Riflescopes & Red Dot Sight Market Size, Share, Industry Analysis Report

By Magnification (1-8x, 8-15x, >15x), By Sight Type, By Technology, By Range, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM1670

- Base Year: 2024

- Historical Data: 2020-2023

Overview

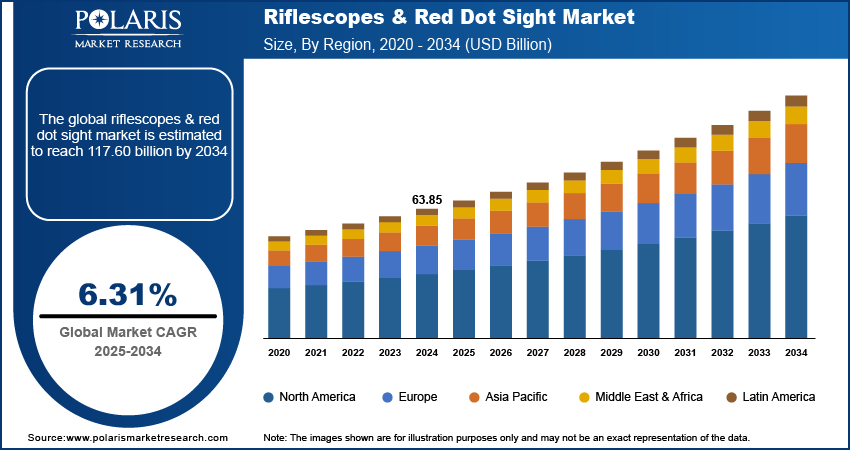

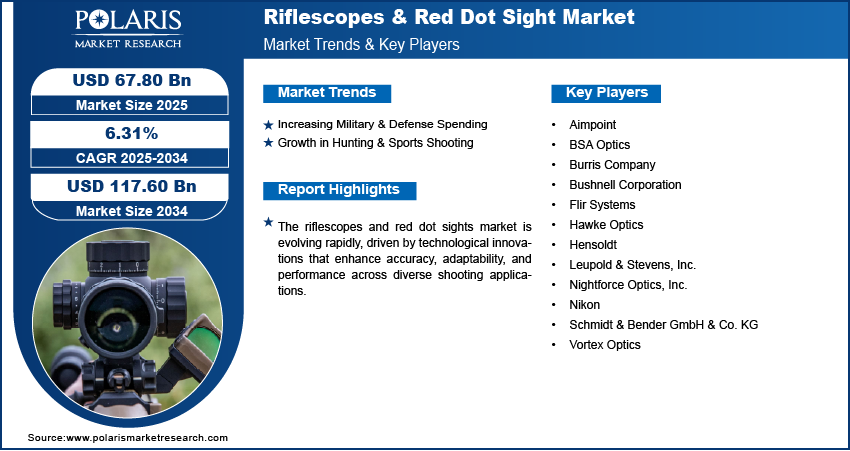

The global riflescopes & red dot sight market size was valued at USD 63.85 billion in 2024, growing at a CAGR of 6.31% from 2025 to 2034. Key factors driving demand include rising demand for electro-optics & night vision, increasing military and defense spending, and growth in hunting and sports shooting.

Key Insights

- The 8-15x magnification segment held a 45.78% share in 2024 due to an ideal balance between zoom and field of view, serving both mid and long-range shooting needs.

- The reflex sights segment is expected to register a CAGR of 5.4% during the forecast period, attributed to the rising demand driven by instant target acquisition and effectiveness in close-quarters scenarios.

- The electro-optic/IR tech segment led the market with 52.4% share in 2024 as they are preferred for high-performance day/night imaging, enhancing tactical flexibility.

- The medium-range segment is expected to witness the highest CAGR of 6.4% during 2025–2034, as shooters seek optics that blend short-range speed with long-range accuracy.

