Smart Irrigation Market Share, Size, Trends, Industry Analysis Report

By Application [Agricultural (Greenhouses, Open-Fields), Non-Agricultural (Turf & Landscape, Golf Courses, Residential, Others)]; By Component; By System Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 114

- Format: PDF

- Report ID: PM2370

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

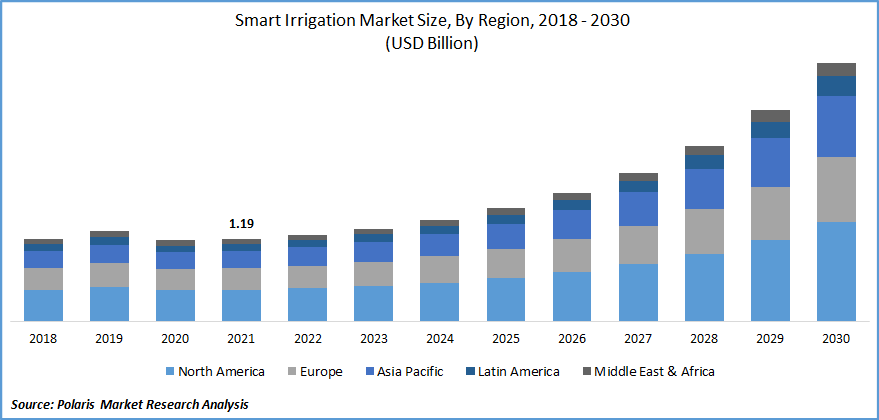

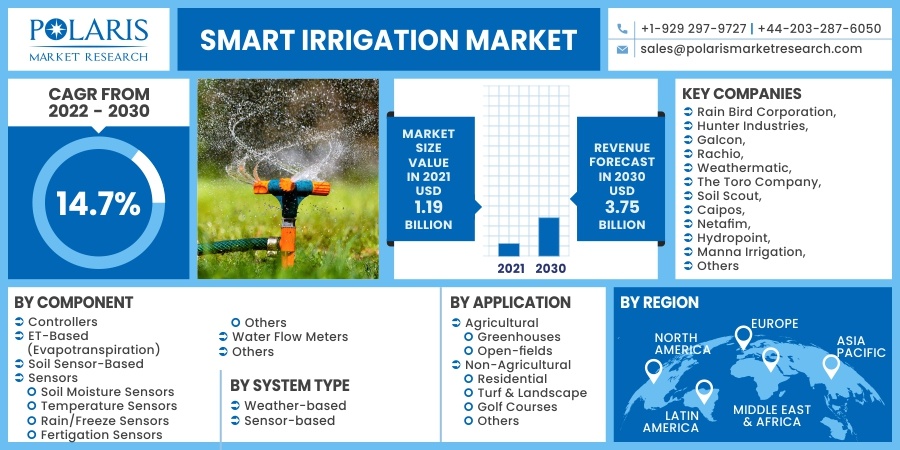

The global smart irrigation market was valued at USD 1.19 billion in 2021 and is expected to grow at a CAGR of 14.7% during the forecast period. The growing adoption of advanced features in irrigation systems, rise in government initiatives to promote water consumption, and enhanced farming is expected to drive market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The surge in penetration of automated monitoring systems in agriculture and the decline in sensors and controller costs are the factors that enhance the market growth. These systems use sensors, controllers, and automated systems to monitor soil, weather, water, and fertility conditions. Smart irrigation systems have gained in popularity in recent years due to significant expansion in modern agriculture and rising acceptance in non-agricultural applications.

The global COVID-19 pandemic has had an impact on the market for smart irrigation. COVID-19 has caused disruption in several areas of the economy, including agriculture. The increased awareness among farmers to use technology for farming operations has led proliferation of sensors such as soil moisture sensors, climate sensors, rain sensors, temperature sensors, and fertigation sensors, thereby creating a lucrative market growth in such a pandemic.

