Point-of-Use Water Treatment Systems Market Share, Size, Trends, Industry Analysis Report

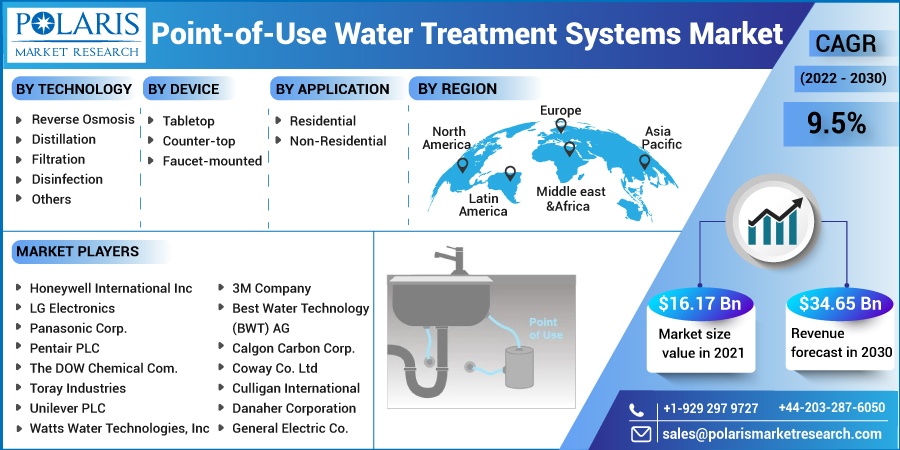

By Technology (RO, Distillation, Filtration, Disinfection, Others); By Device; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 118

- Format: PDF

- Report ID: PM2474

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

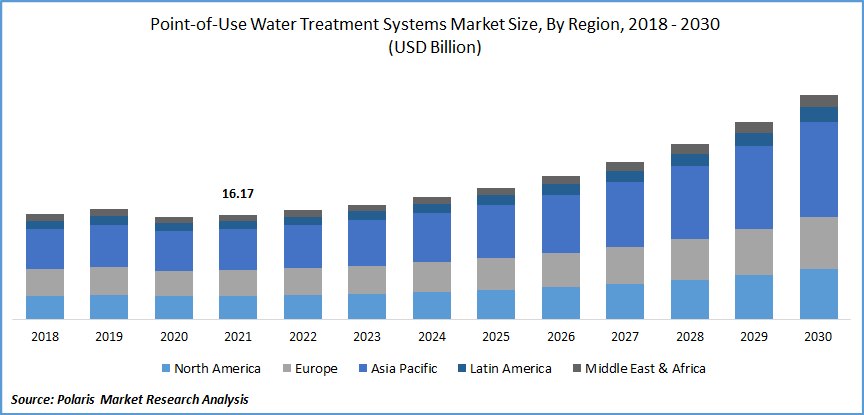

The global point-of-use water treatment systems market was valued at USD 16.17 billion in 2021 and is expected to grow at a CAGR of 9.5% during the forecast period. The point-of-use water treatment systems market is anticipated to witness substantial growth due to the rising demand for fresh and clean drinking water, increasing contamination, budding population, and rising awareness about the advanced and innovative treatment methods.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

These water treatments are mounted in residential and non-residential areas as single connections, usually under the kitchen sink, in faucets, and under bathroom showers, among others, for removing hard water. The point-of-use systems can be considered an ideal solution for softening treatment against harsh or contaminated water at home or in light commercial buildings, as the alternative is very limited.

Moreover, the development of smart point-of-use systems has been a significant trend recently. For instance, adopting the Internet of Things (IoT) has enabled such point-of-use purification systems to emerge as a technological trend in the water treatment industry. These smart purifiers are replaced the conventional and ultraviolet purification systems.

Furthermore, these smart purification products are compact and designed so that they can be operated through smartphones. These point-of-use systems also inform the users about the expiry and replacement of such filters and track the daily consumption to prevent wastage.

The outbreak of the COVID-19 pandemic has significantly impacted the market growth for point-of-use water treatment equipment. During the pandemic, people are more concerned and cautious about their health and well-being, hence taking extreme precautions for their safety. Therefore, during and post lockdown, there has been a significant increase in the demand for point-of-use treatment equipment in the residential sector.

