Rhytidectomy Market Size, Share & Trends Analysis Report

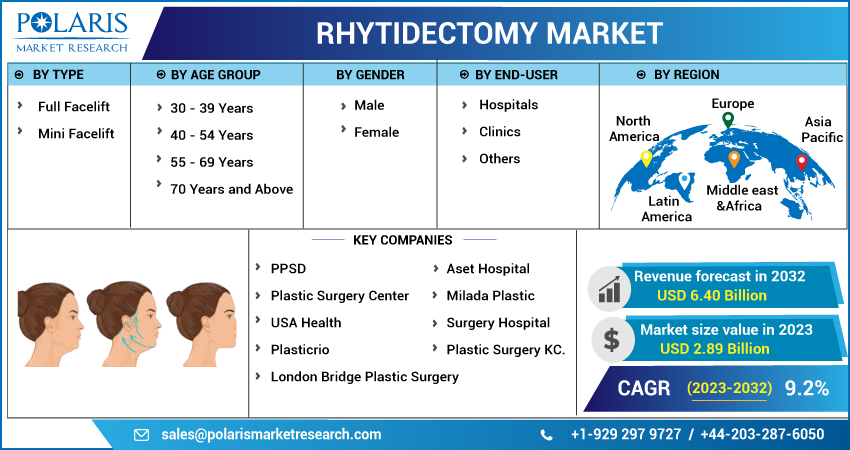

By Type (Full Facelift, Mini Facelift); By Age Group; By Gender (Male, Female); By End-use (Hospital, Clinics, Others); By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jun-2023

- Pages: 115

- Format: PDF

- Report ID: PM3346

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

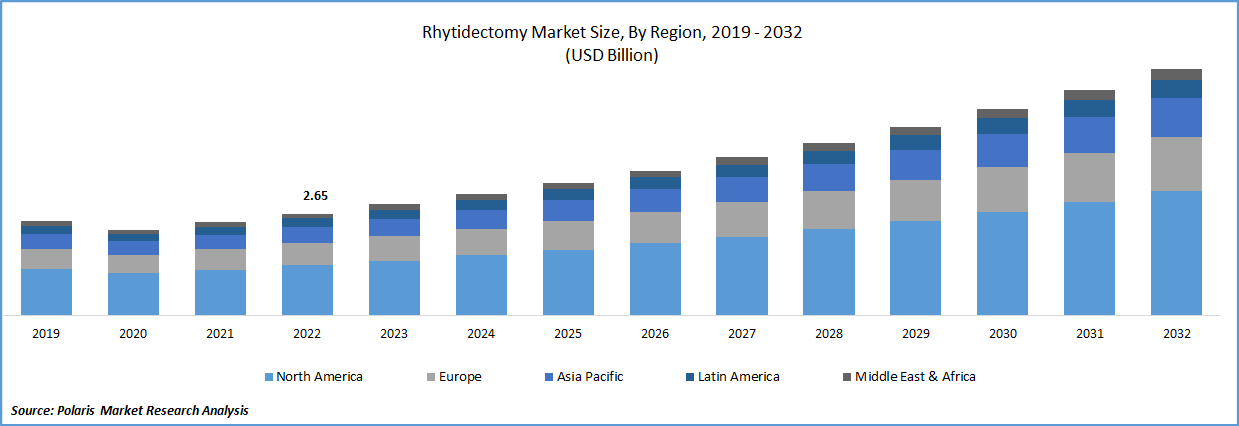

The global rhytidectomy market was valued at USD 2.65 billion in 2022 and is expected to grow at a CAGR of 9.2% during the forecast period. Significant increase in demand for cosmetic surgeries, driven mainly by the aging population's desire to look younger are prime factors driving market forward. Technological advancements, rising disposable income, and growing awareness about aesthetic procedures are some of the factors propelling the market's steady growth.

To Understand More About this Research: Request a Free Sample Report

According to the American Society of Plastic Surgeons (ASPS), facelift surgery is the 5th most common surgical procedure in U.S., in 2020, with 101,657 procedures performed. ASPS reports that most facelift patients are between the ages of 50 and 59, and that the procedure is more common among women than men.

The competition in the market is high, with both established players and new entrants offering innovative and effective products and services. As people age, they tend to develop wrinkles, fine lines, and other signs of aging that can impact their self-confidence and quality of life. Rhytidectomy procedures offer a way for individuals to address these concerns and achieve a more youthful, rejuvenated appearance.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Technological advancements in the field of cosmetic surgery have made rhytidectomy procedures safer and more efficient. For example, the use of endoscopic techniques in rhytidectomy has significantly reduced the need for large incisions and lengthy recovery times. In addition, computer-assisted imaging and three-dimensional modeling have enabled surgeons to plan and execute procedures with greater precision, leading to more predictable outcomes and higher patient satisfaction.

In 2021, a study was published demonstrating the use of 3D printing in surgical planning for rhytidectomy procedures. This technique allows for more precise planning of the surgery and can help surgeons achieve better results. The 3D printed model can also be used as a physical tool during the surgery, allowing the surgeon to reference the planned outcome and make adjustments as needed. This can help to ensure that the surgery is executed with a high degree of precision, leading to better results and higher patient satisfaction.

