Printing Inks Market Size, Share, Trends, Industry Analysis Report

: By Product (Gravure, Flexographic, Lithographic, Digital, Others), By Resin, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM1499

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

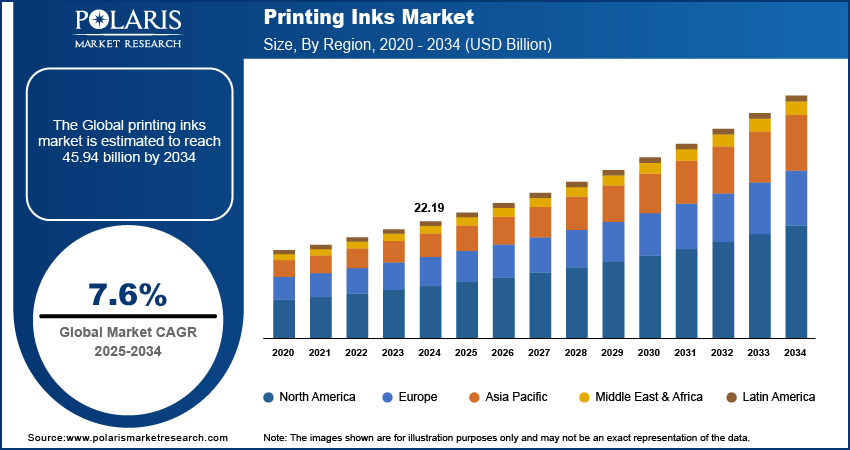

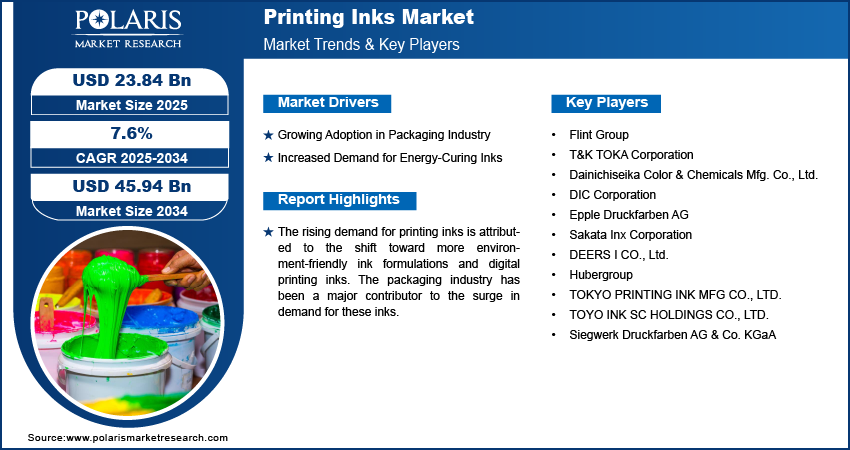

The global printing inks market size was valued at USD 22.19 billion in 2024, exhibiting a CAGR of 7.6% from 2025 to 2034. The market is growing due to increasing packaging needs, the development of eco-friendly inks, innovations in digital ink, and the rise of energy-curing inks that enhance quality and efficiency.

Key Insights

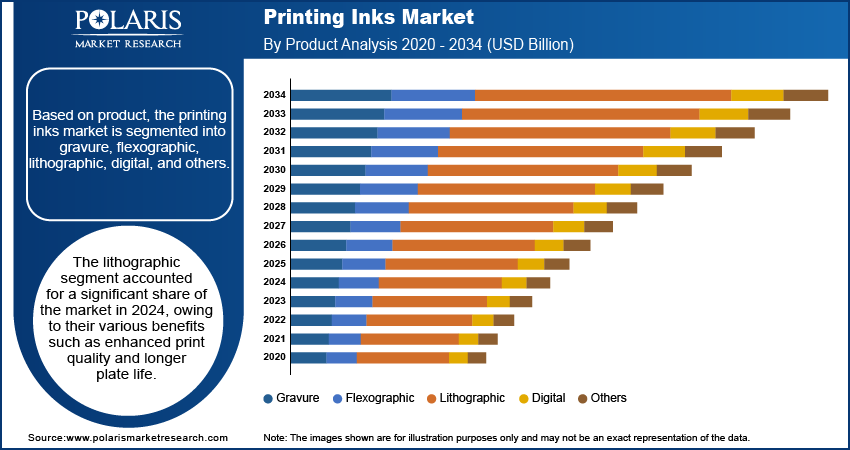

- The lithographic segment is expected to lead the market in 2024, thanks to advantages such as enhanced print quality and extended plate life.

