Silanes Market Share, Size, Trends, Industry Analysis Report

By Product (Alkyl Silane, Sulfur Silane, Amino Silane, Vinyl Silane, Epoxy Silane, Methacrylate Silane, Mono/Chloro Silane, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3348

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

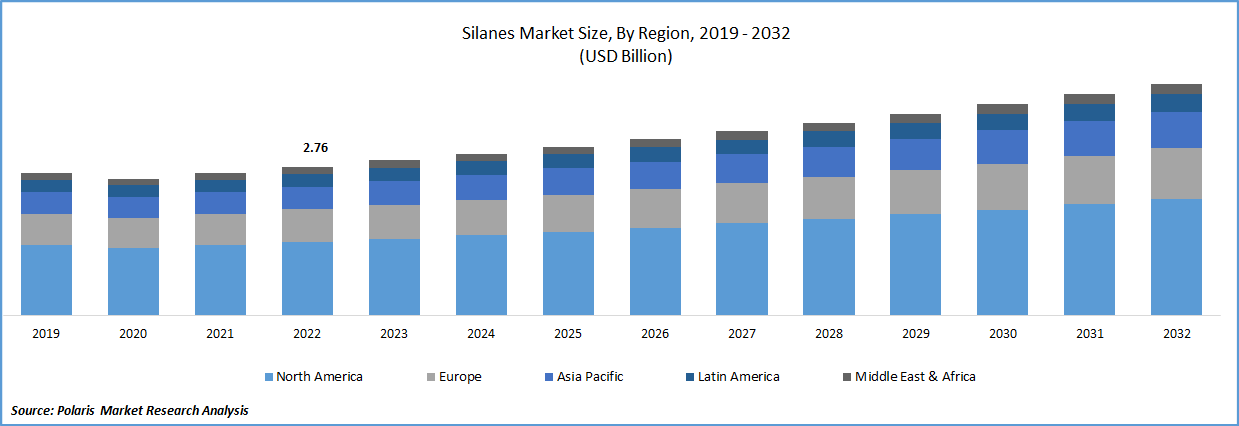

The global silanes market was valued at USD 2.88 billion in 2023 and is expected to grow at a CAGR of 4.6% during the forecast period. Silanes, commonly referred to as silicon hydrides, are substances created when hydrogen and silica form covalent bonds. Silanes primarily serve as surface and coupling modifiers. They come in two varieties: functional groupings and non-functional groups. They are helpful in applications like crosslinking agents, surface moderators, coupling & dispersing agents due to the functional silanes' capacity to react with both inorganic and organic materials, and the non-functional silanes' capacity to do so with inorganic materials. Silanes play a significant role in the rubber and plastics industries, particularly the tire sector. Silanes are extensively used in paints, coatings, adhesives, and fiber treatment, among other things.

To Understand More About this Research: Request a Free Sample Report

One of the key reasons promoting the expansion of the silane market is the rise in demand for the product from globally expanding end-use industries. The market is expanding due to the increased use of the substance in coatings that guard against corrosion, promote adhesion, and modify surfaces, as well as rising demand for paint and coating products from the expanding construction industry.

The increased emphasis on regulatory requirements, fuel efficiency, and water-based coating composition has an additional impact on the industry. The rise of the automotive and building & construction sectors as well as the rising usage of silane in the creation of solvent-free coatings as well as R&D initiatives all have a beneficial impact on the silane market. Also, the market participants will have lucrative prospects due to its use in the pharmaceutical and cosmetics industries as well as emerging economies.

The coronavirus breakdown in 2020 has influenced the need for silanes. Due to the moderately lower demand from several end-use industries, such as construction, automotive, electrical, and electronics, and numerous other sectors, the worldwide market was damaged very badly. With the present worldwide manufacturing, transportation, and other activity constraints brought on by political restrictions and widespread lockdowns, the demand was hindered. This was because supply chain networks were disrupted.

Industry Dynamics

Growth Drivers

Rising use of silanes for combining resins as well as it is used for coatings across the verticals is the major factor driving the growth of the silanes market over the forecast period. To strengthen the connection between the resin covering and the protected substrate, silane is utilized as a primer and tackifier. Evaporation of the solvent, hydrolysis, and condensation of airborne water produce the bottom coating. The coating's viscosity can be significantly decreased.

Additionally, the usage of silanes in the coating has expanded as a result of the paints and coatings industry's shift in focus from solvent-borne to water-borne coating. Epoxy silanes can improve the sanding and block resistance of water-borne transparent coatings, which is expected to increase demand in the upcoming years. It is possible to add serval polymers and oligomers with a variety of viscosities to this application field. The pain & coating sector is anticipated to be a significant end-user of connection silicon throughout the next years.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

The amino silane segment is expected to witness the fastest growth over the projection period

The rising use of silanes as a combining agent in amino is driving the market growth. As a coupling agent, adhesion enhancer, resin additive, and surface modification, amino products are useful. It enhances the chemical bonding of resins in inorganic fillers and reinforcing materials. Amino-based products are appropriate for a variety of applications since they are stable and respond well to water. Amino silane is produced by several significant industry companies for use in paints and coatings.

Furthermore, due to its broad application in reinforcing materials, inorganic fillers, and other products across sectors like plastic and rubber, amino silanes are expected to have the largest worldwide consumption in terms of volume. The demand for different goods is anticipated to increase over the coming years as a result of technical developments made by major product producers throughout the world to service a wider consumer base.

Adhesives & Sealants is expected to hold the significant revenue share during the forecast peiod

The silanes are used across various verticals, among which adhesives and sealants are the major segments. Silanes significantly affect the characteristics of adhesives and sealants. Using silane compounds gives adhesives the necessary level of stability and strength over time. Global demand for adhesives and sealants is mostly driven by the expansion of the plastics sector. Moreover, for usage in cable insulation and electrical wires, silane is used to crosslink polyethylene and its copolymers.

In application where resistance to high temperatures is necessary, silane-based plastic compounds are employed. These plastic materials are also utilized in natural gas carrier pipes and hot and cold water pipes. Thus, market growth is anticipated to be fueled by the expansion of the electrical sector, particularly in the Asia Pacific. Technological developments in the building and transportation industries, where plastic and rubber components are crucially employed across many application sites, are anticipated to further fuel the product demand.

The demand in North America is expected to witness significant growth

The expanding automotive and construction industries in North America are the major market drivers. The residential building industry is the one that is expanding the fastest, and during the past five years, nations like Canada and Mexico have seen tremendous growth in this area. In comparison to other locations, which often have subsidiary units, there is considerable growth in the number of large-scale plants making adhesives to meet the expanding demand for adhesives & sealants from the local construction sector.

Asia Pacific is growing with a high CAGR over the forecast period. This is primarily due to use of rubber substrates in the automotive, industrial machinery, & electronics industries, which was fueled by the growth of the manufacturing sector. In the recent past, India & China have experienced a boom in automobile manufacturing attributable to technology transfer to the sector from the Western nations. Moreover, it is projected that a strong manufacturing base for electrical and electronics in Taiwan, China, & South Korea provided the growth momentum.

Competitive Insight

Some of the major players operating in the global silanes market include Agents-Qingdao, Air Products, CREDIT Chemical Technology, Denka Company, Dalian Resources, GELEST, LINGGAS, Matheson Tri-Gas., NANJING UNION SILICON, Praxair Technology, Qufu Chenguang, Shin-Etsu Chemical, SK materials, Chemical Company, and ENF Ltd.

Recent Developments

- In January 2021, MomentUVe Petormance Materals purchased Ku Corporation's (KGC) sales activities in China, as well as its business operations in Korea and the UK.

- In November 2021, WACKER purchased a 60% share in SICO Performance, Ltd., a maker of specialty silane. These specialty silanes are useful for various verticals.

Silanes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3 billion |

|

Revenue forecast in 2032 |

USD 4.29 billion |

|

CAGR |

4.6% from 2024- 2032 |

|

Base year |

2023 |

|

Historical data |

2019- 2022 |

|

Forecast period |

2024- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Agents-Qingdao Hengda Zhongcheng Technology Co., Ltd., Air Products and Chemicals, Inc., CREDIT Chemical Technology Development Co, Ltd., Denka Company Limited, Dalian Resources Co., Ltd., GELEST, INC., LINGGAS, LTD, Matheson Tri-Gas, Inc., NANJING UNION SILICON CHEMICAL CO., LTD, Praxair Technology, Inc., Qufu Chenguang Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd, SK materials Co., Ltd., The Chemical Company, ENF Ltd., and Thomas Publishing Company. |

FAQ's

The global silanes market size is expected to reach USD 4.29 billion by 2032.

Key players in the silanes market are Agents-Qingdao, Air Products, CREDIT Chemical Technology, Denka Company, Dalian Resources, GELEST, LINGGAS, Matheson Tri-Gas.

North America contribute notably towards the global silanes market.

The global silanes market expected to grow at a CAGR of 4.5% during the forecast period.

The silanes market report covering key segments are product, application, and region.