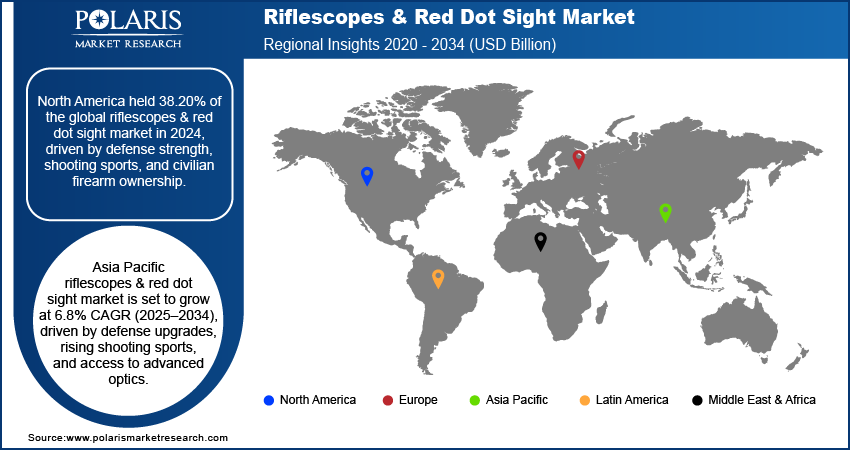

- North America dominated with a 38.2% global share in 2024 due to the strong military spending, shooting sports culture, and high civilian gun ownership, driving market leadership.

- The U.S. led the North America landscape with 82.48% share in 2024 as it is home to top optics brands, a robust defense sector, and an active hunting/shooting community.

- The market in Asia Pacific is expected to witness rapid expansion with a CAGR of 6.8% during 2025-34 due to defense upgrades, rising interest in sport shooting, and better optic availability, fueling growth.

- India’s growth is driven by military modernization and the increasing adoption of civilian precision shooting, which boosts demand for advanced optics.

Industry Dynamics

- Higher defense spending boosts demand for advanced optical systems, as militaries prioritize precision targeting and modernization for better combat performance.

- Growing interest in hunting and shooting sports increases demand for high-quality scopes and red dot sights, improving accuracy and user experience.

- Premium riflescopes and red dot sights with AI, thermal imaging, and smart features remain expensive, limiting adoption among budget-conscious civilian shooters and smaller military units.

- Growing interest in home defense, competitive shooting, and outdoor sports creates a lucrative market for affordable, high-performance optics with military-grade features.

Market Statistics

- 2024 Market Size: USD 63.85 billion

- 2034 Projected Market Size: USD 117.60 billion

- CAGR (2025-2034): 6.31%

- North America: Largest market in 2024

AI Impact on Riflescopes & Red Dot Sight Market

- AI improves targeting systems in riflescopes and red dots, enabling automatic adjustments for wind, distance, and recoil, boosting shooter accuracy.

- AI-powered scopes analyze surroundings in real-time, offering features such as object recognition, threat detection, and augmented reality overlays for better situational awareness.

- AI monitors optic performance, predicting wear and malfunctions before they happen, reducing downtime and improving reliability for military and civilian users.

- AI-driven virtual training tools help shooters practice with smart scopes, improving skills faster through real-time feedback and adaptive scenarios.

Riflescopes and red dot sights are precision optical aiming devices designed to enhance target acquisition, accuracy, and shooting performance across various applications, such as defense, law enforcement, and sports shooting. The growth of the market is boosted by the rising demand for electro-optics and night vision device capabilities, driven by the need for improved operational effectiveness in low-light and challenging visibility conditions. These technologies allow users to detect, identify, and engage targets with higher precision, even in complete darkness or adverse weather. The growing adoption of advanced night vision optics in military modernization programs, hunting, and tactical sports has further boosted this trend, as end-users increasingly aim for equipment that offers both enhanced visibility and operational reliability.

The increasing advancements and innovations in thermal imaging, laser rangefinders, and smart scopes further drive the growth opportunities. In June 2025, UTECH WEAR announced UTRACK, its first AR eyewear system designed for professional use. Featuring thermal imaging, sonar systems, AI recognition, and industrial inspection tools, it provides real-time data overlay for hunters, fishers, and technicians in demanding environments. These developments are transforming traditional optics into multifunctional targeting systems capable of providing real-time data, distance measurement, ballistic calculations, and augmented reality overlays.

Thermal imaging enables users to detect heat signatures beyond the limits of visible light, while integrated laser rangefinders improve target engagement accuracy over varied distances. Smart scopes, equipped with connectivity features and AI-assisted targeting, are further expanding operational capabilities for professional and recreational users alike. Such innovations enhance shooting precision and also cater to the evolving demands of technologically advanced defense and sports shooting ecosystems.

Drivers & Opportunities

Increasing Military & Defense Spending: Increasing military and defense spending is driving expansion opportunities as it directly fuels the procurement of advanced optical systems for combat readiness and modernization programs. According to an April 2025 report by SIPRI's Military Expenditure, global defense spending reached USD 2.718 trillion in 2024, marking ten consecutive years of growth with a 37% cumulative increase over this decade-long period. Higher defense budgets enable armed forces to invest in next-generation targeting solutions that enhance precision, situational awareness, and operational effectiveness across diverse combat environments. Riflescopes and red dot sights are critical for improving marksmanship, enabling faster target acquisition, and supporting both day and night operations. This increased investment accelerates the adoption of technologically advanced optics but also boosts innovation and integration of features such as thermal imaging, ballistic calculators, and laser rangefinders to meet evolving battlefield requirements.

Growth in Hunting & Sports Shooting: The rising popularity of competitive shooting is boosting growth opportunities, as participants aim for high-performance optics to gain a competitive edge. According to the 2022 U.S. National Survey of Fishing, Hunting, and Wildlife-Associated Recreation, approximately 19 million Americans participated in target shooting competitions, ranging from precision rifle matches to dynamic 3-gun events. These competitions require optics that deliver rapid target acquisition, exceptional accuracy, and reliability under time constraints. Red dot sights and advanced scopes meet these demands by offering features such as adjustable magnification, illuminated reticles, and quick target transition capabilities. Additionally, the sport’s focus on precision and speed has driven competitors to invest in optics that enhance their skill levels while adapting to various match formats and target distances. This growing engagement in shooting sports continues to promote steady demand for technologically advanced and competition-ready optical solutions.

Segmental Insights

Magnification Analysis

Based on magnification, the segmentation includes 1-8x, 8-15x, and >15x. The 8-15x segment accounted for 45.78% revenue share in 2024 due to its ability to deliver a balanced combination of magnification power and field of view, making it suitable for both medium- and long-range shooting scenarios. This range offers shooters enhanced precision while retaining situational awareness, which is critical in dynamic operational environments. Its adaptability for varied shooting applications, combined with technological enhancements such as superior lens coatings and advanced reticle designs, has made it a preferred choice among professional shooters and enthusiasts aiming for reliable and accurate performance.

The 1-8x segment is expected to witness a significant CAGR of 6.0% during the forecast period due to its versatility in close-to medium-range engagements and its capability for rapid magnification adjustments. This range supports fast target acquisition while maintaining accuracy, which is especially important in fast-paced shooting situations. Its lightweight design, wide field of view, and ease of handling make it appealing to users prioritizing agility and flexibility. Additionally, advancements in optical clarity, illumination systems, and durability are further boosting adoption in both tactical and recreational contexts.

Sight Type Analysis

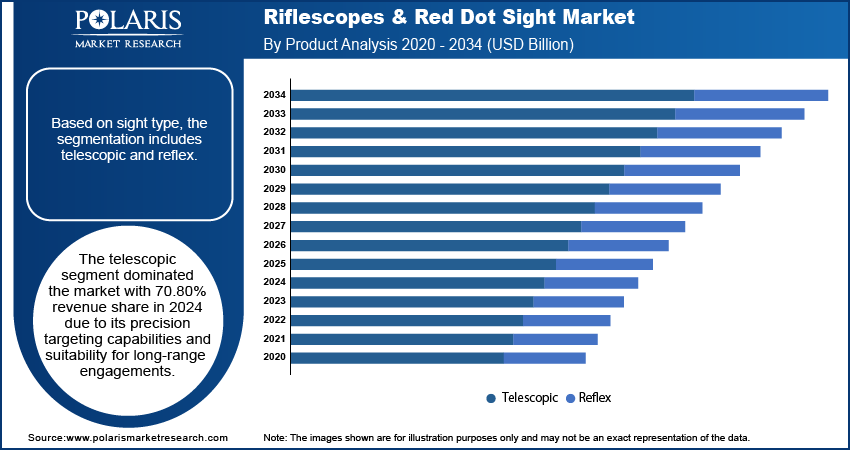

In terms of sight type, the segmentation includes telescopic and reflex. The telescopic segment dominated the market with 70.80% revenue share in 2024 due to its precision targeting capabilities and suitability for long-range engagements. Telescopic sights provide magnification and customizable reticle options, enabling users to engage distant targets with accuracy under various environmental conditions. Their robust construction, enhanced optical performance, and adaptability for different calibers and applications have strengthened their position as the primary choice for professional and recreational shooters.

The reflex segment is expected to register a CAGR of 5.4% during the forecast period owing to its exceptional speed in target acquisition and ability to operate effectively at short ranges. Reflex sights offer minimal parallax, unlimited eye relief, and quick aiming capabilities, which are ideal for high-mobility shooting environments. Their lightweight build, ease of mounting, and compatibility with a wide range of firearms make them increasingly popular for both tactical and sporting purposes. Continuous improvements in brightness adjustment, lens quality, and durability are further enhancing their appeal.

