Reactive Hot Melt Adhesives Market Share, Size, Trends, Industry Analysis Report

By Resin Type (Polyurethane, Polyolefin, Others); By Type; By Substrate; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4476

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

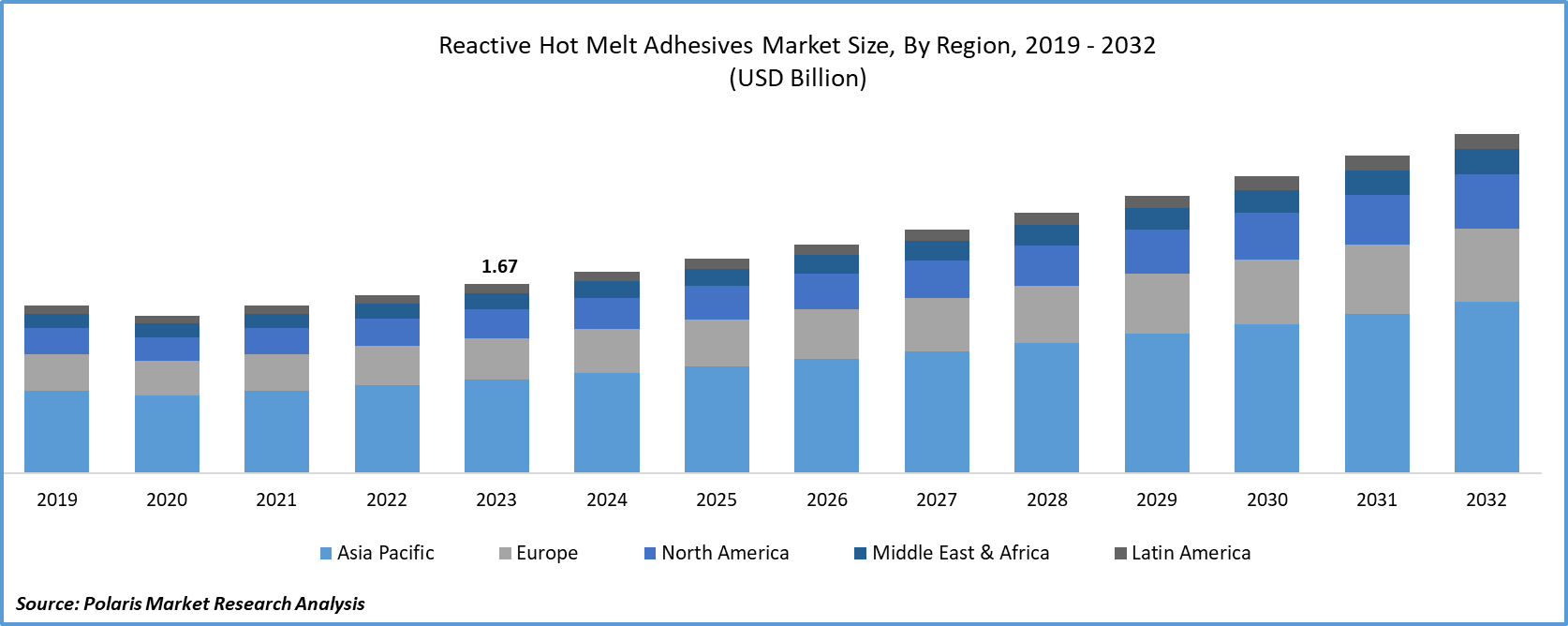

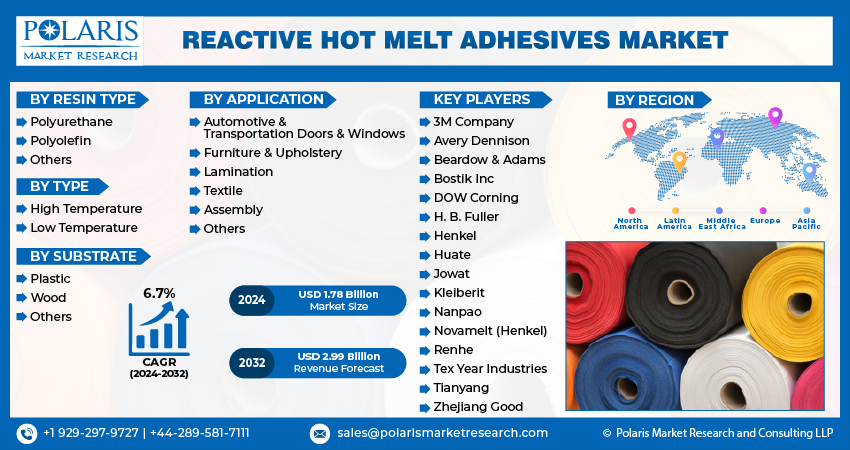

The global reactive hot melt adhesives market was valued at USD 1.67 billion in 2023 and is expected to grow at a CAGR of 6.7% during the forecast period.

Reactive hot melt adhesives are utilized in bonding various substrates, including cardboard, metal, leather, plastic, foam, and rubber, where they need significant permanency & high adherence, such as high-tech devices. This is gaining use in the automotive, electronics, woodworking, textile, and construction industries. After reaction and completion of the drying phase, the bond will become rigid, and it cannot melt again after curing, making it no longer applicable in glue treatment. Rising research studies focusing on exploring the potential of reactive hot melt adhesives are widening the expansion of the market.

- For instance, a 2022 study explored the improvement of mechanical properties and UV resistance of polyurethane reactive hot melt adhesives with the integration of CS–Fe3O4 magnetic nanocomposites.

To Understand More About this Research: Request a Free Sample Report

Moreover, the ability to level out the irregularities in the surface is driving the use of hot melt adhesives in several areas, including furniture, lamination, and textiles. The increasing awareness of the potential benefits of these adhesives is fueling their applications in multiple areas.

However, the higher curing time of reactive hot melt adhesives is a major concern among the users, as it can take several hours, even overnight, to solidify, primarily for the polyurethane resin. The presence of non-compatible temperatures, such as low humidity and low temperatures, makes people try other alternatives to the reactive hot melt adhesives in the marketplace.

