Silico Manganese Market Share, Size, Trends, Industry Analysis Report

By Product (Low Carbon, Medium Carbon, and High Carbon); By Vertical; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 116

- Format: PDF

- Report ID: PM2927

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

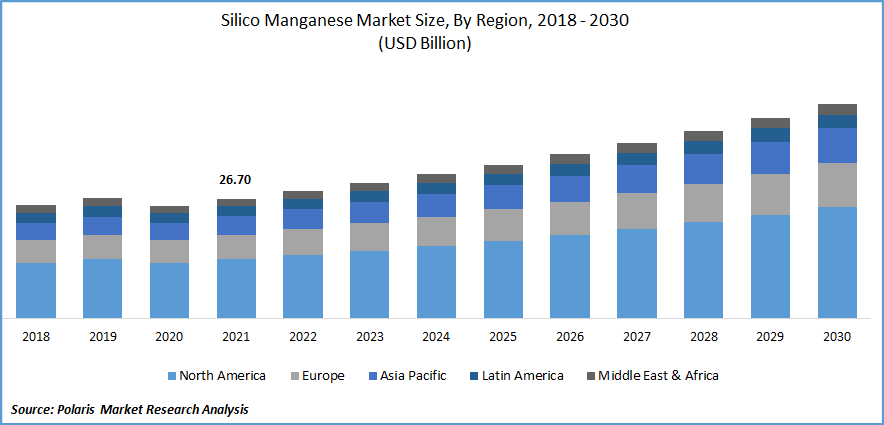

The global silico manganese market was valued at USD 26.70 billion in 2021 and is expected to grow at a CAGR of 6.7% during the forecast period.

Silico manganese alloy has 60% to 68% minerals, 14% to 21% silicon, and 5% to 2.5% iron. It is made by melting quartz fluorescence, coke, and carbon from slightly elevated Ferro manganese or manganese ore in an immersed electrical furnace. The production of different steel grades requires the element silico manganese, which is crucial. High-carbon Ferro manganese, medium-carbon Ferro manganese, and silicomanganese are all in routine production planning.

Know more about this report: Request for sample pages

One important alloy that comprises silicon and manganese components is called silico-manganese. Additionally, the vendor heats a mixture of carbon, silicon dioxide, manganese oxide, and iron oxide to create this spectrum. Typically, deoxidizers and desulfurizes utilize silico manganese.

The primary factor boosting the silico manganese market growth is the rising demand for silicomanganese in the automotive and auto parts industries. The automotive industry has always explored materials that can give the car's body structure increased strength. Due to its high-performance ratio and superior impact resistance, steel has become the preferred material for electric vehicles among makers of cars and commercial vehicles.

According to the International Energy Agency (IEA), in 2017, the EV 30@30 campaign was initiated at the 8th clean energy ministerial meeting to accelerate the deployment of electric vehicles. It sets a goal for the electric vehicle initiative members to cover 30% of the market share of the electric vehicle out of the total vehicle by 2030.

Moreover, steel consumption is anticipated to increase throughout the projected period as the automotive industry is anticipated to rebound following COVID-19 due to rising consumer expenditure. The increase in the requirement for commercial vehicles for heavy-duty work and logistics will be a key factor in the lucrative expansion of the demand for alloy steels and, in turn, drive the development of the market during the projection period.

Additionally, it is projected that growing investments in residential and non-residential development projects will boost steel demand in the United States, which will benefit the silico manganese sector throughout the projection period. For instance, in April 2022, Google said it would spend USD 9.5 billion building offices and data centers around the United States. The business invests in Boulder, Austin, Oklahoma, and Tennessee. However, the variable transportation costs and distribution caused by the availability of silico manganese in some regions marginally slow the market's expansion.

Most industrial and manufacturing facilities worldwide struggle to fulfill demand and produce the necessary quantities during the COVID-19 Pandemic. Additionally, the majority of governments have enacted both temporary and long-term lockdowns. Additionally, workers earning daily pay and those only partially employed return to their hometowns, making them unusable in manufacturing and urban regions. The major firms and the government sector are spending on research and development for the product offering against various market segments to rebound from losses and fulfill market demand.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising urbanization, which increases demand for household goods like utensils, is one of the motivating factors behind market expansion. As per the World Bank, around 57% of the world's population lives in Urban areas. A great alternative to durable, non-toxic, and sturdy kitchen utensils is stainless steel. The durable steel component effectively absorbs heat and cooks food evenly, helping you cook.

Additionally, stainless steel utensils are simple to clean and maintain, which makes them useful for novice cooks, such as college students moving away from home for the first time. Thus, the rising urbanization and increasing use of stainless steel have increased the demand for household goods, such as utensils with different varieties and models, which is the primary factor driving the demand for silico manganese.

