Snow Scooter Market Share, Size, Trends, Industry Analysis Report

: By Scooter Type (Single Board Scooter, Double Board Scooter), By Weight Capacity, By Sales Channel and By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa)–Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 117

- Format: PDF

- Report ID: PM3642

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

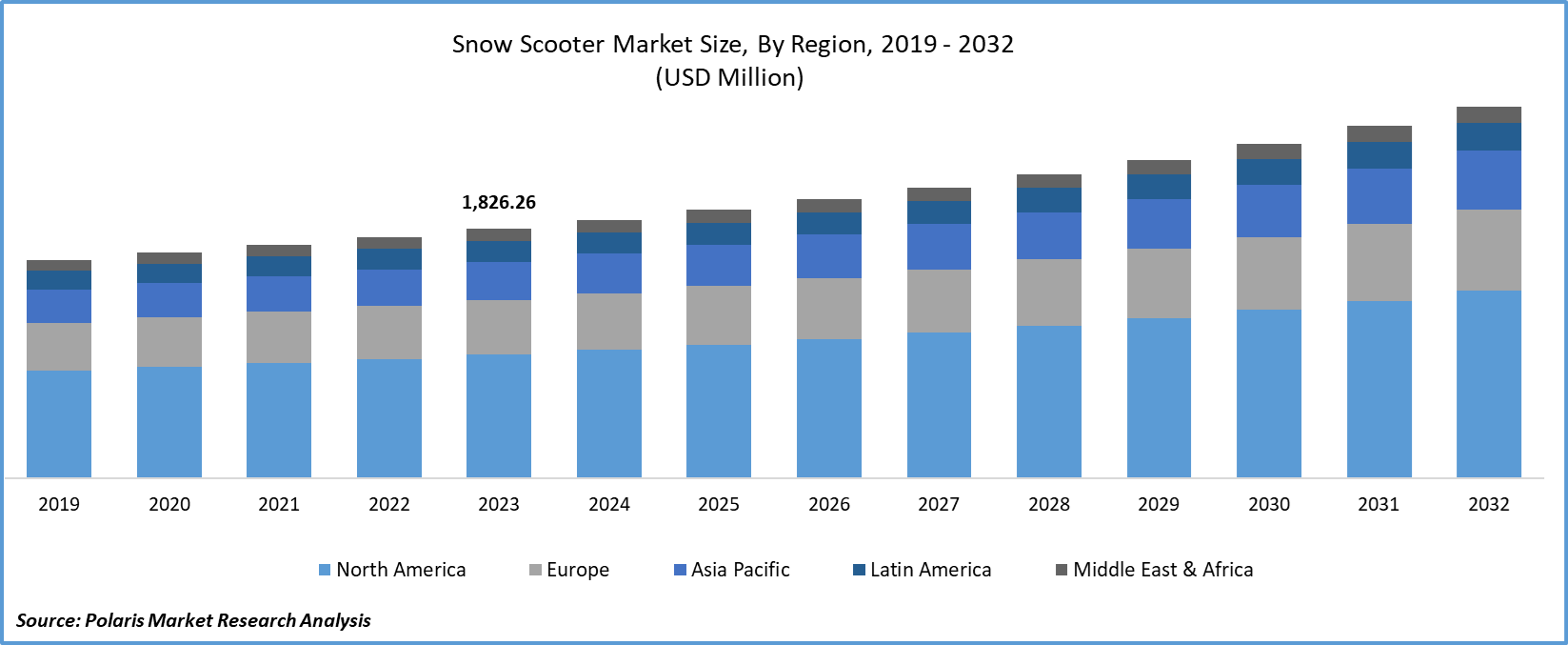

The global snow scooter market was valued at USD 1,826.26 million in 2023. The snow scooter industry is projected to grow from USD 1,893.06 million in 2024 to USD 2,723.06 million by 2032, exhibiting a compound annual growth rate (CAGR) of 4.6% during the forecast period (2024 - 2032).

Snow scooters, also known as snowmobiles, motor sleds, or snow machines, are a type of freestyle scooter developed for transportation in snowy areas. Snow scooters are specifically designed to facilitate the movement of individuals in heavy snow conditions, thus enabling travelers to move when cars and bikes are unable to operate.

Snow scooting provides a solution for varied activities, allowing people to have fun and stay active, which promotes both mental and muscular strength. Also, snow scooting is considered an excellent physical exercise that promotes physical and mental fitness. According to Centers for Disease Control and Prevention (CDC) studies, an individual needs at least 150 minutes of physical activity to prevent the risk of heart stroke, cancer, diabetes, and other health issues caused by an inactive schedule. Therefore, to maintain physical and mental health, individuals have started focusing on performing physical activities by means of snow scooting, which is ultimately promoting the market growth for snow scooters.

To Understand More About this Research: Request a Free Sample Report

Snow scooting, a recreational activity typically used in tourist attraction regions, generates income for tour guides and locals. Also, as a source of revenue generation, snow scooting boosts the economy of the local region. Accordingly, such recreational activities create numerous job opportunities in sectors such as manufacturing, distribution, and tourism, ultimately promoting market growth. According to the International Snowmobile Manufacturers Association, approximately 100,000 jobs were generated in the manufacturing, dealerships, and tourism sectors in 2022. Therefore, due to the growing number of tourists in snowy areas, the demand for snow scooters is increasing, thereby promoting its market growth.

Snow Scooter Market Trends:

Electrification of Snow Scooters is Driving Market Growth

Market CAGR for snow scooters is being driven by the innovation of eco–friendly snow scooters. The drastic climate change and rising number of environmental issues are forcing the adoption of sustainable and environmentally friendly alternatives. Electric snow scooters will be considered the best alternatives in the market in the coming years due to zero emissions of gases during their operation, which contributes to cleaner air and reduces air pollution. In addition to reducing air pollution, these scooters also decrease noise pollution, creating a quieter and more peaceful environment. Electric snow scooters operate more smoothly compared to non-electric models, enhancing customer satisfaction and experience. The electric snow scooters are battery-powered, reducing the reliance on fuel and promoting sustainable development. The decreased dependency on fuel is among the key driving factors for the snow scooter market expansion.

Snow scooters are well-suited for rough and snowy terrains due to their instant torque feature, providing quick acceleration. The growing environmental concerns are leading people to favor sustainable products. As a result, the demand for electric snow scooter market is increasing, leading to an expanded market share. For instance, Crayon Motors, an electric two-wheeler manufacturer, introduced the low-speed electric snow scooter SNOW+ in 2022. The product is priced starting from USD 64,000 and has a top speed of 25 km/h, specifically intended for light mobility.

Versatility of Snow Scooters Tends to Boost Market Growth

Snow scooters are versatile for every activity on snow and even on rough terrain. In addition, snow scooters are easy to drive for all age groups due to their simple structure and features. Snow scooters are considered an excellent combination of a snowboard, a ski, and a sleigh and are often fun to ride, especially for younger kids. Additionally, snow scooters save individuals time as they are convenient to carry everywhere. Besides, the simple and lightweight structure of snow scooters makes it easy for individuals to park and carry them to distant locations.

In addition to recreational and day-to-day activities, snow scooters are often used in snow sports. The rising number of snow scooters has led to the formation of several snow sports communities, resulting in increased participation of individuals in snow sports. For instance, Snowmobile Day was observed on October 28, 2023, to recognize the snowmobiling community and promote snowmobiling safety, resulting in increased demand for snow scooters and driving market expansion.

Snow Scooter Market Segment Insights

Scooter Type Insights:

The snow scooter market scooter type segmentation is based on single-board snow scooters and double-board snow scooters. In 2023, single-board scooters dominated the market due to their numerous features, such as faster riding speed, portability, suitability for single riders, and use over short distances. Moreover, snow scooters are efficient equipment to drive through extreme weather conditions, such as during heavy snowfalls, owing to their agility and speed. Additionally, advancements in technology have introduced various features in snow scooters, including waterproof snow scooters. Waterproof snow scooters are safe to ride in snowfall, whereas others require precautions to prevent damage to the electrical parts of the scooter.

For instance, Sniejik is a lightweight snow scooter designed to travel during snowfall. Sniejik has various features, which include the convertibility of snow scooters to normal scooters, where the sled is removed and replaced by wheels to use as normal scooters during summer.

Snow Scooter Sales Channel Insights:

The snow scooter market sales channel segmentation is based on specialty stores, modern trade channels, direct to customers, third party online stores, and sports variety stores. The specialty stores segment dominated the market growth as these stores sell a particular product category associated with a single brand. The focus on purchasing a specific type of brand is advantageous for consumers as it allows them to gain in-depth knowledge about the product.

Specialty stores provide customers with detailed and practical guidance, which is eliminated in online sales. Additionally, customers can test the quality of the product in offline sales, which helps them gain trust in the product. Therefore, it is projected that the snow scooter market will grow significantly with the help of offline sales.

Global Snow Scooter Market, Segmental Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Snow Scooter Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East, and Africa. Europe snow scooter market is expected to dominate over the forecast period. The key factor driving the market growth for snow scooters in Europe is the growing number of snowmobile clubs in Europe. The International Snowmobile Association reported that 22,964 snowmobiles were sold in the 2022-23 season due to the increased participation of snowmobile clubs in snow sports. This indicates that the market is expected to continue growing steadily in the upcoming years.

Furthermore, the major countries studied in the snow scooter market report are the US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and others.

The North American area is expected to boost the market due to the rising number of manufacturing companies for snow scooters. For instance, Lynx and Bombardier Recreational Products Inc. are major manufacturers in North America. They are providing a wide range of snow scooters due to rising demand from consumers, thereby driving the snow scooter market in North America.

Further, the key market players are merging, acquiring, and collaborating to strengthen their market presence and to serve better offerings in North America, further expected to drive the market during the forecast period. The countries close to polar regions experience long winters and heavy snowfalls, leading to an increasing demand for snow scooters in the market. Thus, due to favorable climatic conditions and the high purchasing demad by the population drives the market revenue.

Asia Pacific snow scooter market is expected to grow significantly during the forecast period due to the increasing population and tourism in countries such as Japan, China, India, South Korea, and others. Moreover, Japan has developed a number of snow ski resorts, and many events are being organized that attract snowboarders as well as tourists. In addition, the advancement of technology in Japan, which helps in the development and innovation of a variety of snow scooters, is among the driving factors for the growth of the snow scooter market.

GLOBAL SNOW SCOOTERT MARKET, REGIONAL COVERAGE, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Snow Scooter Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the snow scooter market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, snow scooter industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global snow scooter industry to benefit clients and increase the market sector. In recent years, the snow scooter industry has offered some technological advancements. Major players in the snow scooter market, including Artic Cat Inc., Bombardier Recreational Products Inc., Polaris Inc., Yamaha Motor Corporation Ltd., Taiga Motors, KYMCO Global , Razor USA LLC , Snowdog, Swagtron, Stigas.p.a. , Crayon Motors, Jiangsu Youmota Technology, NSG Products, Shanghai Puyi Industrial, Lakeside Collection, Eretic Inc., and Wuxi Copower Technology.

There are four major manufacturers that build snow scooters. These include Arctic Cat (headquartered in Thief River Falls, MN), BRP (headquartered in Valcourt, Quebec), Polaris Industries (headquartered in Medina, MN), and Yamaha Motor Corporation (headquartered in Ontario, Canada).

BRP creates innovative products to travel on snow, water, asphalt, and air. The distinctive brands under BRP include Ski-Doo and Lynx snowmobiles, Sea-Doo watercraft and pontoons, Can-Am vehicles, Alumacraft and Quintrex boats, Rotax engines for karts, and recreational aircraft. For instance, in 2024, BRP introduced innovations in snow scooters, which include series such as Renegade, Summit, MXZ, Skandic and others.

Taiga Motors is a manufacturing company specializing in electric on-road and off-road snowmobiles and watercraft, which includes mountain, trail, and utility snowmobiles, as well as personal watercraft models. For instance, the company introduced a new electric snow bike named Nomad in 2024. The new bike is designed for the toughest conditions and to move over with heavy loads.

Key companies in the snow scooter market include:

- Artic Cat Inc.

- Bombardier Recreational Products Inc.

- Crayon Motors

- Eretic Inc.

- Jiangsu Youmota Technology

- KYMCO Global

- Lakeside Collection

- NSG Products

- Polaris Inc.

- Razor USA LLC

- Shanghai Puyi Industrial

- Snowdog

- Stigas.p.a.

- Swagtron

- Taiga Motors

- Wuxi Copower Technology

- Yamaha Motor Corporation Ltd.

Snow Scooter Industry Developments

February 2024: BRP has introduced its first electric snowmobiles, the Ski-Doo Grand Touring Electric and the Lynx Adventure Electric models, which are to be launched in the year 2025. Bombardier Recreational Products Inc. (BRP) will also introduce two additional electric models, the Ski-Doo Expedition Electric and another Lynx Adventure Electric model, suitable for various applications. These new models are specifically designed for transporting personnel around ski centers, resorts, and areas where short distances are traveled or just for recreational use around cabins.

March 2024: Polaris Inc. announced the 2025 lineup series of snow scooters with innovative features. The new features include Dynamix Suspension Technology for additional control to riders while navigating through the snow. Additionally, Polaris will launch new models with the RMK SP and 650 Titan Adventure wide track and expand the availability of Patriot 9R engine.

May 2024: Taiga Motors expanded the deliveries of electric snow scooters across Europe. Moreover, to revolutionize the winter recreational industry, Taiga continues to deliver snow scooters across French and Italian ski resorts.

Snow scooter Market Segmentation:

Snow Scooter Type Outlook

- Single board snow scooter

- Double board now scooter

Snow scooter Weight Capacity Outlook

- Upto 70 lbs

- 70 to 150 lbs

- Above 150 lbs

Snow scooter Sales Channel Outlook

- Specialty stores

- Modern trade channels

- Direct to customer

- Third party online stores

- Sports variety store

Snow scooter Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Snow Scooter Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,826.26 million |

|

Market size value in 2024 |

USD 1,893.06 million |

|

Revenue Forecast in 2032 |

USD 2,723.06 million |

|

CAGR |

4.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global snow scooter market size was valued at USD 1,826.26 million in 2023 and is projected to grow to USD 2,723.06 million by 2032 .

The global market is projected to grow at a CAGR of 4.60% during the forecast period, 2024-2032.

North America had the largest share of the snow scooter market.

The key players in the market are Artic Cat Inc., Bombardier Recreational Products Inc., Polaris Inc., Yamaha Motor Corporation Ltd, Taiga Motors, KYMCO Global, Razor USA LLC, and Snowdog.

The single board scooter category dominated the market in 2023.

The specialty stores had the largest share of the snow scooter market.