Pulmonary Arterial Hypertension Market Share, Size, Trends, Industry Analysis Report

By Type (Generics, Branded); By Drug Class; By Route of Administration; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4051

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

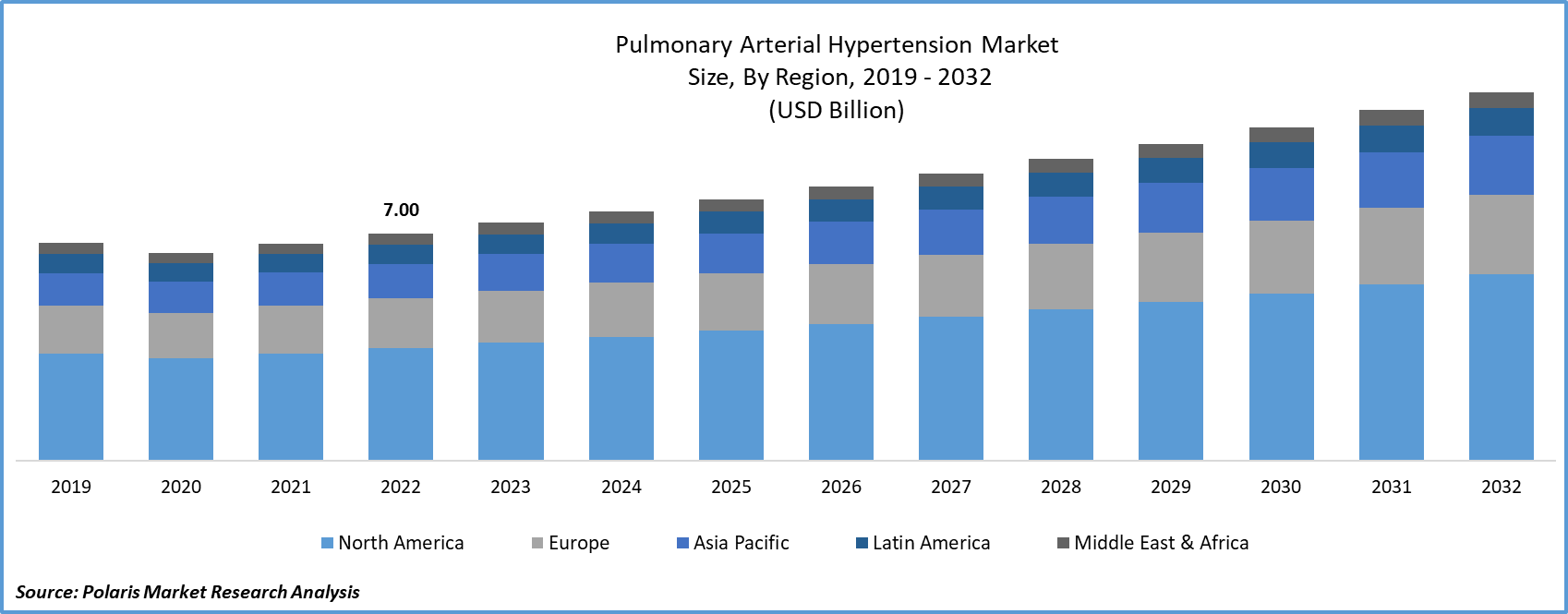

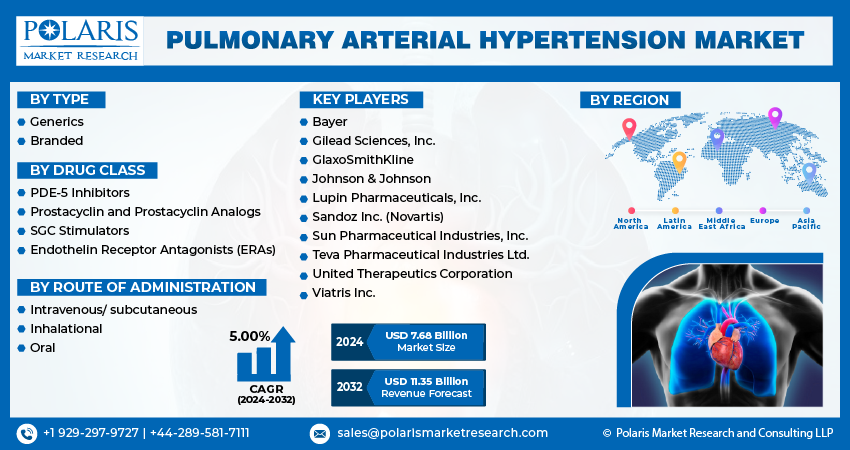

The global pulmonary arterial hypertension market was valued at USD 7.33 billion in 2023 and is expected to grow at a CAGR of 5.00% during the forecast period.

Pulmonary Hypertension (PH) is a rare condition affecting the pulmonary arteries, characterized by high blood pressure in the lungs, known as pulmonary arterial hypertension (PAH) or pulmonary hypertension (PH). This condition involves the narrowing and blockage of arteries and capillaries, often worsening over time and carrying the potential for fatality if left unaddressed. The increasing prevalence of PAH, a growing elderly population, and heightened government support for orphan drug development drive the expected significant market growth in the forecast period.

To Understand More About this Research: Request a Free Sample Report

Key factors propelling this market include increased efforts from leading market players, a high prevalence of pulmonary arterial hypertension, growing adoption rates, availability of reimbursement, and the introduction of generic alternatives. According to the American Lung Association, the U.S. witnesses 500 to 1,000 new PAH diagnoses annually.

The growth of the pulmonary arterial hypertension treatment market is propelled by several key factors, including the increasing prevalence of lung cancer and lung-related disorders, a growing geriatric population, and the widespread adoption of technologically advanced medical devices worldwide.

Moreover, the expansion of the pulmonary artery hypertension market is driven by factors such as the rising prevalence of pulmonary artery hypertension, increased awareness about its treatment, and the growing geriatric population. Furthermore, the market is expected to benefit from increased research and development efforts by major industry players, providing attractive investment opportunities. However, stringent regulatory standards and the high costs associated with development may impede market growth in the near future.

