Blood Testing Market Size, Share, Trends, & Industry Analysis Report

By Test (CBC test, Blood glucose test), By Product, By Method, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM1105

- Base Year: 2024

- Historical Data: 2020-2023

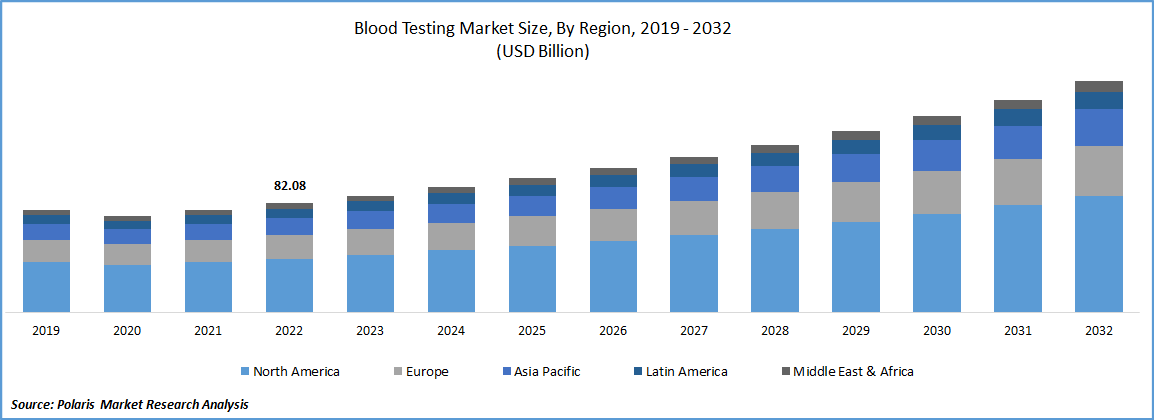

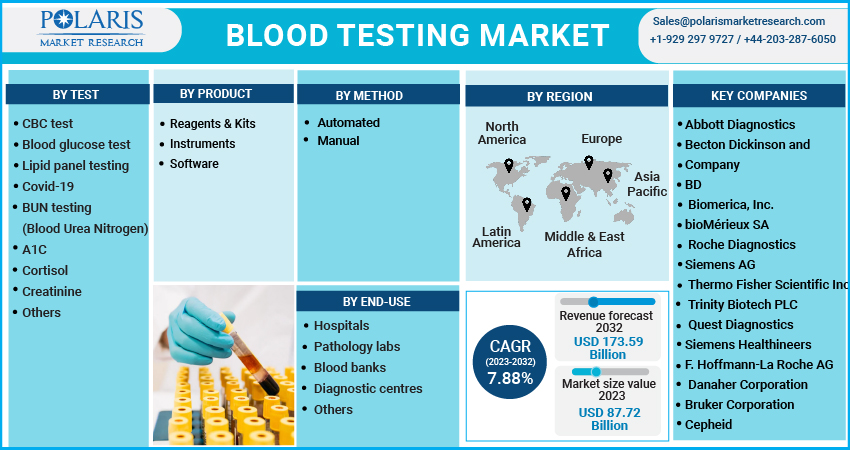

The global blood testing market was valued at USD 98.01 Billion in 2024 and is expected to grow at a CAGR of 9.1% in the forecast period. The increasing burden of chronic and infectious diseases, technological advancements in blood testing devices, and surging point-of-care (POC) testing centers are the major factors projected to drive the market in the future.

Key Insights

- The blood glucose test is expected to account for the fastest growth rate in the forecast period due to increasing diabetic population

- Reagents & Kits are anticipated to dominate the market in the forecast period due to increased blood transfusion procedures.

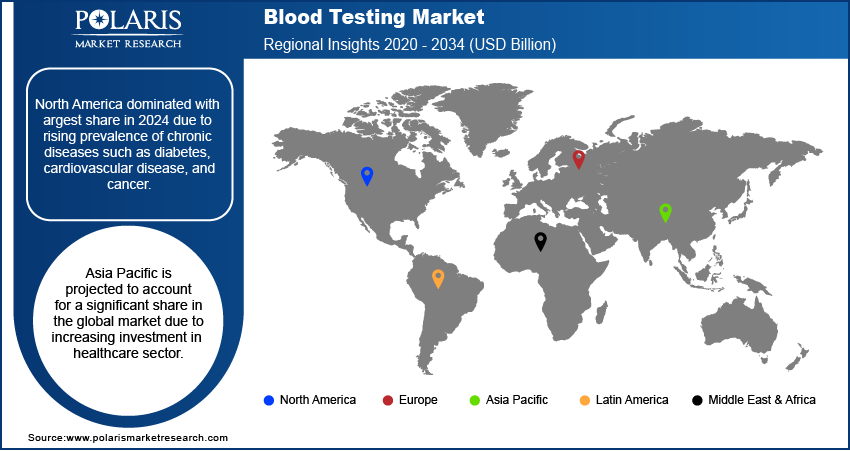

- North America dominated with largest share in 2024 due to rising prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer.

