Single-Use Bioreactors Market Size, Share, Trends, Industry Analysis Report

: By Product (Single-Use Bioreactor Systems, Single-Use Media Bags, Single-Use Filtration Assemblies, and Others), Type, Cell Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 116

- Format: PDF

- Report ID: PM2206

- Base Year: 2024

- Historical Data: 2020-2023

Single-Use Bioreactors Market Overview

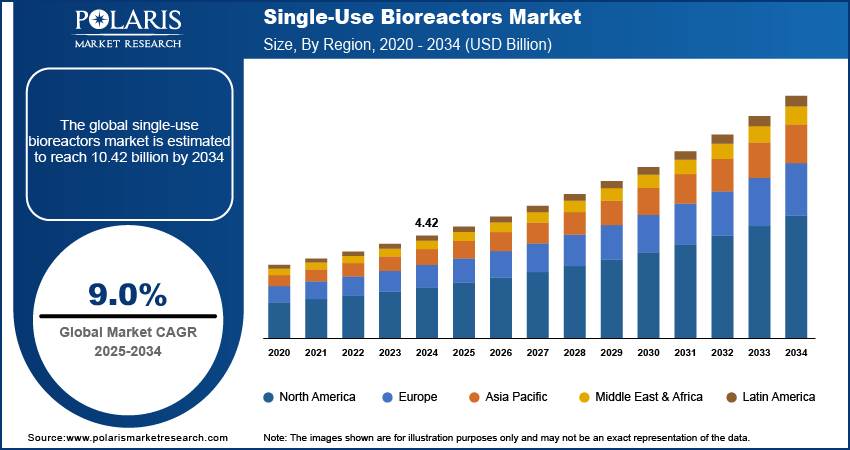

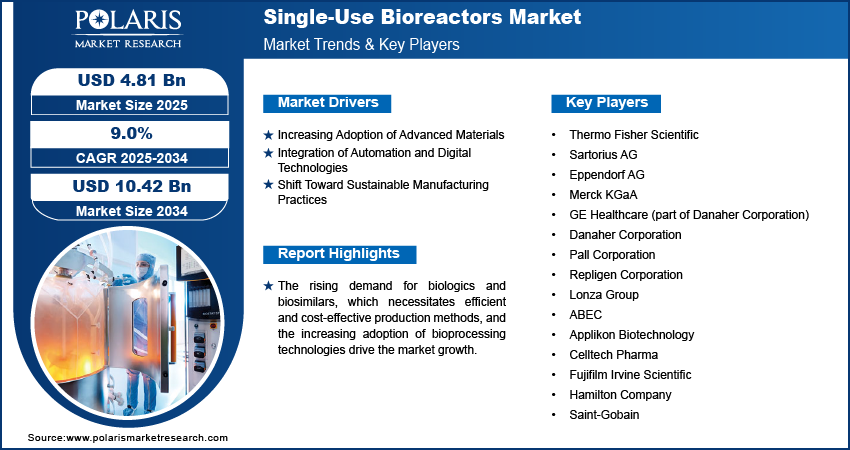

The global single-use bioreactors market size was valued at USD 4.42 billion in 2024. The market is projected to grow from USD 4.81 billion in 2025 to USD 10.42 billion by 2034, exhibiting a CAGR of 9.0% during 2025–2034.

The global single-use bioreactors (SUBs) market focuses on bioreactors designed for one-time use in cell culture processes. The bioreactors are increasingly employed in the pharmaceutical and biotechnology industries. They offer various advantages, such as reduced risk of cross-contamination, lower operational costs, and increased flexibility in manufacturing.

The rising demand for biologics and biosimilars, which necessitates efficient and cost-effective production methods, and the increasing adoption of bioprocessing technologies drive the market growth. The shift toward more sustainable and streamlined manufacturing processes is also contributing to the expansion of the single-use bioreactors market.

To Understand More About this Research: Request a Free Sample Report

Single-Use Bioreactors Market Drivers Analysis

Increasing Adoption of Advanced Materials

The adoption of advanced materials enhances performance and safety. Traditional bioreactors have been replaced by single-use systems made from innovative polymers and films, which offer better chemical resistance and reduced risk of contamination. The use of fluoropolymer coatings has improved the bioreactor's durability and compatibility with various cell cultures. According to a 2022 study published in Biotechnology Advances, these advanced materials have reduced leachables and extractables, which are critical for maintaining product purity in biologic production. Additionally, the development of high-density polyethylene (HDPE) and polypropylene materials has contributed to more efficient and cost-effective bioprocessing.

Integration of Automation and Digital Technologies

The integration of automation and digital technologies into single-use bioreactors enhances the efficiency and precision of bioprocessing by enabling real-time monitoring and control of critical process parameters. Automated systems for pH and dissolved oxygen control, along with real-time data analytics, are increasingly being incorporated into SUBs. A 2023 report from Pharmaceutical Technology highlights that the implementation of these technologies has significantly improved process consistency and reduced human error. The market is seeing an increased demand for digital platforms that provide seamless integration with other manufacturing systems, which facilitates better data management and compliance with regulatory standards.

Shift Toward Sustainable Manufacturing Practices

Sustainable manufacturing practices are positively influencing the single-use bioreactors market. As environmental concerns grow, there is a push toward reducing waste and enhancing the recyclability of bioprocessing materials. Single-use systems are being designed with recyclable components and reduced environmental impact in mind. For instance, some manufacturers are using biodegradable plastics and exploring recycling options for used bioreactor components. According to a 2021 article in the Journal of Cleaner Production, these sustainability efforts help meet regulatory requirements and align with the broader industry shift toward greener production methods. This trend reflects the industry's commitment to reducing its carbon footprint while maintaining high operational efficiency.

Single-Use Bioreactors Market Segment Analysis

Single-Use Bioreactors Market Assessment by Product

The single-use bioreactors market, by product, is segmented into single-use bioreactor systems, single-use media bags, single-use filtration assemblies, and others. The single-use bioreactor systems segment holds the largest market share and is also registering the highest growth. This segment's dominance can be attributed to its critical role in biomanufacturing processes, offering flexibility, reduced contamination risk, and lower operational costs compared to traditional systems. Single-use bioreactor systems are increasingly favored for their efficiency in scaling up production and their ability to meet the growing demand for biologics and biosimilars. According to a 2023 analysis by Pharmaceutical Technology, this segment is projected to continue its rapid growth, driven by advancements in bioprocessing technologies and an increasing shift toward adopting disposable systems for cost efficiency and simplified operations.

The single-use media bags and single-use filtration assemblies segments are experiencing steady demand but do not match the growth rate of bioreactor systems. Single-use media bags are essential for storing and transporting culture media, while single-use filtration assemblies are crucial for separating and purifying biological products. Although these segments contribute significantly to the overall market, their growth is more incremental compared to the dynamic expansion of bioreactor systems. The emphasis on improving bioreactor systems' performance and capabilities continues to drive the majority of market advancements and investments in this sector.

Single-Use Bioreactors Market Evaluation by Type

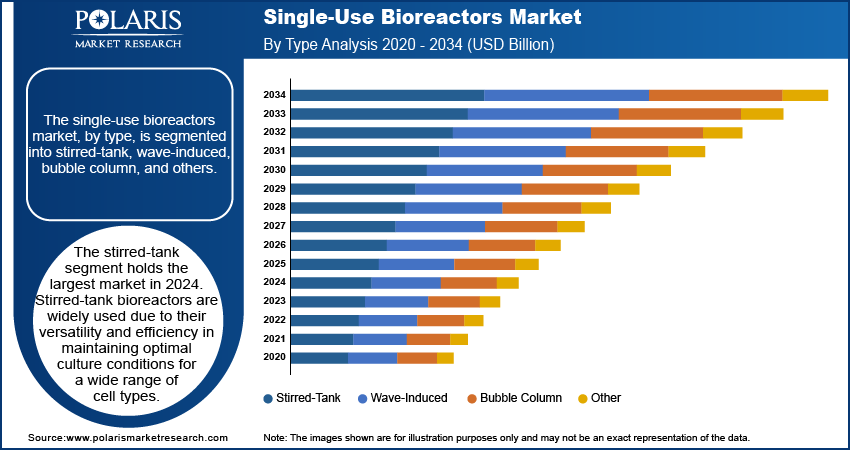

The single-use bioreactors market, by type, is segmented into stirred-tank, wave-induced, bubble column, and others. The stirred-tank segment holds the largest market share and is also experiencing the highest growth. Stirred-tank bioreactors are widely used due to their versatility and efficiency in maintaining optimal culture conditions for a wide range of cell types. They offer superior mixing and aeration, which are essential for high-density cell cultures and large-scale production processes. This segment's growth is driven by ongoing advancements in bioprocessing technology and the increasing demand for biopharmaceuticals. As per the review by Biotechnology Advances published in 2023, stirred-tank systems continue to lead the market due to their established track record and ongoing improvements in design and performance.

The wave-induced and bubble column segments also contribute to the market but do not match the growth trajectory of stirred-tank systems. Wave-induced bioreactors are appreciated for their gentle mixing, which is beneficial for sensitive cell lines. Bubble column bioreactors are valued for their simplicity and scalability. Despite their advantages, these types are not expanding as rapidly as stirred-tank bioreactors, which benefit from broader applicability and continuous innovation. The focus on enhancing the capabilities and efficiency of stirred-tank systems underscores their dominance and the primary driver of market growth in the sector.

Single-Use Bioreactors Market Breakdown Evaluation by Cell Type

In terms of cell type, the single-use bioreactors market is segmented into mammalian cell, bacterial cell, yeast cell, and others. The mammalian cell segment holds the largest market share and is registering the highest growth. This segment's dominance is driven by the significant role mammalian cells play in the production of complex biologics, including monoclonal antibodies and therapeutic proteins. The complexity of mammalian cell culture, coupled with the high-value products it generates, underscores its importance in the biopharmaceutical industry. According to a 2023 report from Pharmaceutical Technology, the demand for mammalian cell cultures continues to grow as biopharmaceutical companies focus on developing advanced therapeutics, which drives the segment's expansion.

The bacterial cell and yeast cell segments also contribute to the market, but their growth rates are comparatively slower. Bacterial cells are commonly used for producing simpler proteins and enzymes, while yeast cells are utilized in research and production due to their ability to perform post-translational modifications. Although both segments have their applications, the rapid advancement and high demand for mammalian cell-based products, particularly in the development of complex biologics, make the mammalian cell segment the leading driver of market growth.

Single-Use Bioreactors Market Breakdown by End Use

Based on end use, the single-use bioreactors market is segmented into pharmaceutical & biopharmaceutical companies, CROs & CMOs, and academic & research institutes. The pharmaceutical & biopharmaceutical companies segment holds the largest market share and is experiencing the highest growth. This segment's expansion is attributed to the increasing demand for biologics and the need for efficient, cost-effective production methods. Pharmaceutical and biopharmaceutical companies are increasingly adopting single-use bioreactors due to their ability to reduce contamination risks, lower operational costs, and enhance production flexibility. According to a 2023 analysis by Biotechnology Advances, this segment's growth is closely tied to the ongoing development of new therapeutic products and the emerging trend toward personalized medicine.

The CROs & CMOs segment also plays a significant role in the market, driven by the growing trend of outsourcing biomanufacturing processes. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are leveraging single-use bioreactors to provide flexible and scalable solutions to their clients, which contributes to their steady growth. The academic & research institutes segment, while important, does not match the rapid growth of the pharmaceutical sector. Research institutions use single-use bioreactors for experimental and developmental purposes, but their demand is relatively lower compared to the large-scale production needs of the pharmaceutical industry.

