Polymer Foam Market Share, Size, Trends, Industry Analysis Report

By Type (Polyurethane, Polystyrene, Polyethylene, Polyvinyl Chloride and Others) By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4431

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

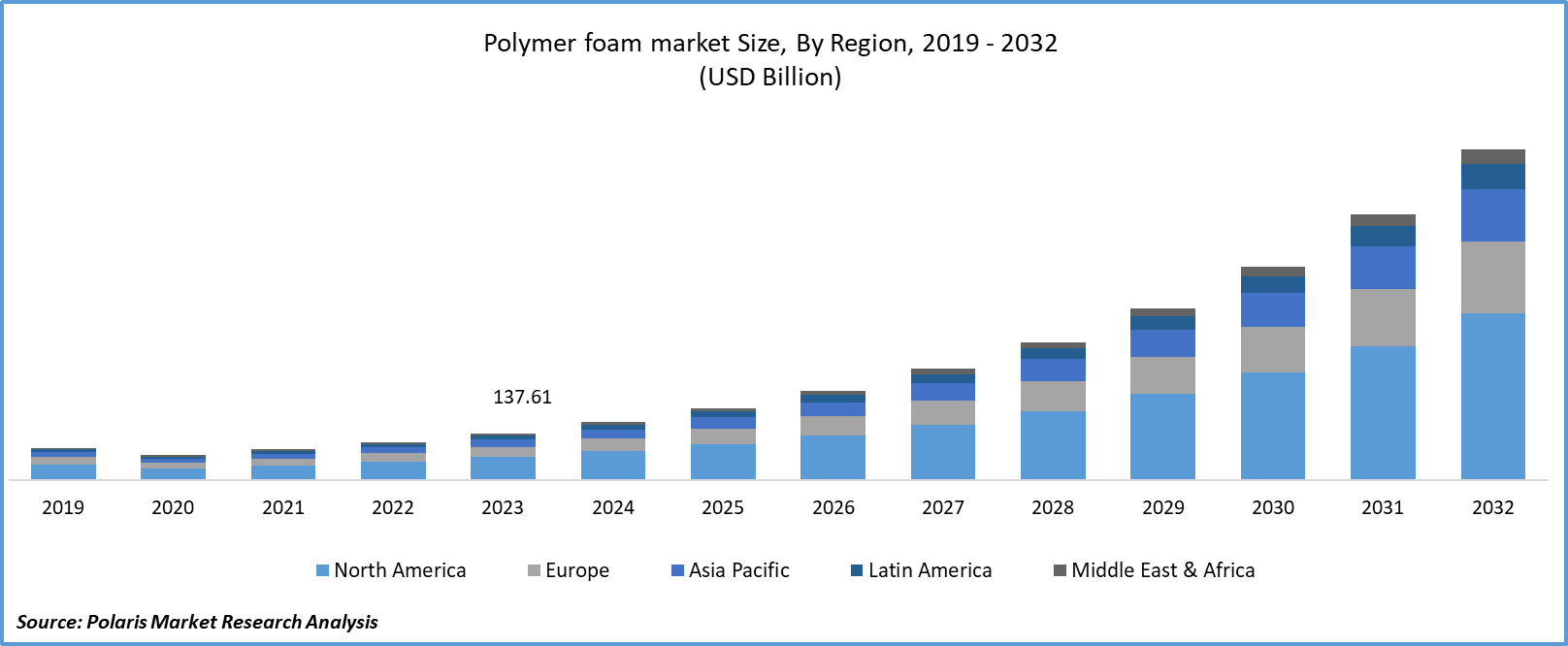

Polymer foam market size was valued at USD 137.61 billion in 2023. The market is anticipated to grow from USD 170.61 billion in 2024 to USD 969.09 billion by 2032, exhibiting a CAGR of 24.2% during the forecast period.

Industry Trends

Polymer foams are lightweight materials derived from polymers, large molecules composed of repeated subunits that have been processed to form a cellular structure with voids or bubbles. It finds applications in various industries due to its unique properties, such as low density, thermal insulation, buoyancy, and shock absorption. Common polymers used to manufacture foams include polyurethane foam, polystyrene, polyethylene, polypropylene, bio-based polyurethane and PVC (polyvinyl chloride). These materials are widely used in sectors such as packaging, construction, automotive, aerospace, and more.

The market is expanding at a rapid rate and is in a high stage. Due to the rapid technological advancements brought about by factors like improvements in the production of polymer foams, the availability of raw materials, and rising plastic consumption across a variety of applications, including packaging, building & construction, and automotive, among others, the polymer foam market is characterized by a high degree of innovation. As a result, creative uses for recycled plastics are continually developing, upending established markets and establishing new ones.

Moreover, the Polymer foam industry reports and market analyses may see growth in the polymer foam market due to collaborations and partnerships that have shaped the market landscape. Collaborations like these are crucial for driving innovation in the materials industry, especially in sectors like building insulation, where the demand for sustainable solutions is increasing. By combining expertise and resources, companies can develop products that meet both performance requirements and environmental standards.

- In September 2023, in order to enhance building thermal insulation, Covestro and the Polish Selena Group worked together to create a range of polyurethane (PU) foams that are more environmentally friendly.

Using the mass balancing approach, the material is ISSC Plus certified to contain plant-based feedstocks, resulting in a 60% reduction in carbon footprint compared to competitors derived from fossil fuels.

To Understand More About this Research: Request a Free Sample Report

Major challenges are impacting market dynamics by issues like manufacturers having to adhere to stringent guidelines regarding the use of specific foam types due to rising environmental regulations and standards.