Technology Analysis

The segmentation, based on technology, includes electro-optic/IR, thermal imaging, and laser. The electro-optic/IR segment held 52.40% share of the market in 2024, driven by its capability to deliver superior imaging performance in both day and night conditions. These systems integrate features such as illuminated reticles, range estimation, and enhanced light transmission, enabling effective target engagement in low-light environments. Their versatility and effectiveness in diverse operational settings have led to broad adoption across multiple user segments.

The thermal imaging segment is projected to witness a robust CAGR of 6.0% during 2025–2034 attributed to its ability to detect heat signatures regardless of lighting or weather conditions. Thermal scopes provide an effective tactical advantage by enabling the detection of concealed or camouflaged targets, which is critical in both defense and hunting applications. Moreover, continuous advancements in resolution, detection range, and compact designs are making thermal imaging more accessible and effective for various user needs.

Range Analysis

In terms of range, the segmentation includes short range, medium range, and long range. The short range segment accounted for 52.87% revenue share in 2024 due to its high demand in fast-paced, close-quarters scenarios where quick target acquisition and a wide field of view are essential. These optics are designed for accuracy at shorter distances, making them ideal for tactical, law enforcement, and close-range hunting applications. Their lightweight construction and ease of handling further contribute to their popularity.

The medium range segment is expected to witness the highest CAGR of 6.4% during the forecast period due to the increasing demand for optics that can effectively bridge the gap between short-range speed and long-range precision. Medium-range optics are valued for their adaptability across varied shooting environments, offering a balance of magnification and accuracy. Additionally, technological enhancements such as improved reticle designs, better light transmission, and integrated range finding capabilities are further driving interest in this category.

Regional Analysis

The North America riflescopes & red dot sight market accounted for 38.20% of global revenue share in 2024. This dominance is attributed to the region’s advanced defense infrastructure, strong culture of shooting sports, and high rate of civilian firearm ownership. The presence of leading optics manufacturers, combined with a developed technological ecosystem, supports the development and adoption of next-generation targeting solutions. Continuous investment in research and innovation has led to the integration of advanced features such as thermal imaging, electro-optics, and smart scope technology, further strengthening the market’s competitive edge. In June 2025, the U.S. Army deployed USD 13 million in AI-powered smart scopes under its TIC 2.0 program. These systems autonomously track drones and trigger shots only when hit confirmation is guaranteed, using cameras and sensors. Additionally, the region’s robust distribution networks and established training programs contribute to sustained demand across both defense and civilian segments.

U.S. Riflescopes & Red Dot Sight Market Insights

The U.S. held 82.48% market share in North America riflescopes & red dot sight landscape in 2024 due to its advanced defense infrastructure, strong presence of leading optics manufacturers, and a deeply rooted culture of hunting and shooting sports. According to a November 2023 U.S. Bureau of Economic Analysis report, the outdoor recreation industry, which includes hunting & shooting, contributed USD 563.7 billion in 2022. Additionally, high defense spending, continuous technological innovations, and the vast adoption of advanced targeting systems across military, law enforcement, and civilian sectors have boosted the country’s dominant position in the regional market.

Asia Pacific Riflescopes & Red Dot Sight Market Trends

The market in Asia Pacific is projected to register a CAGR of 6.8% from 2025 to 2034, owing to increasing defense modernization efforts, growing interest in precision shooting sports, and improving accessibility to advanced optical devices. Rising investments in local manufacturing capabilities and the adoption of advanced technologies such as thermal imaging and electro-optics are enhancing regional production and reducing dependency on imports. According to a March 2025 Indian Ministry of Defence report, the country's defense production has increased, recording production worth USD 15.2 billion in FY 2023-24 and exports reaching USD 2.83 billion in FY 2024-25. Expanding firearm availability in certain areas, along with greater participation in tactical training and competitive shooting, is further creating a broader user base. This rising growth is supported by regional economic development, which enables greater allocation of resources toward high-performance optics.

India Riflescopes & Red Dot Sight Market Overview

The market in India is expanding due to ongoing defense modernization initiatives, rising procurement of advanced optical systems for armed forces, and a growing interest in precision shooting sports. Moreover, increasing manufacturing capabilities, coupled with the adoption of newer technologies such as thermal imaging and electro-optics, is enhancing accessibility and driving growth opportunities within both defense and civilian segments.

