Propionic Acid Market Size, Share, Trends, Industry Analysis Report

: By Application (Animal Feed, Calcium and Sodium Propionate, Cellulose Acetate Propionate, Chemicals, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2024–2032)

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5124

- Base Year: 2023

- Historical Data: 2019-2022

Propionic Acid Market Overview

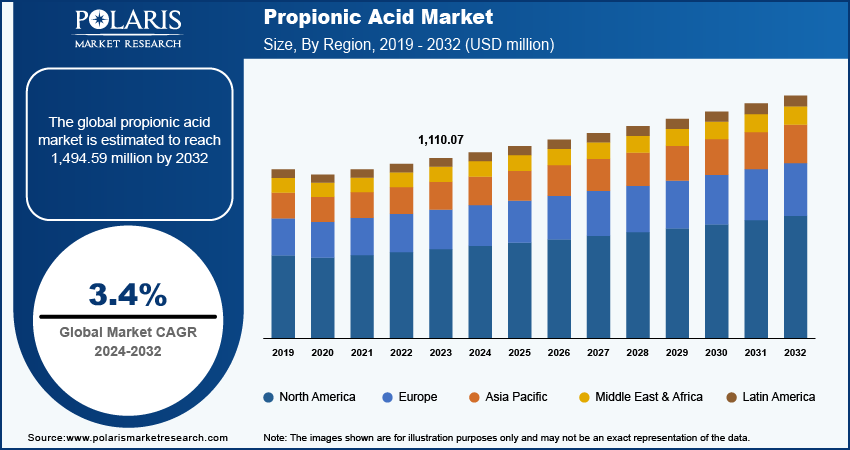

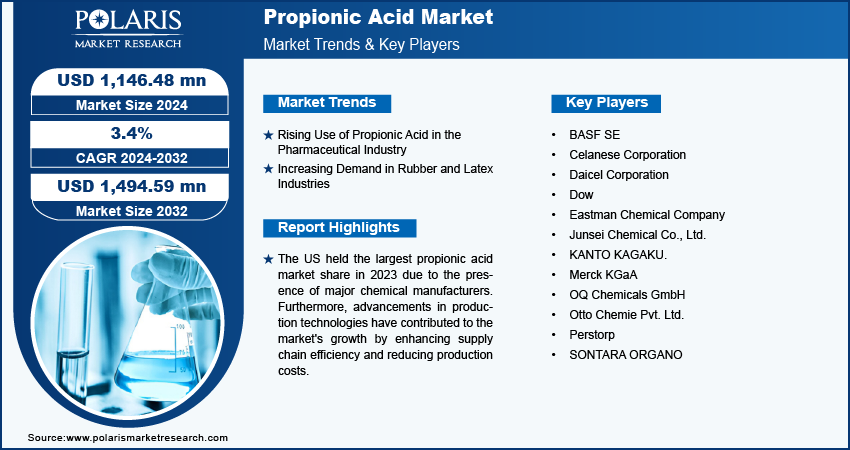

The global propionic acid market size was valued at USD 1,110.07 million in 2023. The market is projected to grow from USD 1,146.48 million in 2024 to USD 1,494.59 million by 2032, exhibiting a CAGR of 3.4% during 2024–2032.

Propionic acid is a naturally occurring carboxylic acid with the chemical formula C3H6O2. It is a colorless, pungent liquid often found in nature as a metabolic by product in living organisms. The rising consumption of processed and packaged foods on a global scale is driving the need for preservatives. The increasing emphasis on prolonging the shelf life of food products to minimize food wastage and fulfill consumer expectations for fresh and durable goods is fueling the demand for propionic acid. Additionally, increasing environmental awareness and government regulations encourage the use of biodegradable chemicals in industries, including agriculture and packaging of materials driving the demand for naturally occurring compounds such as propionic acid.

For Specific Research Requirements: Request a Free Sample Report

The rise in demand for personal care products and cosmetics, especially in emerging economies, is driving the need for propionic acid since it is used as a solvent or stabilizing agent in fragrances and other formulations. Moreover, advancements in fermentation technology and the utilization of renewable biomass for the production of propionic acid are driving more efficient and sustainable manufacturing processes. The transition to bio-based propionic acid production minimizes the environmental footprint and meets the need for eco-friendly chemicals in sectors such as food, agriculture, and chemicals, thereby boosting the propionic acid market growth.

