Recycling Water Filtration Market Share, Size, Trends, Industry Analysis Report

By Product Type (Sand Filters, Multimedia Filters, Activated Carbon Filters, And Membrane Filters); By Membrane Type; By Floe Rate; By End-Use Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4655

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

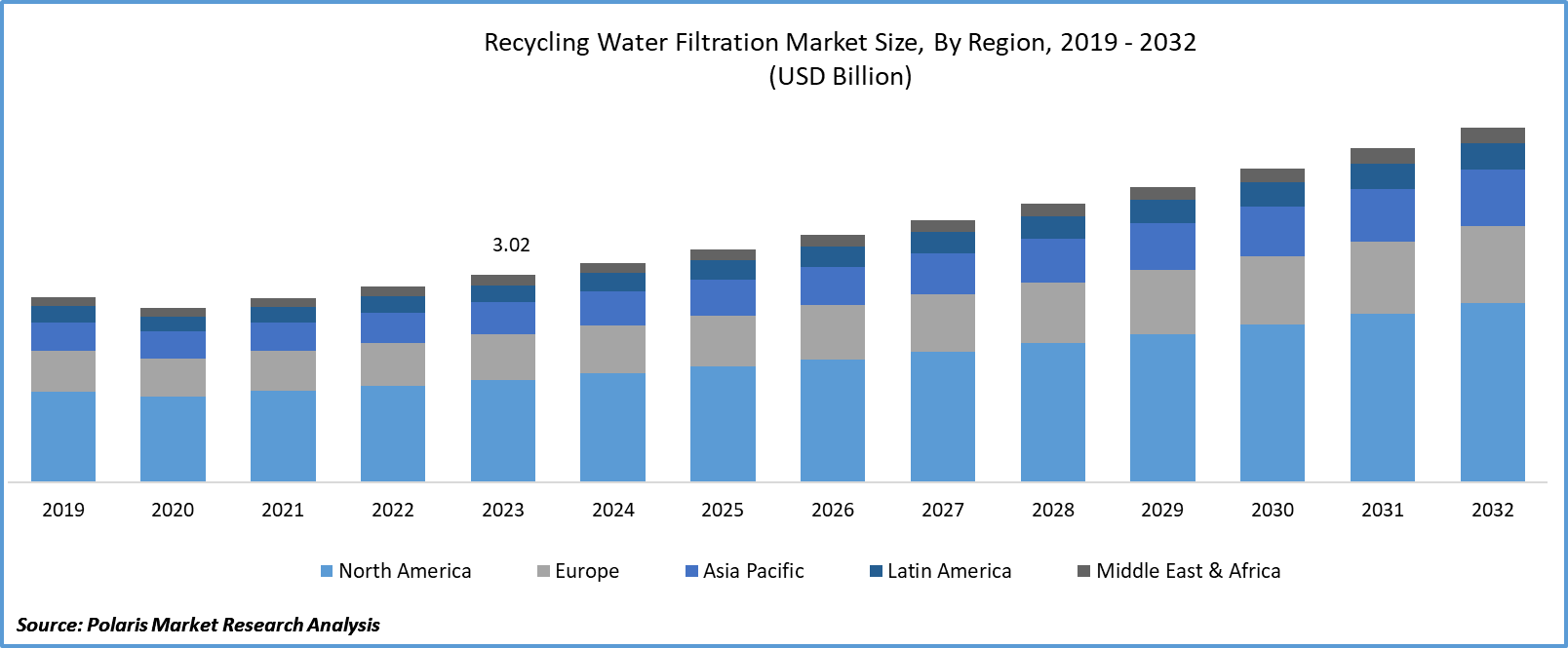

Global recycling water filtration market size was valued at USD 3.02 billion in 2023. The market is anticipated to grow from USD 3.20 billion in 2024 to USD 5.17 billion by 2032, exhibiting the CAGR of 6.2% during the forecast period

Industry Trends

Water, a priceless resource, faces mounting scarcity issues worldwide. This growing scarcity underscores the urgency of adopting sustainable water management practices, particularly through recycling and reuse initiatives. The recycling water and filtration market encompasses a range of technologies, services, and applications geared towards treating and repurposing wastewater and other water sources that might otherwise go to waste, posing environmental risks. Projections indicate substantial growth prospects for the global Water recycling and filtration market in the forecast period. Factors such as escalating water scarcity, population expansion, and rapid urbanization are serving as key catalysts for market expansion, expected to drive increased demand for recycling water and filtration market share.