However, polymer foams are known for their low density, making them desirable for applications where weight is a critical factor. Industries such as automotive and aerospace benefit from the use of lightweight materials to enhance fuel efficiency and overall performance. This results in increasing demand for polymer foam material and significant increases in the polymer foam market.

Key Takeaways

- The Asia Pacific is expected to grow at the highest CAGR during the forecast period

- By type category, the polyvinyl chloride segment accounted for the largest market share in 2023

- By application category, the building and construction segment is projected to grow at fastest CAGR during the forecast period.

What are the market drivers driving the demand for Polymer Foam market?

Rising constructions and infrastructural development

The market for polymer foams, particularly for insulation purposes, is propelled by the increasing construction and infrastructural development activities in the industry. The growing global construction initiatives result in an elevated demand for insulation materials, with polymer foams being a preferred choice. In the automotive and transportation sectors, where enhancing fuel efficiency and minimizing emissions is pivotal, the use of lightweight materials is crucial. Polymer foams, particularly those characterized by high strength-to-weight ratios, are employed in various in-vehicle components to address these efficiency and environmental concerns.

Furthermore, the polymer foam market's future scope is to increase by increasing the advancement in infrastructure expansion activities and growth in the number of strategic partnerships among prominent companies, along with the recent technological advancements, which decrease the production cost of the product while advancing profitable opportunities to the market, will further create huge growth opportunities for polymer foams in the forecast period.

Which factor is restraining the demand for polymer foam?

Environmental concerns

Although eco-friendly foam materials are being developed, some polymer foams may still be criticized for their environmental effects. Environmentally conscious consumers and regulatory agencies may be concerned about issues pertaining to recycling, disposal, and the use of non-renewable resources in the production of foam. Fire safety regulations may restrict the use of certain polymer foams in particular applications due to their susceptibility to combustion. It can be not easy to develop noncombustible foams or substitute materials that adhere to safety regulations.

Report Segmentation

The market is primarily segmented based on type, application and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the basis of polyurethane, polystyrene, polyethylene, polyvinyl chloride, and others. Polyvinyl chloride accounted for the largest polymer foam market share in 2023 due to its versatility and its use in various applications, including construction, automotive, packaging, and furniture. Its adaptability to different industries contributes to its market dominance. PVC foam offers good insulation properties, making it suitable for applications where thermal insulation is crucial. This characteristic is particularly valuable in the construction industry for insulation purposes which result to see the market growth in the upcoming years.

By Application Insights

Based on application analysis, the market has been segmented on the basis of automotive, building and construction, packaging, furniture, appliances, and others. The building and construction segment is expected to grow at the fastest CAGR during the forecast period. Polymer foams, such as polyurethane and polystyrene, are widely used in the construction industry for thermal insulation purposes. These materials offer effective insulation against heat transfer, contributing to energy efficiency in buildings.

The lightweight properties of polymer foams make them desirable for construction and building applications. They help reduce the overall weight of structures, which can be beneficial in terms of construction speed, transportation, and load-bearing considerations. Government and private investments in infrastructure projects, including residential and commercial buildings, can boost the demand for the polymer foams market in the construction sector.

Regional Insights

Asia Pacific

The Asia Pacific is expected to grow at the highest CAGR during the forecast period in the polymer foam market due to the rapid urbanization of the world, the rise in building activity, and the growing demand for consumer goods and packaging in countries like China, India, and Japan. The demand for polymer foams has surged due to the growing middle-class population's increased consumption of consumer goods and their increased need for efficient packaging solutions. Moreover, a few countries in the area have established advantageous policies and incentives to support businesses that use eco-friendly, lightweight materials like polymer foams.

The expanding middle-class demographic has led to a rise in consumer goods consumption and an increased requirement for efficient packaging solutions, consequently driving the demand for polymer foams. Moreover, specific countries in the region have implemented favorable government regulations and incentives to support businesses utilizing lightweight and environmentally friendly materials, including polymer foams. Additionally, the region benefits from a robust manufacturing base for polymer foams, further facilitating its growth and opportunities across various end-use sectors.

Competitive Landscape

The polymer foam market is characterized by a dynamic interplay among key market players, each vying for market share through strategic initiatives and innovations. As the demand for polymer foams continues to grow across diverse industries, the competitive environment is marked by factors such as product development, technological advancements, partnerships, and geographical expansion.

Some of the major players operating in the global market include:

- Arkema Group

- Armacell International S.A.

- BASF SE

- Borealis AG

- JSP Corporation

- Polymer Technologies, Inc

- DowDuPont, Inc.

- Trelleborg AB

- Zotefoams plc

- Rogers Corporation

Recent Developments

- In December 2023, Irgastab PUR 71, a state-of-the-art antioxidant from BASF, enhances polyol and polyurethane foam performance and compliance with regulations. The limitations of conventional anti-scorch additives have been effectively addressed by this premium solution, which has been designed without aromatic amine. This solution satisfies the industry's growing regulatory requirements on substance classification and sustainability thanks to its excellent environmental, health, and safety profile.

Report Coverage

The polymer foam market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, applications, and their futuristic growth opportunities.

Polymer Foam Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 170.61 billion |

|

Revenue forecast in 2032 |

USD 969.09 billion |

|

CAGR |

24.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Polymer Foam Market are Arkema Group, Armacell International S.A., BASF SE, Borealis AG, JSP Corporation, Polymer Technologies, Inc

Polymer foam market exhibiting the CAGR of 24.2% during the forecast period.

The Polymer Foam Market report covering key segments are type, application and region.

key driving factors in Polymer Foam Market are rising constructions and infrastructural development

The global polymer foam market size is expected to reach USD 12.25 billion by 2032