Propionic Acid Market Trends

Rising Use of Propionic Acid in the Pharmaceutical Industry

Propionic acid is increasingly used in the pharmaceutical sector, particularly as a preservative in medications and personal care products. For instance, according to CMS, in 2022, US National Health Expenditure grew by 4.1% to reach USD 4.5 trillion, or USD 13,493 per person, representing 17.3% of the US GDP. Medicare spending increased by 5.9% to USD 944.3 billion, and prescription drug spending surged by 8.4% to USD 405.9 billion in 2022 as compared to 2021. The expansion of pharmaceutical production in the developing market is propelling the demand for safe and effective preservatives to maintain product stability and extend shelf life, which is contributing to the propionic acid market growth. Furthermore, propionic acid is utilized as a key intermediate in drug synthesis, making it an essential component in the development of various pharmaceutical products. Thus, the increasing utilization of propionic acid in the growing pharmaceutical industry is contributing to market growth.

Increasing Demand in Rubber and Latex Industries

Propionic acid is increasingly used as a coagulant in the production of natural and synthetic rubber. Thus, it is essential for manufacturing products used in the automotive and consumer goods sectors, such as automotive tires, gaskets, and various rubber-based components. In 2023, according to the US Tire Manufacturers Association, the tire manufacturing industry was valued at USD 170.6 billion. Thus, the rising consumer demand and industrial development propel the need for efficient rubber processing, which is further driving the utilization of propionic acid in the rubber and latex industries. All these factors drive the propionic acid market growth.

Propionic Acid Market Segment Insights

Propionic Acid Market Breakdown, by Application Insights

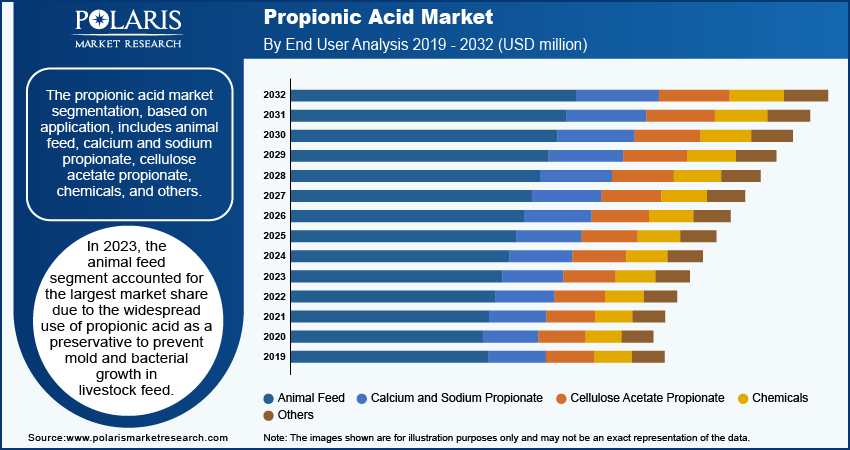

The global propionic acid market segmentation, based on application, includes animal feed, calcium and sodium propionate, cellulose acetate propionate, chemicals, and others. In 2023, the animal feed segment accounted for the largest market share due to the widespread use of propionic acid as a preservative to prevent mold and bacterial growth in livestock feed. Moreover, propionic acid helps extend the shelf life of feed, ensuring its quality and safety, which is crucial for maintaining animal health and productivity. The global rise in meat and dairy consumption, particularly in emerging economies, is expanding livestock farming, further leading to increased demand for high-quality, spoilage-resistant feed. Additionally, farmers are increasingly focused on improving feed efficiency and preventing wastage, further driving the use of propionic acid. This growing reliance on safe and effective feed preservation solutions has significantly boosted the demand for propionic acid. Thus, the animal feed segment accounted for the largest share of the propionic acid market in 2023.

The calcium and sodium propionate segment is expected to register the highest CAGR during the forecast period due to their effectiveness as preservatives in the food & beverage industry. Calcium and sodium propionate compounds are widely used to prevent mold and bacterial growth in a variety of food products, particularly in baked goods, dairy products, and processed meats. The increasing demand for convenience foods with longer shelf lives, coupled with rising consumer awareness of food safety, has boosted the adoption of calcium and sodium propionate. Additionally, the growing focus on clean-label ingredients and the trend toward reducing the use of artificial preservatives are driving manufacturers to choose natural and safe preservatives. This increased usage across food preservation applications is expected to fuel the growth of the calcium and sodium propionate segment during the forecast period.

