Release Liners Market Share, Size, Trends, Industry Analysis Report

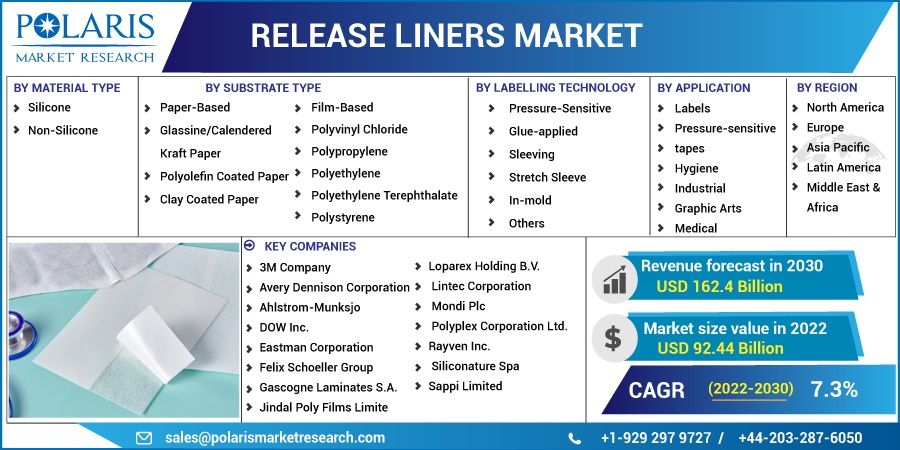

By Material Type (Silicone, and Non-Silicone); By Substrate Type; By Labelling Technology; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2868

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

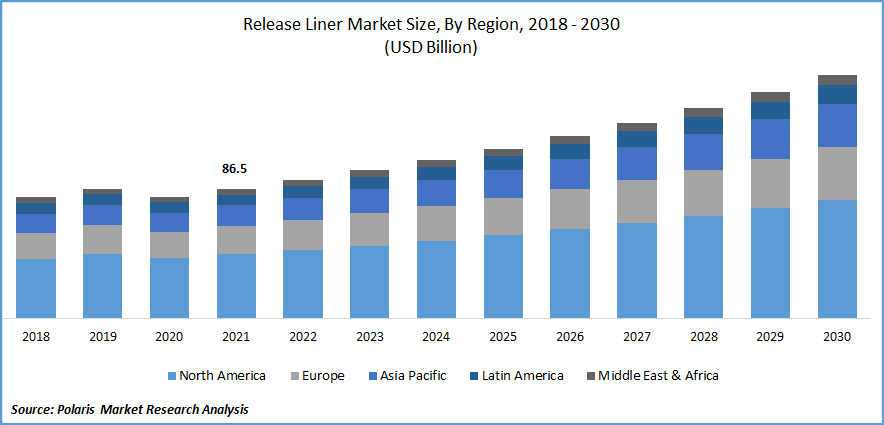

The global release liners market was valued at USD 86.5 billion in 2021 and is expected to grow at a CAGR of 7.3% during the forecast period.

The release liner is often referred to as backing paper or a container. Until it is ready to release, it is employed to move or hold onto the sticky substrate. It may be composed of paper, films, poly-coated paper, or some other unusual substrate including metalized films. The silicone coating on the release liner substrate, which covers the majority of the substrate, enables whatever the liner is transporting to release at the right moment. They are extensively employed in medical applications, using metalized sheets or films. Weatherproofing, roof shingles, and insulating products are all covered under the industrial use of liners.

Know more about this report: Request for sample pages

The global market is expected to increase because of the growing demand for release liners from a variety of industries, including graphic, medical, and packaging. The main manufacturers are altering their strategies to be more sustainable, which involves coming up with environmentally friendly solutions. For instance, In May 2021, Loparex, a manufacturer of release liners, enhanced its line of sustainable products when it received ISCC PLUS-Certified Solutions certification for its Forchheim, Germany, manufacturing facility.

The market is fueled by the significant effects of digital printing in several nations. This arrangement is incredibly affordable, takes little time to set up, and appeals to a variety of industrial verticals.

However, release liners' market expansion is expected to be hampered by stringent government rules and regulations about environmental sustainability. The majority of release liners are constructed from polyvinyl chloride and HDPE materials, both of which pose risks to human and environmental health. The use of dangerous chemicals, such as PVC, is prohibited by strict European Union rules and FDA regulations, which is anticipated to hinder the market expansion of release liners.