Europe Riflescopes & Red Dot Sight Market Analysis

Europe held 25.75% of the global revenue share in 2024, attributed to the region’s long-standing tradition of precision engineering, well-established hunting culture, and advanced defense procurement systems. European manufacturers are recognized for producing premium-quality optics with superior craftsmanship and advanced technology integration, which enhances their appeal in both domestic and global markets. The presence of strict quality standards and regulatory compliance ensures consistent product performance and durability. Furthermore, the combination of innovation, heritage, and a strong export network has reinforced Europe’s position as a major contributor to the global optics industry.

Germany Riflescopes & Red Dot Sight Market Assessment

The growth is driven by the rising demand for multifunctional optical systems that combine magnification, range finding, and advanced imaging capabilities into compact, durable designs. Technological innovations, expanding tactical and recreational shooting activities, and increased investment in research and development are enabling manufacturers to cater to diverse operational requirements while boosting global competitiveness.

Key Players & Competitive Analysis

The riflescopes and red dot sight industry is witnessing intense competition driven by technological advancements, strategic investments, and emerging market segments. Leading players such as Vortex Optics, Leupold, and Aimpoint dominate developed markets, while SMEs and niche brands target growth opportunities in tactical and hunting sectors. Revenue growth is fueled by innovations in thermal imaging, smart scopes, and ruggedized designs, with expansion strategies focusing on untapped regions. Disruptive trends such as digital reticles and lightweight materials are reshaping competitive positioning, while geopolitical shifts influence defense procurement. Vendor strategies emphasize precision, durability, and affordability, with supply chain disruptions prompting localized production. Future development strategies hinge on AI integration and sustainability, as industry trends reflect rising demand for hybrid optics in civilian and military applications. Expert insights highlight latent demand in Asia Pacific and Africa, where economic growth drives adoption. Pricing insights reveal premiumization in long-range scopes, while red dots see mass-market penetration. Competitive intelligence underscores consolidation via mergers and acquisitions, with leaders leveraging regional footprints to capture total addressable market.

A few major companies operating in the riflescopes & red dot sight market include Aimpoint; BSA Optics; Burris Company; Bushnell Corporation; Flir Systems; Hawke Optics; Hensoldt; Leupold & Stevens, Inc.; Nightforce Optics, Inc.; Nikon; Schmidt & Bender GmbH & Co. KG; and Vortex Optics.

Key Players

- Aimpoint

- BSA Optics

- Burris Company

- Bushnell Corporation

- Flir Systems

- Hawke Optics

- Hensoldt

- Leupold & Stevens, Inc.

- Nightforce Optics, Inc.

- Nikon

- Schmidt & Bender GmbH & Co. KG

- Vortex Optics

Riflescopes & Red Dot Sight Industry Developments

- January 2025: KAHLES launched the K5-40x56i riflescope, featuring a 40% wider field of view, an expanded eyebox for comfort, and precise elevation adjustment (160 clicks/rotation). Available with AMR, MSR2/Ki, and SKMR4+ reticles (FFP), it ensures accuracy and usability at high magnifications.

- August 2024: ALPEN OPTICS launched the Argus LT Red Dot in Europe, featuring a durable 6061 aluminum housing, 3 reticle options (3 MOA dot/circle/circle-dot), and 50,000-hour battery life. It supports RMR/Picatinny mounts, offers 0.3 MRAD adjustments, and is waterproof and shockproof.

Riflescopes & Red Dot Sight Market Segmentation

By Magnification Outlook (Revenue, USD Billion, 2020–2034)

- 1-8x

- 8-15x

- >15x

By Sight Type Outlook (Revenue, USD Billion, 2020–2034)

- Telescopic

- Reflex

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Electro-Optic/IR

- Thermal Imaging

- Laser

By Range Outlook (Revenue, USD Billion, 2020–2034)

- Short Range

- Medium Range

- Long Range

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Hunting

- Armed Forces

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Riflescopes & Red Dot Sight Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 63.85 Billion |

|

Market Size in 2025 |

USD 67.80 Billion |

|

Revenue Forecast by 2034 |

USD 117.60 Billion |

|

CAGR |

6.31% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 63.85 billion in 2024 and is projected to grow to USD 117.60 billion by 2034.

The global market is projected to register a CAGR of 6.31% during the forecast period.

The North America riflescopes & red dot sight market accounted for 38.20% of global market share in 2024.

A few of the key players in the market are Aimpoint; BSA Optics; Burris Company; Bushnell Corporation; Flir Systems; Hawke Optics; Hensoldt; Leupold & Stevens, Inc.; Nightforce Optics, Inc.; Nikon; Schmidt & Bender GmbH & Co. KG; and Vortex Optics.

The telescopic segment dominated the market with 70.80% revenue share in 2024.

The thermal imaging segment is projected to register a CAGR of 6.0% during the forecast period