- Asia Pacific is projected to account for a significant share in the global market due to increasing investment in healthcare sector.

Industry Dynamics

- The increasing prevalence of chronic and infectious diseases is fueling the growth.

- The surging demand for point-of-care (POC) testing centers is driving the industry growth.

- Technological advancement is driving the growth.

- The risk of inaccurate results due to sample contamination or improper handling, which can lead to misdiagnosis and reduced trust in testing accuracy is limiting the adoption.

Market Statistics

- 2024 Market Size: USD 98.01 Billion

- 2034 Projected Market Size: USD 233.74 Billion

- CAGR (2025-2034): 9.1%

- Largest Market: North America

Impact of AI on Industry

- AI algorithms analyze blood test data rapidly, reducing turnaround time and improving diagnostic precision.

- AI helps forecast disease risks based on historical blood test data, supporting preventive care strategies.

- AI integrates blood test results with patient histories to recommend tailored treatment options

To Understand More About this Research: Request a Free Sample Report

For instance, as per International Diabetes Federation, India has the highest number of people with diabetes in the world, with about 77 million people living with diabetes, and is projected to reach a value of 134 million by 2045. The increasing number of chronic diseases in India and other countries has necessitated the testing to detect the disease.

A blood test is a medical procedure in which a healthcare professional draws blood samples from a patient's vein using a needle, syringe, or another device. The blood sample is then sent to a laboratory for analysis to determine various aspects of a patient's health.

Blood tests are used for various purposes, including diagnosing diseases and medical conditions, monitoring the effectiveness of treatments, and evaluating overall health. Common blood tests include a complete blood count (CBC), which measures different types of blood cells and their quantities; a blood chemistry test, which evaluates the levels of various chemicals and substances in the blood; and blood glucose tests, which measure the amount of glucose (sugar) in the blood and are commonly used to diagnose and manage diabetes.

The blood glucose test measures the amount of glucose (sugar) in the blood and is commonly used to diagnose and manage diabetes. Similarly, the liver function test evaluates the functioning of the liver by measuring the levels of various enzymes and proteins in the blood.

Higher cost of these testing devices, errors associated with the testing process, and stringent regulatory approval process are some factors expected to hamper the market growth. The market is subject to strict regulations and oversight from government agencies, such as the U.S. Food and Drug Administration (FDA), which can create barriers to entry for new market players and increase the costs and time required for product development and approval.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing prevalence of chronic and infectious diseases are primary growth factor for the blood testing market. Chronic diseases such as diabetes, cancer, and cardiovascular disease are among the leading causes of death worldwide, and the incidence of these diseases is expected to increase as the population ages. Infectious diseases such as HIV, hepatitis, and tuberculosis remain significant public health threats, particularly in low- and middle-income countries.

Technological advancements in the testing devices drive growth in the market by increasing the speed, accuracy, and convenience of testing and expanding the range of tests that can be performed. Companies that can provide innovative, reliable, and cost-effective testing solutions incorporating these technological advancements will likely succeed in this dynamic market.

The surging demand for point-of-care (POC) testing centers is a significant growth factor for the blood testing market. POC testing refers to diagnostic tests in non-laboratory settings, such as clinics, pharmacies, and homes. POC testing offers several benefits over traditional laboratory testing, including faster results, greater convenience, and lower costs.

Report Segmentation

The market is primarily segmented based on test, product, method, end-use, and region

|

By Test |

By Product |

By Method |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The blood glucose test is expected to account for the fastest growth rate in the forecast period.

The segment is anticipated to witness the fastest growth owing to various factors, such as the increasing diabetic population across the region. The global prevalence of diabetes is increasing, particularly in developing countries. Blood glucose testing is essential to diabetes management, driving demand for blood glucose testing devices and products. Healthcare providers and patients are increasingly aware of the importance of monitoring blood glucose levels for diabetes management drives the demand for blood glucose testing devices and products.

Reagents & Kits are anticipated to dominate the market in the forecast period.

