Rail Asset Management Market Share, Size, Trends, Industry Analysis Report

By Component (Solutions, Services); By Deployment; By Application; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2875

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

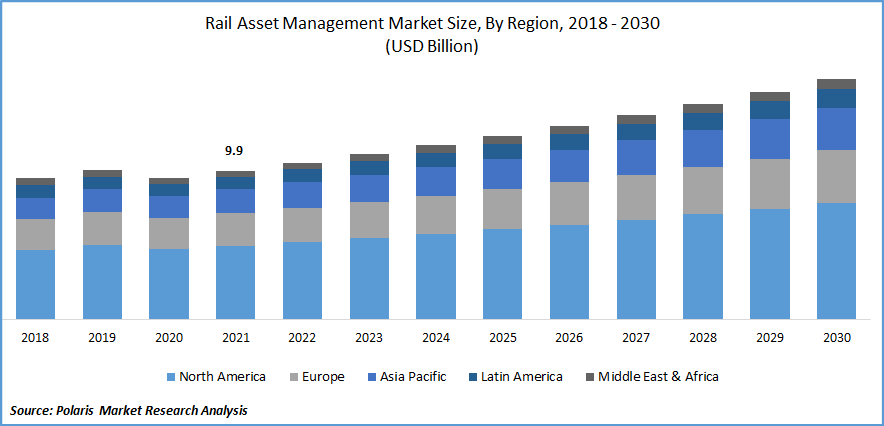

The global rail asset management market was valued at USD 9.9 billion in 2021 and is expected to grow at a CAGR of 5.5% during the forecast period.

The market demand for rail asset management is anticipated to be driven by worldwide government investments in rail infrastructure and digitization initiatives during the forecast period. Rail asset management companies are forming more and more strategic alliances and collaborations to improve their financial standing, broaden their product line, and increase their level of worldwide awareness.

Know more about this report: Request for sample pages

For instance, in 2020, the Asset Management Working Group (AMWG) offered railway enterprises railway-specific interpretations of the worldwide asset management standard ISO 55001. The main output from the endeavor is the roadmap, which advises railway infrastructure managers on the best decision-support technologies that are already accessible or will be made available over the next 10–15 years.

In addition, Kontron's developed 3B Infar’s INFRALIFE software is a tried-and-true solution for asset management across all rail properties. The main objective is to make it easier to manage assets, forecasting, reporting, and process visualization in an integrated manner. INFRALIFE combines cutting-edge information technology with infrastructure knowledge.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The need for rail asset management is anticipated to be fueled by increasing government investments in rail infrastructure and global digitization initiatives. The carrying capacity that railroads provide in a single run enables governments to lower the cost of transferring people and cargo. The increasing reliance on trains has already put a strain on the existing rail system. Due to system wear & tear, malfunctions, damages, & repair requirements, there is much unplanned & unscheduled maintenance for both rolling stock & related infrastructure.

For instance, as of October 2022, the High-Speed Rail Line in California was one of the most valuable infrastructure projects in the world, either planned or under construction. The majority of the significant infrastructure projects currently under development are railway lines in nations like Norway and Sweden, the United Kingdom, the United States, Asia, South-East Asia, and Japan. Additionally, India had the most active infrastructure projects as of May 2022, each costing over 25 million USD. There were 1,944 construction projects in India, 1,866 in the US, and 1,175 in China. Power facilities made up the majority of the recently constructed private infrastructure in the US.

Report Segmentation

The market is primarily segmented based on component, deployment, application, and region.

|

By Component |

By Deployment |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Solution segment is the largest market segment in the industry.

The solution segment dominated the market in 2021, and it is anticipated that this trend would persist over the anticipated time. The primary factor driving market expansion of the solution sector, such as providing accurate information to all stakeholders at the appropriate time to enable them to decide in a way that would increase the efficiency of plant operations. The selection of a rail asset management system is crucial, especially in the asset-intensive rail industry.

