Shredder Blades Market Share, Size, Trends, Industry Analysis Report

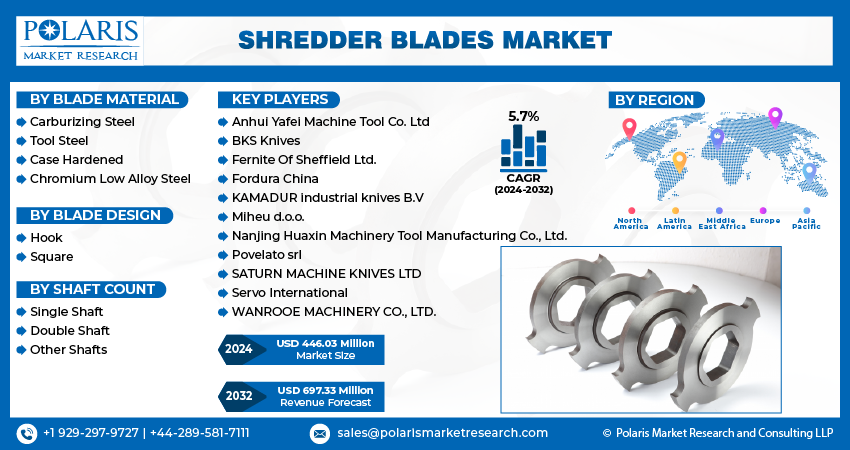

By Blade Material (Carburizing Oil, Tool Steel, Case Hardened, Chromium Low Alloy Steel); By Blade Design; By Shaft Count; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4362

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

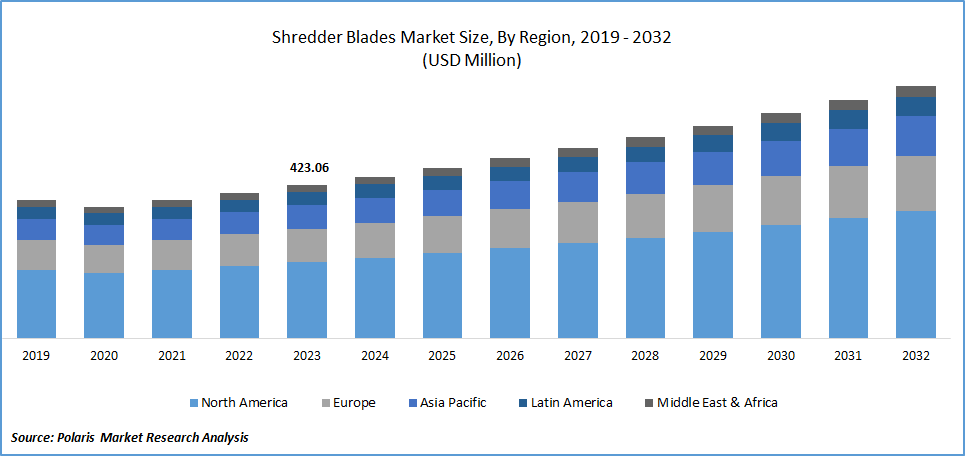

The global shredder blades market was valued at USD 423.06 million in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period.

Shredder blades are made up of quality steel and tool steels used to cut wood, plastic, metal, and more in the recycling processes. The increased focus on the circular economy is the major factor driving companies to collect the waste produced in the production process along with the used products in reuse or refurbishment initiatives.

The efficient management of resources with lower waste generation and the promotion of waste disposal activities to reduce environmental pollution are the major objectives of the circular economy. The growing awareness about optimal resource utilization is driving the demand for recycling infrastructure, necessitating the need for shredder blades. The rising product innovations in this field are unraveling the potential shredder blades.

To Understand More About this Research: Request a Free Sample Report

- For instance, in February 2023, the SSI developed the shredder, the Dual-Shear M120, for wind turbine recycling. It is aimed at reducing aluminum, electronic scrap, tires, and appliances.

Moreover, the increasing generation of e-waste is likely to stimulate the demand for shredder blades, as they are crucial in waste recycling operations. The e-waste generation witnessed a 60% rise between 2010 and 2019. Worldwide, e-waste generation accounts for 50 million tonnes, which is expected to grow to 75 million tonnes by 2030. If this trend continues further, there will be a huge need for shredder blades on the market.