Due to travel restrictions and the suspension of production operations, the COVID-19 epidemic reduced sales expectations. Due to sluggish demand from the food and beverage, electrical and electronic industries, sales of release liners have dramatically decreased. However, due to its numerous uses in the healthcare sector for the packaging of pharmaceutical and medical device products, demand for release liners has since recovered. The whole packaging business is showing signs of a quick revival with accelerated vaccination drives and the restart of production.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The release liners market is expanding primarily due to the growing demand for industrial labels, which are crucial components of the packaging industry as a whole and the product supply chain. The major players are also focusing on the launches for the release liners for the packaging industry. For instance, in September 2022, EasiLiner expands Essentra Tapes' product line to help e-commerce packaging manufacturers. These paper-based silicon releases liners shield pressure-sensitive adhesive lines. When a glue line is employed in production, EasiLiner permits the preservation of adhesive characteristics on packing types. It offers sheet plant converters a comprehensive opening and closing solution when used in conjunction with the SF-AS DH1 applicator and the widely utilized RippaTape collection.

Furthermore, the need for release liners in the food & beverage industry is supporting growing packaged food consumption as a result of its benefits, such as ready-to-eat options, rapid cooking, and ease of eating, which is likely to propel market expansion. Due to the rising demand for packaging items worldwide as a result of an expanding population, there is a significant demand for these liners because labels and tapes are also in great demand.

In October 2019, the Modern retort beverage line for the manufacture of ready-to-drink ("RTD") coffee and latte beverages was introduced by Berner Food & Beverage, Inc. The new funding increases Berner's beverage production capacity by more than double. It is the company's fastest, most technologically sophisticated, and most versatile beverage reaction line. Therefore, the demand for release liners is also rising as a result of fast urbanization and rising disposable income, as well as the rising demand for packaged food and beverage goods.

Report Segmentation

The market is primarily segmented based on substrate type, material type, labeling technology, application, and region.

|

By Material Type |

By Substrate Type |

By Labelling Technology |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Paper-based release liners segment is expected to witness the fastest growth

Food items are frequently packaged with release linear paper, a form of packaging film. It is useful for the packaging of ready-to-eat foods such as sandwiches, wrappers, and burgers due to its high tensile strength and barrier properties. The product can also be used in the food service sector to wrap around hot and cold foods and to shield them from sunlight so they stay fresh until they are consumed by customers. Manufacturers are becoming more and more enamored with paper-based liners as they aid in achieving their environmental goals. End-users are increasingly using paper-based liners because they offer higher strength under strain and dependability on high-speed packing processes.

The silicone release liners segment industry accounted for the highest market share in 2021

With the booming demand for labeling in the packaging business, silicone-covered release liners are rapidly gaining traction. Only major manufacturers who needed bulk pressure-sensitive labeling procedures employed silicone-based release liners. However, due to the advancement of silicone release liners, they are being utilized in even more minor procedures and uses. This is mostly because several small-scale manufacturers have entered the market for silicone-coated release liners.

The demand in North America is expected to witness significant growth

The need for pharmaceutical drugs and medical product packaging and labeling has expanded as the healthcare industry in the U.S. has grown. The region's dominance is anticipated to remain unchallenged during the forecast period due to growing product usage in industrial, medicinal, and hygiene applications. It is projected that factors including rising healthcare spending and consumer knowledge of safe products will support the expansion of the healthcare sector, hence increasing the demand for release liners in the nation.

Further, the Asia-Pacific region led the fastest growth in the market, largely because of the expanding packaging industry. In China, the automobile and healthcare industries are the two main sources of demand for release liners. The rising demand from the medical industry in the region such as for female hygiene, and sanitary pads must also include release liners driving the growth. Due to increased consumer spending on personal care, China's consumption of hygiene products is expected to rise. Due to the government's continued support for these industries, the need for release liners is predicted to rise throughout the projection period, hence supporting market growth in developing countries like China and India.

Competitive Insight

Key players include the market include 3M Company, Avery Dennison Corporation, Ahlstrom-Munksjo, DOW Inc., Eastman Corporation, Felix Schoeller, Gascogne Laminates, Jindal Poly Films, Loparex Holding, Lintec Corporation, Mondi, Mitsubishi Chemical America, Polyplex Corporation, Rayven Inc., Siliconature, Sappi Limited, and Wausau Paper.

Recent Developments

In December 2021, Rayven, a manufacturer of coated functional films, specialty tapes, and specialized release liners, was acquired by Duraco Specialty Tapes.

In July 2020, to lessen the impact of poly-coated kraft (PCK) paper release liners on the environment, Mondi introduced "the first-to-market solution." The NextLiner solution makes use of polymers derived from renewable resources and recycled base paper.

Release Liners Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 92.44 billion |

|

Revenue forecast in 2030 |

USD 162.4 billion |

|

CAGR |

7.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Material Type, By Substrate Type, By Labelling Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M Company, Avery Dennison Corporation, Ahlstrom-Munksjo, DOW Inc., Eastman Corporation, Felix Schoeller Group, Gascogne Laminates S.A., Jindal Poly Films Limited, Loparex Holding B.V., Lintec Corporation, Mondi Plc, Mitsubishi Chemical America, Inc., Polyplex Corporation Ltd., Rayven Inc., Siliconature Spa, Sappi Limited, and Wausau Paper Inc |