Regional Insights

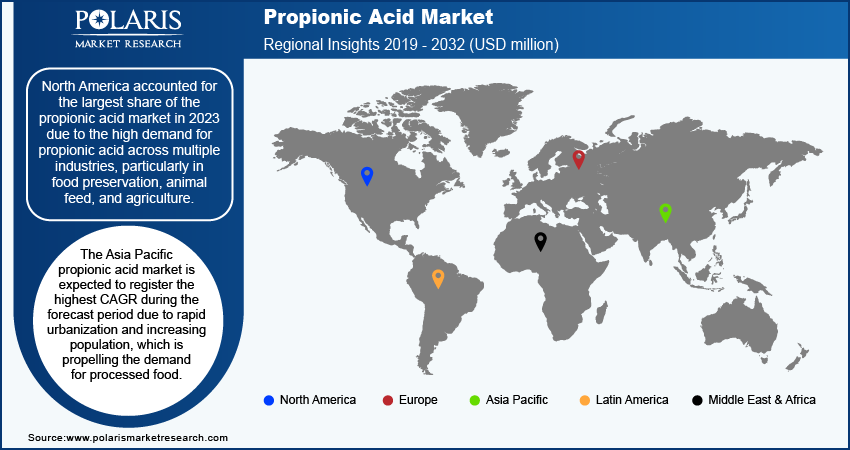

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the propionic acid market in 2023 due to the high demand for propionic acid across multiple industries, particularly in food preservation, animal feed, and agriculture. The robust growth of the food & beverage sector in the region, driven by the increased spending by consumers and upsurged consumption of processed and convenience foods, has significantly fueled the need for propionic acid as a preservative. In 2022, US households in the lowest income quintile spent an average of USD 5,090 (i.e., 31.2% of income) on food, whereas those in the highest income quintile spent USD 15,713 (i.e., 8.0% of income). Additionally, the expanding livestock farming industry in North America has led to a surge in demand for propionic acid to ensure the quality and safety of animal feed. The region's well-established agricultural practices and focus on reducing food waste through efficient preservation techniques have also contributed to the dominance of the North American market.

The US held the largest share of the propionic acid market in North America in 2023 due to the presence of major chemical manufacturers. Furthermore, advancements in production technologies have contributed to the market's growth by enhancing supply chain efficiency and reducing production costs.

The Asia Pacific propionic acid market is expected to register the highest CAGR during the forecast period due to the higher demand for processed food because of rapid urbanization and increasing population, which boosts the need for effective preservatives such as propionic acid. Additionally, the growing livestock sector in countries such as China and India is creating substantial demand for propionic acid in animal feed to prevent spoilage and ensure the health of livestock. Moreover, the region’s expanding agricultural practices, alongside rising awareness of food security and quality, contribute to the increased adoption of propionic acid in agricultural applications. According to the OECD-FAO, Asia contributes significantly to global grain output, especially in rice, with a 90% production share. China and India collectively produce almost 60% of the region's rice. China's rice production is expected to increase by 4%, while India’s production is projected to grow by 17%, raising its regional production share to 27% by 2030. Thus, the increasing focus on agriculture in Asia Pacific is driving demand for propionic acid.

The India propionic acid market is expected to record the highest CAGR in Asia Pacific during the forecast period due to the increasing demand for pesticides and agricultural chemicals. Furthermore, as the country is focusing on enhancing agricultural productivity to meet the needs of its growing population, the adoption of effective pest control solutions becomes essential. Propionic acid serves as an important intermediate in the production of various agrochemicals, including herbicides and fungicides, helping to improve crop yields and protect against pests and diseases.