Furthermore, significant market players are making substantial investments in the introduction of new products and innovations to provide more precise treatment options.

- For instance, in February 2021, United Therapeutics obtained a license for the Remunity pump for Remodulin, a treatment for pulmonary arterial hypertension.

This device, which is smaller, more compact, and preloaded with medication compared to existing subcutaneous pump alternatives, is anticipated to yield improved outcomes. This development is expected to have a substantial influence on overall market growth during the forecast period. Additionally, mergers and collaborations play a pivotal role in expanding the market.

Industry Dynamics

Growth Drivers

- Cases of Pulmonary Arterial Hypertension (PAH) Facilitate Market Growth

Pulmonary arterial hypertension (PAH) is classified as a rare condition, with a relatively low global prevalence of approximately 15 to 50 cases per million people, indicating that only a small number of individuals in a given population are diagnosed with PAH. The cumulative number of new cases reported each year falls within the range of 100,000 to 200,000 worldwide. PAH can also be associated with other underlying diseases, often considered a serious lung and cardiac disorder. For instance, individuals with conditions such as chronic obstructive pulmonary disease (COPD), interstitial lung disease, or pulmonary fibrosis face a higher risk of developing PAH. Congenital heart defects like atrial septal defect or ventricular septal defect can also contribute to PAH development.

Moreover, underlying factors such as coronary artery disease, lung blood clots, and hypertension can be potential causes of PAH. It's essential to recognize that while these conditions may elevate the risk of PAH, not everyone with these risk factors will develop the disorder. The precise mechanisms by which PAH develops remain a subject of ongoing research.

