Savory Snack Products Market Share, Size, Trends, Industry Analysis Report

By Distribution Channel (Retail, Foodservices); By Flavor (Barbeque, Spicy, Salty, Plain/Unflavored, Others); By Product; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2025

- Pages: 127

- Format: PDF

- Report ID: PM2448

- Base Year: 2024

- Historical Data: 2020 - 2023

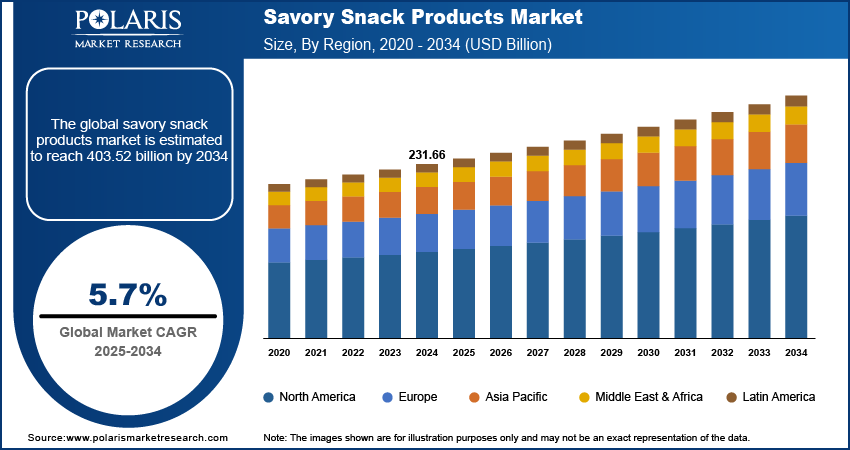

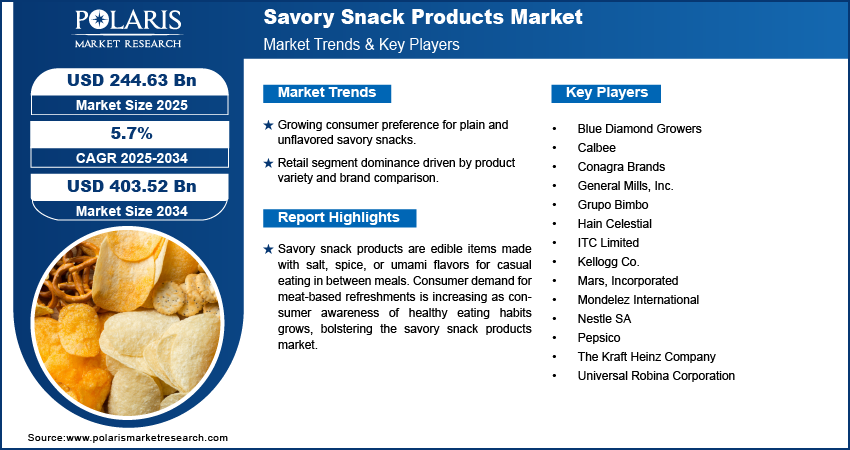

The global savory snack products market was valued at USD 231.66 billion in 2024 and is expected to grow at a CAGR of 5.7% from the forecast period. Key factors driving the market includes expansion of retail industry globally, increasing demand for healthy snacks, increasing market penetration, and increased customer desire for meat appetizers.

Key Insights

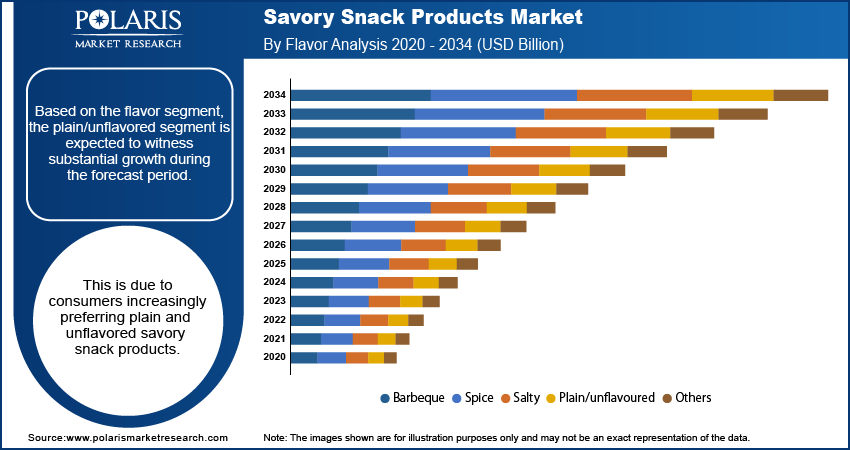

- The plain/unflavored segment is expected to witness growth during the forecast period. This is due to the consumers who prefer plain and unflavored savory snack products.

- In 2024, the retail segment held the largest revenue share due to a wide range of goods from diverse brands, enabling customers to compare and make informed purchase decisions.

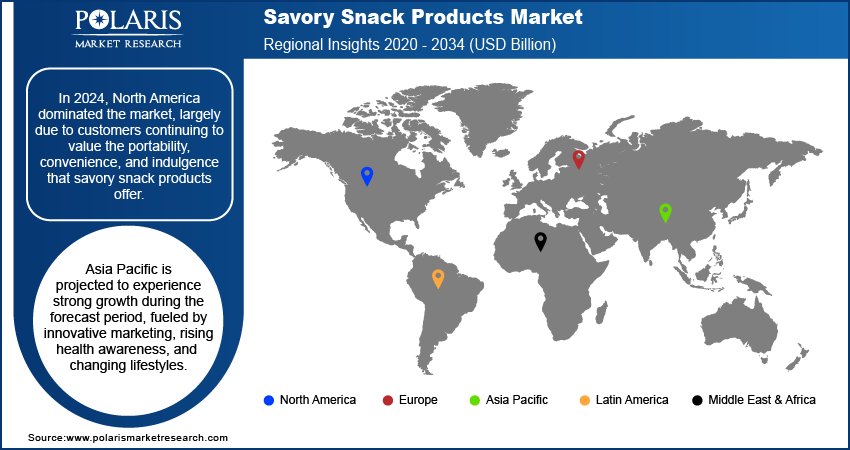

- In 2024, North America dominated the market, largely due to customers continuing to value the portability, convenience, and indulgence that savory snack products offer.

- The Asia Pacific is expected to witness robust growth in the global market during the forecast period, driven by innovative ads and campaigns, increasing consumer awareness of healthy snacks, and a shift in lifestyle.

Industry Dynamics

- The plain/unflavored segment is expected to witness growth during the forecast period. This is due to the consumers who prefer plain and unflavored savory snack products.

- In 2024, the retail segment held the largest revenue share due to a wide range of goods from diverse brands, enabling customers to compare and make informed purchase decisions.

- In 2024, North America dominated the market, largely due to customers continuing to value the portability, convenience, and indulgence that savory snack products offer.

- The Asia Pacific is expected to witness robust growth in the global market during the forecast period, driven by innovative ads and campaigns, increasing consumer awareness of healthy snacks, and a shift in lifestyle.

Market Statistics

- 2024 Market Size: USD 231.66 billion

- 2034 Projected Market Size: USD 403.52 billion

- CAGR (2025-2034): 5.7%

- Largest market in 2024: North America

To Understand More About this Research: Request a Free Sample Report

AI Impact on Savory Snack Products Market

- Analyze consumer trends to develop new flavor profiles and product concepts.

- Enhance production for consistency, reduce waste, and ensure precise quality control.

- Optimize shelf placement and craft hyper-targeted ads by predicting purchasing behavior.

- Forecast demand and manage inventory for fresh products to ensure optimal stock levels.

Savory snack products are edible items made with salt, spice, or umami flavors for casual eating in between meals. Consumer demand for meat-based refreshments is increasing as consumer awareness of healthy eating habits grows, bolstering the savory snack products market. Protein is required in their packs for several reasons, including satiety, muscle support, nutrition, and healthy aging. Meat appetizers have traditionally been found on the shelves of convenience stores, as more consumers desire healthier and leaner refreshments, they are taking up more shelf space in a variety of retail formats.

The total demand for savory snack products is likely to be driven by increasing market penetration and a rise in customer demand for meat appetizers. Furthermore, they are available in various flavors, such as teriyaki, spicy, smoked, and hickory, which provides consumers with a wide range of options. However, the health risks connected with major ingredients in savory foods, such as wheat, corn, vegetable oil, salt, sugar, chemical additives, and preservatives, create a serious threat to market expansion over the forecast period. Moreover, snacking regularly adds extra calories to the body, which leads to enormous weight gain and obesity. According to a September 2024 Centers for Disease Control and Prevention (CDC) data, the prevalence of obesity among adults in the U.S. was 40.3% from August 2021 to August 2023. These major health concerns are creating a threat to the global savory snack products market.

Industry Dynamics

Growth Drivers

Consumer eating habits have changed with their preference for convenience products. This change is occurring due to the growth of urbanization and busy lifestyles. Consumers are increasingly opting for traditional meals, with an aim for more adaptable choices, convenient options, and light refreshments as disposable incomes and busy lifestyles continue to grow.