Single-Use Bioreactors Market Breakdown by Regional Insights

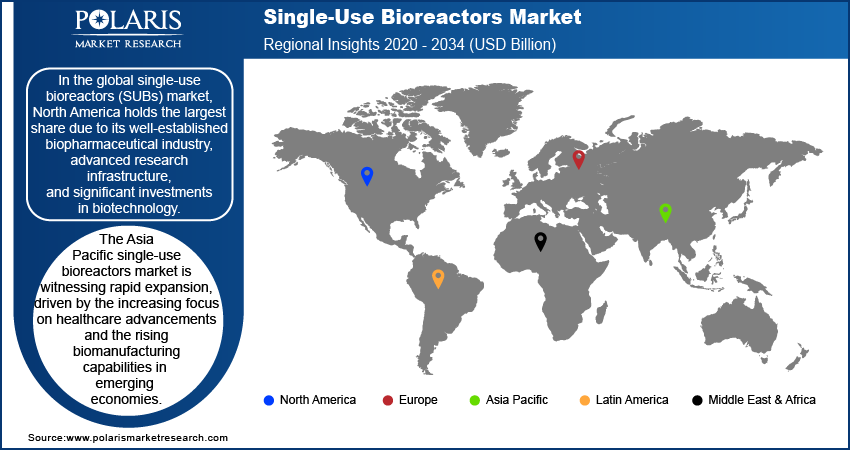

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the global single-use bioreactors (SUBs) market, North America holds the largest share due to its well-established biopharmaceutical industry, advanced research infrastructure, and significant investments in biotechnology. The region's dominance is driven by the high demand for biologics and biosimilars, supported by a robust network of pharmaceutical companies, contract manufacturing organizations, and research institutions. Additionally, North America's leadership in technological innovation and regulatory advancements boosts its position in the market. While Europe and Asia Pacific also contribute notably to the market, with growth in biomanufacturing and research activities, North America's established industry base and ongoing investments in bioprocessing technologies ensure its leading share.

In Europe, the single-use bioreactors (SUBs) market is experiencing steady growth, driven by advancements in biopharmaceuticals and an expanding focus on innovative therapies. The regional market benefits from a strong presence of leading pharmaceutical companies, biotech firms, and contract manufacturing organizations. Europe’s emphasis on high-quality standards and stringent regulatory frameworks support the adoption of single-use technologies. Key countries such as Germany, Switzerland, and the UK contribute significantly to the market due to their advanced research facilities and substantial investments in biotechnological advancements. The European market is also influenced by increased government funding for biotech research and development, which fuels the demand for efficient and scalable bioprocessing solutions.

The Asia Pacific single-use bioreactors market is witnessing rapid expansion, driven by the increasing focus on healthcare advancements and the rising biomanufacturing capabilities in emerging economies. Countries such as China and India are at the forefront, with significant investments in biopharmaceutical manufacturing and research activities. Lower production costs, the growing number of biotech startups, and increasing demand for affordable biologics support the regional market growth. Additionally, the Asia Pacific market benefits from favorable government policies and incentives aimed at boosting the biotech sector. As these countries continue to enhance their manufacturing infrastructure and research capabilities, the demand for single-use bioreactors is expected to increase in the region.

Single-use Bioreactors Market – Key Market Players and Competitive Analysis Report

Thermo Fisher Scientific, Sartorius AG, Eppendorf AG, Merck KGaA, GE Healthcare, Danaher Corporation, Pall Corporation, Repligen Corporation, Lonza Group, ABEC, Applikon Biotechnology, Celltech Pharma, Fujifilm Irvine Scientific, Hamilton Company, and Saint-Gobain are among the major players in the SUBs market. These companies are active in the market, providing a range of single-use bioreactor products and services designed to meet various bioprocessing needs. Notably, a few players, such as GE Healthcare, are part of Danaher Corporation, while others, such as Sartorius AG and Merck KGaA, are independent and not acquired.