Report Segmentation

The market is primarily segmented based on type, drug class, route of administration, and region.

|

By Type |

By Drug Class |

By Route of Administration |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Drug Class Analysis

- The Prostacyclin and Prostacyclin Analogs segment held the largest revenue share in 2022

The significant market share is a result of strong demand and expanding indications. The SGC stimulators segment is poised to experience the most rapid growth, with a CAGR exceeding 5%. SGC stimulators have the potential to enhance NO-sGC signaling and optimize sGC activation. In this category, Adempas by Bayer, represented by Riociguat, stands as the sole drug approved for treating PAH. The remarkable surge in Adempas sales in 2020, exceeding a 50% increase compared to 2019, underscores the substantial demand in this segment.

By Route of Administration Analysis

- The Oral segment accounted for the highest market share during the forecast period

As, increasing presence of oral formulations for pulmonary arterial hypertension and the preference of patients for oral administration. Examples of oral PAH drugs include Letairis, Adcirca, Opsumit, and Revatio.

For instance, Opsumit tablets from Johnson & Johnson achieved total sales of USD 1.6 billion in 2020, reflecting a 23.5% year-on-year growth compared to 2019. Furthermore, factors such as patient safety, high efficacy, affordability, and the swift delivery of drugs are contributing to the increased adoption of oral drug administration.

The intravenous/subcutaneous segment is expected to achieve the most rapid growth, surpassing 5.0% over the forecast period. This growth can be attributed to expanding indications, regulatory approvals, and advancements in drug delivery systems aimed at improving patient compliance. For instance, In February 2021, United Therapeutics unveiled the Remunity subcutaneous pump designed for delivering Remodulin to patients with PAH using prefilled cassettes. This product stands out with substantial enhancements compared to traditional subcutaneous pumps, featuring a compact size, water resistance, and the convenience of wireless remote programming.

Regional Insights

- North America dominated the largest market in 2022

The substantial market share in North America is primarily attributed to the well-established healthcare infrastructure in the U.S. and Canada, enabling advanced therapeutic accessibility. Additionally, increased awareness, a high rate of diagnosis, and government initiatives that lend support further boost market growth in this region. A well-structured reimbursement system and the presence of key industry players also play pivotal roles in the regional market's expansion. The increasing incidence of chronic and infectious diseases, coupled with a high diagnostic rate, is fueling the demand for advanced healthcare facilities pertaining to pulmonary arterial hypertension in the North American region.

The Asia Pacific region is poised to experience the most rapid Compound CAGR. This is attributed to the increasing utilization of generic medications, the presence of major pharmaceutical firms, and the development of healthcare infrastructure. For instance, in April 2019, Cipla, headquartered in India, received FDA clearance in the United States for Ambrisentan Tablets, a generic version of Gilead Sciences' Letairis. This approval expanded the company's product portfolio. Furthermore, the Asia Pacific region, with its substantial population and the growing burden of diseases like HIV, which can lead to PAH, is witnessing a surge in demand for enhanced healthcare systems.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Bayer

- Gilead Sciences, Inc.

- GlaxoSmithKline

- Johnson & Johnson

- Lupin Pharmaceuticals, Inc.

- Sandoz Inc. (Novartis)

- Sun Pharmaceutical Industries, Inc.

- Teva Pharmaceutical Industries Ltd.

- United Therapeutics Corporation

- Viatris Inc.

Recent Developments

- In July 2023, Novartis and the Novartis US Foundation are extending their enduring collaboration for the Beacon of Hope initiative, a cooperative program committed to addressing disparities in health and education. The initiative is dedicated to equity, fostering diversity, inclusion, and trust within the research and development ecosystem. It will encompass a diverse array of clinical trials, including those related to pulmonary arterial hypertension, hypertension, giant cell arteritis, urticaria, and breast cancer studies.

- In April 2021, United Therapeutics Corporation made a significant announcement regarding the FDA approval and market introduction of Tyvaso® for the treatment of Pulmonary Hypertension Associated with Interstitial Lung Disease (PH-ILD). This development signifies a substantial leap in treatment options and a strategic growth opportunity for the company within the pulmonary hypertension market.

Pulmonary Arterial Hypertension Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.68 billion |

|

Revenue forecast in 2032 |

USD 11.35 billion |

|

CAGR |

5.00% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Drug Class, Route of Administration, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |