SerDes Market Share, Size, Trends, Industry Analysis Report

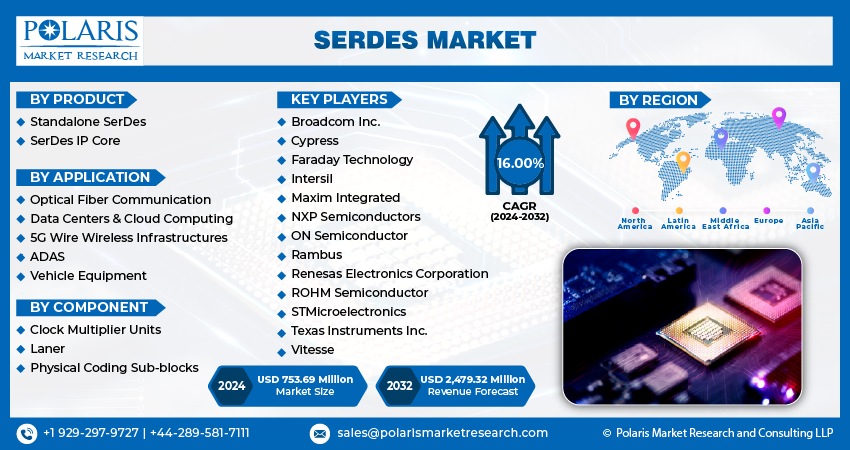

By Product (Standalone SerDes and SerDes IP Core); By Application; By Component; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4109

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global SerDes market was valued at USD 661.14 million in 2023 and is expected to grow at a CAGR of 16.00% during the forecast period.

The rapid increase in the amount of data generated through various applications has led to greater demand for effective and efficient data-sharing services and solutions and the surging adoption of SerDes as a prominent or crucial technology used for the transmission of high-speed data between integrated circuits and chips, are among the leading factors influencing the growth of the market. Apart from this, the rising proliferation and need for speedy, robust data connections to download and stream HD movies to exchange larger datasets without any hassles is further likely to influence the market positively.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to our findings, the amount of data created every day is approx. 328.77 million terabytes and about 120 zettabytes of data are projected to be generated in 2023, and the number is expected to reach 181 zettabytes by 2025, with over 50% of internet data traffic accounting for videos.

Moreover, the continuous expansion of cloud computing services across the globe and the rising proliferation of data centers led to a higher need for efficient and effective communication between storage devices and servers. Thus, product manufacturers and suppliers have started focusing on the implementation of new SerDes solutions that offer improved benefits, including reduced power consumption and better space utilization.

- For instance, in April 2023, Marvell Technology announced the launch of its new 3nm SerDes silicon that is specially designed to boost data transfer speed up to 45% faster than the company’s existing approaches. The newly developed solution is likely to help cloud service providers stay ahead of ever-escalating demand for increased speeds and more traffic.

However, the high cost associated with the components used in SerDes technology, the growing power consumption concern in various modern electronic devices, and the higher need to comply with industry regulations and standards are key factors hampering the growth of the global market.

Industry Dynamics

Growth Drivers

- Rise of big data and expansion of network infrastructure fostering the global market growth

There has been drastic growth in the expansion of network infrastructure that produces a significant amount of data that needs to be effectively transmitted. Along with this, the continuous growth of big data, the digital revolution across the globe, and the surging use of SerDes in the telecom sector are all among the factors influencing the demand and growth of the SerDes market at a substantial pace.

- For instance, according to a recent report, it is expected that the data generated in 2023 will be three times the data generated in 2019, and by 2025, people will create over 181 ZB of data. Also, it is projected that 9 out of 10 companies will increase their data and analytics investments in 2023.

Report Segmentation

The market is primarily segmented based on product, application, component, and region.

|

By Product |

By Application |

By Component |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Standalone SerDes segment accounted for the largest market share in 2022

The standalone SerDes segment accounted for the largest market share. The growth of the segment market can be largely attributed to the growing proliferation of various data-intensive applications, including cloud computing, big data, IoT, and 5G, along with its surging use in enabling high-speed connectivity across various applications like networking equipment, data centers, and communication systems.

