Serum Separation Gel Market Share, Size, Trends, Industry Analysis Report

By Product Type (Serum Separation Gel Integrated with Tube and Serum Separation Gel without Tube); By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4791

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

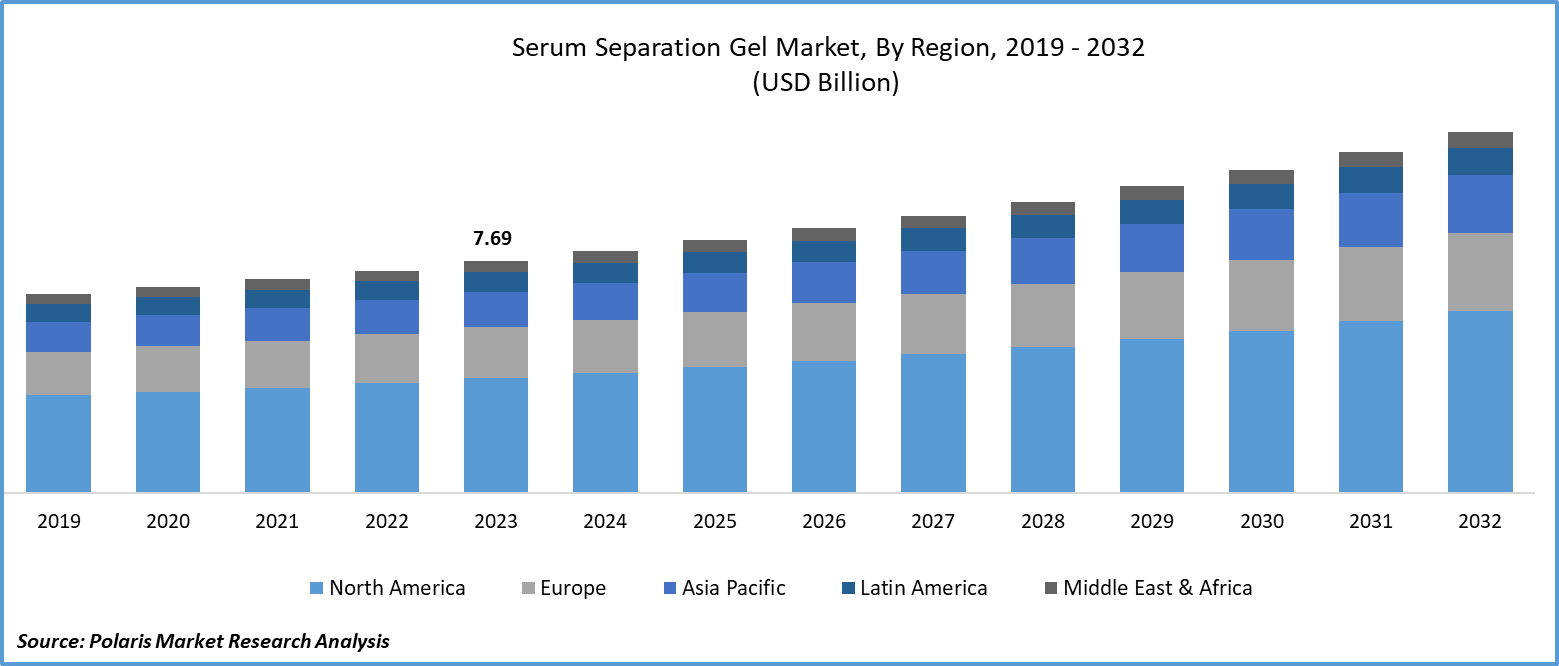

Global serum separation gel market size was valued at USD 7.69 billion in 2023. The market is anticipated to grow from USD 8.03 billion in 2024 to USD 11.96 billion by 2032, exhibiting the CAGR of 5.1% during the forecast period.

Market Overview

The substantial rise in the number of blood banks and blood tests worldwide to examine the state and type of blood and the continuous increase in the prevalence of bloodstream infection diseases, including nosocomial candidemia, are key factors driving the global market growth. Moreover, surging awareness among the global public regarding infectious disease diagnosis is further expected to propel the number of examinations, which, in turn, fuels the market for serum separation gel at a rapid pace.

- For instance, according to an article published in the Journal of Tropical Medicine, more than 30 million people are affected by bloodstream infection, which accounts for almost 6 million deaths, with about 3 million newborns and 1.2 million children suffering from sepsis every year.

To Understand More About this Research: Request a Free Sample Report

Furthermore, several studies and research are being conducted worldwide for the development of equipment-free, novel, and paper-based assays for direct and highly efficient serum separation with greater efficiency, purity, recovery, and applicability. They are also optimized using different types of coagulation activators, blood collection methods, incubation conditions, and paper types that help in achieving serum band directly.

Growth Factors

Increasing prevalence of chronic diseases to drive market growth

The continuous upsurge in the prevalence of various chronic diseases worldwide is driving the growth of the market. Chronic diseases such as heart disease, infectious diseases, diabetes, and cancer are becoming increasingly common and require regular blood tests, propelling the demand for serum separation gels due to their importance in obtaining accurate blood test results. For instance, according to the Institute for Health Metrics and Evaluation, currently, over 529 million people worldwide are living with diabetes, and the number is expected to double and reach 1.3 billion people by 2050. As healthcare systems worldwide focus on early detection, prevention, and management of chronic diseases, the demand for serum separation gel products is expected to surge, driving market growth in the coming years.