Growth Drivers

Rising demand for stronger adhesion in construction activities.

The sturdiness and longer durability of reactive hot melt adhesives are gaining momentum in the construction and automotive industries due to their crosslinking and curing processes after the solidifying stage, which are not possible with traditional hot melt adhesives. In construction, strong bonds are crucial for safety and can lower additional maintenance costs in the future. It is incorporated in the installation of plywood panels, flooring, cladding, furniture assembly, and decoration purposes. The rising adoption of insulation in buildings, coupled with the rising concern for energy efficiency, is showing significant demand for reactive hot melt adhesives, as they enable strong bonding.

Report Segmentation

The market is primarily segmented based on resin type, type, substrate, application and region.

|

By Resin Type |

By Type |

By Substrate |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Resin Type Analysis

Poly-urethane segment is expected to witness the highest growth during the forecast period

The poly-urethane segment will grow rapidly, mainly driven by its prominent strength and flexibility. These adhesives are made up of a combination of polyurethane resins and reactive hotmelt technology. The enhanced resistance to temperature and chemical reactions are vital factors driving its adoption in the market. By adding catalysts, such as antioxidants, to the formulation of reactive hot melt adhesives, we can limit the adhesive from degrading over time. Solventless, ease of handling, and eco-friendly nature are fueling its adoption in the marketplace.

Polyolefin segment is expected to witness significant growth in the coming years owing to its versatility in applications. It is a modified silane-based adhesive that does not contain hazardous reactive chemical compound isocyanates, making it a suitable option for manufacturers of sustainable vehicles.

