, based on end use, includes hospitals, clinics, research and diagnostic laboratories, and others. The hospital segment dominated with the largest share in 2024, due to their need for quick diagnostic turnaround, especially in emergency and cardiac care settings. Hospitals benefit from POC lipid testing to make faster treatment decisions without relying on central labs, particularly in critical care or outpatient clinics. Their ability to handle high test volumes and their integration of diagnostic workflows support the adoption of rapid lipid testing devices. Additionally, hospitals have the infrastructure and trained staff to implement and manage these technologies effectively, positively impacting the segment growth.

Regional Analysis

North America Point of Care Lipid Test Market Trends

North America dominated the global market with the largest share in 2024, driven by rising cardiovascular disease prevalence, an aging population, and well-established healthcare infrastructure. The region benefits from widespread awareness about preventive care and routine cholesterol screening. Strong insurance coverage, rapid adoption of advanced diagnostic devices, and a growing emphasis on decentralized healthcare contribute to growth. Additionally, government support for heart health initiatives and frequent product innovations further demand for POC lipid tests. Moreover, the need for fast, accurate lipid testing continues to expand across hospitals, clinics, and home care settings with a high rate of diabetes and obesity, fueling the growth.

U.S. Point of Care Lipid Test Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, due to its strong emphasis on preventive healthcare and early disease detection. The country has high testing volumes, especially for lipid profiles, owing to widespread public awareness and chronic disease burden. Advanced medical technologies, favorable reimbursement policies, and the presence of major players support rapid adoption. Additionally, point of care testing is increasingly used in primary care, pharmacies, and even at home, making cholesterol monitoring more accessible. The demand for efficient, on-the-spot lipid testing in the U.S. is growing as healthcare continues to shift toward value-based models, driving the growth.

Asia Pacific Point of Care Lipid Test Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period, driven by increasing cardiovascular disease cases, growing health awareness, and expanding access to healthcare services. Countries across the region are investing in early diagnosis tools to reduce the burden of chronic diseases. Additionally, rising disposable incomes, urbanization, and government health programs are encouraging more frequent health screenings. Mobile clinics and decentralized care models are gaining popularity, especially in rural and underserved areas. Moreover, a large population base and rising incidence of diabetes and obesity further drives the growth in Asia Pacific.

China Point of Care Lipid Test Market Overview

The China industry is projected to witness rapid growth during the forecast period due to its large population and increasing focus on public health. Lifestyle changes have led to a surge in heart disease and metabolic disorders, boosting the need for regular lipid testing. The government’s push toward community-based healthcare and early diagnostics has encouraged the adoption of POC testing tools in local clinics and health centers. Domestic manufacturers are further making affordable, innovative devices more available. The demand for fast, accessible lipid testing is rising as China continues to modernize its healthcare infrastructure, fueling the growth.

Europe Point of Care Lipid Test Market Insights

The industry in Europe is expected to grow rapidly in the future, driven by its advanced healthcare systems, aging population, and increasing burden of cardiovascular diseases. Preventive care is a priority across many European nations, leading to widespread adoption of rapid diagnostic tools. The European Union’s focus on reducing chronic disease mortality has encouraged early screening and decentralized testing, especially in primary care settings. Additionally, strong support from healthcare policies and reimbursement frameworks facilitates the integration of POC testing. Moreover, rising health consciousness and demand for personalized care are further fueling growth across the region.

Germany Point of Care Lipid Test Market Outlook

The market in Germany is expected to experience significant growth due to its strong medical infrastructure and emphasis on early disease detection. The country’s large aging population, combined with a high incidence of cardiovascular conditions, increases the need for accessible lipid testing. POC devices are commonly used in ambulatory care service clinics and general practitioner (GP) offices, where fast results help guide treatment. Additionally, Germany’s support for innovation in diagnostic technology and digital healthcare integration further boosts the adoption.

Key Players and Competitive Analysis

The competitive landscape of the industry is characterized by a mix of global healthcare giants and specialized diagnostic companies, each striving for innovation, accuracy, and accessibility. Abbott Laboratories and F. Hoffmann-La Roche Ltd. lead the space with robust R&D pipelines, strong global distribution networks, and trusted brand presence. Nova Biomedical and SD Biosensor, Inc. offer technologically advanced analyzers with rapid testing capabilities, gaining popularity in both clinical and decentralized settings. Sinocare Inc. and VivaChek Biotech are expanding their market share, particularly in Asia Pacific, through cost-effective, portable solutions tailored for emerging markets. Menarini Group and Callegari Srl focus on integrated diagnostic systems with user-friendly interfaces, ideal for primary care and home use. Startups such as MiCoBio are innovating through biosensor technology and connectivity features. Overall, competition revolves around improving test accuracy, reducing turnaround time, and integrating digital health tools for real-time data sharing and chronic disease management.

Key Players

- Abbott Laboratories

- Callegari Srl

- F. Hoffmann-La Roche Ltd.

- Menarini Group

- MiCoBio

- Nova Biomedical

- SD Biosensor, Inc.

- Sinocare Inc.

- VivaChek Biotech (Hangzhou) Co., Ltd.

Point of Care Lipid Test Industry Development

In May 2024, Roche launched the Tina-quant Lp(a) RxDx assay after receiving FDA Breakthrough Device Designation, enabling precise measurement of lipoprotein (a) levels to identify patients at risk of cardiovascular disease and support future Lp(a)-lowering therapies.

Point of Care Lipid Test Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Instruments

- Consumables

By Application Outlook (Revenue, USD Million, 2020–2034)

- Hyperlipidemia

- Hypertriglyceridemia

- Tangier Disease

- Hyperlipoproteinemia

- Familial Hypercholesterolemia

- Others

By Disease Indication Outlook (Revenue, USD Million, 2020–2034)

- Lipid and Lipoprotein Disorders

- Atherosclerosis

- Liver and Renal Diseases

- Diabetes Mellitus

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Clinics

- Research and Diagnostic Laboratories

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Point of Care Lipid Test Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 758.98 Million |

|

Market Size in 2025 |

USD 805.47 Million |

|

Revenue Forecast by 2034 |

USD 1,392.97 Million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 758.98 million in 2024 and is projected to grow to USD 1,392.97 million by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Abbott Laboratories; Callegari Srl; F. Hoffmann-La Roche Ltd.; Menarini Group; MiCoBio; Nova Biomedical; SD Biosensor, Inc.; Sinocare Inc.; and VivaChek Biotech (Hangzhou) Co., Ltd.

The consumables segment dominated the market share in 2024.

The hypertriglyceridemia segment is expected to witness the significant growth during the forecast period.