Competitive analysis of key players reveals a market characterized by strong innovation and diverse product offerings. Thermo Fisher Scientific and Sartorius AG are recognized for their broad portfolio of single-use bioreactor systems and related products, focusing on enhancing performance and scalability. Companies such as Merck KGaA and GE Healthcare offer integrated solutions that combine bioreactor systems with advanced analytics and automation technologies, catering to a growing demand for sophisticated bioprocessing tools. Furthermore, firms such as Repligen and Pall Corporation are noted for their specialized solutions and continuous product development efforts.

The market's competitive landscape highlights a trend toward technological innovation and customization. Players are investing in research and development to advance bioreactor technology, with a focus on improving efficiency, reducing costs, and integrating new technologies such as automation and digital monitoring. The increasing emphasis on flexibility and scalability in bioprocessing reflects the industry's response to the growing demand for biologics and the need for cost-effective production solutions. This ongoing innovation drives competition among market players and shapes the future direction of the single-use bioreactors market.

Thermo Fisher Scientific is a kay player in the global single-use bioreactors (SUBs) market, known for its wide range of bioprocessing solutions. The company offers single-use bioreactor systems designed to enhance flexibility and efficiency in cell culture processes. Thermo Fisher Scientific supports various biopharmaceutical applications with its comprehensive product line.

Sartorius AG is another participant in the SUBs market, providing advanced bioreactor systems and related products. Sartorius focuses on developing solutions that cater to diverse bioprocessing needs, including single-use systems that facilitate efficient and scalable production.

Key Companies in the Single-Use Bioreactors Market

- Thermo Fisher Scientific

- Sartorius AG

- Eppendorf AG

- Merck KGaA

- GE Healthcare

- Danaher Corporation

- Pall Corporation

- Repligen Corporation

- Lonza Group

- ABEC

- Applikon Biotechnology

- Celltech Pharma

- Fujifilm Irvine Scientific

- Hamilton Company

- Saint-Gobain

Single-Use Bioreactors Market Developments

- In October 2023, Sartorius AG launched an updated version of its single-use bioreactor system, featuring enhanced automation capabilities and improved user interface to streamline bioprocessing workflows.

- In June 2023, Thermo Fisher Scientific announced the expansion of its single-use bioreactor offerings with the introduction of new models aimed at increasing scalability and improving process control.

Single-Use Bioreactors Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Single-Use Bioreactor Systems

- Single-Use Media Bags

- Single-Use Filtration Assemblies

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Stirred-Tank

- Wave-Induced

- Bubble Column

- Others

By Cell Type Outlook (Revenue – USD Billion, 2020–2034)

- Mammalian Cell

- Bacterial Cell

- Yeast Cell

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical & Biopharmaceutical Companies

- CROs & CMOS

- Academic & Research Institutes

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Single-Use Bioreactors Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.42 billion |

|

Market Size Value in 2025 |

USD 4.81 billion |

|

Revenue Forecast in 2034 |

USD 10.42 billion |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global single-use bioreactors market size was valued at USD 4.42 billion in 2024 and is projected to grow to USD 10.42 billion by 2034.

The global market is projected to register a CAGR of 9.0% during 2025–2034.? The global market is projected to register a CAGR of 9.0% during 2025–2034.

North America held the largest share of the global market.

Key players in the single-use bioreactors (SUBs) market are Thermo Fisher Scientific, Sartorius AG, Eppendorf AG, Merck KGaA, GE Healthcare, Danaher Corporation, Pall Corporation, Repligen Corporation, Lonza Group, ABEC, Applikon Biotechnology, Celltech Pharma, Fujifilm Irvine Scientific, Hamilton Company, and Saint-Gobain.

The single-use bioreactor systems segment accounted for the largest market share.

The stirred-tank bioreactors segment accounted for the largest market share.