- The most extensive and fastest-growing application is packaging & labels, fueled by growing middle-class demand for stylish, convenient, and environmentally friendly packaging.

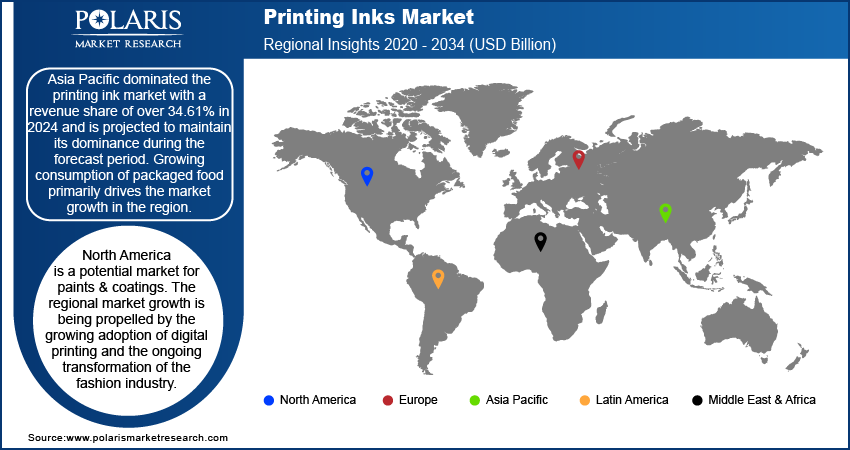

- Asia Pacific dominated the market with a revenue share of 34.61% in 2024, driven by increasing packaged food consumption and advancements in the packaging and labeling sectors.

- Growth is being experienced in North America due to a turnaround in construction, manufacturing, digital printing, and the changing fashion industry.

Industry Dynamics

- Digital ink has revolutionized the printing ink industry, driven by global advancements in print speed and quality.

- The increased application of printing ink in the packaging sector is stimulating market demand.

- The enhanced characteristics of energy-curing inks, including improved print quality, reduced energy consumption, and zero VOC emissions, are driving their increased demand and expanding the printing inks industry.

- One of the major restraints in the printing inks industry is the increasing price of raw materials, which may restrict affordability and impact production costs.

Market Statistics

2024 Market Size: USD 22.19 billion

2034 Projected Market Size: USD 45.94 billion

CAGR (2025-2034): 7.6%

Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Printing inks are specialized chemical compounds used to transfer text, images, or designs onto paper, fabric, cardboard, and other packaging materials. They are made of various materials, including pigments, binders, solvents, and additives. Offset inks, liquid inks, digital inks, energy-curable inks, and sublimation inks are a few most commonly used printing ink types.

Printing ink demand is expected to benefit from the shift toward more environment-friendly ink formulations and digital printing inks. The packaging industry has been a major contributor to the surge in demand for printing inks. Raw material demand is anticipated to expand by around 2% annually till 2025. Colorants and additives are expected to see advancements in formulation, driven by the demand for high-performance printing inks with bright colors.

The advent of digital ink has been a remarkable technological advancement in the printing ink market in recent years. This progress is driven by significant developments within the digital technology space globally, including improvements in print speed and quality. In addition, the rise in the use of digital inks reflects a broader trend toward shorter run lengths and customization in several applications, ranging from commercial printings of inserts and direct mailings to the development of specialized designs for the textile industry.

Market Dynamics

Growing Adoption in Packaging Industry

In the past, printing inks were primarily used to print publications such as magazines and newspapers. With the rapid urbanization and increased demand for digitalized products, the application scope of printing inks has evolved significantly. Printing inks are now being used in the packaging industry to print information and graphics on packaging materials to make them more attractive and appealing to consumers. The use of printing inks offers a great way for product promotion and marketing. Thereby, the rising adoption of printing inks in the packaging industry drives the printing inks market growth.

Increased Demand for Energy-Curing Inks

Energy-curing inks, which are a form of printing inks, have gained increased traction in several sectors worldwide. These inks offer print quality that’s equal to or better than offset. Also, they cure instantly, reducing energy consumption and increasing throughput. Besides, energy-curing inks do not require solvents and can have zero VOC, which lowers emissions. Thus, the superior properties of energy-curing inks drive their demand, which positively impacts the printing inks market expansion.

