Server Operating System Market Share, Size, Trends, Industry Analysis Report

By Type (Windows, Linux, UNIX, and Others); By Virtualization; By Deployment Mode; By Vertical; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2934

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

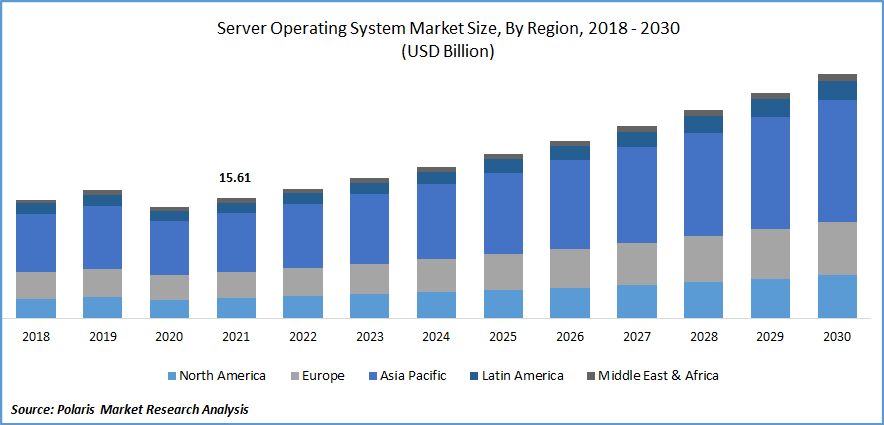

The global server operating system market was valued at USD 15.61 billion in 2021 and is expected to grow at a CAGR of 8.2% during the forecast period.

The server operating system (OS) is a cutting-edge generation of an operating system containing features and capabilities required in a client-server infrastructure or related enterprise computing environment. Along with a centralized interface to combine security and other crucial administrative activities, the platform has an innovative combination of hardware, software, and configuration management services. Additionally, end users are rapidly adopting server and operating system technologies that allow for quicker and safer data exchange in addition to cost savings.

Know more about this report: Request for sample pages

The adoption of cloud-based solutions has been accelerating globally and has increased the need for computers. The development of IoT and Big Data technologies, among other causes, are the main drivers of this necessity. Big Data and cloud computing are two essential technologies that are gaining traction in mainstream information technology. Although these two technologies are not the same, as Big Data represents the content and cloud computing represents infrastructure, combining the two can produce excellent results. Due to the size and sensitivity of such data sets, it's critical to maintain them in a safe and efficient environment. As the cloud becomes more widely adopted, companies will have more opportunities to use Big Data.

Additionally, the server operating system market growth has been propelled by the increase in cloud-native server users and the cost of cloud service adoption. Cloud computing is a computing infrastructure model, which enables the delivery of software-as-a-service (SaaS). The company is keen to benefit from the growing cloud computing market. The company's successful cloud offerings include SoftLayer infrastructure-as-a-service (IaaS) portfolio, which offers bare metal, private cloud, and virtual server instances.

Additionally, businesses trust cloud technology for a variety of reasons, including enhanced customer service, increased flexibility, and increased speed. Thus, several advantages associated with cloud computing are anticipated to soon create new opportunities for the growth of the worldwide server OS market. Contrarily, it is anticipated that over the projection period, the rise of the market will present lucrative prospects due to the proliferation of technology and the rising requirement for security in IT infrastructure.

To support businesses in their workplace culture of production and development on server operating systems in these vital times, several organizations have added new strategies like business growth and new product releases. For instance, Amazon Web Services introduced a new speed that met the requirements for Microsoft Windows Server on the Amazon Elastic Compute Cloud (EC2) in January 2022. This solution increased EC2 speed by 65% while lowering the possibility of expensive delays. The market expansion in the anticipated years will be significantly boosted by these new strategic efforts. However, the increased cost of server operating systems, significant server downtime, and lack of experienced IT employees in data center facilities, limit market expansion.

The market has shown rapid expansion in recent years, but it is predicted to have a minor decline shortly, particularly in 2020, as a result of the COVID-19 pandemic. This is due to the enactment of lockdowns by government authorities in several nations and the worldwide suspension of trade and travel to stop the spread of the virus. Due to increased consumer expenditure on networking technologies and significant growth in the Information and Communication Technology (ICT) Infrastructure, the COVID-19 pandemic has had a beneficial long-term effect on the server operating system industry.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The server operating system industry is expanding as a result of companies spending more money to create a strong data center infrastructure. Data centers must become an essential component of modern computer infrastructures used by businesses worldwide. They are now seen as intrinsic business factors for information storage and business operation models rather than as external facilities.