To Understand More About this Research: Request a Free Sample Report

The company has recently made a significant investment in an innovative initiative, utilizing state-of-the-art technology to transform its operations. This forward-looking strategy aims not just to improve current products and services but also to introduce pioneering solutions that will establish new market opportunities within the industry. By adopting this comprehensive approach, the company seeks to expand its recycling water filtration market presence, appeal to new customer demographics, and ensure sustainable growth in an increasingly market dynamic business environment. Through the integration of investment, technology, innovation, and strategic planning, the company is well-positioned to maintain competitiveness and emerge as an industry leader.

- For instance, In May 2023, Xylem successfully finalized the acquisition of Evoqua Water Technologies Corp. for a total of USD 7.5 billion. This merger brings together unparalleled expertise and resources, establishing the most advanced platform globally to tackle the urgent water challenges faced by customers and communities alike.

To address water scarcity challenges, governments often implement policies and incentives to promote water conservation and recycling practices. These measures may include mandates for specific industries to utilize recycled water, incentives for individuals and businesses to adopt recycled water systems, and investment in water recycling infrastructure, this result is increasing the recycling water filtration market share in the upcoming years.

The impetus behind Recycling water filtration techniques stems from stringent environmental regulations and water conservation policies enforced by governments and regulatory bodies worldwide. These laws compel industries to adopt sustainable water management solutions, fostering compliance with environmental standards. The escalating demand for water in industrial sectors, notably in water-intensive industries such as manufacturing, electricity generation, and food and beverage production, is driving the adoption of water recycling practices. Hence, the recycling water filtration market size is expected to grow in the forecast period.

Key Takeaway

- North America dominated the largest market and contributed to more than 40% of share in 2023.

- Asia Pacific accounted the market to be the fastest growing CAGR during the forecast period.

- By Product Type category, Membrane filters segment accounted for the largest market share in 2023.

- By End-use industry category, the power generation segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the Recycling water filtration market?

Rising population and industrialization

The global population continues to grow, due to increased urbanization and industrialization. As the population expands, the demand for water also rises, necessitating efficient water recycling and filtration systems to meet the growing needs. Rapid industrialization across various sectors results in increased water usage for manufacturing processes. Industries are increasingly recognizing the importance of sustainable water management, and recycling water through advanced filtration technologies becomes crucial in this context. Water recycling presents a viable solution to alleviate this strain by repurposing wastewater for non-drinking purposes, thereby reducing reliance on freshwater sources. As freshwater prices surge worldwide, the adoption of water recycling technologies becomes imperative, offering cost-effective and energy-efficient alternatives.

Which factor is restraining the demand for Recycling water filtration?

High Initial Costs

The initial investment necessary for implementing recycling water filtration systems presents a substantial financial commitment. These systems often involve the purchase of equipment, installation costs, and potentially the development of infrastructure to support their operation. For businesses and municipalities considering such investments, the upfront costs can be a significant consideration, particularly if budgets are tight or competing priorities exist.

Furthermore, there may be concerns about the timeframe required to recoup the initial investment. While recycling water filtration systems can offer long-term cost savings through reduced water consumption, lower wastewater discharge, and potential revenue generation from recycled water, the return on investment (ROI) may take time. This delayed ROI can make decision-makers hesitant to move forward with investing in these systems, especially if some alternative projects or expenditures promise more immediate returns.

Report Segmentation

The market is primarily segmented based on product type, membrane type, flow rate, end-use industry, and region.

|

By Product Type |

By Membrane Type |

By Flow Rate |

By End Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Type Insights

Based on product type analysis, the market is segmented on the basis of sand filters, multimedia filters, activated carbon filters, and membrane filters. Membrane filters held the largest market share in 2023. Membrane filtration technologies, such as reverse osmosis (RO) and ultrafiltration (UF), are highly efficient in removing contaminants from water, including suspended solids, microorganisms, and dissolved particles. This efficiency ensures that recycled water meets stringent quality standards for various applications, including industrial processes, drinking water treatment, and agricultural irrigation. Membrane filtration technologies, such as reverse osmosis (RO) and ultrafiltration (UF), are highly efficient in removing contaminants from water, including suspended solids, microorganisms, and dissolved particles. This efficiency ensures that recycled water meets stringent quality standards for various applications, including industrial processes, drinking water treatment, and agricultural irrigation.

