Single-cell Analysis Market Share, Size, Trends, Industry Analysis Report

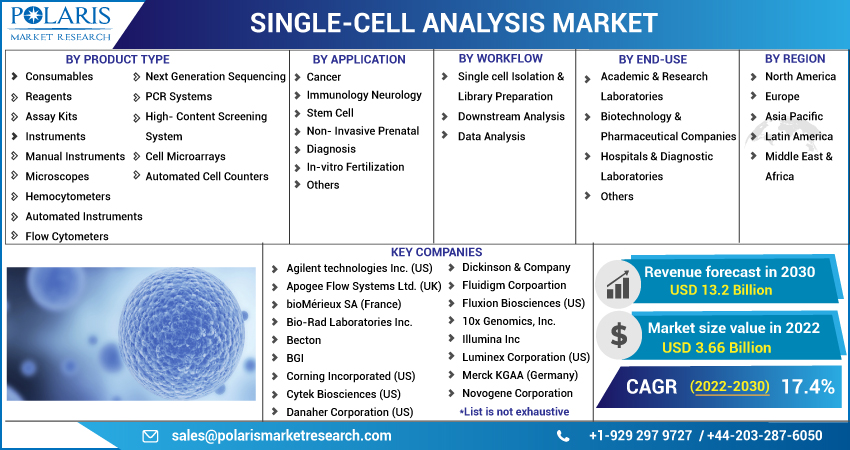

By Product (Consumables, Instruments); By Application (Cancer, Immunology); By Workflow ; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM1966

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

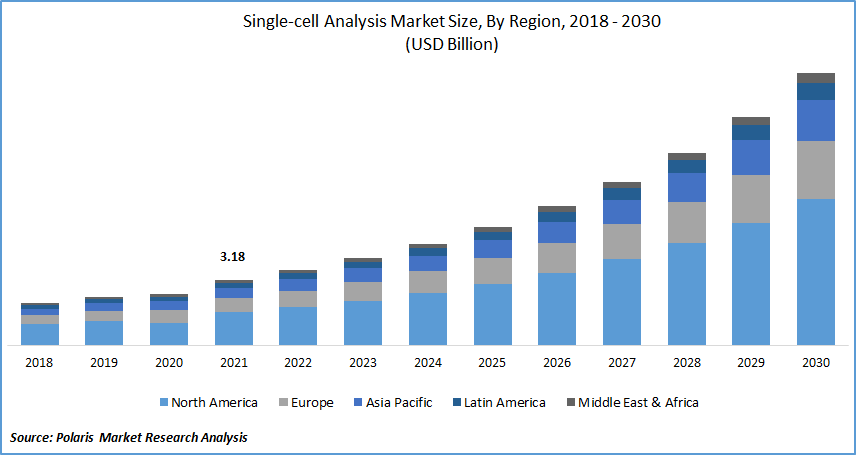

The global Single-cell Analysis Market was valued at USD 3.18 billion in 2021 and is expected to grow at a CAGR of 17.4 % during the forecast period. Technology developments in single-cell analysis products, increasing research in cancer treatments, growing R&D in the pharmaceutical and biotechnology sectors an rise in stem cell research, are the primary drivers of market expansion.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Single-cell Analysis Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Know more about this report: Request for sample pages

The single-cell proteomics and transcriptomics investigations are important for understanding the properties of cellular heterogeneity, complicated illnesses like cancer, evolving differentiation dynamics, and quantifying transcriptional stochasticity. Additionally, these analyses aid in our understanding of a number of biological processes, including embryonic development, immune response, and tissue regeneration.

The increasing prevalance of cancer patinents wordwide, growing demand for advance diagnosis in biotechlogical and diagnostic sectros and technological advancements in single cell analysis are attributed to market growth over the forecast period.

Scientists need to use single-cell studies to provide more specific information for treatment decision-making in precision medicine in order to better comprehend the changes from cell to cell. To supply intact and viable single cells, businesses in the single-cell analysis market are concentrating on technological developments. Companies in the industry are raising the recovery rates of delicate cells and removing the need for specialized instruments while still maintaining sample integrity during shipping, storage, and processing with the use of technological innovations.

In the areas of genomics, proteomics, transcriptomics, and metabolomics, there is an increasing need for SCA(Single-cell Analysis). Analysis of massive data sets and comprehension of the genetic foundation is made easier with the help of single-cell omics research. Technology developments in high throughput assays, efficient cell sorting and tagging, sequencing, microfluidics, single-cell amplification, and advanced software tools. Naturally, the availability of these products and the variety of uses they have are increasing the revenue of this industry.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Increasing the use of Single-cell sequencing technologies, single-cell sequencing, fluorescence-based detecting devices, single-cell transcriptomics, In-situ hybridization, FRET biosensors, fluorescence biosensors, and mass spectroscopy due to this factor the market for single-cell analysis is also anticipated to expand further.

The market growth is being significantly boosted by a thorough examination of single-cell genomics, proteomics, and metabolomics, which has led to a variety of solutions for proteins, small molecules, and an organism's genetic makeup.

The current COVID-19 pandemic had a positive effect on the single-cell analysis market (SCA). The broad application of SCA techniques in virology research has been prompted by the epidemic. In addition, Government agencies around the world have increased funding for vaccine development,production and social costs, which has increased the use of single-cell analytic tools for COVID-19 research. A better understanding of immune cells on a single-cell basis and how the functional cells contribute to immune function can lead to the development of better vaccines and immunotherapies.

Report Segmentation

The market is primarily segmented based on product, application, workflow, end-use, and region.

|

By Product |

By Application |

By Workflow |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The consumable segment accounted for the largest share in 2021

The consumable segment accounted for the highest revenue share in 2021, and it is expected to grow during the forthcoming period, owing to the high usability of products and repetitive reagent purchase due to the continuous requirement for assay and the rising in the prevalence of target diseases. Isolation of RNA and DNA, research and genetic exploration, and exosome analysis is also anticipated to fuel market growth.

The replacement of old instruments and installation of new instruments and services generated revenue for the instrument segment .due to the high-end features and the technically advanced analytical options as well as the automated instruments are helping the market to grow forthcoming year.

The Cancer Segment dominated the market and had the largest market share in 2021.

Single-cell analysis, which has shown efficacy for earlier cancer diagnoses, is the segment's main driving force. These methods simplify the identification of cell types, mutation rates, and growth conditions.

The rising need for stem cell therapeutics for regenerative and personalized medicines that are boosting the market growth. The number of research activities for the identification of single-cell genomics and proteomics has expanded, which has led to an increase in the adaption of single-cell analytic methodologies for therapeutic and diagnostic applications. Additionally, therapies like bone marrow and hair transplants and tissue transplants are boosting the use of single-cell analysis techniques.

In 2021, by workflow, the single cell isolation and library preparation segment generated the largest revenue share.

Rising the research with the help of single cell analysis is expected to boost the revenue growth of these segments. Researchers looking for diverse cell isolation kits, reagents, and accessories, including those made for specific cell types or isolation techniques, browse the cell isolation catalog. There will be a rising demand for cell isolation and library preparation products such as reagents and kits.

Numerous market players provide a range of single-cell isolation products, including FACS and MACS for heterogeneous cell suspensions, microdissection of fixed tissue samples, and microfluidics, which contribute to segment revenue. In addition, some technologies, like the development of next-generation sequencing to analyze cellular expressions and FISH (fluorescence in situ hybridization), have shown to be important tools for single-cell analysis. As a result, the downstream analysis market is also expanding as a result of recent technological advancements.

The largest share held academic and research laboratories in 2021.

Due to the widespread adoption of single cell analysis technology in research settings, academic and research laboratories have the fastest increase. The demand for single-cell analysis is being driven by the rise in medical institutions and universities around globe and significant investments in life science research. Additionally, numerous active research initiatives using SCA methodologies at multiple universities have fueled this adaptation. In addition, The development of spatial genomics also made single cell analysis in research activities more rapid, which contributed to the growth of this market.

Technological advancements such as microfluidics used for the development of next-generation therapies have increased the adoption of single-cell analysis by biotechnology and pharmaceutical companies.

North America is expected to dominate and witness the fastest growth over the forecast period.

Due to numerous government financing programs, rise in consumer awareness of costs associated with personal healthcare, and widespread use of advanced analytical instruments and methodologies, North America is the prominent region of single cell analysis market. The dominance of North America in this market is mostly attributable to increasing population of gearitric patients, and supportive reimbustment policies in healthcare system collectively drive the market growth in this region.

In addition, factors like expanding single cell technology acceptance, aging population, and rising prevalence of target diseases, Asia Pacific is anticipated to develop at the fastest rate over the forecast period.

Competitive Insight

Some of the major players operating in the global market include Agilent technologies Inc. (US), Apogee Flow Systems Ltd. (UK), bioMérieux SA (France),Bio-Rad Laboratories Inc., Becton,BGI, Corning Incorporated (US), Cytek Biosciences (US), Danaher Corporation (US) , Dickinson & Company , Fluidigm Corpoartion, Fluxion Biosciences (US), 10x Genomics, Inc. Illumina Inc; Luminex Corporation (US), Merck KGAA (Germany), Menarini Silicon Biosystems, Novogene Corporation, Oxford Nanopore Technologies (UK), Promega Corporation (US), QIAGEN NV, Rarecyte Inc (US), Tecan Group Ltd(Switzerland), Sartorius AG (Germany), Tecan Group Ltd.(Switzerland )Thermo Fisher Scientific, Inc.

Recent Development

Oct 2021: The HIVETM scRNAseq Solution for single-cell isolation and analysis, the first product of its kind, was launched by PerkinElmer, Inc. and Honeycomb Biotechnologies, Inc. A portable, handheld device is used by the HIVE solution to capture, store, and prepare RNA-Seq libraries for a variety of cell types, including fragile and labile cells like granulocytes, nephrons, hepatocytes, and neurons.

March 2021: CytoFlex SRT Benchtop Cell Sorter from Beckman Coulter Life Sciences was launched, which features extended laser and color options for use in labs of all sizes. With the advent of new technology, more laboratories can now benefit from the capability of single-cell analysis by automating, streamlining, and stream maintenance.

Single-cell Analysis Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.66 billion |

|

Revenue forecast in 2030 |

USD 13.2 billion |

|

CAGR |

17.4 % from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Workflow , By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Agilent technologies Inc. (US), Apogee Flow Systems Ltd. (UK), bioMérieux SA (France),Bio-Rad Laboratories Inc., Becton,BGI, Corning Incorporated (US), Cytek Biosciences (US), Danaher Corporation (US) , Dickinson & Company , Fluidigm Corpoartion, Fluxion Biosciences (US), 10x Genomics, Inc. Illumina Inc; Luminex Corporation (US), Merck KGAA (Germany), Menarini Silicon Biosystems, Novogene Corporation, Oxford Nanopore Technologies (UK), Promega Corporation (US), QIAGEN NV, Rarecyte Inc (US), Tecan Group Ltd(Switzerland), Sartorius AG (Germany), Tecan Group Ltd.(Switzerland )Thermo Fisher Scientific, Inc |

Want to check out the Single-cell Analysis Market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.