The solution market has become more advanced, and functioning presently requires fusing a broader range of abilities with some technical requirements. For instance, in November 2022, the ZEDAS solution ensured efficient technical asset management in rail transport & cargo handling. The system creates all the essential data for planning and making strategic decisions and provides current information about the state of assets at any time. Improves maintenance management and enables the development of streamlined automated workshop processes, lowering maintenance costs and overall life cycle costs.

Cloud segment will account for a higher share of the market.

Cloud segment is expected to have the greatest market share in 2021. The flexibility and adaptability of the cloud are expected to cause it to grow more swiftly during the predicted period. Using cloud technology, railway companies can save money on technical employees, gear, software, and storage. Due to the ease of upkeep and upgrade of cloud-based asset management solutions, the railway industry is implementing cloud deployment.

For instance, in April 2021, Trimble planned Solutions introduced Trimble Quantum technology for the Lisbon to the Madrid High-Speed Rail Project, a crucial Trans-European Transport Network (TEN-T) project. Trimble manages the lifetime of rail transport assets from operation to maintenance and repair with its integrated suite of on-premise and software-as-a-service (SaaS) solutions.

Infrastructure is expected to hold the significant revenue share

The infrastructure segment is expected to expand at the fastest CAGR during the projection period. This is primarily due to many rail corporations investing significantly in rail infrastructure. Various systems, including earthworks, bridges, tunnels, steelwork, timber, and track systems, make up the railway infrastructure. Among the tasks involved in managing infrastructure assets are plans that are particularly created to maximize the delivery of upgrades, maintenance, and additions. The steps, materials that will be needed, and planned infrastructure modifications are often described in these blueprints. The asset management system makes these systems work more effectively and safely.

For instance, according to a report from 2021, the “Asian Infrastructure Investment Bank” is allegedly assisting the Turkish government in financing Infrastructure for Future through a connectivity project that promises to boost the capacity, security, and speed of rail transportation between Turkey and the European Union. AIIB has approved a loan amount of EUR 300 million for the “Ispartakule Cerkezkoy” project, to construct a double-track, electrified railway line.

The demand in Asia Pacific is expected to witness significant growth

Asia Pacific is projected to grow at the highest growth rate due to the expanding acceptance of new technologies, rising investments in digital transformation, and rising GDP in Asia Pacific nations. Asia Pacific has experienced similar effects to the rest of the world in terms of the pandemic's increased market volatility and slowing of GDP. As a result, there was reduced freight movement and a decline in economic activity.

For instance, Asian megaprojects include the 7.2 billion Don Mueang-Suvarnabhumi-U-Tapao railways, in Thailand. The goal of this project is to build a 220 Km high-speed rail route connecting. Furthermore, in October 2022, the Asian Development Bank intends to assist governments such as Azerbaijan in providing safe, conveniently accessible, and environmentally friendly transportation. For this TA, the Austrian government contributed USD 595,600. Additionally, Austria's expertise was crucial in enabling Azerbaijan to make the adjustments necessary to strengthen its railway transportation system.

Competitive Insight

Key players in the market include Siemens, IBM, Hitachi, SAP, Trimble, Bentley Systems, DXC Technology, Trapeze, L&T Technology, Capgemini, Accenture, Huawei Technologies, ZEDAS, KONUX, SNC-Lavalin, and Bombardier.

Recent Developments

In March 2022, Alstom announced plans to construct a new green rail mobility research center in Quebec, Canada. Its main objective is to develop platforms for future green hybrid, battery, that are primarily aimed at the rail freight & passenger market.

Rail Asset Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 10.45 billion |

|

Revenue forecast in 2030 |

USD 16.0 billion |

|

CAGR |

5.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Siemens, IBM, Hitachi, Wabtec, SAP, Trimble, Bentley Systems, Bombardier, Atkins, DXC Technology, Trapeze, Tego, Konux, L&T Technology Services Limited, Capgemini, Accenture, Huawei Technologies, Cyient, ZEDAS, KONUX, SNC-Lavalin, Tego, and Bombardier. |