By End Use Industry Insights

Based on end-use industry analysis, the market has been segmented based on power generation, oil and gas plants, food and beverage, pharmaceutical, chemicals, water detoxification plants, and farms. The power generation segment is expected to witness the fastest-growing CAGR during the forecast period. With the increasing global population and industrialization, there is a growing demand for electricity worldwide. As a result, power generation facilities are expanding to meet this demand, due to a higher adoption rate of new technologies and equipment within the sector. There is a global shift towards renewable energy sources such as solar, wind, and hydroelectric power. These sources are becoming increasingly prominent in the power generation mix due to environmental concerns and government incentives. As renewable energy technologies continue to advance and become more cost-effective, the power generation segment is expected to witness significant growth in this area.

Regional Insights

North America

North America accounted for the largest market share in 2023 in the recycling water filtration market; North America has stringent environmental regulations governing water quality and wastewater treatment. These regulations compel industries and municipalities to invest in advanced water filtration technologies to meet compliance standards. As a result, there is a high demand for recycling water filtration systems in the region. North America is a hub for technological innovation, particularly in the field of water treatment and filtration. The region is home to numerous research institutions, technology companies, and startups focused on developing cutting-edge water filtration technologies. This continuous innovation drives the adoption of recycling water filtration systems in North America. It has a large and diverse industrial base, including sectors such as manufacturing, energy, and agriculture, which require significant amounts of water for various processes.

Asia Pacific

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. North The Asia Pacific region is undergoing rapid industrialization and urbanization, due to increased demand for water across various sectors such as manufacturing, construction, and municipal services. As water resources become scarcer and environmental concerns escalate, there is a growing need for efficient water filtration solutions to treat and reuse wastewater. With a large and rapidly growing population, particularly in countries like China and India, the Asia Pacific region faces significant challenges in meeting the demand for clean water. Recycling water filtration technologies offer a sustainable solution to address water scarcity by treating wastewater and making it suitable for non-potable uses, such as industrial processes and irrigation. Governments across the Asia Pacific region are increasingly prioritizing water conservation and environmental sustainability.

Competitive Landscape

The recycling water filtration market exhibits fragmentation, with competition stemming from a multitude of players. Key service providers within this sector continually enhance their technologies to maintain a competitive edge, emphasizing efficiency, reliability, and safety. In their quest for substantial market dominance, these entities highlight the significance of strategic alliances, ongoing product enhancements, and cooperative ventures to surpass their industry peers.

Some of the major players operating in the global market include:

- A. O. Smith Corporation

- ALFA LAVAL

- Dow Inc.

- Ecolab Inc.

- GE Water and Process Technologies

- Hansgrohe

- Hitachi Zosen

- Hitachi, Ltd

- Pentair plc

- PHOENIX Water Recycling

- SUEZ

- Veolia Environnement

- WOG Group

- Xylem Inc.

Recent Developments

- In April 2023, TORAY INDUSTRIES, INC. assured a contract in Hong Kong to supply reverse osmosis (RO) membranes for the Tseung Kwan O Desalination Plant. This project signifies Hong Kong's inaugural large-scale desalination facility utilizing RO membranes, boasting a daily capacity of 135,000 cubic meters, which will fulfil 5% of the city's water needs. Expected to be operational by late 2023, there are provisions in place to expand the daily capacity to 270,000 cubic meters.

Report Coverage

The recycling water filtration market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, membrane type, flow rate, end-use industry, and their futuristic growth opportunities.

Recycling Water Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.20 Billion |

|

Revenue forecast in 2032 |

USD 5.17 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Membrane Type, By Floe Rate, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Recycling Water Filtration Market report covering key segments are product type, membrane type, flow rate, end-use industry, and region.

Recycling Water Filtration Market Size Worth $ 5.17 Billion By 2032

Global recycling water filtration market exhibiting the CAGR of 6.2% during the forecast period

North America is leading the global market

key driving factors in Recycling Water Filtration Market are product type, membrane type, flow rate, end-use industry, and region.