However, point-of-use water treatment equipment incurs high equipment costs. Also, installing the same is an expensive procedure, which in turn is leading to the primary restraining factors to the growth of this market. Moreover, countries worldwide have imposed stringent government regulations in providing eco-friendly point-of-use treatment equipment; therefore, the players or companies are focusing on manufacturing the same.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

There has been an increase in contamination worldwide due to industrial activities spreading toxic chemicals and microbial pathogens. Therefore, people are more likely to adopt purifier systems in residential areas, which would filter the impure substances available in H2O, and will prevent the health of individuals.

Therefore, this will act as a driving factor for the global point-of-use treatment systems market over the forecast period. Favorable government laws to ensure the supply of clean and potable drinking water are further expected to augment business growth in the coming years.

Further, there have been government initiatives for a substantial reduction in the cost of raw materials and components, which would further boost the market growth and encourage higher adoption of treatment systems to prevent an epidemic of liquid-borne diseases.

Report Segmentation

The market is primarily segmented based on technology, device, application, and region.

|

By Technology |

By Device |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Reverse Osmosis (RO) technology accounted for the largest market share in 2021

RO technology of point-of-use systems is a process of purifying contamination with impure and harsh substances and pesticides and also helps eliminate harmful minerals such as calcium, radium, sulfate, and others from the main liquid.

Generally, RO systems are combined with an activated and mechanical carbon filter, wherein the sand and other particles are eliminated from the mechanical filter first and then through an activated carbon filter to remove organic compounds. The Reverse Osmosis (RO) technology incurs higher efficiency, enhanced capacity, and economic costs in comparison with other technology, boosting the growth of this market.

Counter-top accounted for the largest market share in 2021

Based on devices, the counter-top units are projected to be the largest in the point-of-use water treatment systems market. These filters are fitted on the counter and are directly connected to the faucet. They consist of a diverter, allowing users to switch between unfiltered and filtered.

Counter-top point-of-use units operate on reverse osmosis as well as activated carbon technologies. These filters reduce contaminants, such as bacteria, dirt, chlorine, particulates, rust, lead, mercury, sediment, copper, benzene, cadmium, and cysts. The significant advantage of counter-top units is that they do not require frequent filter changes. However, they need some plumbing.

Residential sector is expected to hold the significant revenue share

The demand for point-in-use treatment systems in the residential sector is increasing mainly to produce filtered and pure drinking H2O for domestic consumption. The residential treatment application is projected to witness high growth due to the increasing need for treated drinking water, eliminating unpleasant taste, odor, and discoloration, biodegradable organics, and pathogenic bacteria.

The Asia Pacific region lead the global point-of-use water treatment systems market by 2030

The Asia Pacific region accounted for the largest market share in 2021. The smart purifier is primarily driven by India, China, and ASEAN countries undergoing measures to treat H2O-related diseases, increase in rapid urbanization, and economic development.

The increasing population in these countries represents a massive customer base. Further, inadequate treatment infrastructures at municipal treatment facilities have increased the adoption of such devices in the household, especially point-of-use systems in countries such as India and China.

Competitive Insight

Some of the major players operating in the global point-of-use systems market include 3M Company, BWT AG, Calgon Carbon Corporation, Coway Co. Ltd, Culligan International, Danaher Corporation, General Electric Company, Honeywell International Inc, LG Electronics, Panasonic Corporation,

Pentair PLC, The Dow Chemical Company, Toray Industries, Unilever PLC, and Watts Water Technologies, Inc. are expanding their presence across various geographies. These companies are entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products to cater to the growing consumer demands.

Recent Developments

In October 2021, Unilever PLC launched a new product line of Pureit. The product Pureit 5 series helped in high-performance filtration technology. This enables purification by reducing germs and bacteria and eliminating up to 90% of total dissolved solids and heavy metals.

In December 2019, Kent RO Systems introduced a purifier with zero-waste technology. This product was launched to reduce wastage and to keep the minerals intact. In October 2017, Honeywell International Inc. launched a new product, tabletop purifier & dispenser, under their purifier category. This purifier helped remove 99.97% of bacteria and chlorine from drinking water.

Point-of-Use Water Treatment Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 16.17 billion |

|

Revenue forecast in 2030 |

USD 34.65 billion |

|

CAGR |

9.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Technology, By Device, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3M Company, Best Water Technology (BWT) AG, Calgon Carbon Corporation, Coway Co. Ltd, Culligan International, Danaher Corporation, General Electric Company, Honeywell International Inc, LG Electronics, Panasonic Corporation, Pentair PLC, The DOW Chemical Company, Toray Industries, Unilever PLC, Watts Water Technologies, Inc |