Further, the major participants in the cloud computing industry are making large investments in the construction of cloud infrastructure all around the world. For instance, Google LLC began developing cutting-edge cloud infrastructural projects in India in July 2021. The business would spend over 4.5 billion USD in 2020 on the Jio Platform to help the nation digitize. Google LLC had 146 cloud access points, 79 cloud zones, and 26 cloud regions. The need for data center and server operating systems is being fuelled by the rapid expansion of data centers and their applications in a wide range of sectors. As a result, the networking of the data center infrastructure depends heavily on the demand for a server operating system, which ultimately fuels the expansion of the server OS industry.

Report Segmentation

The market is primarily segmented based on type, virtualization deployment mode, vertical, and region.

|

By Type |

By Virtualization |

By Deployment Mode |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The cloud segment is expected to witness the fastest growth

Cloud adoption helps businesses provide capabilities with greater flexibility and efficiency. The two key advantages of rising operating systems used in the cloud are lower costs and significantly less maintenance. With the help of cloud-based solutions, organizations can access a huge range of operating systems for servers and then use cloud platforms to carry out analysis and visualization. In April 2020, Alibaba Cloud committed about USD 28 billion to the advancement of cloud infrastructure. The investment was concentrated on upgrading Alibaba Cloud's current data centers' servers, operating systems, and chips.

Additionally, the server operating system offers the data center several features like a central interface for managing multiple users, putting in security measures, and other administrative procedures. Global market expansion has been fueled by an increase in data center deployments due to a boom in the use of managed services.

The Linux segment industry accounted for the highest market share in 2021

Linux OS is anticipated to have the most market share. The increase is attributable to benefits including open source, affordability, honest performance, compatibility, and security. In November 2021, Microsoft has revealed the existence of a stable version of their "edge browser" for such Linux operating system.

Furthermore, due to increased multi-layer security and modernizing workloads on Azure, both on-premises and in the cloud, it is projected that the market for Windows will expand at a large rate. For instance, in May 2022, General Motors is working with Red Hat Inc. to create a new Linux-based infrastructure. The GM and Red Hat cooperation is accelerating the development and introduction of new software-defined capabilities more safely, reliably, and in a shorter amount of time as new vehicles go from being operating systems to be software-defined. Therefore, collaboration is extending the demand for software to a large extent.

The demand in North America is expected to witness significant growth

The Americas region is anticipated to dominate the global market due to the rising demand for server operating systems and the explosive growth of online applications. To administer many applications, including data storage, network administration, and others, server operating systems are utilized. Artificial intelligence (AI) is used in these applications. technology. Government spending across the region is also predicted to fuel market expansion.

The Asia-Pacific region will experience the fastest growth rate due to the growing adoption of technologies like artificial intelligence, the internet of things, and big data across a variety of end-user industries. This will raise the need for servers OS in the region. Additionally, the Indian government's cloud computing policy, which allows for the storing of information generated in India, may increase the number and scale of data storage facilities there, which would support the growth of the market.

Competitive Insight

Some of the major players operating in the global market include Amazon Web Services, Cisco Systems Inc., Canonical Limited, Debian GNU/Linux, DELL INC., Fujitsu Company, Google LLC, Huawei Technologies Co. Ltd., HP Development Company, IBM Corporation, Microsoft Corporation, NEC Corporation, Oracle Corporation, RED Hat Enterprises Limited, SUSE Linux Enterprise, Stratus Technologies, Trend Micro, Inc., and Unisys Global Technologies

Recent Developments

In September 2021, Microsoft Corporation has introduced a cutting-edge Windows server with innovations in hybrid, security, and containers. The flexibility of Windows Server 2022 has been improved, with support for 48TB of memory and 2,048 logical cores operating on 64 physical cores.

In September 2021, Trend Micro opened its Cloud One local data facilities in India to support data sovereignty and protect data privacy in the nation. Trend Micro's flagship technology for cloud security services, Cloud One, safeguards servers, infrastructure, and programs.

In November 2021, With new features and enhancements, Red Hat Enterprise Linux (RHEL) released version 9 Beta. RHEL Beta 9 is based on kernel upstream version 5.14 and enables a preview of significant RHEL changes. This is intended for hybrid multi-cloud installations, on-premises, physical, cloud platforms, and computing.

Server Operating System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 16.88 billion |

|

Revenue forecast in 2030 |

USD 31.76 billion |

|

CAGR |

8.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Virtualization, By Deployment Mode, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Amazon Web Services, Cisco Systems Inc., Canonical Limited, Debian GNU/Linux, DELL INC., Fujitsu Company, Google LLC, Huawei Technologies Co. Ltd., HP Development Company, IBM Corporation, Microsoft Corporation, NEC Corporation, Oracle Corporation, RED Hat Enterprises Limited, SUSE Linux Enterprise, Stratus Technologies, Trend Micro, Inc., and Unisys Global Technologies |