Rising healthcare expenditure and technological advancements to spur market growth

Rising healthcare expenditure coupled with continuous technological advancements are poised to significantly spur market growth in the serum separation gel sector especially in emerging economies such as India, China, Malaysia, and South Korea, coupled with the advancements in healthcare and laboratory diagnostics that led to the development of advanced and more efficient separation gels, are further likely to foster serum separation gel market growth. For instance, according to the American Medical Association, health expenditure in the US in 2021 increased by 2.7 percent to USD 4.3 trillion or USD 12914 per capita.

Restraining Factors

Stringent regulatory requirements and its high cost to restrain growth

Serum separation gels require compliance with several stringent regulatory requirements regarding product safety and quality standards, which pose significant challenges and increase the overall production cost, limiting their adoption, especially in low and middle-income countries.

Report Segmentation

The market is primarily segmented based on product type, end user, and region.

|

By Product Type |

By End User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Insights

Serum separation gel integrated with tube segment accounted for largest share in 2023

The serum separation gel integrated with the tube segment accounted for the largest share. This dominance is attributed to the widespread use of these tubes for clinical research in pathology for managing the burden of infectious illness. In addition, several benefits associated with such type of serum separation gel, including less interference with the clinical test results and better resistance to radiation, are further propelling its adoption and growth.

For instance, according to a report published by the Centers for Disease Control and Prevention, the number of visits to physician offices for infectious and parasitic diseases was around 10.2 million in the United States in 2021, and the number of emergency visits with infectious diseases stood at 3.8 million in the year.

By End User Insights

Blood banks segment held the maximum share in 2023

The blood banks segment held the majority share. Segment’s dominance is fueled by a significant increase in the number of blood tests being performed globally and the widespread adoption of blood and its related components, such as red blood cells, white blood cells, plasma, and platelets, for various medical purposes. Additionally, rising government efforts towards encouraging the public to blood donation through several awareness campaigns and blood donation drives also contributed to the segment growth.

For instance, according to a report by The Royal College of Pathologists, more than 500 million biochemistry and about 130 million hematology tests are performed every year. Over 2 million units of donated blood are transfused in the UK each year, mainly for hematologist patients.

The pharmaceutical and biotechnology companies’ segment will grow at the fastest pace. This segment’s growth is fueled by these companies' growing focus on the development of new drugs and therapies that require serum separation gels in various crucial laboratory processes, like blood sample testing.

Regional Insights

North America region dominated the global market in 2023

The North America region dominated the global market. Region’s dominance is accelerated by a drastic increase in the incidences of hematological disorders and infectious diseases and the availability of a large number of blood banks with cutting-edge infrastructure and readily available co-pay systems. In addition, rising emphasis on preventive healthcare measures and early detection of diseases in the region has led to an increased number of diagnostic tests utilizing serum separation gels, also driving the growth of the market.

For instance, as per a report published by the American Red Cross, every year, more than 6.8 million people in the United States donate blood, and approx. 13.6 million units of red blood and whole blood cells are estimated to be collected every year. Around 16 million blood components are transfused every year in the country.

The Asia Pacific region is anticipated to emerge as fastest fastest-growing region with a healthy CAGR, owing to developing healthcare infrastructure and spending in developing nations and a rising number of favorable government initiatives that are aimed at improving accessibility to advanced healthcare facilities. Moreover, the growing aging or geriatric population in the region propels the demand for advanced healthcare services, including diagnostic testing in which serum separation gel plays a crucial role. For instance, according to our findings, the elderly population or people aged 60 years or above in India was estimated to be around 149 million in 2022, and the number is anticipated to double its current size to reach 347 million by 2050.

Key Market Players & Competitive Insights

Companies are competing on product quality in the market

The serum separation gel market is moderately fragmented in nature. Key companies are competing on factors such as product quality, effective pricing, better marketing strategies, and compliance with regulatory standards and requirements.

Some of the major players operating in the global market include:

- BD Biosciences (US)

- Becton, Dickinson and Company (US)

- Corning Incorporated (US)

- FL Medical Srl (Italy)

- Kabe Labortechnik GmbH (Germany)

- Labnet International (US)

- Narang Medical Limited (India)

- Qiagen NV (Netherlands)

- Sarstedt AG & Co. KG (Germany)

- Sekisui Chemical Co. Ltd. (Japan)

- Terumo Corporation (Japan)

- Thermo Fisher Scientific (US)

Recent Developments in the Industry

- In April 2023, Salve Pharma announced the launch of its new firmer range of products specially developed for ageless beauty and confidence. The new range will help people regain their youthful appearance and revitalize their skin, irrespective of age. It comprises four products: anti-aging serum, honey locust skin gel, Pep Se pure peptide serum, and pre-make-up primer cream.

Report Coverage

The serum separation gel market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, end user, and their futuristic growth opportunities.

Serum Separation Gel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.03 billion |

|

Revenue forecast in 2032 |

USD 11.96 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global serum separation gel market size is expected to reach USD 11.96 billion by 2032

Key players in the market are Narang Medical Limited, Sekisui Chemical, Thermo Fisher Scientific, Qiagen NV

North America contribute notably towards the global Serum Separation Gel Market

Serum separation gel market exhibiting the CAGR of 5.1% during the forecast period.

The Serum Separation Gel Market report covering key segments are product type, end user, and region.