Other integrated irrigation methods, including controllers and water flow meters, are likely to be more widely adopted in poorer nations, as labor shortages impede irrigation management. Furthermore, in the post-COVID-19 period, remote access to irrigation controllers and the ability to obtain appropriate inputs from fields can be a major factor responsible for the market growth of the smart irrigation sector.

Industry Dynamics

Growth Drivers

A major factor driving the growth of this market is the growing relevance of effective watering techniques for non-agricultural applications such as domestic, turf and landscape, and golf courses. In many regions across the globe, the trend of smart cities has forced the government to take supportive initiatives for smart irrigation in the market.

The appropriate treatment of water in residential and business spaces is emphasized in smart cities. With rapid urbanization and depletion of forest areas, individuals have been forced to use smart irrigation to maintain the balance of the green environment.

Moreover, over-watering due to flaws in conventional irrigation methods and systems wastes most water. Thus, the rise of smart cities is projected to provide doors for new entrants. Smart city adoption will foster the market demand for smart irrigation controllers, driving the market growth.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, system type, application, and region.

|

By Component |

By System Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by System Type

Over the projection period, the sensor-based market segment is anticipated to grow at the fastest CAGR. Growth is primarily due to sensor-based automated systems employed in agriculture to farm productivity, coupled with real-time information on humidity, rain, moisture, nutrient capabilities, and optimum temperature requirement. Sensor-based systems are also preferable to weather-based systems because they do not depend on weather forecasts or information from weather stations.

Sensor-based systems assist in collecting data from field sensors and the transport of that data to the cloud. The soil moisture level is pre-programmed into sensor-based smart irrigation controllers. As a result, the smart irrigation system begins irrigating that specific zone or area when the reading falls below the threshold level. They outperform weather-based systems because they can respond to precise zone watering demands based on current soil moisture levels. Thus, driving the segment growth in the smart irrigation market over the forecast period.

Geographic Overview

North America is expected to account for the highest market share and the fastest-growing region during the projection period. The regional growth is expected to be supported by the strong agricultural industry of the United States and other nations and the widespread adoption of modern smart irrigation technology.

Asia Pacific is witnessing the highest CAGR due to the surging proliferation of IoT-based irrigation practices in India and China. Additionally, the growing number of smartphone users and other devices to remotely monitor or access the field status and the rise in investments by APAC nations have significantly accelerated the market growth.

Farmers in Asia, notably in India, are battling difficulties in water management - India's agriculture consumes 90% of the country's water due to rapid groundwater depletion and inadequate infrastructure. The fact that Indian farmers use 2 - 4 times more water within a specific food crop cycle than China or Brazil demonstrates India's degree of irrigation resource mismanagement.

According to the India Brand Equity Foundation, the agricultural sector consumes the freshest water in the country, accounting for up to 78 percent. Additionally, as per the OECD's environmental forecast for 2050, India will experience severe water scarcity by 2050.

A smart irrigation system that can deliver enough water to the fields while adapting to the soil's moisture level is needed. Precision agriculture techniques facilitated by the Internet of Things give farmers effective tools for optimizing their farming chores.

These technology-driven approaches aim to boost agriculture harvests and profitability while reducing the number of traditional inputs like water, pesticides, fertilizer, and herbicides required to grow crops. Smart farming, in essence, utilizes less to generate more. Thus, creating a lucrative growth opportunity in such an emerging market.

Competitive Insight

Rain Bird Corporation, Hunter Industries, Galcon, Rachio, Weathermatic, The Toro Company, Soil Scout, Caipos, Netafim, Hydropoint, Manna Irrigation, Stevens Water Monitoring, Delta-T Devices, Calsense, Skydrop, Aquaspy, and others are some of the players operating in the smart irrigation market.

Smart Irrigation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.19 Billion |

|

Revenue forecast in 2030 |

USD 3.75 Billion |

|

CAGR |

14.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By System Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Rain Bird Corporation, Hunter Industries, Galcon, Rachio, Weathermatic, The Toro Company, Soil Scout, Caipos, Netafim, Hydropoint, Manna Irrigation, Stevens Water Monitoring, Delta-T Devices, Calsense, Skydrop, and Aquaspy. |