The rising demand for automobiles worldwide led to the increasing adoption of iron casting, which further encouraged the market's growth over the forecast period. For instance: according to the Indian Brand Equity Foundation, the total passenger vehicle sales in India were recorded at approximately 2.8 million, and it is expected to reach 2.7 million units of passenger vehicle sales in 2021. As per the International Organization of Motor Vehicle Manufacturers OICA, the global production of vehicles from January to March YTD 2020 was 18,036,164 and has risen to 21,084,417 from January to March YTD 2021. Thus, these propel the market’s growth over the forecast period.

Report Segmentation

The market is primarily segmented based on product, application, vertical, and region.

|

By Product |

By Application |

By Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Stainless steel segment held a significant revenue share in 2021

The category expansion is fueled by increasing electric vehicle use and expanding construction industry expenditure. For instance, as it offers structural support, Tesla uses cold-rolled stainless steel to construct the external portions of the Tesla Cybertruck, a battery-powered light-duty truck. By mid-2023, Tesla will start making these electric trucks. In addition, as ongoing projects and ambitious infrastructure programs continue, demand for construction equipment is projected to increase the demand for stainless steel.

Further, the Department for Promotion of Industry and Internal Trade (DPIIT) reports that between April 2020 and December 2020, foreign direct investments (FDIs) in India's construction sector were $29.53 billion and $23.99 billion, respectively. This significant investment in the construction industry stimulates machinery and equipment production, propelling segment expansion.

Low Carbon segment industry accounted for the highest market share in 2021

Stainless steel and other low-carbon steel grades are frequently produced using vacuum oxygen decarburization, argon oxygen decarburization, & Creusot-Loire Uddeholm processes, all of which utilize low-carbon silico manganese. Over the projection period, rising SS production on a global scale is anticipated to boost the segment's expansion. For instance, according to the world steel association, the manufacturing of SS melt shops grew substantially by 12.5% in 2021, from 51.8 metric tons to 58.3 kilotons.

The carbon steel segment is expected to be the fastest over the forecast period

Because of its high strength, the carbon steel material is utilized to make buildings, pipeline networks, train tracks, and equipment parts. Rising investments in such industries are anticipated to fuel market expansion. For instance, The National Water Company of Saudi Arabia said in August 2022 that it would carry out 1,429 projects for a combined USD 28.7 billion during the ensuing years to expand its water distribution infrastructure. The requirement for carbon steel pipes is anticipated to increase owing to investments in water distribution network infrastructure, which will likely have a favorable impact on the market's expansion throughout the forecast period.

The demand in North America is expected to witness significant growth

The consumption of silico manganese in the United States is estimated to rise throughout the projected period as a result of rising investments in steel manufacturing plants. For instance, United States Steel Corporation declared in February 2022 that it would invest USD 3 billion in constructing a sophisticated steel factory in Arkansas. The new production plant is expected to contain two electric arc furnaces with a 3.0 million tonne annual output capacity. Thus, the rising investment in manufacturing facilities and the rising demand for automobiles are the factors driving regional growth.

Furthermore, the Asia-Pacific countries' investments in different infrastructure development projects to boost their economies after the epidemic era are attributed to the market's fastest growth. Asia Pacific is the emerging hub of manufacturing, construction, and automotive components, owing to its cost-effective techniques, availability of skilled labor, and raw materials.

Moreover, the growing demand for iron casting along with stainless steel in the construction industry for manufacturing sanitary fittings like manholes, sewer pipes, water pipes, and cisterns is further bolstering the demand for silico manganese is driving the market growth. Additionally, growing investment in the automobile sector will increase the production of automobiles, thereby augmenting the demand for iron-casting automotive parts. Thus, the rising application of iron casting and stainless steel in the automotive sector increases the need for the silico manganese market.

Competitive Insight

Some of the major players operating in the global market include AngloAmerican, Assmang Proprietary, Brahm Group, Eramet Group, Gulf Ferro Alloys, Henan Xibao Metallurgy, Jindal Steel, Mesa Minerals Limited, NIPPON DENKO, OM Holdings Ltd., Pertama Ferroalloys, Steel Authority of India Limited, Sakura Ferroalloys, Tata Steel Limited, and Vipra Ferro Alloys.

Recent Developments

In April 2021, Milwaukee made a USD 60 Mn investment in cutting-edge development of manufacturing tools to support their brand-new, 500,000-square-foot production plant in Grenada. The company's expanding power tool and accessory business will be able to handle more capacity at this manufacturing site.

Silico Manganese Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 28.36 billion |

|

Revenue forecast in 2030 |

USD 47.77 billion |

|

CAGR |

6.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Anglo American plc, Assmang Proprietary Limited, Brahm Group, Eramet Group, Gulf Ferro Alloys Company, Henan Xibao Metallurgy Materials Group, Jindal Steel & Power Ltd., Mesa Minerals Limited, NIPPON DENKO CO., LTD., OM Holdings Ltd., Pertama Ferroalloys Sdn. Bhd., Steel Authority of India Limited, Sakura Ferroalloys, Tata Steel Limited, and Vipra Ferro Alloys Pvt Ltd., |