However, the higher initial and maintenance costs associated with shredder blades are major factors impeding the growth of the market.

Growth Drivers

Rising awareness about waste recycling operations

The shredders are gaining momentum with their ability to enhance the recycling of various materials. They have various designs that are utilized in households and industrial operations. Recycling is building its footprints in various industries, primarily manufacturing. It is known to save millions of pounds among manufacturing industries.

The increasing use of plastic and the lack of plastic disposal are contributing to environmental pollution. According to the Teri report, plastic waste constitutes at least 267 species worldwide, including sea turtle species, seabird species, and marine mammals (86%, 44%, and 443%, respectively). This is driving the need for recycling at this moment and the creation of effective shredder blades in recycling processes.

Report Segmentation

The market is primarily segmented based on blade material, blade design, shaft count, and region.

|

By Blade Material |

By Blade Design |

By Shaft Count |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Blade Material Analysis

The carburizing steel segment is expected to witness the highest growth during the forecast period.

The carburizing steel segment will grow at a rapid pace, mainly driven by its higher hardness, wear, and corrosion resistance. These blades are known to stay sharp longer and hold better than blades made of other standard steel.

The tool steel segment led the industry, largely attributable to its ability to offer wear resistance, improved hardness, and toughness. Most shredder blades are made of carburizing steel and tool steel.

By Blade Design Analysis

The hook segment accounted for the largest market share in 2023

The hook segment accounted for the largest market share in 2023. The size of the hook determines its ability to grab more material in the recycling process. The square segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in demand for high-security and efficient shredding.

By Shaft Count Analysis

Single shaft segment held a significant market share in 2023

The single shaft segment held a significant market share due to its ease of recycling. It has various advantages, including the processing of various materials, the ability to handle different materials, and environmental sustainability with the recycling process.

Regional Insights

Europe region registered the largest share of the global market analysis in 2023

The European region held the global market share. The market growth of the segment market can be largely attributed to the increasing measures to cut back on waste generation and promote economic welfare. According to the data from the European Environment Agency, Europe produces 4.8 tonnes of waste per year, of which 39% is recycled. By waste stream, in 2021, around 64% of packaging waste was recycled, while electrical and electronic waste recycling constituted 39%. The increasing focus on recycling plastic and electrical waste in the region is one of the major factors driving demand for shredder blades.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing emphasis on a circular economy. Countries in this region are showing enormous interest in promoting sustainable utilization of natural resources for global welfare. China is working on a circular economy as a part of its 14th five-year plan, which lasts from 2021 to 2025. The objectives of promoting a circular economy in China include encouraging green product design, recycling, remanufacturing, and renewable resources. These initiatives are likely to support the growth of shredder blade adoption in this region throughout the study period.

Key Market Players & Competitive Insights

The shredder blades market has a few major players with worldwide coverage. Companies in this field are emphasizing the utilization of advanced technologies in product design and manufacturing for versatile applications to diversify their product portfolio in the marketplace. For instance, in October 2022, AIShred introduced a new version of its shredder machine consisting of a single shaft.

Some of the major players operating in the global market include:

- Anhui Yafei Machine Tool Co. Ltd

- BKS Knives

- Fernite Of Sheffield Ltd.

- Fordura China

- KAMADUR industrial knives B.V

- Miheu d.o.o.

- Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd.

- Povelato srl

- SATURN MACHINE KNIVES LTD

- Servo International

- WANROOE MACHINERY CO., LTD.

Recent Developments

- In August 2022, a study published in MDPI explored the performance and wear mechanisms of shredder blades in various geometries and orientations.

Shredder Blades Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 446.03 million |

|

Revenue Forecast in 2032 |

USD 697.33 million |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Blade Material, By Blade Design, By Shaft Count, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global shredder blade market size is expected to reach USD 697.33 million by 2032

BKS Knives, Fernite of Sheffield Ltd., Fordura China, KAMADUR industrial knives B.V, Miheu d.o.o., & Povelato Srl are the top market players in the market.

Europe region contribute notably towards the global Shredder Blades Market.

The global shredder blades market is expected to grow at a CAGR of 5.7% during the forecast period.

The Shredder Blades Market report covering key segments are blade material, blade design, shaft count, and region.