The reagents and kits segment of the market is experiencing growth due to increased blood transfusion procedures. Blood transfusion is a common medical procedure involving transferring blood or blood products from one person to another. It treats various conditions, including anemia, bleeding disorders, and cancer. The demand for blood transfusions is increasing due to a growing number of surgical procedures, cancer treatments, and other medical interventions that require blood transfusions. This is driving demand for reagents and kits used in blood typing and screening, as well as in blood collection and processing.

The automated segment is the fastest-growing segment in the market.

The automated testing method is a rapidly growing segment in the market, driven by increased efficiency, technological advancements, and increasing demand. Automation of testing processes reduces human error and increases efficiency. It allows for faster turnaround times for test results and reduces the need for manual labor, which can be time-consuming and costly. The systems can help healthcare providers reduce costs by minimizing the need for manual labor and reducing the risk of errors. Additionally, these systems help reduce the need for repeat testing, which can be costly and time-consuming.

Diagnostic centers are expected to account for the fastest growth rate in the forecast period.

The demand for diagnostic services is increasing due to a growing aging population, increasing prevalence of chronic diseases, and the need for regular health screenings. Diagnostic centers offer various services, including blood testing, that help patients and healthcare providers identify and manage health conditions. There is growing awareness among patients and healthcare providers about the importance of preventive healthcare, including regular health screenings and early detection of health conditions. Diagnostic centers are key in providing these services, including testing, to help identify potential health issues.

North America region accounted for largest share.

North America has a high prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer. The testing plays a crucial role in diagnosing and managing these conditions, driving demand for testing services in the region. The North American region is home to many leading companies and research institutions operating technological advancements in testing. It includes the development of more accurate and efficient devices and the use of artificial intelligence and machine learning to improve the accuracy of blood testing results. The healthcare infrastructure in North America is well-developed, with many hospitals, clinics, and diagnostic centers offering testing services. It, coupled with high healthcare spending, drives the region's demand for blood testing services.

Asia Pacific is expected to witness significant growth.

The Asia Pacific is expected to witness significant growth during the forecast period due to rising investment in the healthcare sector. Major developing countries such as India, Vietnam, and Bangladesh are investing in healthcare sector to improve the healthcare infrastructure. This rise in investment in the sector increases the number of hospitals and diagnostics centers. This rise in the number fuels the demand for the blood testing kits in the region. Moreover, rising prevalence of chronic disease is fueling the demand for the accurate diagnostic kits to detect disease at early stage. This is fueling the demand for the blood testing kits, thereby fueling the growth in Asia Pacific.

Competitive Insight

Some of the prominent key players operating in the blood testing market space includes Abbott Diagnostics, Becton Dickinson and Company, BD., Biomerica, Inc., bioMérieux SA, Roche Diagnostics, Siemens AG, Thermo Fisher Scientific Inc., Trinity Biotech PLC, Quest Diagnostics, Siemens Healthineers, F. Hoffmann-La Roche AG, Danaher Corporation, Bruker Corporation, Cepheid

Recent Developments

- August 2025: Biolabs International launched its AI-powered Connected Diagnostics app, enabling users to self-test for COVID and flu, receive instant AI-interpreted results, and access telehealth consultations, while also introducing a decentralized clinical trial platform to streamline remote research and data collection.

- August 2022: Bio-Rad Laboratories Inc. has acquired Curiosity Diagnostics, a developer of technology solutions for medical diagnostic and healthcare markets, to bring new rapid PCR systems to market.

Blood Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 98.01 Billion |

| Market size value in 2025 | USD 106.72 Billion |

|

Revenue forecast in 2034 |

USD 233.74 Billion |

|

CAGR |

9.1% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Test, By Product, By Method, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Abbott Diagnostics, Becton Dickinson and Company, BD, Biomerica, Inc., bioMérieux SA, Roche Diagnostics, Siemens AG, Thermo Fisher Scientific Inc., Trinity Biotech PLC, Quest Diagnostics, Siemens Healthineers, F. Hoffmann-La Roche AG, Danaher Corporation, Bruker Corporation, Cepheid |

FAQ's

Key companies in the blood testing market are Abbott Diagnostics, Becton Dickinson and Company, BD., Biomerica, Inc., bioMérieux SA, Roche Diagnostics, Siemens AG, Thermo Fisher Scientific Inc.

The global blood testing market expected to grow at a CAGR of 9.1% in the forecast period.

The blood testing market report covering key segments are test, product, method, end-use, and region.

Key driving factors in blood testing market are implementation of favorable government initiatives & external funding for R&D activities.

The blood testing market size is expected to reach USD 233.74 Billion by 2034.