Resistant Maltodextrin Market Share, Size, Trends, Industry Analysis Report

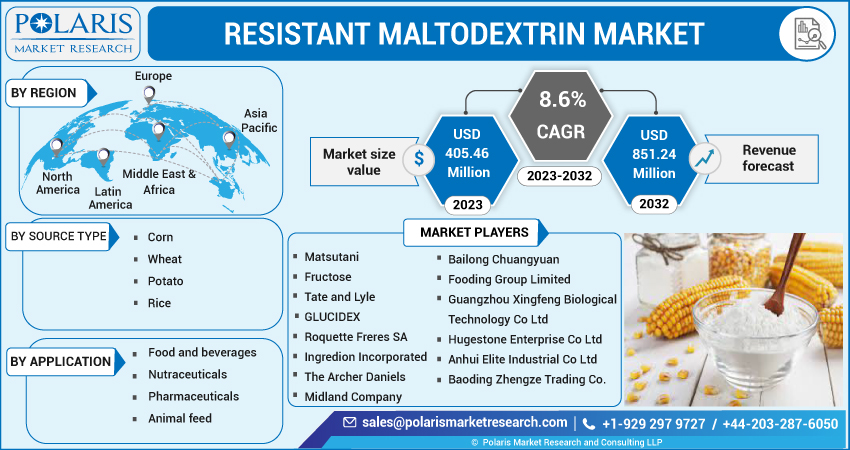

By Source Type (Corn, Wheat, Potato, Rice, Others); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Mar-2023

- Pages: 118

- Format: PDF

- Report ID: PM3102

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

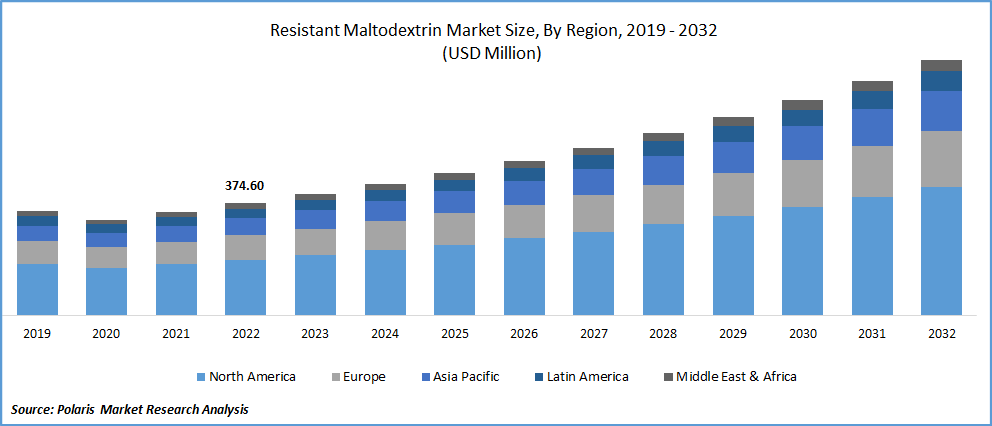

The global resistant maltodextrin market was valued at USD 374.60 million in 2022 and is expected to grow at a CAGR of 8.6% during the forecast period. The increasing demand for functional food ingredients and rising health concerns among the population are driving the growth of the market. As an active ingredient, resistant maltodextrin is used in various products, such as baked goods, dairy products, confectionery, and beverages. It is also used in nutraceuticals and pharmaceuticals as a prebiotic, fiber, and bulking agent.

Know more about this report: Request for sample pages

In addition, the resistant maltodextrin market is growing steadily due to its various functional properties and health benefits. Resistant maltodextrin is a soluble fiber resistant to digestion in the human gut, which means it passes through the digestive system intact and provides several health benefits.

The resistant maltodextrin industry is experiencing significant growth due to the increasing population of obese and older people worldwide. In addition, there has been a shift in the dietary patterns of millennials, who are now focused on maintaining their health through functional and nutritional supplements.

Resistant maltodextrin is becoming popular among younger generations because it reduces the overall carbohydrate level in final food products compared to starch-based sweeteners. The rise in health consciousness and demand for low-calorie food is expected to drive the revenue of resistant maltodextrin over the forecast period.

Furthermore, the growth of the sports industry and the increasing demand for functional digestive products will contribute to the revenue share of resistant maltodextrin.

The market experienced a surge in demand during the early stages of the COVID-19 pandemic as consumers stocked up on essential food products. However, disruptions in the supply chain, closure of manufacturing facilities, and restrictions on international trade also impacted the market. Despite the challenges, the market's resilient nature, increasing demand for functional food ingredients, growing health consciousness, and expanding the sports industry are expected to contribute to the market's long-term growth. The pandemic also led to changes in consumer behavior, creating new opportunities for the market as consumers shifted towards online shopping and home-cooked meals.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising health consciousness among consumers is spurring demand for low-calorie and available food ingredients like resistant maltodextrin. The increasing prevalence of obesity and the aging population worldwide is creating a demand for healthy food options, further driving the growth of the resistant maltodextrin market.

Additionally, the growing popularity of sports and fitness activities, the shift in dietary patterns among millennials, and the use of resistant maltodextrin in various food applications contribute to the market's growth.

Furthermore, food and beverage manufacturers' increased adoption of resistant maltodextrin as a replacement for high glycemic index sweeteners drives the market growth. The demand for clean labels and natural food products also creates new opportunities for the industry.

As consumers continue to seek natural, non-GMO, and organic food products, the trend toward clean-label products is expected to boost the demand for natural-resistant maltodextrin. The market is expected to grow in the coming years, driven by multiple factors, including health consciousness, demographic shifts, and clean-label trends.

Report Segmentation

The market is primarily segmented based on source type, application, and region.

|

By Source Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Corn segment is accounted for the largest market revenue share

The corn segment is holding the largest revenue share as corn is the primary source of resistant maltodextrin due to its abundance, affordability, and high starch content, which makes it an excellent source for producing resistant maltodextrin.

Corn-based resistant maltodextrin is widely used in various food and beverage applications, including bakery, confectionery, beverages, and dairy products, owing to its functional properties such as fat mimetic, bulking agent, and stabilizing agent. It also offers several health benefits, such as improving digestive health, maintaining healthy blood sugar levels, and reducing the risk of cardiovascular disease.

Food and beverages segment expected to witness fastest growth over forecast period

The food and beverage segment are anticipated to hold fastest growth over projected period. Resistant maltodextrin is used in various food and beverage products, including bakery, confectionery, beverages, and dairy products. In bakery products, resistant maltodextrin is used as a bulking agent fat replacer to enhance texture, mouthfeel, and shelf life. In confectionery products, it is used as a binding and bulking agent to prevent crystallization. In beverages, it is used to improve the product's mouthfeel, texture, and stability. In dairy products, it is used as a stabilizer to enhance the product's texture and mouthfeel.

The increasing demand for low-calorie and functional food products, along with the rising health consciousness among consumers, is driving the growth of the food and beverage segment. The demand for clean labels and natural food products also creates new opportunities for resistant maltodextrin in this segment.

North America dominated the global market in 2022

North America is the dominant region. Due to attributed to various factors, such as the increasing concerns about health and wellness, the rising prevalence of metabolic syndrome, and the growing consumption of nutritional supplements and beverages to improve health. Additionally, the region is witnessing an increasing awareness among consumers regarding the dietary benefits of improving health, which is driving the demand for resistant maltodextrin.

However, Asia-Pacific is expected to grow at the fastest rate due to the increasing adoption of a healthy lifestyle and a rising demand for functional food and beverage products. China, India, and Japan are the leading markets in this region, where consumers are increasingly aware of the benefits of consuming food products that are rich in dietary fiber.

Competitive Insight

Some of the major players operating in the global market include Matsutani, Fructose, Tate and Lyle, GLUCIDEX, Roquette Freres SA, Ingredion Incorporated, The Archer Daniels Midland Company, Bailong Chuangyuan, Fooding Group Limited, Guangzhou Xingfeng Biological Technology Co Ltd, Hugestone Enterprise Co Ltd, Anhui Elite Industrial Co Ltd, and Baoding Zhengze Trading Co.

Recent Developments

- In March 2022, Tate & Lyle PLC has acquired Quantum Hi-Tech (Guangdong) Biological Co., Ltd (Quantum). Quantum is a leading business in China's prebiotic dietary fiber market, and the acquisition is aimed at strengthening Tate & Lyle's position in the global prebiotic fiber market.

Resistant Maltodextrin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 405.46 million |

|

Revenue forecast in 2032 |

USD 851.24 million |

|

CAGR |

8.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Source Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Matsutani, Fructose, Tate and Lyle, GLUCIDEX, Roquette Freres SA, Ingredion Incorporated, The Archer Daniels Midland Company, Bailong Chuangyuan, Fooding Group Limited, Guangzhou Xingfeng Biological Technology Co Ltd, Hugestone Enterprise Co Ltd, Anhui Elite Industrial Co Ltd, and Baoding Zhengze Trading Co. |

FAQ's

Key companies in the resistant maltodextrin market are Matsutani, Fructose, Tate and Lyle, GLUCIDEX, Roquette Freres SA, Ingredion Incorporated, The Archer Daniels Midland Company, Bailong Chuangyuan.

The global resistant maltodextrin market expected to grow at a CAGR of 8.6% during the forecast period.

The resistant maltodextrin market report covering key segments are source type, application, and region.

Key driving factors in resistant maltodextrin market are increasing prevalence of obesity and the aging population.

The global resistant maltodextrin market size is expected to reach USD 851.24 million by 2032