By Type Analysis

Low temperature segment accounted for the significant growth in 2023

The low-temperature segment held the largest share. The enhanced durability, flexibility, and performance over a range of climatic conditions is driving the demand for reactive hot melt adhesives. The compatibility with heat-sensitive substrates, such as wood and plastic, is one of the leading factors driving the low-temperature segment, as it can protect substrates from damage.

By Substrate Analysis

Plastic segment registered the larger market share in 2023

The plastic segment witnessed the largest share. Reactive hot melt adhesives are formulated efficiently for the purpose of bonding various substrates, primarily plastics, without causing any damage to the material. The growing prevalence of combining plastic in numerous fields, including automotive, packaging, electronics, and more, is fueling the growth of the plastic segment in the reactive hot melt adhesives market.

The wood segment is expected to grow at a significant rate over the next few years on account of the rapid increase in demand for adhesives in the furniture landscape. The rising production of specialised adhesives pertaining to woodworking is further boosting the growth of this segment. For instance, in 2022, Bostic unveiled two hot-melt polyurethane reactive adhesives, SG6518 and SG6520, for woodworking applications.

By Application Analysis

Doors & Windows segment held the significant market revenue share in 2023

Doors & windows segment held a significant market share, which is highly accelerated due to the continuous rise in demand for lightweight and lower greenhouse gas emission vehicles in the market. The automotive industry is undergoing a rapid transformation to reach ongoing consumer preferences towards sustainable vehicles, encouraging them to incorporate eco-friendly auto equipment, including reactive hot melt adhesives, which are essential in assembling the doors and windows of vehicles.

Regional Insights

Asia Pacific region registered the largest share of the global market in 2023

The Asia Pacific dominated the market. This is due to the rising urban population in developing countries like India, leading to a housing shortage. According to the Federation of Indian Chambers of Commerce (FICCI), the country's urban population is expected to increase by 900 million by 2025. This trend is driving the expansion of the construction industry, which led to the significant demand for adhesives in the region, contributing to the largest share in the reactive hot melt adhesives market.

North America will grow at the rapid pace, owing to the growing consumption of reactive hot melt adhesives in several areas, such as textile, lamination, medical, packaging, and more end-use industries. The presence of major market players and growing innovations in the adhesives market are bolstering the growth of the market. For instance, in 2023, Henkel introduced an innovation center for the development of adhesive technologies in Bridgewater, US.

Key Market Players & Competitive Insights

The reactive hot melt adhesives market is moderately consolidated, with the existence of fewer key players attributable to the rising collaborative initiatives, mergers, and acquisitions among the global players to gain a competitive edge over their peers. This trend is creating new opportunities for reactive hot melt adhesives, with their increased penetration into several end-use industries. For instance, H.B. Filler acquired Adhezion Biomedical, a US medical adhesives company, which can enhance its footprint in the medical adhesives industry.

Some of the major players operating in the global market include:

- 3M Company

- Avery Dennison

- Beardow & Adams

- Bostik Inc

- DOW Corning

- H. B. Fuller

- Henkel

- Huate

- Jowat

- Kleiberit

- Nanpao

- Novamelt (Henkel)

- Renhe

- Tex Year Industries

- Tianyang

- Zhejiang Good

Recent Developments

- In July 2023, H.B. Fuller completed the acquisition of XCHEM International, an adhesive manufacturer in the United Arab Emirates (UAE). This will enhance the portfolio of the company with construction adhesives.

Reactive Hot Melt Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.78 billion |

|

Revenue forecast in 2032 |

USD 2.99 billion |

|

CAGR |

6.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Resin Type, By Type, By Substrate, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Reactive Hot Melt Adhesives Market report covering key segments are resin type, type, substrate, application and region.

Reactive Hot Melt Adhesives Market Size Worth $2.99 Billion By 2032

The global reactive hot melt adhesives marketis expected to grow at a CAGR of 6.7% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Reactive Hot Melt Adhesives Market are Rising demand for stronger adhesion in construction activities