Additionally, within developing countries such as China, India, Bangladesh, and Indonesia, the convenience meal market is witnessing growth. Western culture is introducing products such as pretzels, extruded appetizers, and other refreshments that are gaining acceptance worldwide. Global GDP is continuing to grow, with increasing consumer purchasing power to indulge in premium and luxury foods, and allowing the savory snack products sector to expand.

Food retail is being driven by consistent government regulations and investments in the retailing industry, which has boosted the exposure of savory snack products. Continuing economic development is expected to drive demand for imported goods. At the same time, retail innovation will open up more options to display consumer-oriented, high-value goods on store shelves and e-commerce platforms. For instance, in October 2021, the Indian retailer Future Group, in partnership with 7-Eleven, the world's largest convenience store chain, opened its first outlets in India.

Report Segmentation

The market is primarily segmented based on product, flavor, distribution channel, and region.

|

By Product |

By Flavor |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Flavor Analysis

Based on the flavor segment, the plain/unflavored segment is expected to witness substantial growth during the forecast period. This is due to consumers increasingly preferring plain and unflavored savory snack products. Consumers are also seeking products with consumer-friendly ingredients, clean label claims, and regionally and ethically sourced ingredients, which is expected to help companies develop health and wellness products.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes retail and foodservice. The retail segment held the largest revenue share in 2024. This is due to a variety of goods from diverse brands, allowing customers to compare and make an informed purchase decision. The importance of impulsive buying when purchasing a pack of savory snack products is attributed to retail establishments. This impulsive behavior is attributed to the extensive shelf space available in supermarkets and the prevalence of impulse buying when purchasing snack products. Customers receive greater value for their money due to discount opportunities and a wider range of options, leading to people worldwide choosing to purchase or shop for groceries at offline retail outlets.

Regional Analysis

North America Savory Snack Products Market Overview

North America held the largest revenue share in 2024. This is due to the customers continuing to value the portability, convenience, and indulgence that savory snack products provide. The trend of sanctification among consumers in the region is an everyday habit, with consumers of all ages nibbling at least once a day. Chips and tortilla chips are the two most popular savory snack product choices among Americans, with chips accounting for the most dollar value sales. Furthermore, the taste map and the demand for savory snack products in the region are expanding due to different preparation techniques, such as toasted coconut kale chips, oven-roasted sweet potato chips, and a wide variety of roasted almonds.

Asia Pacific Snack Products Market Assessment

Asia Pacific is expected to witness a high CAGR in the global market during the forecast period. This growth is primarily due to innovative ads and campaigns aimed at product adoption, increasing consumer awareness of healthy snacks, and a shift in lifestyle among the upper-middle-class population with high disposable income. The South Asian nations offer a wide range of savory snacks with a substantial population of millennials who seek healthier lifestyles. Moreover, the rising obese population and awareness of healthy eating are expected to boost the region’s growth.

Competitive Insight

Some of the major players operating in the global market include Blue Diamond Growers, Calbee, Conagra Brands, General Mills, Inc., Grupo Bimbo, Hain Celestial, ITC Limited, Kellogg Co., Mars, Incorporated, Mondelez International, Nestle SA, Pepsico, The Kraft Heinz Company, and Universal Robina Corporation, among others.

Industry Developments

April 2025: The Hershey Company acquired LesserEvil, a manufacturer of organic, delectable snacks. The acquisition is expected to expand Hershey's snacking portfolio and also bring additional manufacturing capabilities and capacity to meet the growing needs of consumers and retailers.

August 2024: Mars, Incorporated, a global snacking company, acquired Kellanova for USD 35.9 billion, expanding its international presence in cereal and noodles.

Savory Snack Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 231.66 Billion |

| Market size value in 2025 | USD 244.63 Billion |

|

Revenue forecast in 2034 |

USD 403.52 Billion |

|

CAGR |

5.7% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Flavor, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Blue Diamond Growers, Calbee, Conagra Brands, General Mills, Inc., Grupo Bimbo, Hain Celestial, ITC Limited, Kellogg Co., Mars, Incorporated, Mondelez International, Nestle SA, Pepsico, The Kraft Heinz Company, and Universal Robina Corporation |

FAQ's

• The global market size was valued at USD 231.66 billion in 2024 and is projected to grow to USD 403.52 billion by 2034.

• The global market is projected to register a CAGR of 5.7% during the forecast period.

• North America dominated the global market share in 2024.

• A few of the key players are Blue Diamond Growers, Calbee, Conagra Brands, General Mills, Inc., Grupo Bimbo, Hain Celestial, ITC Limited, Kellogg Co., Mars, Incorporated, Mondelez International, Nestle SA, Pepsico, The Kraft Heinz Company, and Universal Robina Corporation.

• In 2024, the retail segment held the largest revenue share.

• The plain/unflavored segment is expected to witness the fastest growth during the forecast period.