Propionic Acid Market – Key Players and Competitive Insights

The competitive landscape of the propionic acid market is characterized by a mix of established global players and emerging regional manufacturers, all competing for market share in a growing industry. Key companies in this sector include major chemical producers such as BASF SE, The Dow Chemical Company, and Eastman Chemical Company, which have extensive production capabilities and strong distribution networks. These companies leverage their technological expertise to develop innovative products and enhance production efficiency. Additionally, regional players such as Perstorp Holding AB and OXEA Corporation focus on specific applications in the food, animal feed, and agricultural sectors, often tailoring their offerings to meet local market demands. The competitive dynamics are also influenced by the increasing trend of mergers and acquisitions as companies seek to expand their product portfolios and enter new markets. Moreover, the market is witnessing a growing emphasis on sustainability, with manufacturers investing in the development of bio-based propionic acid alternatives to meet consumer demand for eco-friendly products. This shift is prompting companies to enhance their research and development efforts to create sustainable solutions, thereby positioning themselves as leaders in the evolving market landscape. Major players include BASF SE; Celanese Corporation; Daicel Corporation; Dow; Eastman Chemical Company; Junsei Chemical Co., Ltd.; KANTO KAGAKU.; Merck KGaA; OQ Chemicals GmbH; Otto Chemie Pvt. Ltd.; Perstorp; and SONTARA ORGANO.

BASF SE is a global chemical corporation with seven distinct business segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the materials section, inorganic basic products and specialties for the plastic and plastic processing industries. In September 2022, BASF offered neopentyl glycol and propionic acid with a zero cradle-to-gate product carbon footprint. These products, available globally as “PA ZeroPCF” and “NPG ZeroPCF,” are produced at BASF’s Ludwigshafen Verbund site in Germany.

Merck KGaA, or the Merck Group, is a German multinational pharmaceutical, chemical, and life sciences company developing, manufacturing, and marketing biotech pharmaceutical, and specialty chemical products for global consumption. Merck KGaA operates in three business segments—healthcare, life science, and performance materials. The healthcare segment includes pharmaceuticals, over-the-counter drugs, and other health-related products. Merck KGaA's pharmaceutical portfolio includes medicines for oncology, neurology, fertility, endocrinology, and cardiometabolic diseases. The life science segment provides products and services for the biopharmaceutical industry, including tools for genomic research, cell culture products, and bio-processing equipment. The performance materials segment offers specialty chemicals and materials used in various industries, such as electronics, coatings, and printing.

Key Companies in Propionic Acid Market

- BASF SE

- Celanese Corporation

- Daicel Corporation

- Dow

- Eastman Chemical Company

- Junsei Chemical Co., Ltd.

- KANTO KAGAKU.

- Merck KGaA

- OQ Chemicals GmbH

- Otto Chemie Pvt. Ltd.

- Perstorp

- SONTARA ORGANO

Propionic Acid Industry Developments

In January 2022, Perstorp completed the acquisition of GEO's Di-MethylolPropionic Acid [DMPA] strengthening its sustainable specialty solution provider in the resins and coatings sector.

In August 2021, BASF and SINOPEC expanded their joint venture, BASF-YPC Co., Ltd., in Nanjing, China. The expansion includes increasing production capacities for chemicals such as propionic aldehyde, propionic acid, ethanolamines and purified ethylene oxide, and ethyleneamines and building a new tert-butyl acrylate plant.

Propionic Acid Market Segmentation

By Application Outlook (Revenue – USD million, kilotons, 2019–2032)

- Animal Feed

- Calcium and Sodium Propionate

- Cellulose Acetate Propionate

- Chemicals

- Others

By Regional Outlook (Revenue – USD million, kilotons, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Propionic Acid Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,110.07 million |

|

Market Size Value in 2024 |

USD 1,146.48 million |

|

Revenue Forecast by 2032 |

USD 1,494.59 million |

|

CAGR |

3.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million, Kilotons and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Application |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global propionic acid market size was valued at USD 1,110.07 million in 2023 and is projected to grow to USD 1,494.59 million by 2032.

The global market is projected to register a CAGR of 3.4% during the forecast period.

North America accounted for the largest share of the global market in 2023 due to the high demand for propionic acid across multiple industries, particularly in food preservation, animal feed, and agriculture.

A few key players in the market are BASF SE; Celanese Corporation; Daicel Corporation; Dow; Eastman Chemical Company; Junsei Chemical Co., Ltd.; KANTO KAGAKU; Merck KGaA; OQ Chemicals GmbH; Otto Chemie Pvt. Ltd.; Perstorp; and SONTARA ORGANO

The animal feed segment dominated the market in 2023 due to its widespread use as a preservative to prevent mold and bacterial growth in livestock feed.

The calcium and sodium propionate segment is expected to grow at the highest CAGR during the forecast period due to their effectiveness as preservatives in the food & beverage industry.