Report Segmentation

The market is primarily segmented based on type, age group, gender, end-use, and region.

|

By Type |

By Age Group |

By Gender |

By End-use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Full facelift segment accounted for the largest market share in 2022

The full facelift segment is one of the most popular rhytidectomy procedures, accounting for the largest market share. A full facelift typically involves the removal of excess skin, tightening of facial muscles, and repositioning of facial fat to achieve a more youthful, rejuvenated appearance. There are several companies that offer full facelift procedures and have made significant developments in this area. For example, in 2020, Allergan Aesthetics, a subsidiary of AbbVie, launched the Juvéderm Voluma XC injectable gel to help lift and contour the cheeks and chin. This product is designed to provide a nonsurgical alternative to a full facelift, with results that can last up to two years.

The mini-facelift segment is expected to grow at the fastest growth rate over the study period This is due to several factors, including the increasing demand for less invasive procedures and the growing trend towards more natural-looking results. Mini-facelifts typically involve smaller incisions and a quicker recovery time compared to traditional facelifts, making them a popular option for individuals who want to address early signs of aging without undergoing a more extensive procedure.

40-54 Years segment is expected to grow the fastest in 2022

In the 40-54 age group, individuals may be interested in more comprehensive procedures such as full or mini facelifts, which can help to address more advanced signs of aging such as sagging skin and deeper wrinkles. There are several companies that offer rhytidectomy procedures tailored to each age group.

The segment 55-69 years segment had the highest market share as this age group is concerned with restoring a more youthful appearance to the face. This age group tends to have more advanced signs of aging such as sagging skin, wrinkles, and jowls. As a result, procedures such as brow lifts, eyelid lifts, and neck lifts, in addition to full or mini facelifts, are commonly performed. In 2021, a new non-invasive eyelid lift device called the Plexr Plasma Soft Surgery was launched in the UK. This device uses plasma energy to tighten the skin around the eyes without the need for surgery.

Females segment is expected to hold the significant revenue share over the forecast period

Females are the primary customers for rhytidectomy and other cosmetic surgeries due to several reasons. Firstly, societal pressures and cultural norms place a significant emphasis on appearance, particularly for females. As a result, many women feel the need to maintain a youthful and attractive appearance, and cosmetic surgeries such as rhytidectomy can help them achieve this goal.

On the other hand, aging male population is increasing. As men age, they experience many of the same changes in their facial features as women, such as wrinkles and sagging skin. This has led to a growing demand for rhytidectomy and other cosmetic procedures among men. Lastly, advancements in technology and techniques have made rhytidectomy and other cosmetic surgeries safer and more effective for men. This has helped to increase their confidence in these procedures and further fuel the growth of the male segment in the rhytidectomy market.

Hospital segment is expected to hold the significant revenue share

The hospital segment is the largest and dominant segment in the global market. This is due to several factors. Firstly, rhytidectomy is a surgical procedure that requires specialized equipment, skilled medical professionals, and a sterile environment to minimize the risk of complications. Hospitals are well-equipped to provide these requirements, making them the preferred choice for patients seeking rhytidectomy. Secondly, hospitals have a larger patient base and greater visibility, which allows them to provide a wider range of services to a larger population. This translates into more patients seeking rhytidectomy from hospitals compared to clinics or other healthcare facilities.

The demand in Asia Pacific is expected to witness significant growth

Asia Pacific registered a robust growth rate over the study period. This is primarily due to growing demand for minimally invasive cosmetic procedures, increasing disposable income, and the presence of a large aging population in the region are some of the key factors driving the market growth. For instance, China is one of the largest markets for rhytidectomy procedures in the Asia Pacific region. According to the China Association of Plastics and Aesthetics (CAPA), the number of cosmetic surgery procedures performed in China increased by 30% in 2020 compared to the previous year. On the other hand, according to the International Society of Aesthetic Plastic Surgery (ISAPS), Japan was the fourth-largest market for cosmetic surgery procedures in the world in 2019, with over 424,000 procedures performed.

Moreover, there has been a shift in societal attitudes towards cosmetic surgery in Asia Pacific. In countries like South Korea and Japan, cosmetic surgery has become widely accepted and is even considered a part of mainstream culture. This has led to a surge in demand for various cosmetic procedures, including rhytidectomy.

Furthermore, North America is currently the dominant region in the global market. This can be attributed to several factors such as the presence of advanced healthcare infrastructure, high disposable income, and a large aging population. In addition, companies in the region are investing heavily in research and development to introduce innovative products and techniques for rhytidectomy.

Competitive Insight

Some of the major players operating in the global market include Milada Plastic Surgery Hospital PPSD, London Bridge Plastic Surgery, Plastic Surgery Center, USA Health, Plasticrio, Asset Hospital, & Plastic Surgery.

Recent Developments

- In January 2021, Sientra a US-based medical aesthetics company, announced the launch of its new line of facial rejuvenation products, including dermal fillers and skin care products. These recent developments highlight the ongoing innovation and competition in the rhytidectomy market, as companies strive to introduce new products and techniques to meet the evolving needs and preferences of patients.

Rhytidectomy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.89 billion |

|

Revenue forecast in 2032 |

USD 6.40 billion |

|

CAGR |

9.2% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2022 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Age Group, By Gender, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

PPSD, Plastic Surgery Center, USA Health, Plasticrio, London Bridge Plastic Surgery, Aset Hospital, Milada Plastic Surgery Hospital and Plastic Surgery KC. |

FAQ's

The rhytidectomy market report covering key segments are type, age group, gender, end-use, and region.

Rhytidectomy Market Size Worth $6.40 Billion By 2032.

The global rhytidectomy market expected to grow at a CAGR of 9.2% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in rhytidectomy market are increasing use of advanced technology in hospitals and clinics.