Segment Insights

Market Outlook by Product Insights

The printing inks market segmentation, based on product, includes gravure, flexographic, lithographic, digital, and others. The lithographic segment accounted for a significant share of the market in 2024, owing to their various benefits such as enhanced print quality and longer plate life. Also, the use of lithographic inks results in lower ink consumption as compared to other ink types. Besides, they are suitable for printing on flat media such as paper, foil, plastic, and cardboard. Thus, the versatility and other benefits of lithographic printing inks drive their demand.

Market Assessment by Application Insights

The printing inks market segmentation, based on application, includes packaging & labels, publication & commercial printing, corrugated cardboards, and others. The packaging & labels segment is the largest and fastest growing application segment, accounting for over 44% of the total segment revenue share. The use of printing inks in packaging and labels has witnessed a significant rise over the past few years due to the increasing middle-class population and their preference for visually appealing products in countries such as Thailand and India. Other factors contributing to the segment’s robust growth include shifting consumer preferences toward convenient food packaging and online retailing and increasing demand for bio-degradable items.

Regional Analysis

The research report offers printing inks market insights into North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of over 34.61% in 2024 and is projected to maintain its dominance during the forecast period. Growing consumption of packaged food primarily drives the market growth in the region. Besides, the booming packaging and labeling industry, owing to the emergence of several companies across sectors such as healthcare, consumer goods, and e-commerce, supports the regional printing inks market demand.

North America, which rebounded significantly from its decline experienced during 2005–2010, is yet another potential market for paints & coatings. Regional product demand is expected to benefit from a highly improved outlook for building & construction and manufacturing activity in the region. The regional market is also being propelled by the growing adoption of digital printing and the ongoing transformation of the fashion industry.

Key Players and Competitive Insights

The leading players in the market are emphasizing research and development initiatives to improve their product offerings. Key market players are also undertaking various strategic initiatives such as mergers and acquisitions, and collaborations to expand their global reach. To expand and survive in a more competitive and rising market environment, the printing inks market players must offer innovative solutions.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients and increase the sector. In recent years, the printing inks market has witnessed several technological and innovation breakthroughs. A few key players in the market are Flint Group; T&K TOKA Corporation; Dainichiseika Color & Chemicals Mfg. Co., Ltd.; DIC Corporation; Epple Druckfarben AG; Sakata Inx Corporation; DEERS I CO., Ltd.; Hubergroup; TOKYO PRINTING INK MFG CO., LTD.; TOYO INK SC HOLDINGS CO., LTD.; and Siegwerk Druckfarben AG & Co. KGaA.

List of Key Companies

- Flint Group

- T&K TOKA Corporation

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- Epple Druckfarben AG

- Sakata Inx Corporation

- DEERS I CO., Ltd.

- Hubergroup

- TOKYO PRINTING INK MFG CO., LTD.

- TOYO INK SC HOLDINGS CO., LTD.

- Siegwerk Druckfarben AG & Co. KGaA

Printing Inks Industry Developments

March 2023: Toyo Ink Group and its subsidiary Toyo Ink (Thailand) Co., Ltd announced a share purchase agreement for the complete takeover of Thai Eurocoat Ltd. According to the Toyo Ink Group, Thai Eurocoat Ltd. will continue its operations as a business unit of Thailand-based Toyo Ink Ltd after the share transfer.

December 2022: ALTANA AG revealed the acquisition of a stake in technology startup SARALON. With the acquisition, ALTANA aims to strengthen its portfolio in printing electronic inks and prefabricated electronic components.

Printing Inks Market Segmentation

By Product Outlook

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

By Resin Outlook

- Modified Rosin

- Modified Cellulose

- Acrylic

- Polyurethane

- Others

By Application Outlook

- Packaging & Labels

- Corrugated Cardboards

- Publication & Commercial Printing

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Printing Inks Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.19 billion |

|

Market Size Value in 2025 |

USD 23.84 billion |

|

Revenue Forecast by 2034 |

USD 45.94 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The printing inks market size was valued at USD 22.19 billion in 2024 and is projected to grow to USD 45.94 billion by 2034.

The market is projected to register a CAGR of 7.6% from 2025 to 2034.

Asia Pacific accounted for the largest market share in 2024.

A few key players in the market are Flint Group, T&K TOKA Corporation, and Dainichiseika Color & Chemicals Mfg. Co., Ltd.; DIC Corporation; Epple Druckfarben AG; Sakata Inx Corporation; DEERS I CO., Ltd.; Hubergroup; TOKYO PRINTING INK MFG CO., LTD.; TOYO INK SC HOLDINGS CO., LTD.; and Siegwerk Druckfarben AG & Co. KGaA.

The lithographic segment accounted for a significant market share in 2024.

The packaging and labels segment is the fastest growing application segment in the market.