The SerDes IP core segment is projected to exhibit the highest growth rate over the next coming years, mainly due to its emergence as a crucial component in several applications, such as high-speed data transmission and advanced networking systems. Besides this, they are able to be integrated with various semiconductor devices like system-on-chip and field-programable gate arrays.

By Application Analysis

- Data centers & cloud computing segment held the significant market share in 2022

The data centers & cloud computing segment held the majority share in terms of revenue in 2022, which is mainly driven by the growing transition to 400G and beyond across the world and exponential growth in the data traffic that is mainly fueled by streaming media, cloud-based devices, and IoT devices, which often requires more efficient and faster data transmission. With the increasing number of data centers undergoing modernization efforts to enhance their efficiency, reduce power consumption, and improve overall performance, the adoption of SerDes solutions across data centers is rapidly increasing.

- For instance, according to a report by Exploding Topics, the number of IoT devices as of 2023 is about 15.14 billion, and the figure is expected to double to approximately 29.42 billion by the end of 2030. Only in Greater China the number of IoT devices stand at 5.04 billion in 2023 and is likely to reach 8.57 billion.

By Component Analysis

- Clock multiplier units segment is projected to witness highest growth rate

The clock multiplier units segment is projected to witness the highest growth rate with a healthy CAGR during the projected period on account of growing advancements in semiconductor manufacturing technologies, which will enable the integration of more complex CMUs into SerDes solutions. Along with this, several companies operating in the market are increasingly focusing on offering customizable solutions to meet the specific needs of different applications and meeting industry regulations and standards related to data transmission and signal integrity, which, in turn, creates lucrative growth opportunities for the segment market.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with a considerable share in 2022 and is also projected to continue its market position throughout the study period. The regional market growth is highly attributable to the robust presence of various leading SerDes vendors in the region, such as Texas Instruments, Renesas, and Maxim Integrated, among others, and rising product applications in the telecommunications and automotive industries.

In addition, the region is home to numerous leading research and development institutions, universities, and technology companies; thereby, ongoing research in high-speed data communication and networking technologies will continue to drive innovation and adoption of SerDes solutions at a significant pace across the region.

APAC will grow at a substantial pace, owing to widespread product adoption in computers, smartphones, and other smart devices and the presence of some of the leading semiconductor manufacturing and designing facilities in countries like South Korea, Taiwan, and China, which led to the development of more innovative and advanced SerDes solutions.

- For instance, as per a report by Invest Korea, Korea’s semiconductor market will account for almost 17.7% of the global market share in 2022, which makes it the second-largest market worldwide. Also, Korea accounts for almost 60.5% of global memory semiconductors and is looking to expand its market further.

Key Market Players & Competitive Insights

The SerDes market is moderately competitive, with the presence of several global market players worldwide. The top market companies are focusing on maintaining their product standards and quality control, strengthening the supply chain management systems, and adopting various business development and expansion strategies, including partnerships, collaborations, and new product launches.

Some of the major players operating in the global market include:

- Broadcom Inc.

- Cypress

- Faraday Technology

- Intersil

- Maxim Integrated

- NXP Semiconductors

- ON Semiconductor

- Rambus

- Renesas Electronics Corporation

- ROHM Semiconductor

- STMicroelectronics

- Texas Instruments Inc.

- Vitesse

Recent Developments

- In August 2022, Credo Technology Group introduced a new comprehensive family of 112G PAM4 SerDes IP that supports a large range of demand, including long reach, long reach plus, medium reach, extreme short reach plus, and extreme short reach.

- In December 2022, VSI unveiled its new commercial SerDes solution, which is likely to comply with the Automotive SerDes Alliance standards. The new solution offers a data transmission rate of up to 16-resolution image data collected with the help of vehicle image sensors.

SerDes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 753.69 million |

|

Revenue forecast in 2032 |

USD 2,479.32 million |

|

CAGR |

16.00% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Component, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |