Shipbuilding Anti-Vibration Market Share, Size, Trends & Industry Analysis Report

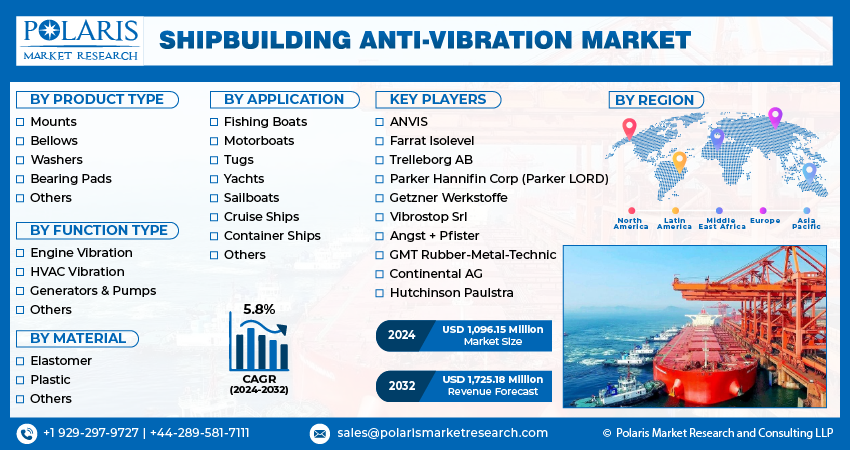

By Product Type (Mounts, Bellows, Washers, Bearing Pads, Others); By Function Type; By Application; By Material; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 116

- Format: PDF

- Report ID: PM2908

- Base Year: 2024

- Historical Data: 2020-2023

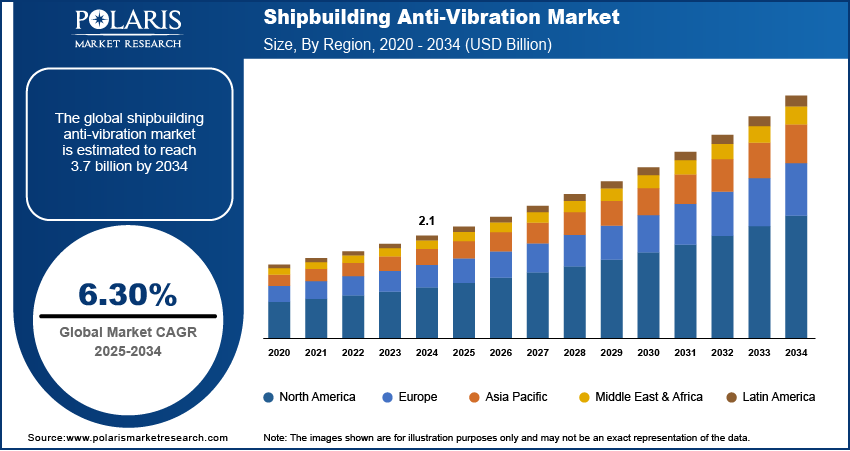

The global Shipbuilding Anti-Vibration Market was valued at USD 2.1 billion in 2024 and is forecasted to grow at a CAGR of 6.30% from 2025 to 2034. Advancements in marine engineering and vessel comfort standards are supporting market growth.

Industry Trend

A surge in consumer purchasing power, coupled with a shift towards luxury goods and a rising demand for ships offering premium comfort, are key drivers fueling the global market's growth. Furthermore, there is a growing need for anti-vibration products like mounts and bellows in shipbuilding applications such as HVAC, propulsion engines, and compressors. This demand is particularly pronounced in countries like India, South Korea, and China, where ship repair and maintenance activities are on the rise.

To Understand More About this Research:Request a Free Sample Report

Increased fishing activities and global trade in countries like China, Japan, and the US propel the fishing segment's growth. Similarly, the uptick in minor bulk shipments, encompassing dry bulk cargo like cement, fertilizers, chemicals, and metals, is spurred by the expansion of international trade.

Rapid economic development and growth in the manufacturing and energy sectors are driving factors in the Asia-Pacific (APAC) region. Additionally, increased shipbuilding activities and government investments in marine infrastructure contribute to market expansion in this region.

Among shipbuilding anti-vibration solutions, HVAC Vibration holds a significant market share due to the burgeoning shipbuilding industry in emerging economies like India and China. Its capability to regulate the ship's onboard climate makes it indispensable for various vessels, including cruise ships, tugs, and yachts.

The outbreak of the COVID-19 pandemic had a substantial impact on the market, causing disruptions in transportation and maritime activities due to lockdowns and regulations. However, as global trade volumes began to recover after the third quarter of 2021, the adverse effects of COVID-19 on the shipbuilding anti-vibration industry started to diminish.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By function type category, the HVAC vibration segment accounted for the largest market share in 2024.

- By vehicle type category, the motorboats segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the shipbuilding anti-vibration market?

Increasing containers and dry bulk trade.

Trade growth is a significant driver of the global economy, and maritime transport plays a pivotal role in facilitating this expansion. Ships are integral to transporting goods across the world, with the vast majority of international trade relying on sea routes. This underscores the crucial role that ships play in enabling global trade to function smoothly. Notably, countries like China, Japan, and South Korea are at the forefront of shipbuilding, collectively producing a large portion of the world's ships. This highlights their importance in supporting the maritime industry and facilitating global trade.

As countries engage in more trade with one another, the demand for ships continues to rise. Ships are essential for transporting goods such as raw materials, manufactured products, and commodities between countries. With increasing trade volumes, there is a corresponding increase in the need for ships to carry out these transactions efficiently. Consequently, the shipbuilding industry experiences growth in tandem with the expansion of global trade. The continual rise in trade activity fuels demand for new vessels, leading to the development and expansion of the shipbuilding sector to meet these requirements.

Which factor is restraining the demand for shipbuilding anti-vibration?

Presence of alternative materials are expected to hinder the growth of the market.

The shipbuilding industry has faced significant challenges since 2019 due to a combination of factors including a global economic slowdown, infrastructural limitations, the US-China trade war, and the recent outbreak of the novel coronavirus, which has further hindered growth. Additionally, growing environmental concerns have prompted governments worldwide to implement stringent environmental protection regulations. These regulations may increase demand for new, more environmentally friendly ships if they apply to existing vessels, as retrofitting old ships to comply with new standards might be impractical or too costly. Consequently, this could lead to an increase in the scrapping of older ships, further impacting the market dynamics.

Report Segmentation

The market is primarily segmented based on product type, function type, application, material, and region.

|

By Product Type |

By Function Type |

By Application |

By Material |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Function Type Insights

Based on function type analysis, the market is segmented on the engine vibration, HVAC vibration, generators & pump, others. HVAC vibration held the largest market share in 2023. The HVAC vibration category made up the largest percentage of the global market's revenue and is expected to expand considerably throughout the foreseeable future. the quick growth of the shipbuilding sector and the widespread use of cutting-edge technology, particularly in developing countries like India, China, and Indonesia. Also, because to its superior capabilities and ability to operate a complete ship from within, it is increasingly used in a variety of applications, such as tugboats, yachts, bulk containers, and cruise ships, which is fueling the sector market's expansion.

By Application Insights

Based on application analysis, the market has been segmented on the basis of fishing boats, motorboats, tugs, yachts, sailboats, cruise ships, container ships, others. The Motorboats segment expected to be the fastest growing CAGR during the forecast period. There has been a significant increase in recreational boating activities globally. As more people engage in leisure boating, the demand for motorboats has surged. This growth in recreational use directly fuels the need for effective anti-vibration solutions to enhance comfort and reduce noise and vibrations, ensuring a pleasant experience for users. Advances in motorboat design and technology have led to the development of more powerful and efficient engines. These modern engines often produce higher levels of vibration, necessitating advanced anti-vibration systems to ensure smooth operation and longevity of the motorboat components.

As disposable incomes rise, particularly in emerging markets, more individuals can afford to purchase motorboats for personal use. This increase in motorboat ownership drives demand for high-quality, durable anti-vibration solutions that improve the boating experience. There is a growing awareness among consumers about the importance of comfort and safety in motorboats. Anti-vibration systems play a crucial role in reducing fatigue and preventing long-term damage to both the vessel and its occupants, making them a critical component in modern motorboat manufacturing.

Regional Insights

North America

North America region accounted to be the largest market share in 2023. North America, particularly the United States and Canada, boasts a well-established and advanced shipbuilding industry. The presence of leading shipbuilding companies and a strong focus on innovation and technological advancements in ship design and construction contribute significantly to the demand for high-quality anti-vibration systems.

The region has a robust recreational boating culture, with a substantial market for personal and leisure boats. The popularity of recreational boating in North America drives the demand for motorboats, yachts, and other leisure vessels that require sophisticated anti-vibration solutions to enhance comfort and performance.

North America has stringent regulations regarding noise and vibration control in marine vessels. Regulatory bodies such as the U.S. Coast Guard and the Environmental Protection Agency (EPA) enforce standards that require shipbuilders to incorporate advanced anti-vibration technologies, thus boosting the market for these systems.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. The Asia Pacific region hosts some of the world’s leading shipbuilding nations, including China, South Korea, and Japan. These countries dominate the global shipbuilding market and are consistently investing in expanding their shipbuilding capacities. This surge in shipbuilding activities drives the demand for anti-vibration systems to ensure the safety and efficiency of vessels. As global maritime trade rises, so does the demand for new ships. The Asia Pacific region, with its strategic geographical location and extensive coastline, serves as a crucial hub for international shipping routes. The increase in maritime trade necessitates the construction of more ships, thereby boosting the demand for shipbuilding anti-vibration systems.

Additionally, rapid economic development in countries such as China, India, and Southeast Asian nations is leading to higher disposable incomes. This economic growth translates into increased spending on recreational boating and luxury vessels, which require advanced anti-vibration solutions for enhanced comfort and performance.

Competitive Landscape

The shipbuilding anti-vibration market is highly competitive, driven by the increasing demand for advanced vibration control solutions in the maritime industry. Key players such as Trelleborg, Hutchinson, and Parker Hannifin lead the market, leveraging their extensive expertise in materials science and engineering to develop innovative anti-vibration products. These companies focus on creating solutions that enhance the durability, performance, and safety of ships by minimizing the impact of vibrations on critical components and systems. The competitive landscape is marked by continuous innovation, with firms investing heavily in research and development to offer products that meet the stringent regulatory standards and performance requirements of the maritime industry. Additionally, the market sees contributions from smaller, specialized firms that provide tailored solutions for specific shipbuilding needs. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their technological capabilities and market reach.

Some of the major players operating in the global market include:

- ANVIS

- Farrat Isolevel

- Trelleborg AB

- Parker Hannifin Corp (Parker LORD)

- Getzner Werkstoffe

- Vibrostop Srl

- Angst + Pfister

- GMT Rubber-Metal-Technic

- Continental AG

- Hutchinson Paulstra

Recent Developments

· In February 2023, Angst + Pfister expanded its production site in China, this expansion will serve Asian and global companies with sophisticated sealing solutions.

· In November 2022, Trelleborg Antivibration Solutions has created an app for measuring the vibration of important machinery and locating the appropriate item to resolve vibration-related issues: The MountFinder Pro.

· In November 2022, Continental A.G. acquired Cooper Standard's anti-vibration system business to expand their product portfolio of anti-vibration.

Report Coverage

The shipbuilding anti-vibration report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, function type, application, material, and their futuristic growth opportunities.

Shipbuilding Anti-Vibration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.2 Billion |

|

Revenue forecast in 2034 |

USD 3.7 Billion |

|

CAGR |

6.30% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By Function Type, By Application, By Material And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Shipbuilding Anti-Vibration Market Size Worth $ 3.7 Billion by 2034

The top market players in Shipbuilding Anti-Vibration Market are ANVIS, Farrat Isolevel, Trelleborg AB, Parker Hannifin Corp (Parker LORD), Getzner Werkstoffe

North America is the region contribute notably towards the Shipbuilding Anti-Vibration Market

The shipbuilding anti-vibration market exhibiting a CAGR of 6.30% during the forecast period.

Shipbuilding Anti-Vibration Market report covering key segments are product type, function type, application, material, and region.